Hey there! If you're feeling a bit overwhelmed by the prospect of quarterly tax estimations, you're definitely not alone. Whether you're a seasoned entrepreneur or just starting out, getting a grip on your tax obligations is crucial for maintaining your financial well-being. In this article, we'll dive into a handy letter template that simplifies the process and helps you stay organized. So, let's explore how to ease your tax worries and keep your finances on trackâread on for some valuable insights!

Taxpayer Information

Quarterly tax estimation requires accurate taxpayer information to ensure compliance with IRS regulations. Essential details include the taxpayer's full name, Social Security Number (SSN), or Employer Identification Number (EIN) for business entities. The address should reflect the taxpayer's primary residence or business location, including city, state, and ZIP code. Additionally, it is crucial to provide estimated income for the current tax year, detailing various sources such as wages, self-employment earnings, and investment income. A precise calculation of potential deductions and credits should also be included, contributing to a well-rounded evaluation of the projected tax liability for the quarter. Ensuring that all this information is accurate aids in avoiding penalties and misconceptions during tax filing.

Estimated Income Details

Quarterly tax estimation requires precise estimated income details to accurately calculate tax obligations. Taxpayers must compile projected income figures from various sources such as salary, freelance earnings, business revenue, and investment returns. For instance, an individual may anticipate annual earnings of $50,000 from a full-time position, alongside an additional $10,000 from freelance graphic design projects. It is crucial to delineate each income stream clearly, specifying amounts expected for the upcoming quarter, such as $15,000 for Q1. Furthermore, taxpayers should consider applicable deductions like retirement contributions or business expenses, which can significantly influence taxable income. Accurate estimations support effective financial planning and ensure compliance with IRS regulations.

Deductions and Credits

Quarterly tax estimation requires careful consideration of various deductions and credits that can significantly impact the final tax liability for individuals or businesses. Common deductions include the standard deduction, which for the tax year 2023 stands at $13,850 for single filers and $27,700 for married couples filing jointly. Itemized deductions, such as mortgage interest, property taxes, and medical expenses exceeding 7.5% of adjusted gross income, may also apply. Additionally, tax credits like the Child Tax Credit, offering up to $2,000 per qualifying child, and the Earned Income Tax Credit, which varies based on income and number of dependents, can further reduce tax liability. Understanding the eligibility and rules associated with these deductions and credits is crucial for accurate quarterly tax estimations, ensuring compliance with IRS regulations while maximizing potential savings.

Payment Instructions

Quarterly tax estimation requires careful attention to detail. Taxpayers must calculate estimated tax payments based on income projections for the year, adhering to IRS guidelines. For the 2023 tax year, individuals can use Form 1040-ES, which provides worksheets for estimating taxable income and determining the appropriate payment amounts. Payments should be made electronically through the IRS Direct Pay service or via the Electronic Federal Tax Payment System (EFTPS), available 24/7 for convenience. Deadlines for quarterly payments occur on April 15, June 15, September 15, and January 15 of the following year, with penalties applying for late payments. Maintaining accurate records for deductions and credits, such as charitable contributions or mortgage interest, proves essential for precise estimations.

Contact Information

Quarterly tax estimations require accurate calculations and timely submissions to avoid penalties. Taxpayers must provide essential contact information, including full name, mailing address, and phone number, to the Internal Revenue Service (IRS) or relevant local tax authority. The deadline for the first quarter is usually April 15, followed by June 15 for the second quarter. Ensuring updated contact details facilitates important notifications regarding payments or changes in tax law. It's crucial to submit estimated payments via approved channels, such as the IRS Direct Pay electronic system or through an authorized financial institution, to maintain compliance and track payment history effectively.

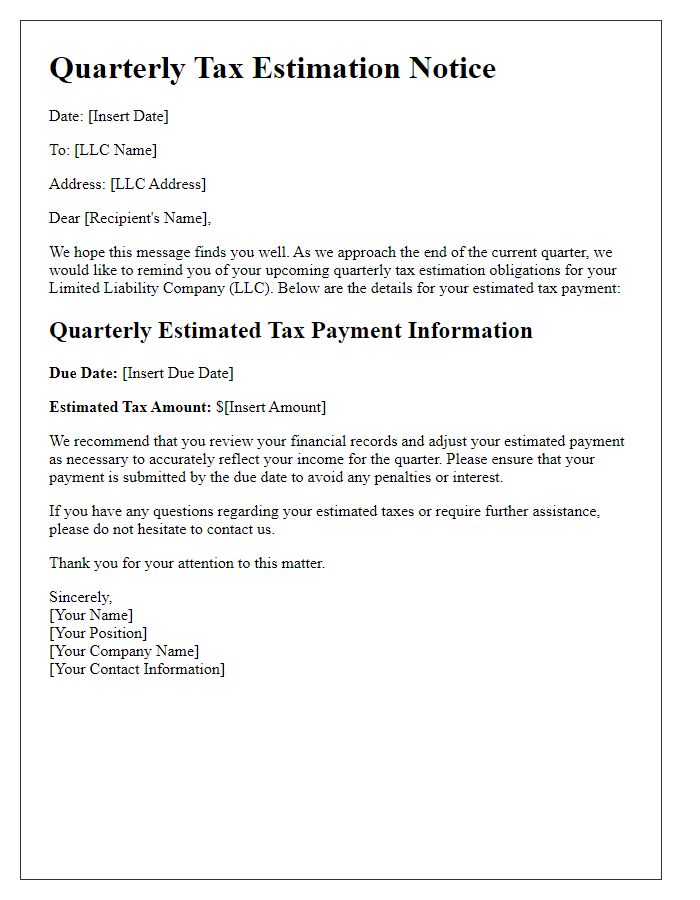

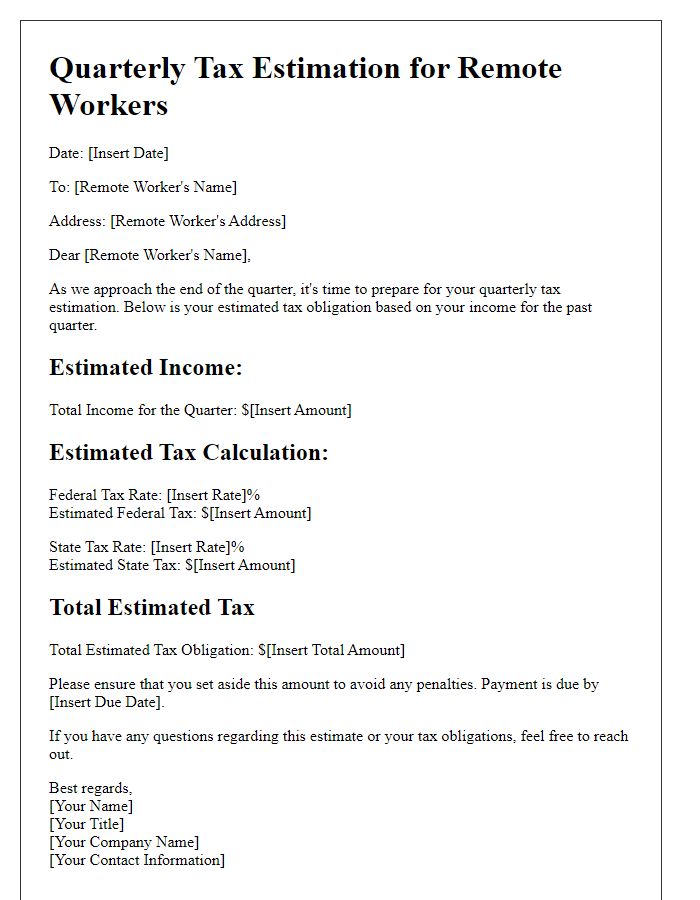

Letter Template For Quarterly Tax Estimation Samples

Letter template of quarterly tax estimation for self-employed individuals

Comments