Are you ready to embark on a seamless audit journey? Understanding the acceptance of an audit engagement is crucial for both auditors and clients to establish clear expectations and responsibilities. This process not only sets the tone for a successful partnership but also paves the way for transparency and trust within the financial landscape. If you'd like to learn more about crafting the perfect letter for audit engagement acceptance, keep reading!

Clear Understanding of Scope and Objectives

In the audit engagement acceptance process, a clear understanding of the scope and objectives is crucial for the effective execution of the audit. The scope includes the specific areas of the client's operations that will be examined, such as financial statements, compliance with regulations, and internal controls. Objectives consist of identifying material misstatements, enhancing financial reporting accuracy, and ensuring regulatory compliance. Precise delineation of the audit boundaries, like the fiscal year ending December 31, 2023, and associated information, such as auditing standards applicable (International Standards on Auditing, for instance), is essential for aligning expectations between the audit team and the client. This fosters a framework for developing an appropriate audit plan, resource allocation, and Zeitplan to meet both stakeholder requirements and compliance obligations. Establishing these parameters upfront helps minimize misunderstandings during the audit process and ensures that relevant risks are thoroughly assessed.

Defined Roles and Responsibilities

In audit engagements, defined roles and responsibilities are crucial for ensuring a smooth and efficient process. The audit team, typically comprising a lead auditor and several staff auditors, must clearly understand their responsibilities in gathering evidence and assessing financial statements. The client management team holds the responsibility to provide accurate financial records and access to relevant documents, while also ensuring that internal controls are effectively documented and followed. Communication between the audit team and the client is essential for identifying key timelines, such as the final audit report due date, typically set several weeks after the fieldwork concludes. Stakeholders, including the audit committee or board of directors, play a vital role in oversight and establishing expectations for both the audit process and the handling of any identified issues. Clear delineation of these roles not only fosters collaboration but also enhances the reliability and integrity of the audit results.

Timeline and Deliverables

The audit engagement acceptance process presents a structured timeline and critical deliverables essential for successful completion. Initially, the engagement letter outlines key details, including scope, responsibilities, and the timeline spanning from planning phases to final report submission. Typically, the planning phase, which includes kickoff meetings and risk assessment, occurs over a two-week period. Subsequently, fieldwork is conducted for four to six weeks, during which auditors gather and evaluate evidence. Key deliverables during this phase include working papers and preliminary findings, which require careful documentation. The final stage encompasses the preparation of the audit report, scheduled for delivery approximately two weeks after fieldwork completion, detailing findings, recommendations, and an evaluation of internal controls. Regular communication checkpoints ensure stakeholders remain informed and aligned throughout the process.

Fee Structure and Payment Terms

Audit engagement acceptance involves critical negotiation of fee structures and payment terms to ensure clarity and mutual understanding between the audit firm and the client organization. Typically, the fee structure can be classified into three categories: hourly rates for staff, fixed fees for specific audit projects, or a blend of both, often influenced by the complexity of financial data being reviewed and the size of the organization, like small businesses or large corporations. Payment terms usually include details about deposit requirements, scheduled payment milestones during the audit timeline, and final payment upon completion of the audit report. These financial arrangements must be documented explicitly to avoid disagreements, with clear explanations of additional costs, such as travel expenses and external consultant fees, that may arise during the audit process. Establishing a transparent financial framework is essential for maintaining strong professional relationships and ensuring the successful completion of audit engagements.

Confidentiality and Data Protection Agreements

Audit engagement acceptance requires careful consideration of confidentiality and data protection agreements. Organizations, such as accounting firms or corporate auditors, must ensure compliance with regulations like the General Data Protection Regulation (GDPR) in the European Union, which mandates protecting personal data to prevent breaches. The audit agreement should include clauses outlining responsibilities for safeguarding sensitive information, such as financial records, client data, and proprietary business insights. Furthermore, both parties must agree to protocols for data handling, storage, and disposal to maintain confidentiality throughout the audit process, which typically spans several weeks or months, depending on the organization's size. Non-disclosure terms may also be necessary to protect trade secrets during and after the engagement.

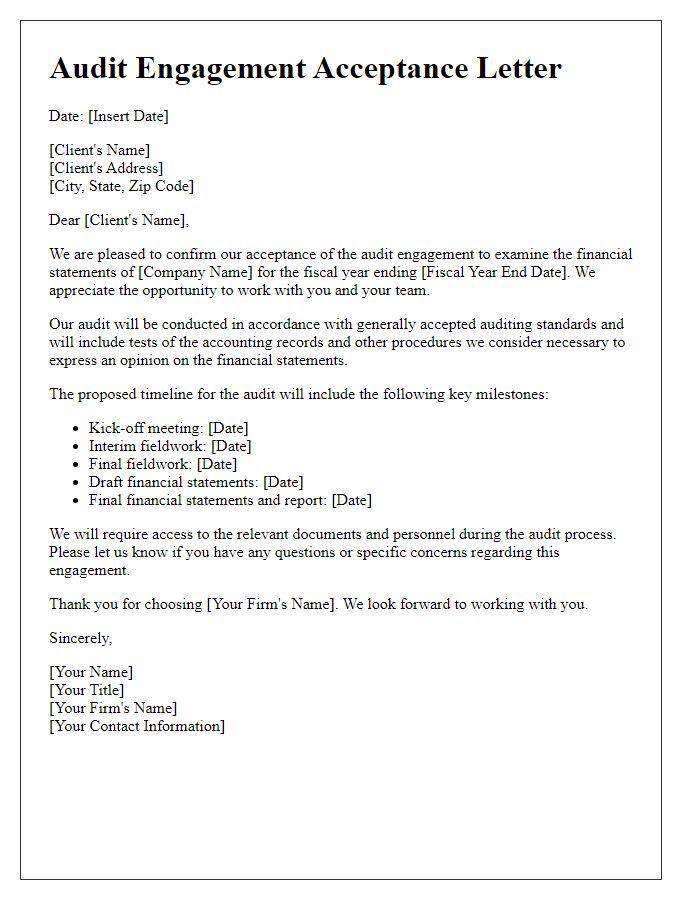

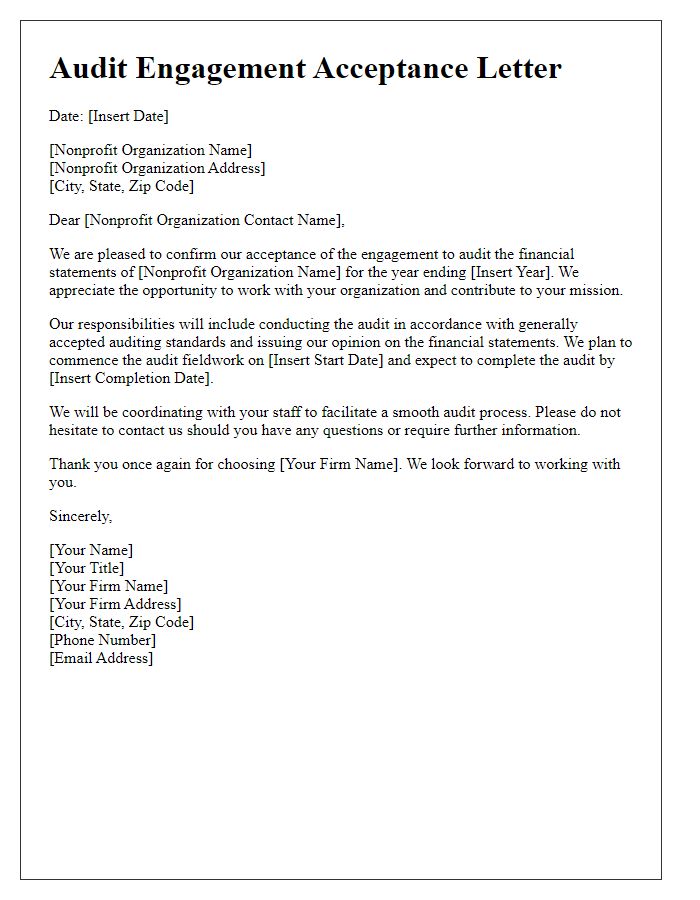

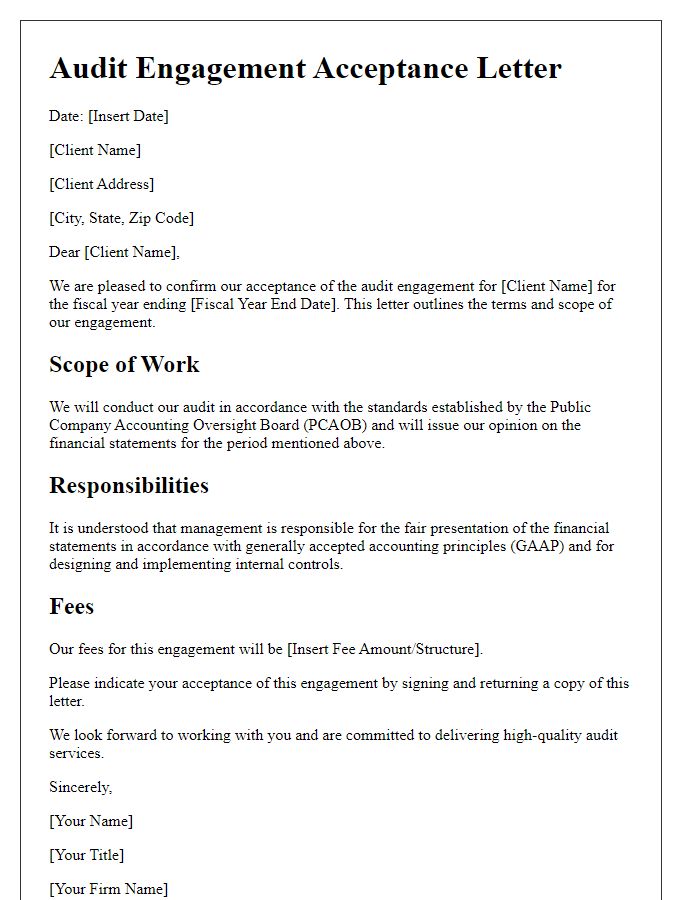

Letter Template For Audit Engagement Acceptance Samples

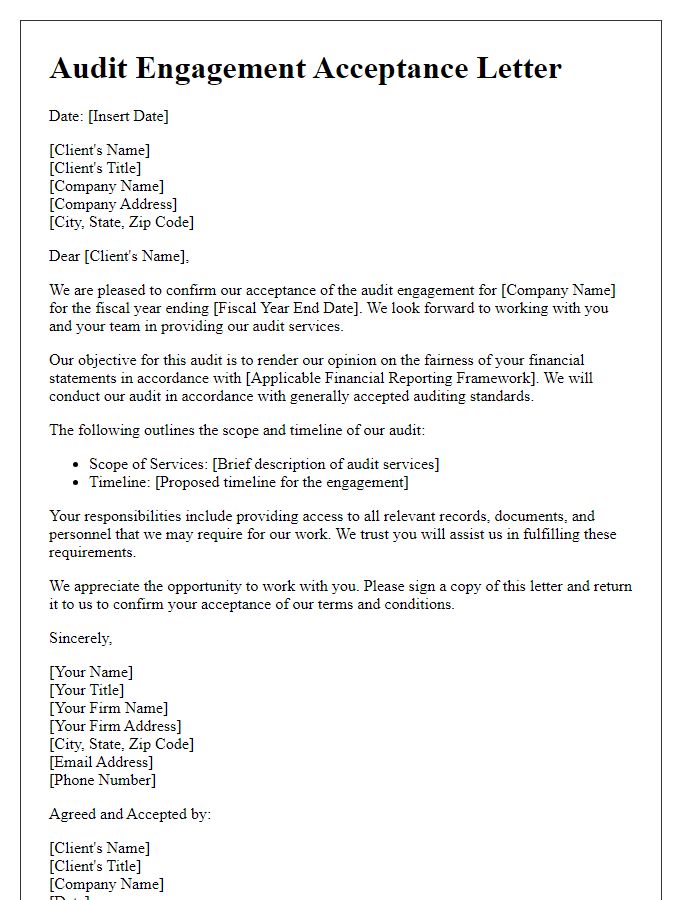

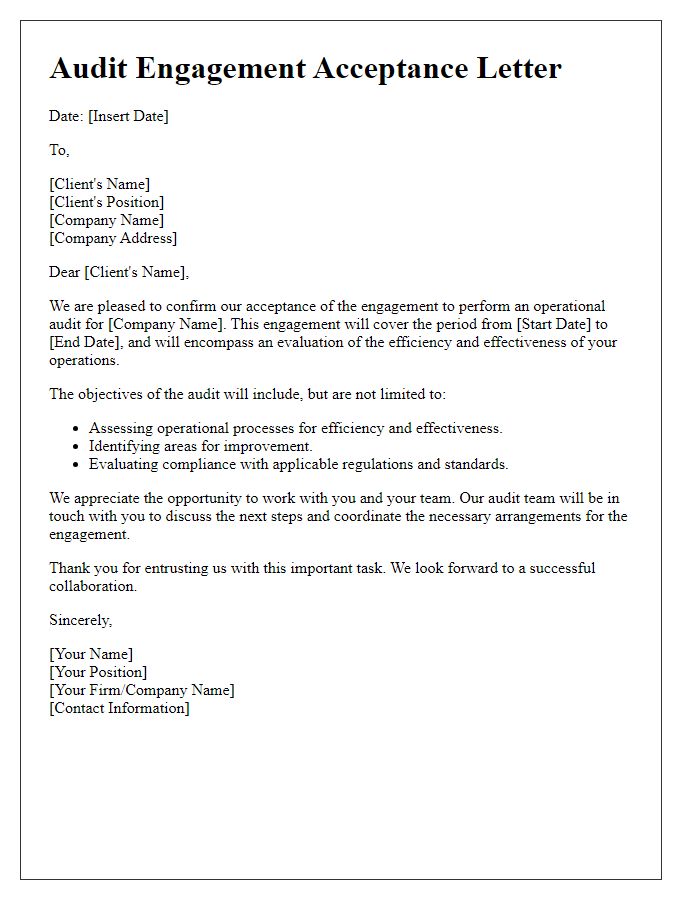

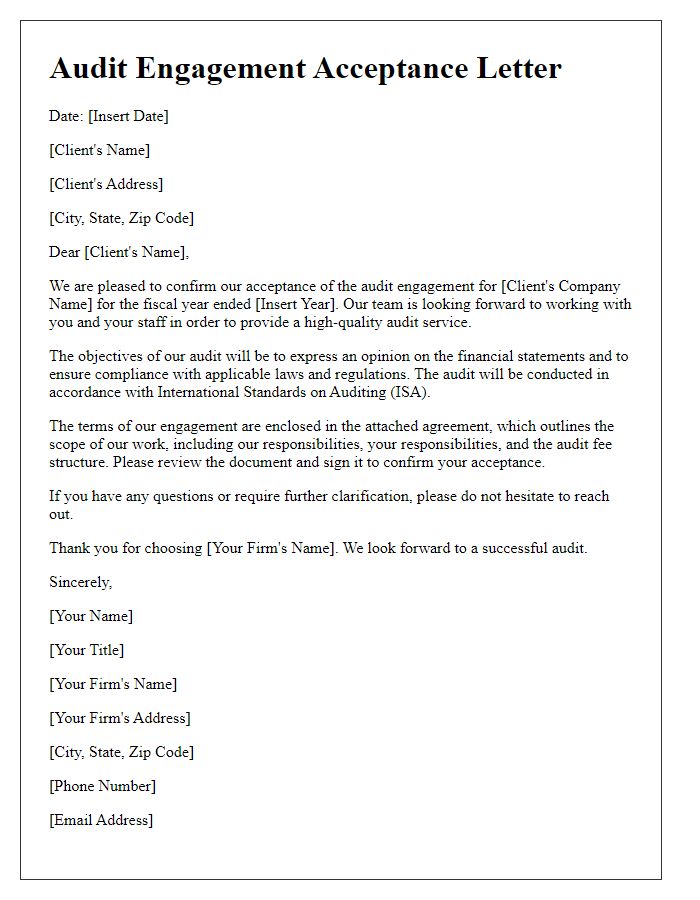

Letter template of audit engagement acceptance for financial statements.

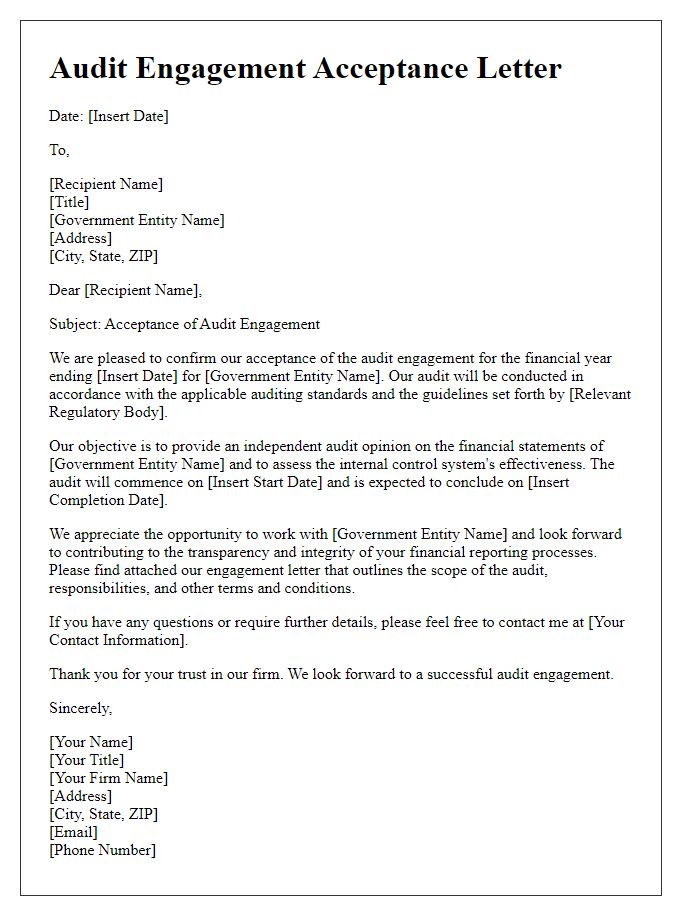

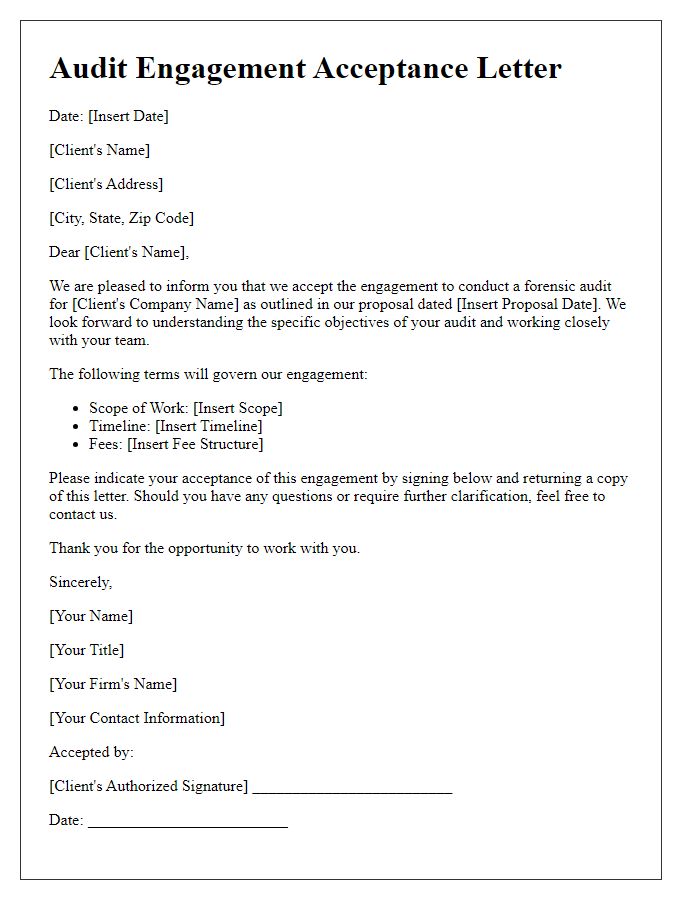

Letter template of audit engagement acceptance for nonprofit organizations.

Comments