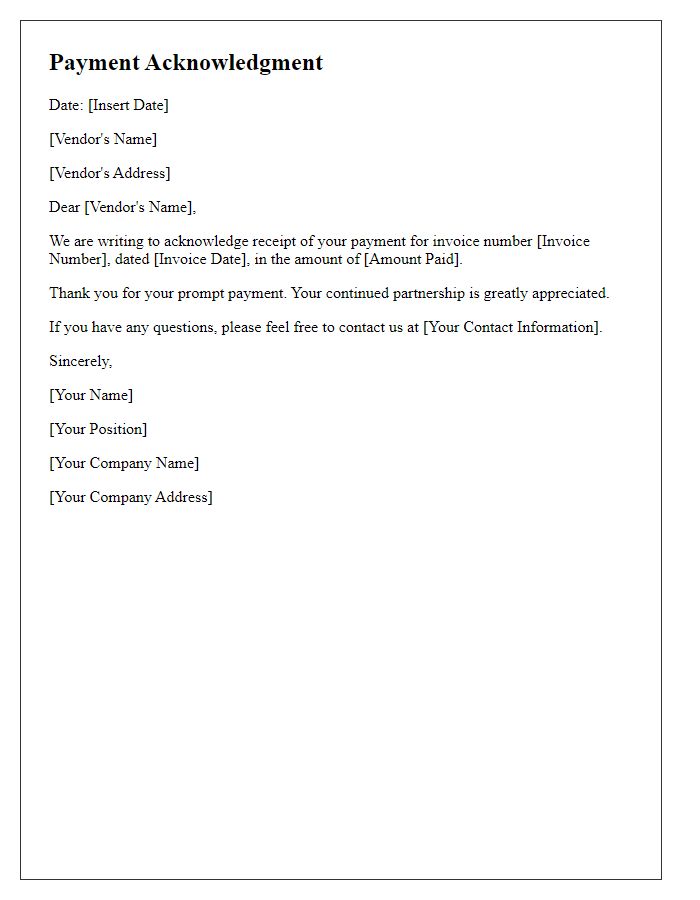

In today's fast-paced business world, clear communication is essential, especially when it comes to vendor relationships. Sending a payment confirmation letter not only assures your vendor that their invoice has been processed but also fosters a sense of trust and professionalism. Whether you're confirming a recent payment or detailing the specifics of a transaction, crafting a well-structured letter can make all the difference. Join me as we explore some effective templates and tips to streamline your payment confirmation process!

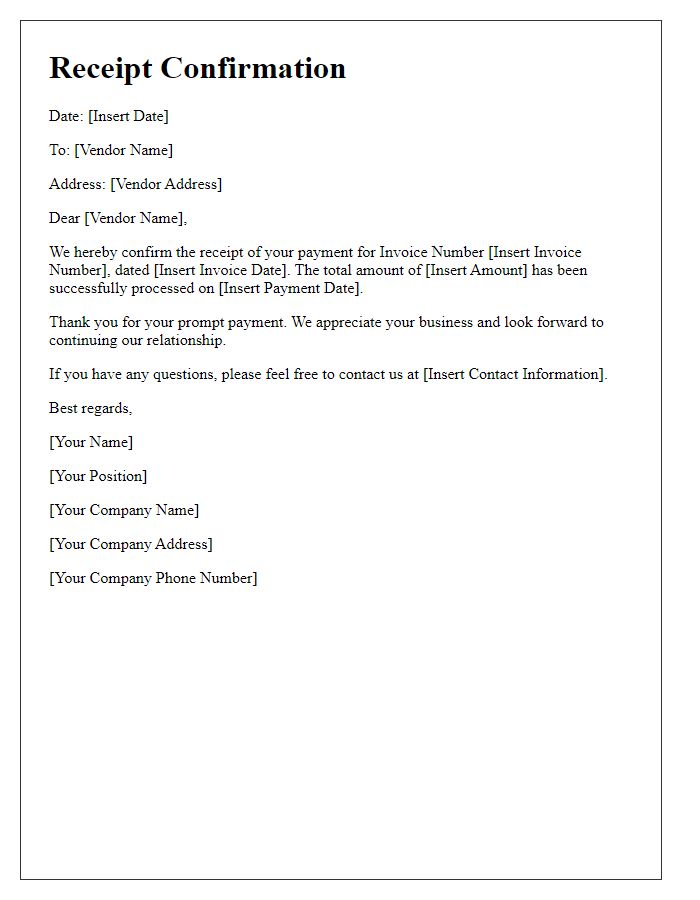

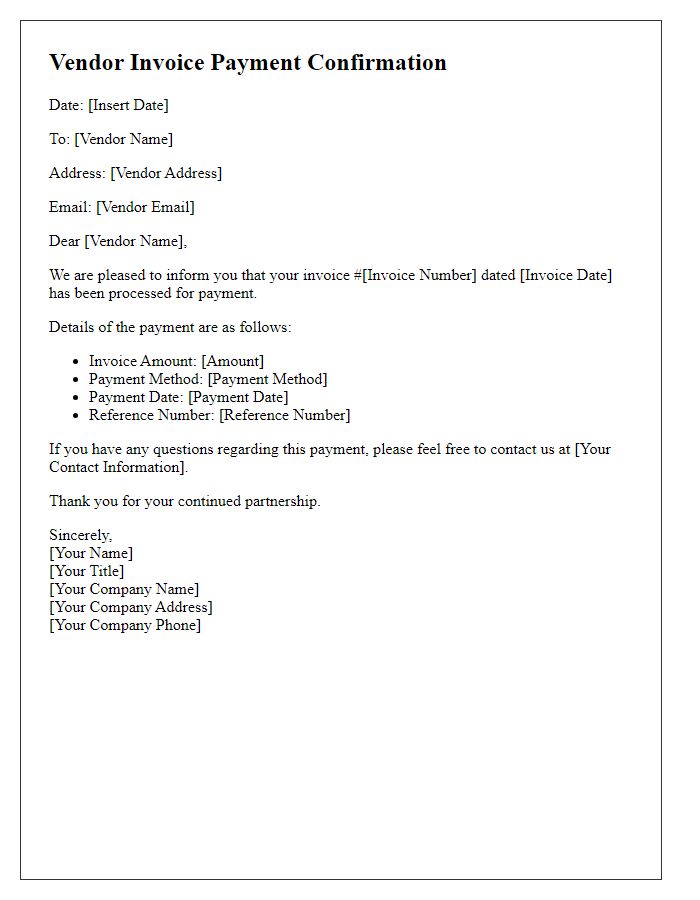

Vendor details confirmation

Confirmation of vendor payment is essential for maintaining healthy business relationships. Vendor details such as company name (e.g., ABC Supplies), address (e.g., 123 Market Street, Suite 456, Cityville), tax identification number, and bank account information (including account number and routing number) must be verified to ensure accurate processing. Payment amounts (e.g., $5,000) should match the agreed-upon terms in the contract or invoice. Additionally, significant dates (such as invoice issuance on April 1, 2023, and payment due date on April 15, 2023) need acknowledgment to avoid any late fees or penalties. Ensuring all information is accurate facilitates timely transactions and fosters trust between the business and its vendors.

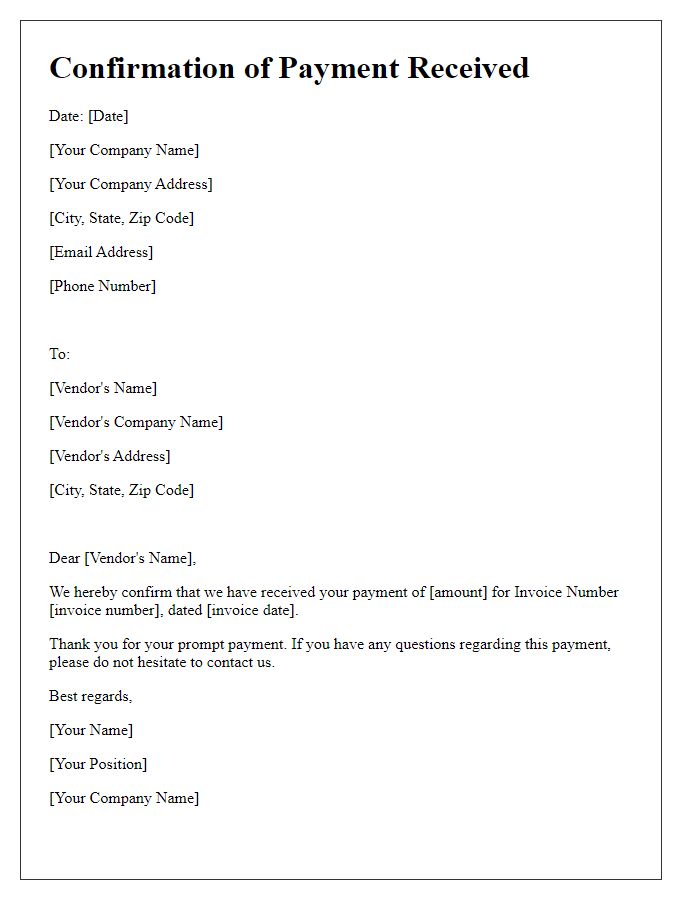

Payment amount verification

Payment confirmation is vital in maintaining vendor relationships. A payment amount verification involves a detailed assessment of the invoice provided by the vendor. Financial departments typically check essential elements such as invoice number, due date, and payment terms. For instance, verifying a payment of $5,000 against an invoice submitted on September 1, 2023, ensures that the transaction aligns with the agreed-upon contract terms. This process also includes cross-referencing with internal records to confirm receipt of goods or services. Additionally, accurate payment verification prevents potential disputes and fosters trust with vendors. Efficient tracking systems, such as accounting software, can streamline this verification process, ensuring timely and accurate payments.

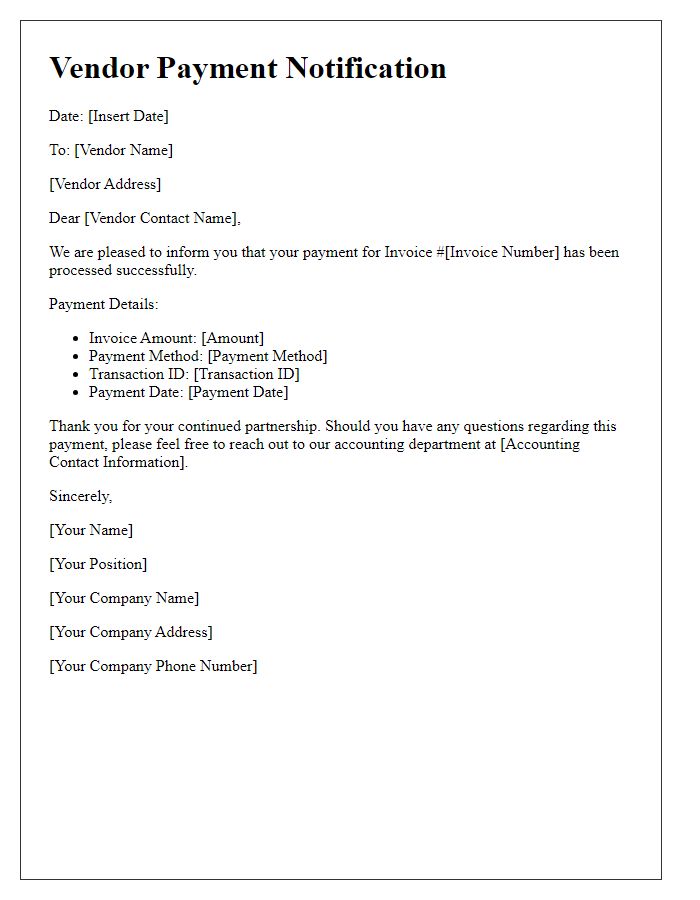

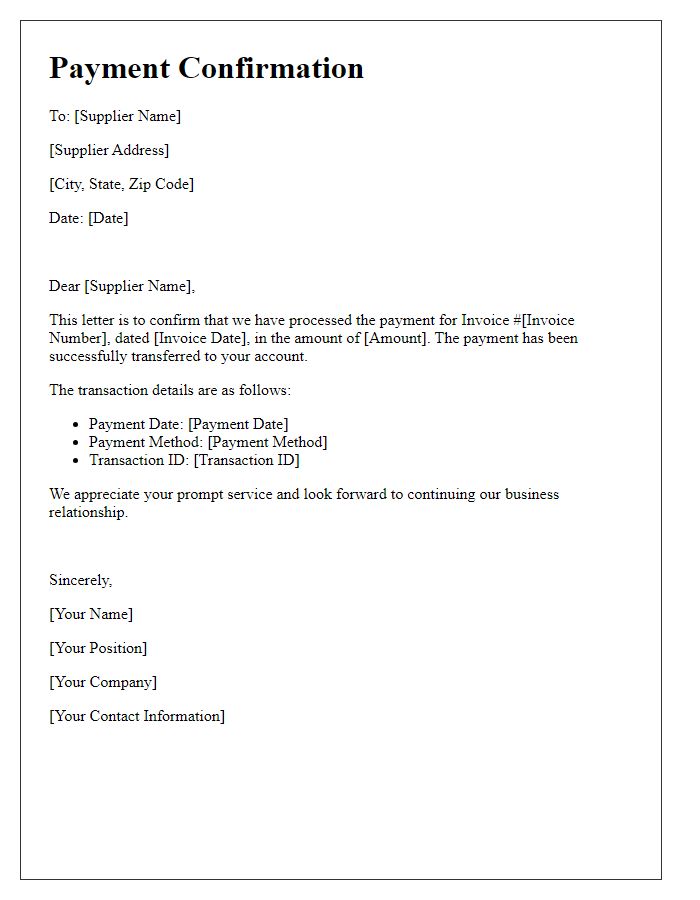

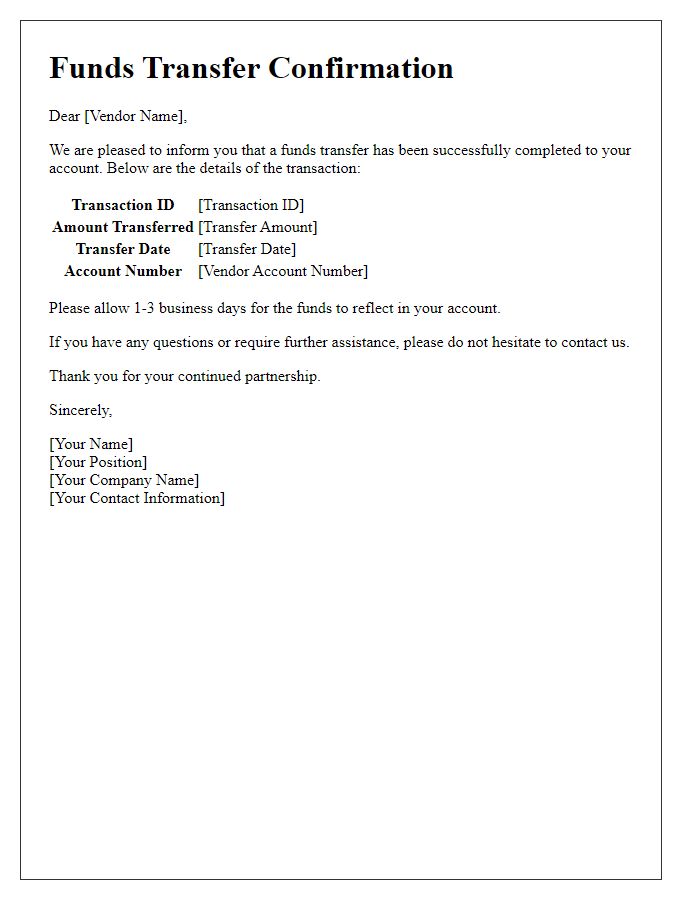

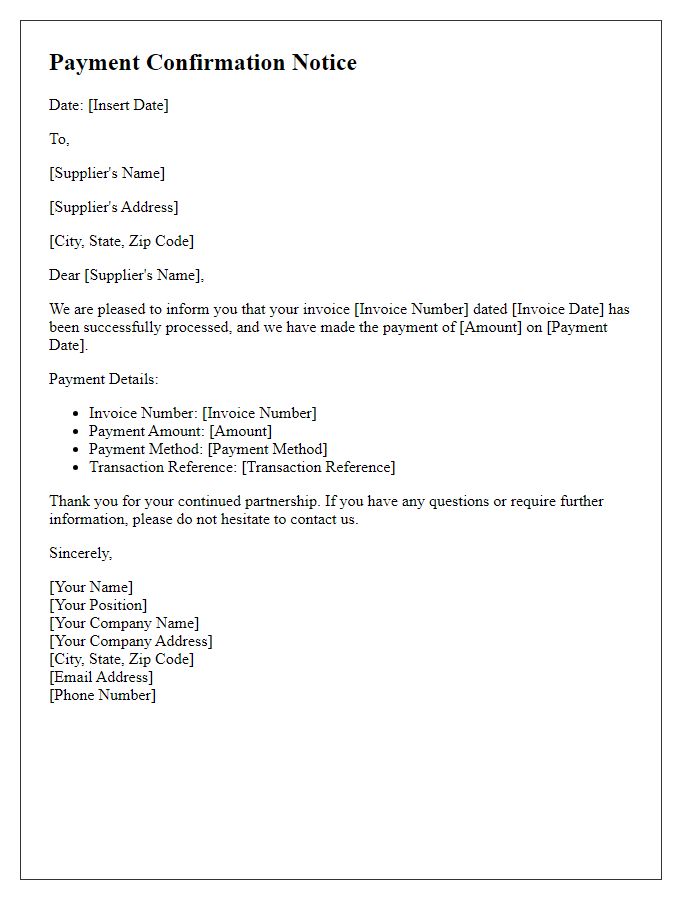

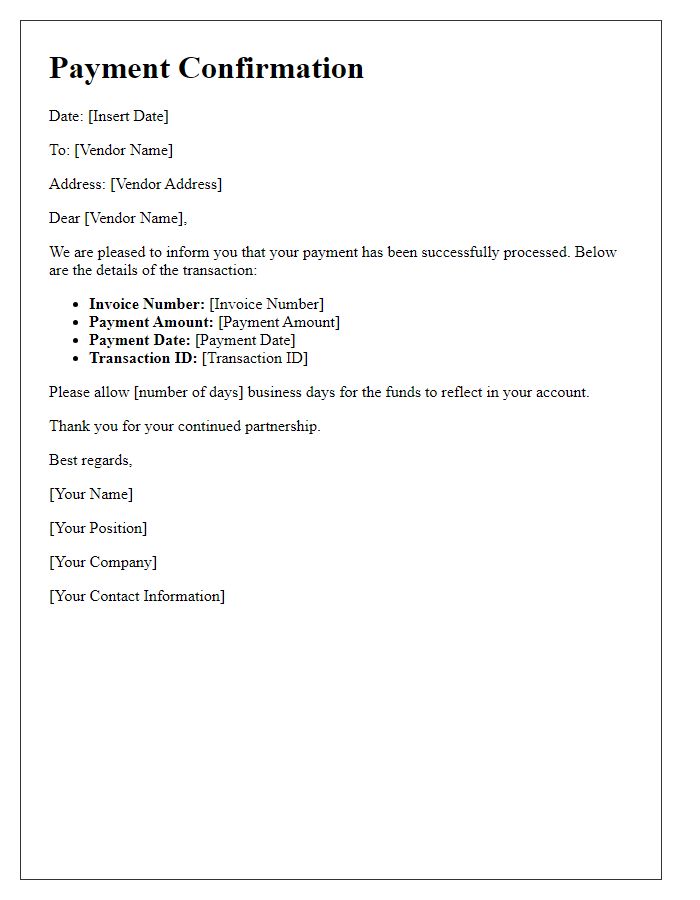

Payment method and date

Payment confirmation for invoices is a crucial business practice that ensures clarity in financial transactions. Vendors typically receive confirmations via email or official letters. Payment methods may include bank transfers, credit card payments, and electronic funds transfers. The date on which the payment is processed also holds significance, particularly for accounting purposes. For instance, a bank transfer may take up to three business days depending on the financial institution involved. Timestamped confirmations aid in providing a clear record for both the vendor and the payer, promoting transparency and trust in the business relationship.

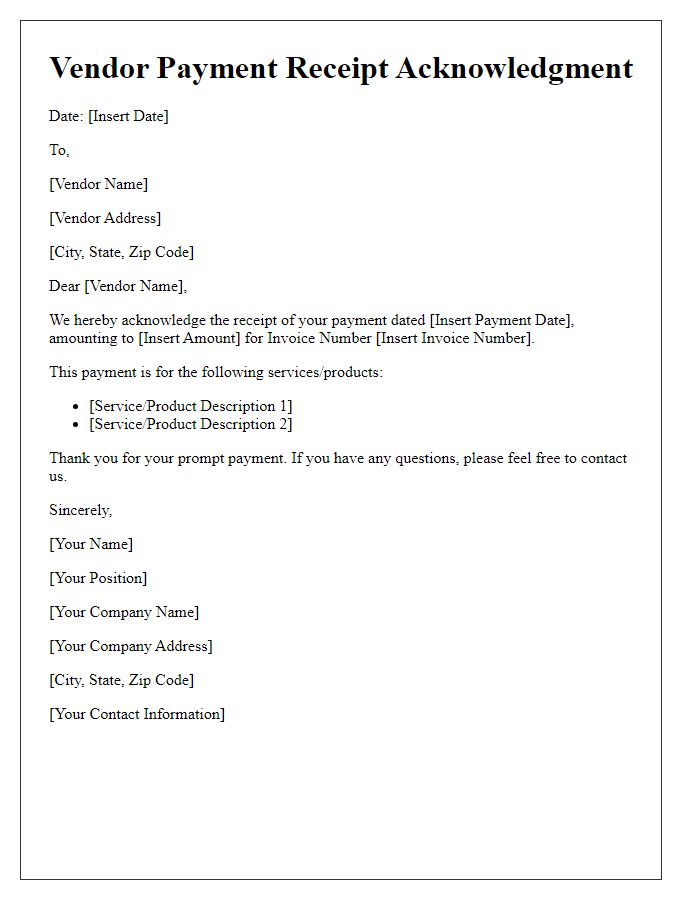

Reference or transaction ID

Vendor payment confirmation requires accurate details for both transparency and tracking. The reference or transaction ID serves as a unique identifier for each payment made to vendors. This ID enables quick verification in financial systems, ensuring proper allocation of funds to vendors such as suppliers or service providers. For example, in a recent transaction, a reference ID of "TX123456789" facilitated easy tracking within payment platforms like PayPal or bank systems, aiding in seamless record-keeping. Effective use of transaction IDs improves communication and accountability between businesses and their vendors during financial interactions.

Contact information for follow-up

Timely vendor payment confirmations are essential for maintaining positive business relationships and are often required to ensure smooth transactions. Prompt confirmation of payment can help mitigate misunderstandings regarding account balances and avoid potential disruptions in service. Key contact information for follow-up, such as the finance department's email (e.g., finance@yourcompany.com) or direct line (e.g., +1-800-555-0199), ensures vendors can easily reach out for inquiries about their payments. Clear documentation of the transaction, including payment dates, invoice numbers (e.g., Inv#123456), and amounts (invoiced amounts such as $10,000), enhances record-keeping efficiency and accountability. In addition, specifying whether payments were made via check, ACH transfer, or credit card can increase transparency.

Comments