Are you looking to finalize a property sale agreement smoothly? Closing a property deal can be a daunting task, filled with legal jargon and necessary paperwork, but it doesn't have to be. In this article, we'll break down a simple letter template that will guide you through the closure process with ease. Keep reading to discover how to effectively communicate the details of your property sale agreement!

Parties involved and their contact information.

The property sale agreement closure entails essential details regarding the parties involved in the transaction. Buyer information includes name, address, phone number, and email for communication purposes. Seller information, similarly, comprises name, property address (typically a specific location with street address, city, and state), phone number, and email. In cases of real estate agents representing either party, their name and contact details should be included. Additional entities, such as mortgage lenders or legal representatives, may also have their contact information noted to ensure seamless communication throughout the closing process. Essential documentation details, including the closing date, transaction amount, and specific property description, should be referenced to avoid discrepancies.

Property description and legal details.

The property located at 123 Maple Street, Springfield, boasts a charming three-bedroom, two-bathroom layout encompassing 1,800 square feet (approximately 167 square meters) of living space. This single-family home sits on a 0.25-acre (about 1,089 square meters) lot, featuring a well-maintained garden, a two-car garage, and an inviting front porch. Legal details encompass a clear title, free of liens and encumbrances, verified through a comprehensive title search conducted by Springfield Title Company. The property is zoned for residential use under the Springfield Municipal Code, ensuring compliance with local regulations. The sale agreement stipulates a closing date set for December 15, 2023, with a purchase price of $350,000, reflecting recent market trends and comparable sales in the area.

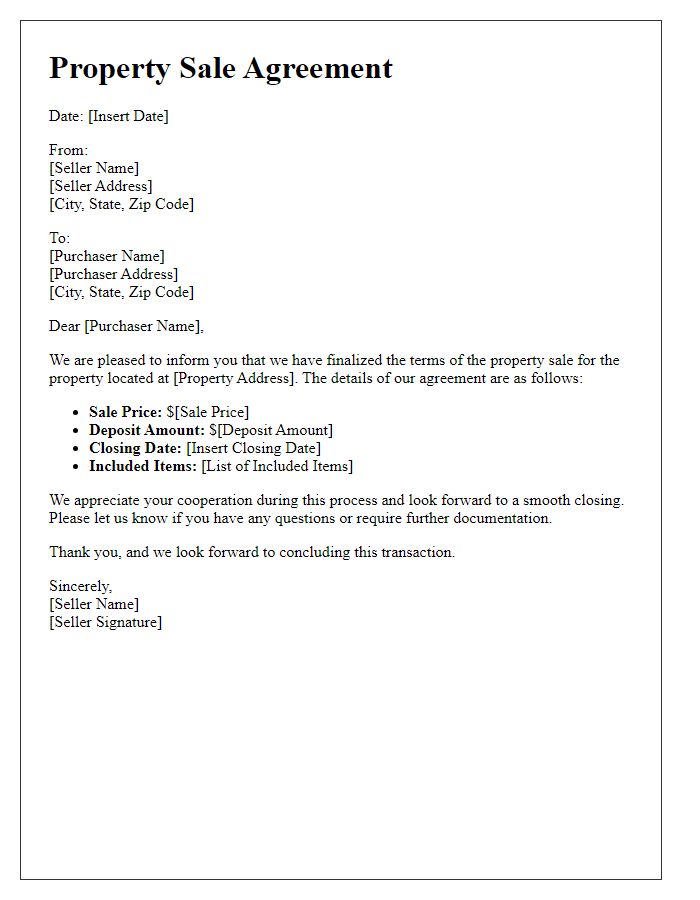

Sale price and payment terms.

In a property sale agreement, the sale price typically represents the total monetary value exchanged for the property, negotiated between the buyer and seller, and commonly outlined in the contract. Payment terms define the conditions under which the sale price is paid, including methods such as direct bank transfers or mortgage financing and timelines specifying due dates for payments. Often, an earnest money deposit (usually around 1-3% of the sale price) is required to indicate serious intent from the buyer. Closing costs, consisting of fees associated with the transaction (such as title insurance, property inspection, and attorney fees), are also included in detailed negotiations. The agreement may stipulate contingencies, which are conditions that must be satisfied before the sale can proceed, ensuring that both parties have clear expectations regarding the financial aspects.

Closing date and required documents.

The property sale agreement closure requires a well-defined closing date, typically a date mutually agreed upon by both the buyer and seller, often falling within a 30 to 60-day period post-offer acceptance. Essential documents include the title deed, which proves ownership of the property, the closing disclosure outlining details of the sale, and the mortgage documents if applicable, detailing loan terms if the buyer is financing the purchase. Additional documents such as a property inspection report, proof of homeowner's insurance, and any applicable disclosures (like lead paint or pest issues) must also be provided. The closing process often occurs at a title company, where funds are exchanged, and the new deed is recorded with the local government, ensuring legal transfer of ownership.

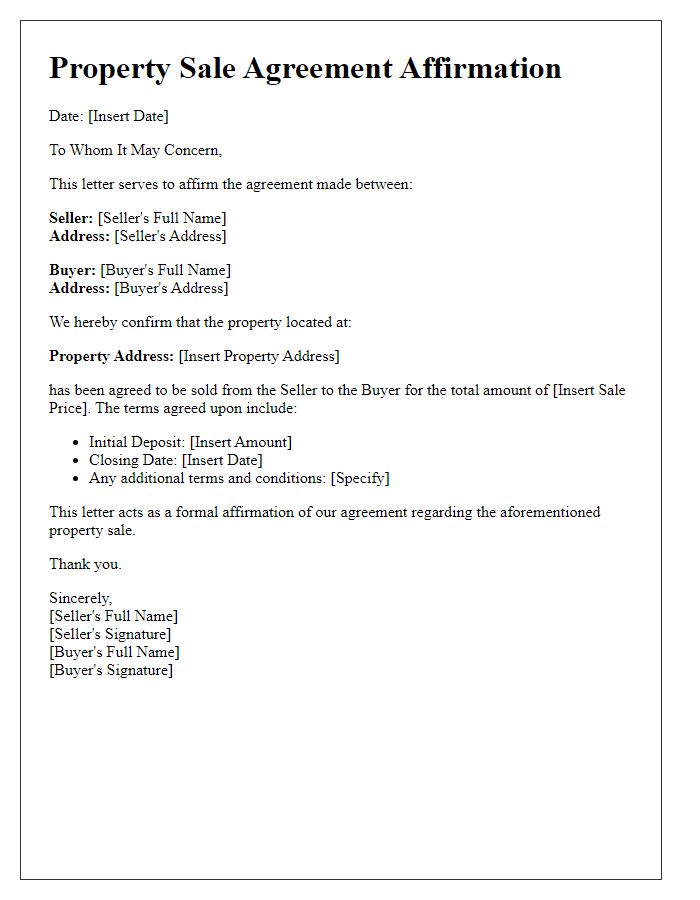

Signatures and agreement validation.

The finalization of a property sale agreement requires the signatures of both the buyer and the seller to validate the transaction legally. Typically, the document is prepared on official legal paper, explicitly outlining the agreed-upon terms, including the purchase price, property address, and closing date, which often occurs within 30 to 60 days after signing. Witnesses may also need to sign the agreement, depending on local laws, to ensure the legality of the document in jurisdictions like California or Texas. Notarization may be required in some areas, providing an additional level of verification. Finally, after all parties have signed, copies are distributed to the buyer and seller for their records.

Comments