Are you looking to enhance your accounts receivable management? In today's fast-paced business world, effectively managing receivables can significantly boost cash flow and strengthen client relationships. With the right strategies in place, you can streamline processes and reduce outstanding invoices, ensuring your organization remains financially healthy. Dive into our detailed article to discover actionable tips and best practices that can transform your accounts receivable approach!

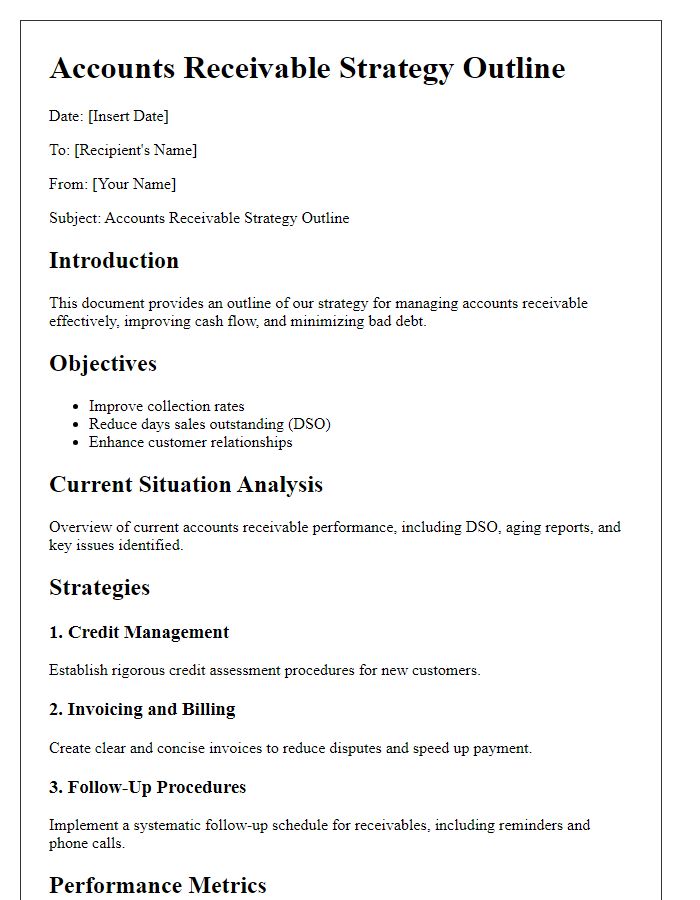

Clear subject line

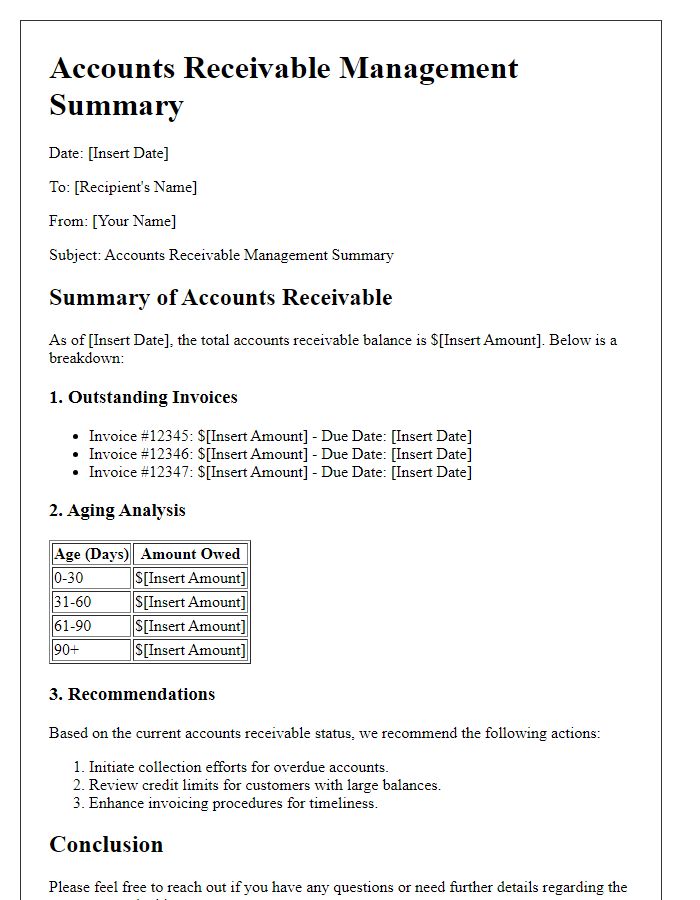

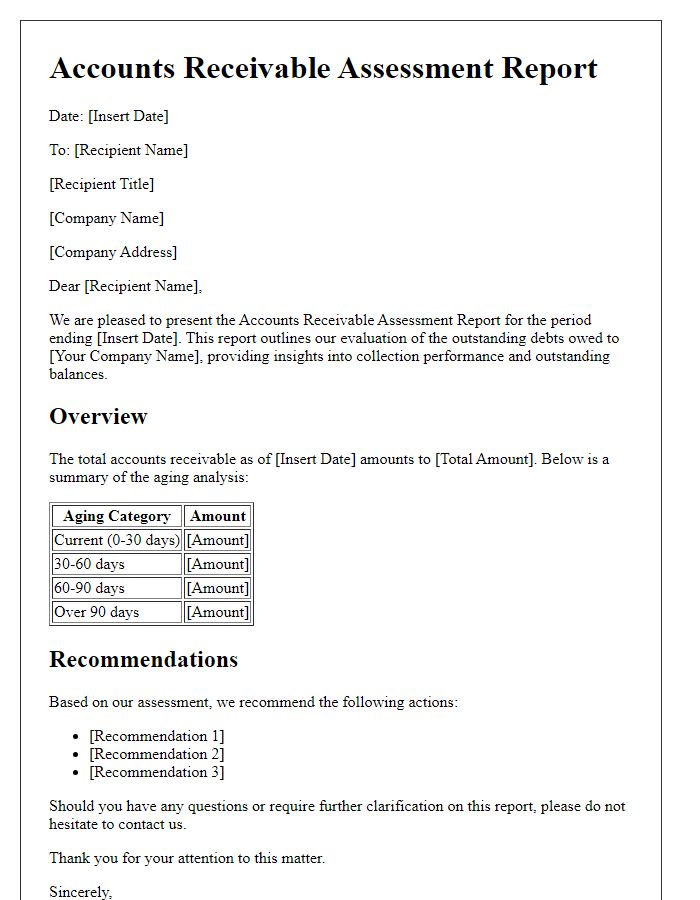

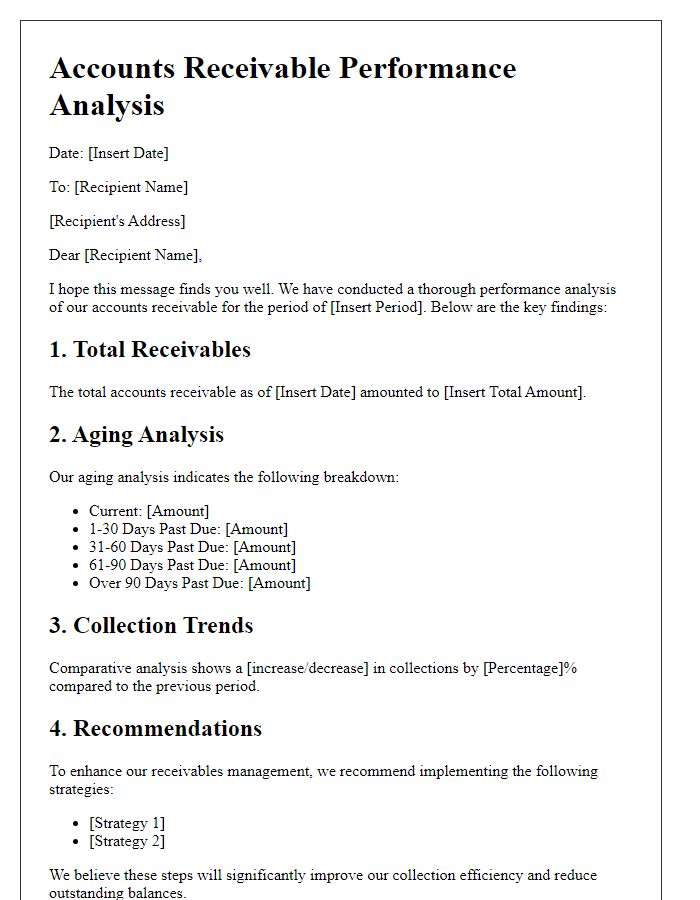

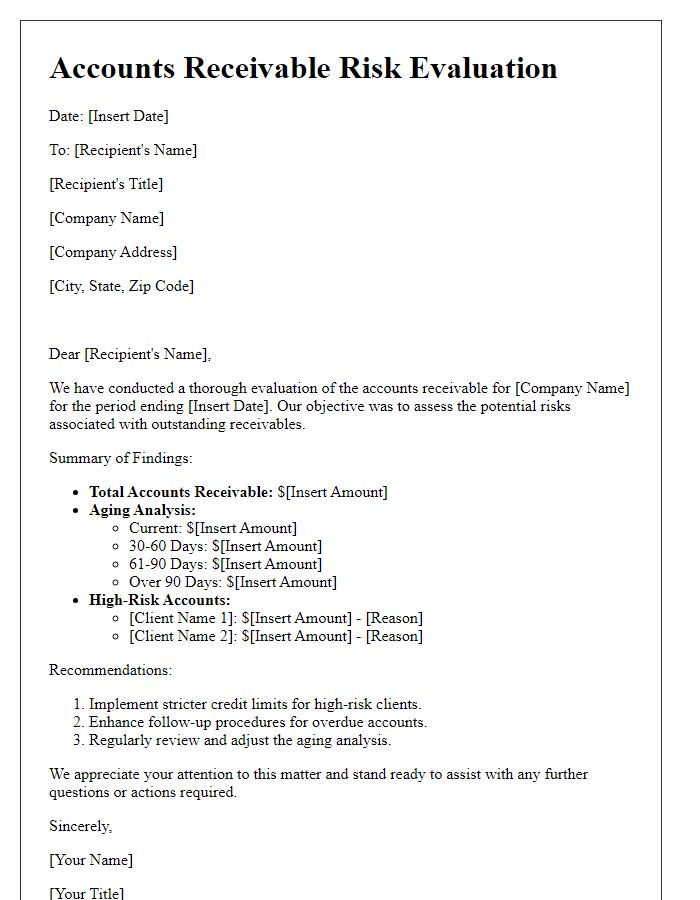

Accounts Receivable Management Overview provides essential insights into the effectiveness of credit and collections strategies within a business's financial operations. Utilizing a systematic approach, tracking key metrics such as Days Sales Outstanding (DSO), aging reports, and collection effectiveness can significantly enhance cash flow management. Regular assessments of outstanding invoices, typically categorized into 0-30, 31-60, and 61+ days past due, allow businesses to identify potential issues early, ensuring proactive measures are taken. Implementation of efficient communication strategies with clients regarding payment terms and follow-up processes enhances relationships while optimizing credit risk management. Supporting technologies, such as automated invoicing systems or customer relationship management software, streamline operations, providing valuable data for decision-making. Overall, a robust accounts receivable management framework is crucial for maintaining liquidity and fostering sustainable growth.

Concise introduction

Accounts receivable management is a critical component of financial health for businesses, impacting cash flow and operational efficiency. Proper management involves timely invoicing, tracking outstanding balances, and maintaining relationships with clients to ensure prompt payments. Effective strategies often include regular follow-ups on overdue accounts, clear payment terms, and employing accounting software to streamline processes. Monitoring key metrics such as Days Sales Outstanding (DSO) can provide insights into the collection process effectiveness and overall financial stability. Emphasizing proactive communication with clients can further enhance collection rates, ultimately safeguarding a company's liquidity and growth potential.

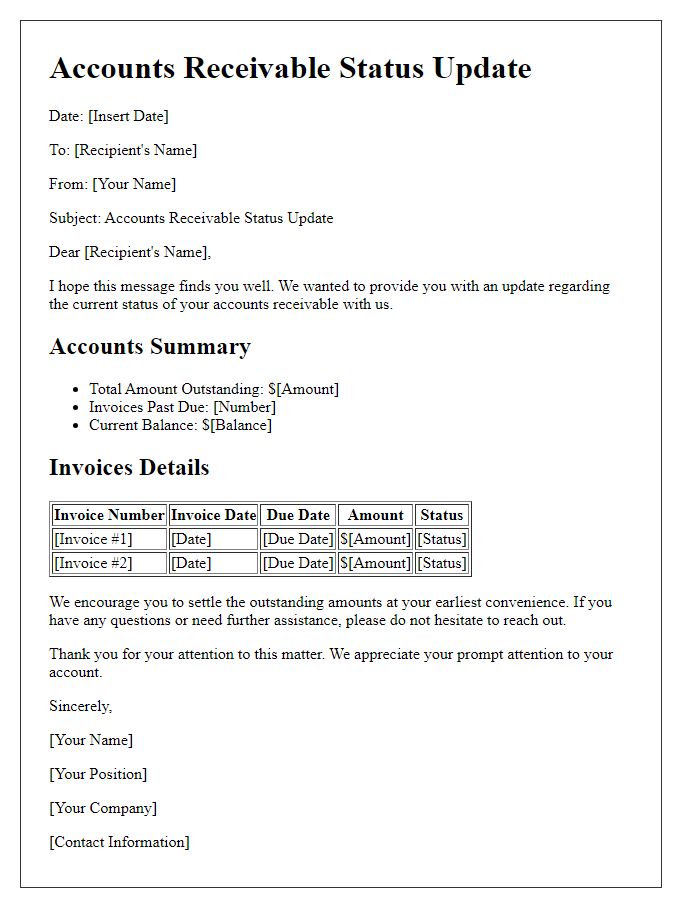

Detailed account summary

Effective accounts receivable management is vital for maintaining cash flow and minimizing financial risk within businesses. A detailed account summary includes Critical metrics such as average days sales outstanding (DSO) calculated using accounts receivable turnover ratios. Regular monitoring of aging reports (60, 90, and 120 days overdue) provides insight into outstanding invoices, highlighting clients requiring follow-up. The summary should also encompass total outstanding balances across different customer segments, potentially revealing trends affecting collections, such as payment habits of specific industries (like retail or manufacturing). Notably, effective collection strategies may involve establishing payment plans or offering discounts for early settlements to enhance cash flow. Understanding these components ensures proactive measures are in place to minimize delinquencies and strengthen overall financial health.

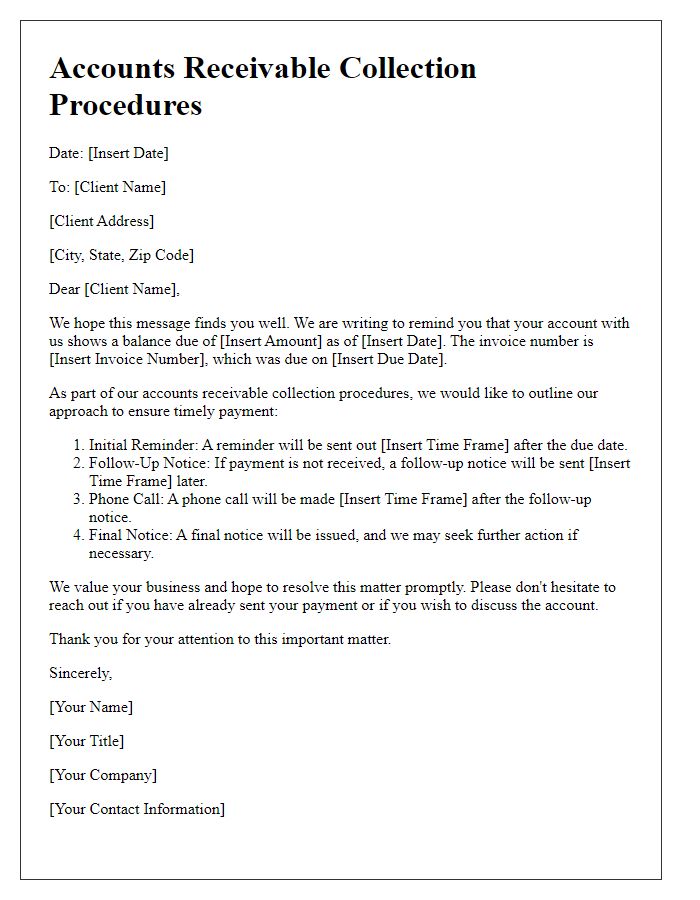

Payment terms and deadlines

Efficient accounts receivable management is crucial for maintaining cash flow, particularly regarding payment terms and deadlines. Standard payment terms, such as Net 30 or Net 60, define the time frame within which customers must settle their invoices, commonly established by businesses like small enterprises and large corporations. Compliance with these terms ensures timely cash inflow, allowing organizations to meet operational expenses. Regular monitoring of receivables aging reports helps identify overdue accounts, typically within 30 days, 60 days, or 90 days past due. Implementing a systematic follow-up process, such as reminders or collection calls, enhances recovery rates and minimizes overdue payments. Establishing clear policies and communicating deadlines effectively can strengthen relationships with clients while ensuring financial stability for companies.

Contact information for queries

Efficient accounts receivable management is crucial for maintaining healthy cash flow and cultivating strong client relationships. Timely communication is essential for addressing queries related to outstanding invoices, payment terms, and account details. Contact information should include dedicated email addresses, phone numbers, and office hours to ensure prompt responses. For example, an accounts receivable department can list contact names, such as Jane Doe, Senior Accountant, available at (555) 123-4567 or janedoe@example.com, to assist clients directly. Establishing clear channels for communication fosters transparency and trust, enabling quicker resolution of disputes and enhancing overall satisfaction.

Comments