Are you considering streamlining your finances with professional bookkeeping services? Finding the right support can transform the way you manage your time and money, allowing you to focus more on growing your business. Whether you're a small startup or a thriving enterprise, understanding your bookkeeping needs is crucial for success. Dive into our article to discover how to choose the ideal bookkeeping service for your unique requirements!

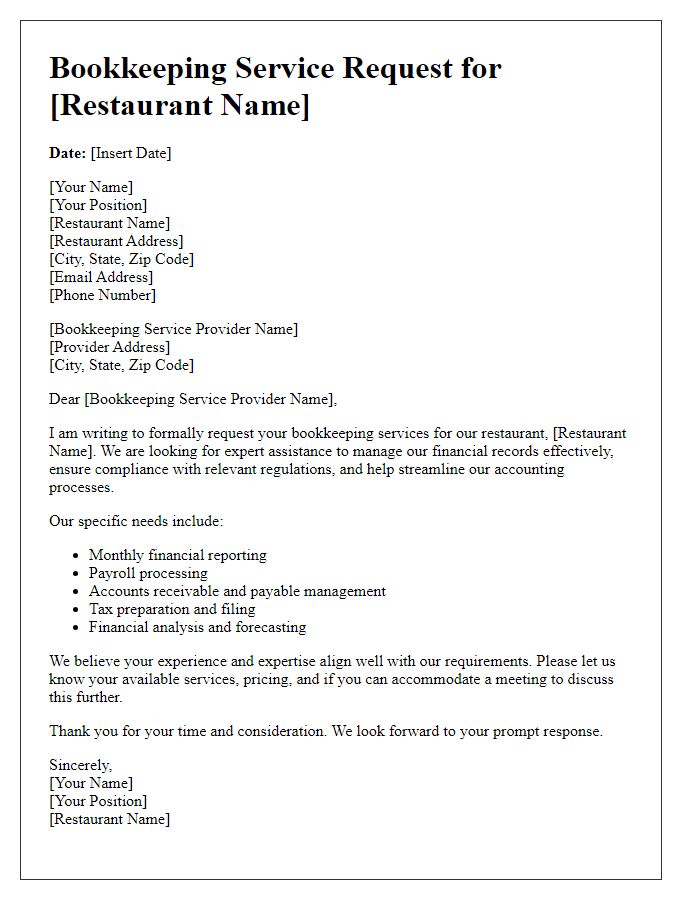

Service details and scope of work

A comprehensive bookkeeping service includes various tasks vital for maintaining accurate financial records for a business. These services typically encompass accounts payable and receivable management, precise transaction recording, bank reconciliation to ensure alignment between financial statements and bank transactions, and financial statement preparation including profit and loss statements and balance sheets. Payroll processing may be included, ensuring employees receive timely and accurate payments while adhering to tax regulations. Tax preparation for both quarterly and annual filings ensures compliance with local (specific regulations may vary by state or country), state, and federal (IRS guidelines in the United States) requirements. Regular financial reporting is crucial, providing clients with in-depth insights into their financial status, cash flow analysis, and budget forecasting to aid in strategic decision-making. Secure cloud-based software integration enhances efficiency and accessibility while maintaining data privacy and security. A qualified bookkeeper typically holds certifications such as Certified Bookkeeper (CB) or similar credentials, showcasing their expertise and commitment to excellence in financial management.

Experience and qualifications

When considering outsourcing bookkeeping services, it is essential to evaluate the experience and qualifications of potential providers. An ideal bookkeeping service should have a minimum of 5 years of experience working with small businesses in various sectors, such as retail, hospitality, or e-commerce. Professional certification, such as Certified Public Accountant (CPA) or Certified Bookkeeper (CB), signifies expertise in accounting principles and tax regulations. Familiarity with accounting software, like QuickBooks or Xero, can enhance efficiency in record-keeping processes. Additionally, a strong understanding of financial reporting standards, like Generally Accepted Accounting Principles (GAAP), ensures compliance and accurate financial statements. Checking references and client reviews can provide insights into reliability and service quality in handling complex financial transactions.

Pricing and payment terms

Inquiries about bookkeeping services often involve understanding pricing structures and payment terms. Many firms offer tiered pricing models based on the complexity of financial transactions, such as basic, standard, and premium packages. For instance, basic packages may start at approximately $200 per month, covering essential services like transaction recording and monthly reports. Payment terms can vary, with options for monthly billing or annual contracts, providing flexibility for businesses. It's important to clarify whether there are additional fees for services such as tax preparation or financial consulting, as these can significantly affect overall costs. In addition, firms may require a retainer fee to initiate services, ensuring commitment and coverage of initial workloads.

Confidentiality and data security measures

When considering bookkeeping services, confidentiality and data security are paramount. Professional bookkeeping firms implement strict protocols to protect sensitive financial information. Common measures include encryption technologies, which safeguard data during transmission and storage, and secure access controls that limit data visibility to authorized personnel only. Additionally, regular security audits ensure compliance with industry standards, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) for businesses operating within the European Union. Some firms may also require non-disclosure agreements (NDAs) to reinforce their commitment to maintaining client confidentiality and trust. Furthermore, training staff on data security best practices is essential to prevent breaches and ensure that all employees are vigilant against potential threats.

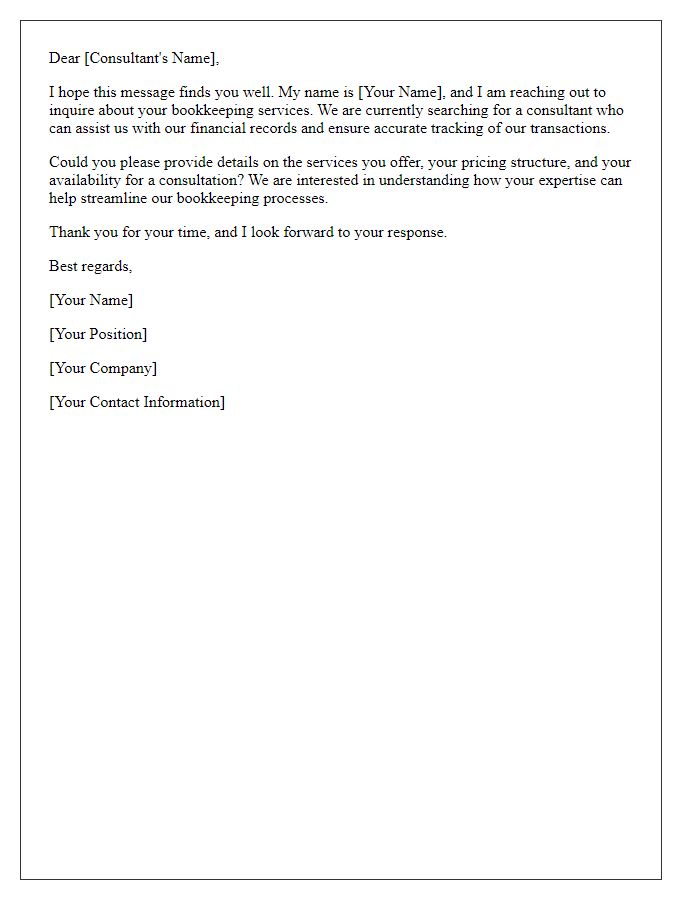

Contact information and next steps

Inquiring about bookkeeping services requires providing clear contact information and outlining next steps for effective communication and decision-making. Potential clients should share their full name, company name, email address, and phone number to ensure prompt responses from professionals. After receiving initial contact, it is useful to discuss specific needs, such as monthly reconciliations, financial reporting, or payroll management, to tailor the services. A follow-up call or meeting can be scheduled to go over pricing, service timelines, and any additional documentation needed, such as tax returns or previous financial statements, to assist in creating an accurate proposal.

Letter Template For Bookkeeping Service Inquiry Samples

Letter template of bookkeeping service inquiry for non-profit organizations

Letter template of bookkeeping service request for e-commerce businesses

Letter template of bookkeeping service inquiry for real estate professionals

Comments