Are you looking to streamline the preparation of your consolidated financial statements? Creating a clear and effective letter template can make a world of difference in communicating with your finance team and stakeholders. By laying out essential information in a concise manner, you can ensure everyone is on the same page and ready to tackle the complexities of consolidation. Ready to learn more about crafting the perfect letter template?

Purpose of Consolidation

The purpose of consolidation in financial statements is to present an accurate and comprehensive view of a company's financial position when it controls one or more subsidiaries. This process aims to combine the financial performances, assets, and liabilities of the parent company with those of its subsidiaries, such as Company A and its subsidiary Company B, within a defined fiscal year, typically January to December 2023. Consolidation eliminates intercompany transactions, such as sales or loans between the entities, ensuring that the financial reports reflect the true economic reality of the corporate group as a single entity. This practice enhances transparency, compliance with international financial reporting standards (IFRS), and provides stakeholders with a clear understanding of consolidated revenue figures, total assets estimated at $500 million, and overall liabilities amounting to $300 million, facilitating informed decision-making by investors and regulators.

Financial Reporting Standards

The preparation of consolidated financial statements is governed by specific Financial Reporting Standards, notably IFRS 10, which outlines the principles for preparing consolidated financial statements for entities that control one or more subsidiaries. This process involves combining the financial results of the parent company, including all subsidiaries, to present a unified view of the financial position, performance, and cash flows. Significant criteria include total control over the financial and operational policies of subsidiaries, generally achieved through ownership of more than 50% of the voting shares. The consolidation process requires eliminating inter-company transactions and balances to avoid double counting, as mandated by IFRS 3. Furthermore, entities must disclose key judgments made in determining control over subsidiaries, as well as the accounting policies applied to ensure transparency and enhance comparability, crucial for stakeholders and investors analyzing the financial health and performance of the corporate group.

Entity Details and Structure

Entity details, such as legal name, registration number, and principal place of business (e.g., 123 Main Street, City, State), need to be clearly defined for accurate financial reporting. The structure of the entity, whether a corporation, partnership, or limited liability company, significantly influences accounting practices and financial disclosures. Understanding the ownership structure, including major shareholders or partners, along with any subsidiaries (like XYZ Subsidiary, located in Country) and associated entities, is vital for consolidating financial statements. Moreover, the fiscal year-end date, for example, December 31st, determines reporting timelines and must be consistently applied. Stakeholders, including investors, creditors, and regulatory authorities, rely on precise entity details to assess financial health and compliance with accounting standards like IFRS or GAAP.

Intercompany Transactions and Balances

The preparation of consolidated financial statements involves careful reporting of intercompany transactions and balances, essential for accurate financial representation of entities such as subsidiaries and parent companies. Intercompany transactions, which occur between corporate entities, can include the sale of goods, provision of services, or financial transfers, typically adjusted on consolidation. Balances arising from these transactions, including accounts receivable and accounts payable between companies, must be eliminated to avoid overstatement of revenues and assets. For instance, in a scenario where Company A sells inventory to Subsidiary B for $500, any profits generated from this transaction must be disregarded if the inventory remains unsold by the end of the reporting period. Comprehensive disclosure of these eliminations enhances transparency and complies with reporting standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Accurate documentation ensures that consolidated statements reflect a true and fair view of the financial position across the corporate group.

Timeline and Submission Guidelines

The consolidated financial statement preparation process requires a structured timeline and clear submission guidelines to ensure accuracy and compliance. The timeline typically spans several months, starting with preliminary data collection from all subsidiaries by the end of Q1. Each subsidiary's financial data must be finalized by March 31, ensuring necessary adjustments for intercompany transactions are made by April 15. The major milestone of consolidating all financials occurs by April 30, leading to the preparation of draft statements. Review meetings are scheduled in early May, with feedback incorporated by mid-May. The final consolidated financial statements must be completed and submitted to regulatory agencies, such as the Securities and Exchange Commission, by June 30. Companies must adhere to International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), depending on their operational jurisdiction, during this comprehensive process to guarantee transparency and accuracy in their fiscal representation.

Letter Template For Consolidated Financial Statement Preparation Samples

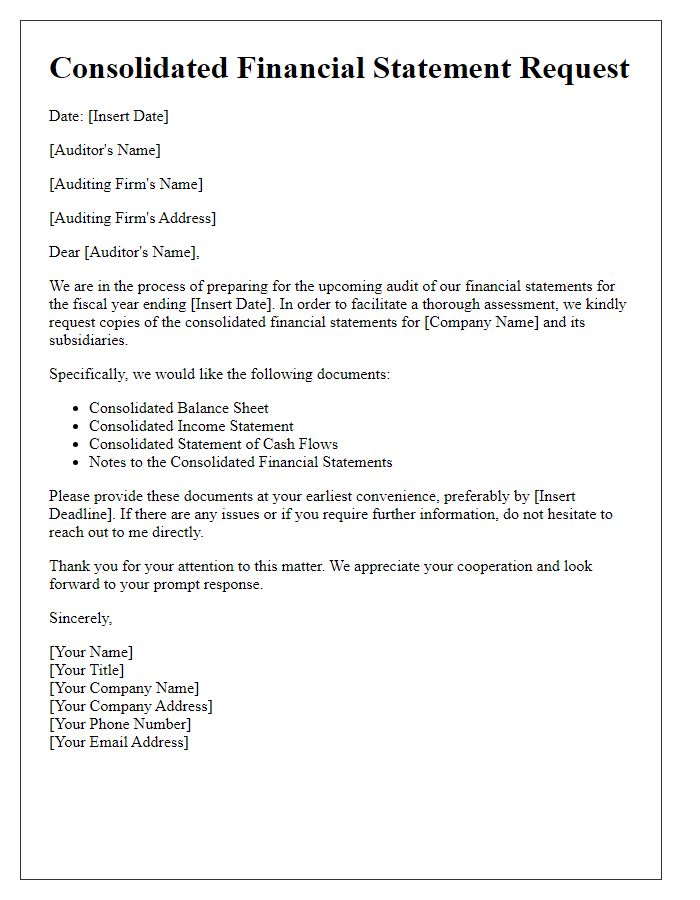

Letter template of consolidated financial statement request for audit purposes

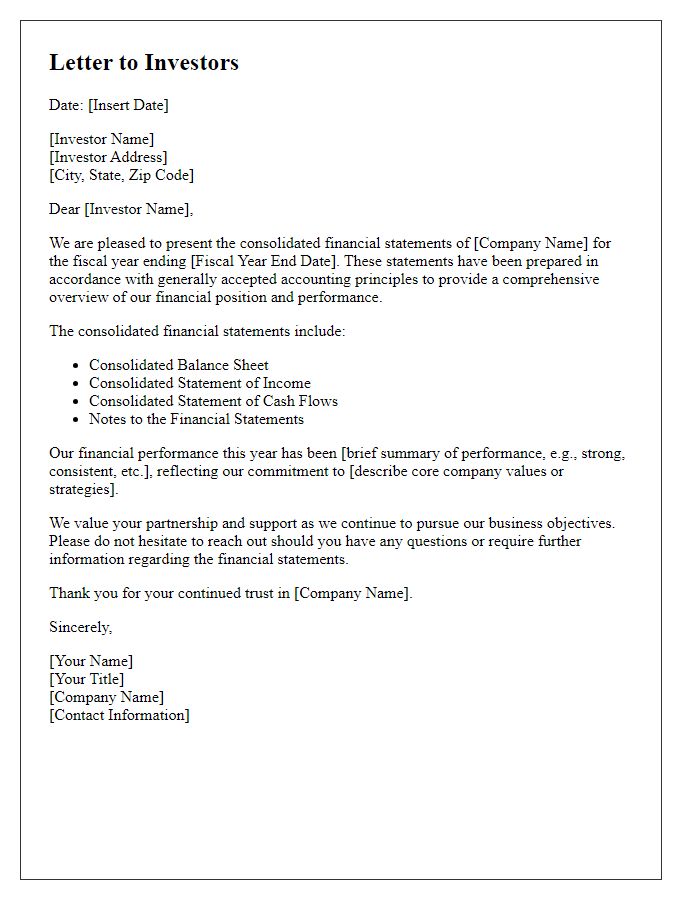

Letter template of consolidated financial statement preparation for investors

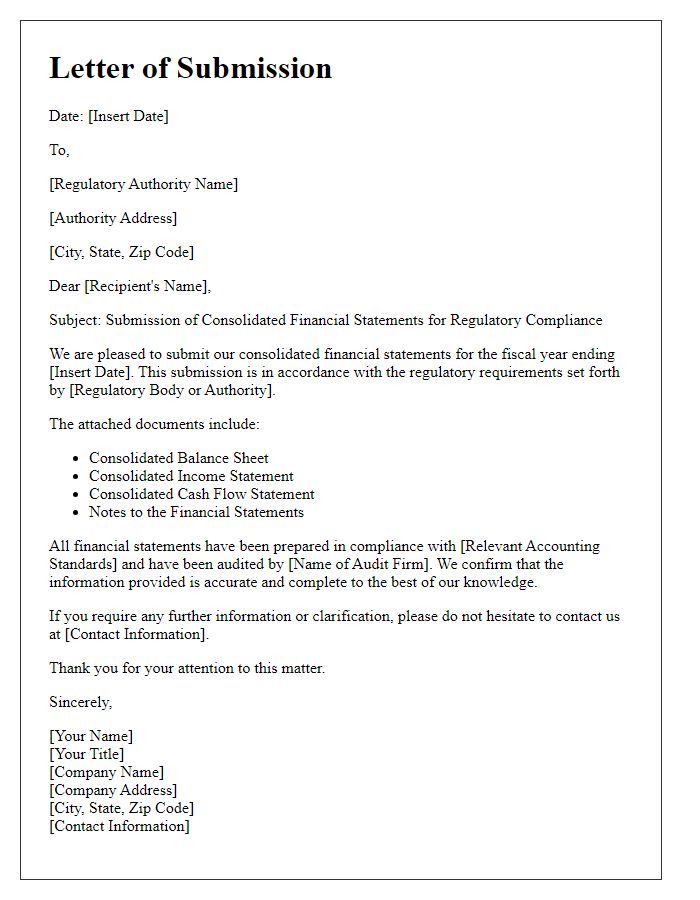

Letter template of consolidated financial statement submission for regulatory compliance

Letter template of consolidated financial statement update for board review

Letter template of consolidated financial statement preparation for tax purposes

Letter template of consolidated financial statement distribution to stakeholders

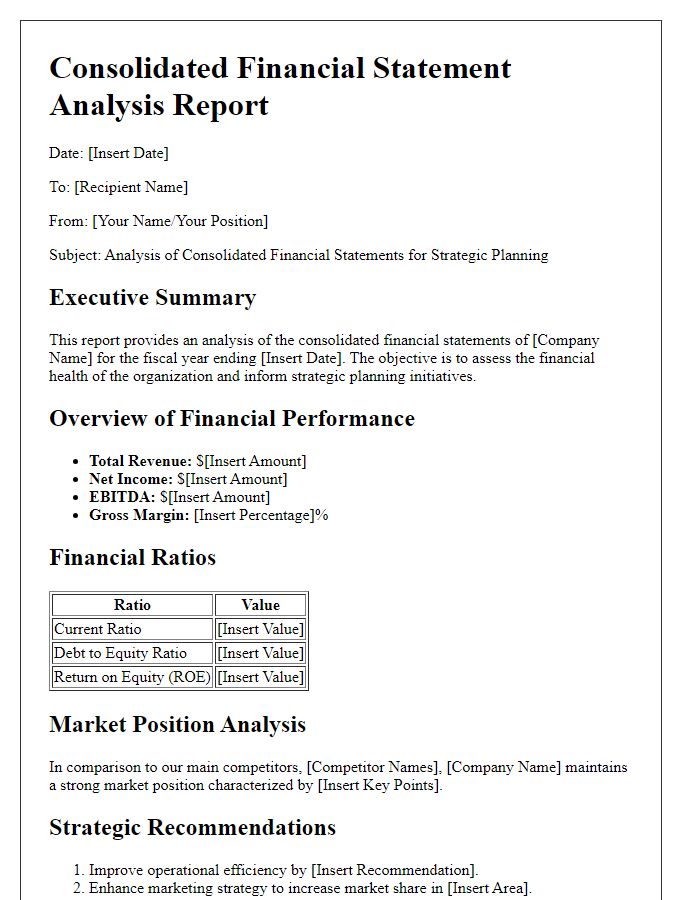

Letter template of consolidated financial statement analysis for strategic planning

Letter template of consolidated financial statement preparation for grant applications

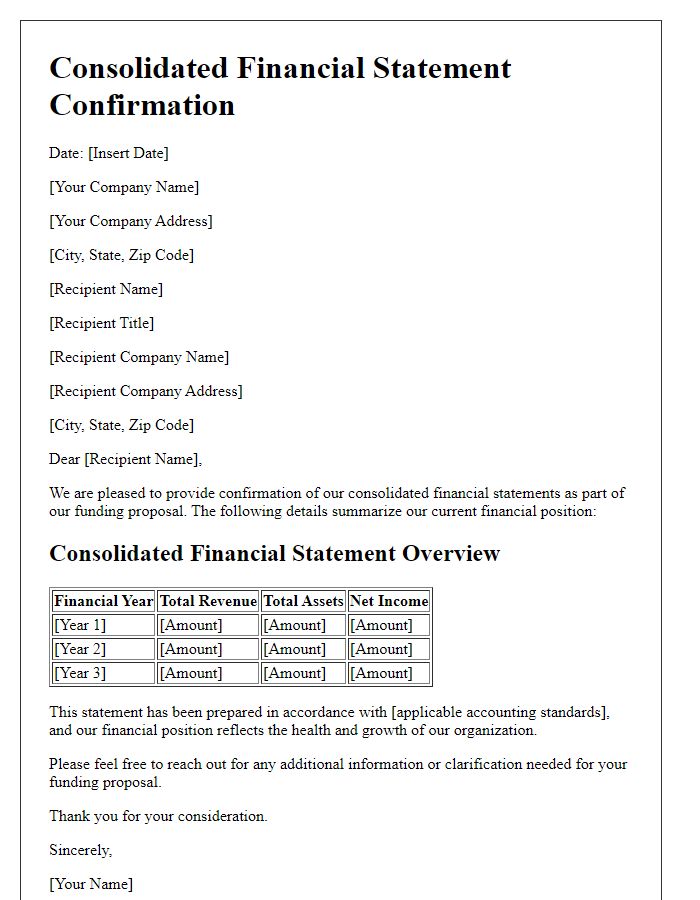

Letter template of consolidated financial statement confirmation for funding proposals

Comments