Are you in need of a clear and concise letter template for operating lease disclosures? Understanding the nuances of lease agreements can be overwhelming, but having the right framework can simplify the process significantly. In this article, we'll explore a structured approach to crafting your operating lease disclosures letter, ensuring you cover all essential details. So, let's dive in and discover how to create an effective template that meets your needs!

Nature and terms of lease agreement

Operating lease agreements, commonly associated with the rental of assets such as office space or equipment, feature specific terms that define the relationship between the lessor and the lessee. These agreements typically include the duration, which can range from short-term (less than one year) to long-term arrangements, potentially lasting for several years. Key terms also encompass payment structure, often detailing monthly rental amounts, escalation clauses linked to inflation rates, or market adjustments. Additionally, responsibilities regarding maintenance, insurance, and property taxes are outlined, specifying which party bears these costs. Lease agreements may also include renewal options, allowing lessees to extend the lease under predefined conditions. Notably, operating lease agreements are characterized by the absence of ownership transfer at the end of the term, which is crucial in assessing the economic impact for both parties involved.

Lease payment obligations and schedule

Operating lease obligations represent future financial commitments related to the use of leased assets, such as office spaces or equipment. Organizations typically categorize these obligations by annual payment schedules, detailing amounts due each fiscal year. For instance, a company may list commitments of $50,000 for the first year, $45,000 for the second year, $40,000 for each of the next three years, and a final payment of $35,000 in the sixth year. These financial commitments are critical for accurate financial reporting, with implications for cash flow forecasting and balance sheet management, particularly in compliance with accounting standards, like IFRS 16 or ASC 842, which govern lease accounting practices. Prompt disclosure of these future payment obligations assists stakeholders in assessing the company's long-term liabilities and overall financial health.

Accounting policy and recognition criteria

Operating leases represent contractual agreements where the lessee obtains the right to use an asset, such as real estate or equipment, over a specified period without assuming ownership. Recognition of lease expenses occurs on a straight-line basis, meaning that the total lease payments are evenly distributed over the lease term, ensuring consistent expense reporting. Lessees disclose lease commitments in the notes to the financial statements, detailing future minimum lease payments and the lease term. Additionally, lessees assess whether the lease arrangement includes variable lease payments tied to performance metrics or indices, emphasizing the distinction between fixed and variable costs associated with lease agreements. The accounting treatment aligns with the guidelines set forth in ASC 842, promoting transparency in financial reporting for stakeholders, including investors and analysts.

Contingent rents and escalation clauses

Operating lease agreements often include contingent rents and escalation clauses, which add complexities to the financial reporting of leases. Contingent rents depend on specific events or conditions, such as increased sales or other performance metrics, making them variable in nature; they can significantly impact the financial performance of entities, especially during high-revenue periods. Escalation clauses typically enable landlords to adjust rental payments based on inflation rates or market conditions, ensuring rent remains aligned with current economic conditions; for instance, an annual adjustment based on the Consumer Price Index (CPI) can lead to substantial increases over time. Disclosures regarding these lease components are vital for stakeholders to assess the potential liabilities and cash flow implications for businesses, given the variability and unpredictability these terms introduce into lease obligations.

Potential sublease arrangements

Operating lease agreements often include potential sublease arrangements that provide flexibility for lessees. Companies may opt to sublease leased assets, such as office space or equipment, to third parties to optimize resource utilization. The lease terms typically outline the conditions under which subleasing is permissible, including the requirement for the lessor's consent. Financial implications arise, such as recognizing sublease income in financial statements, which can impact reported revenue. Regulatory frameworks, such as Accounting Standards Codification (ASC) 842 in the United States, require detailed disclosures regarding the nature of subleases, potential risks, and obligations to ensure transparency for stakeholders in assessing the lessee's lease obligations and overall financial position.

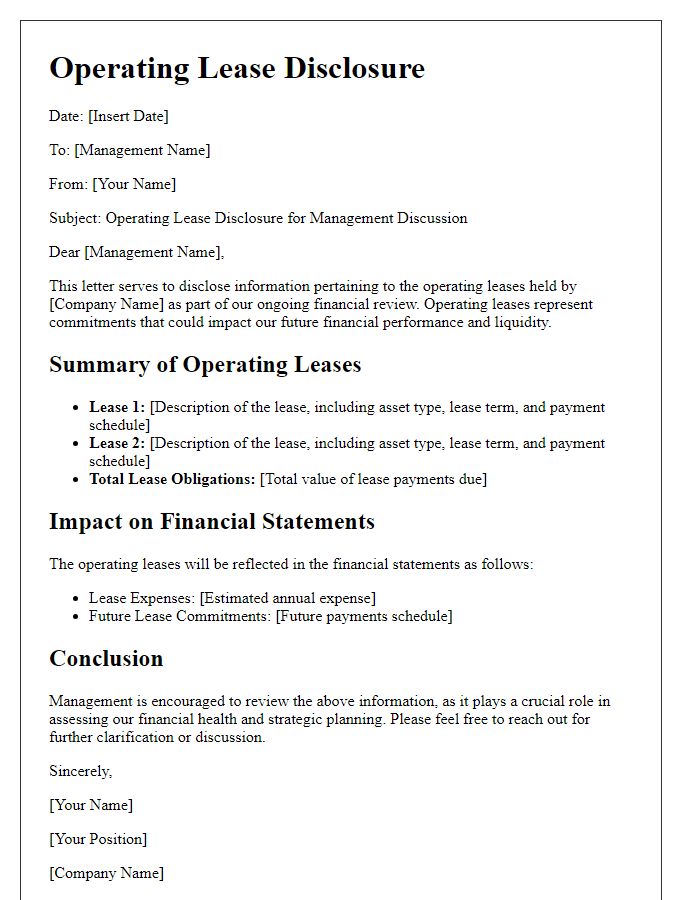

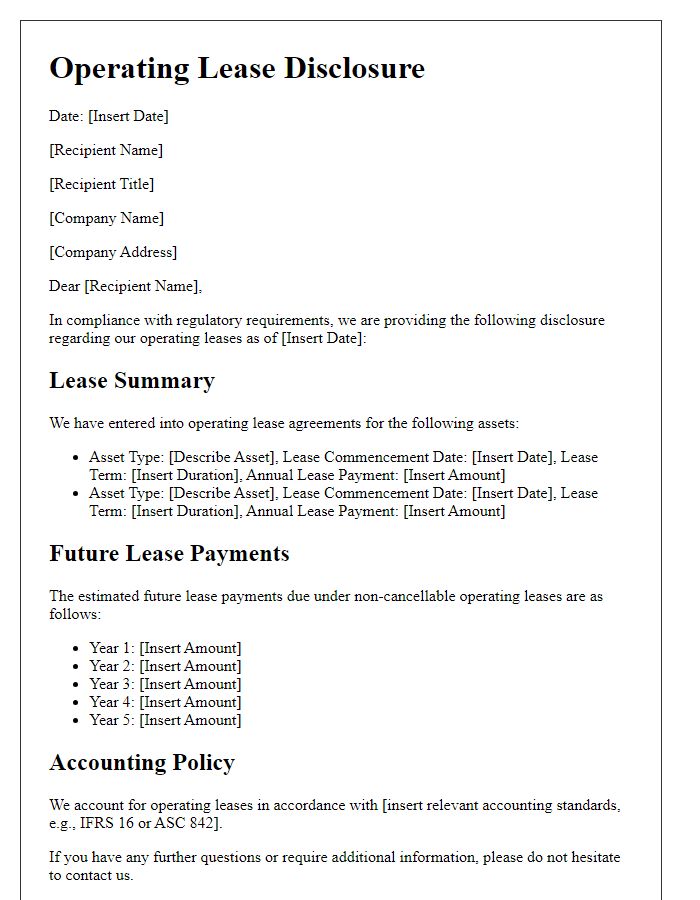

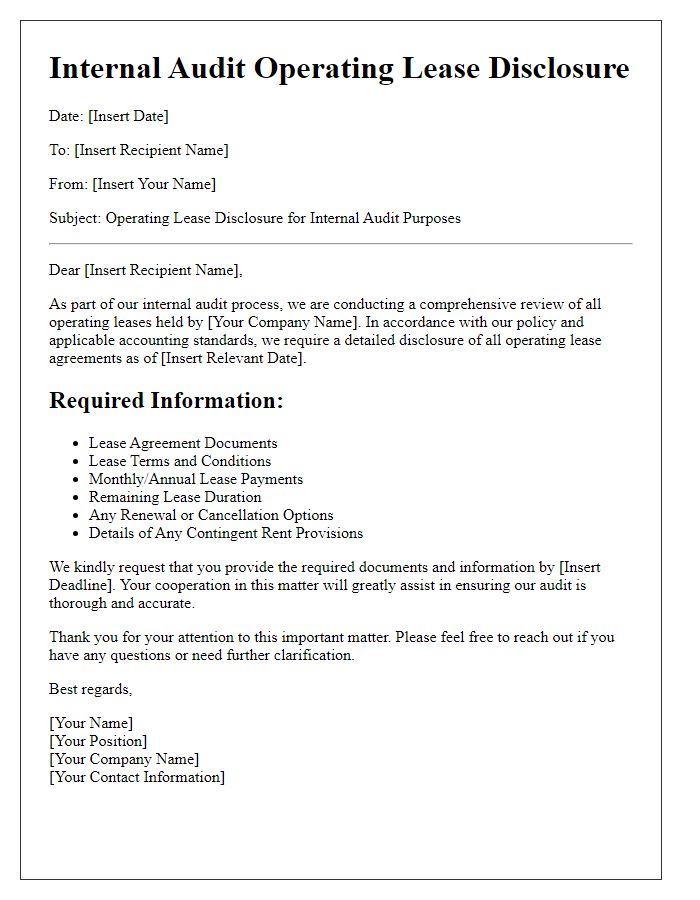

Letter Template For Operating Lease Disclosures Samples

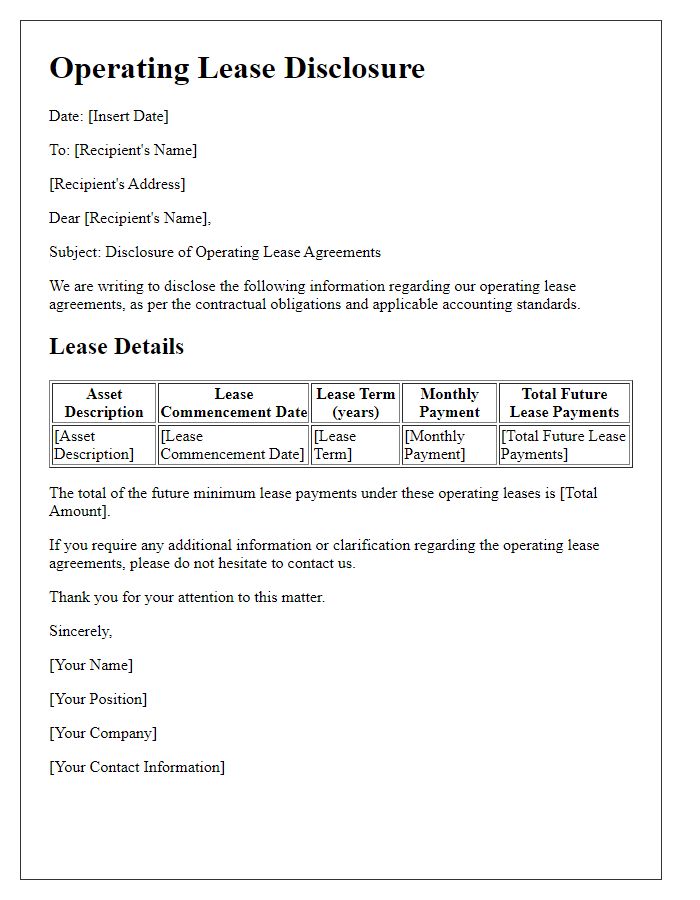

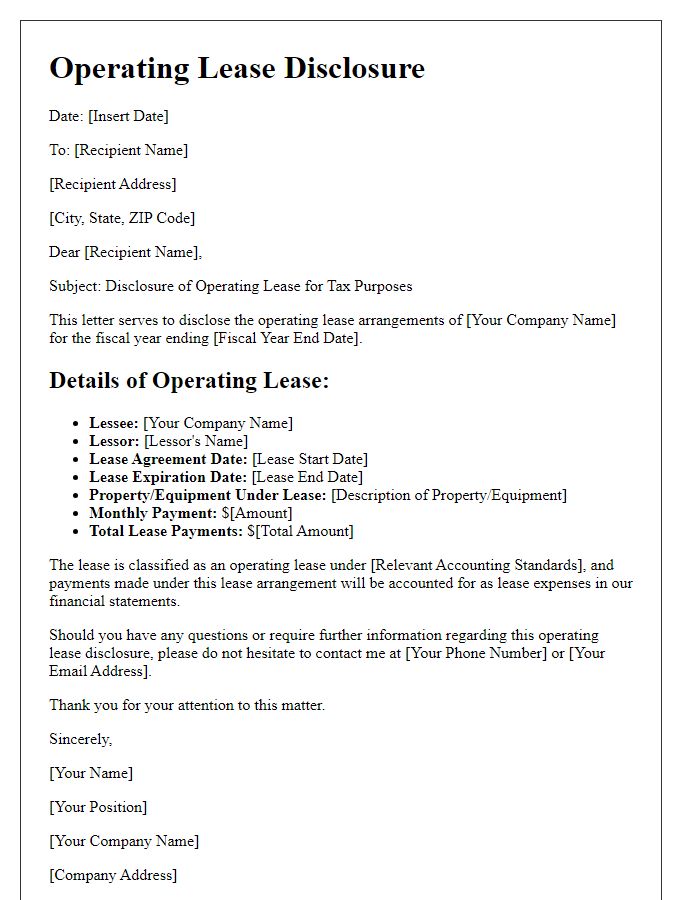

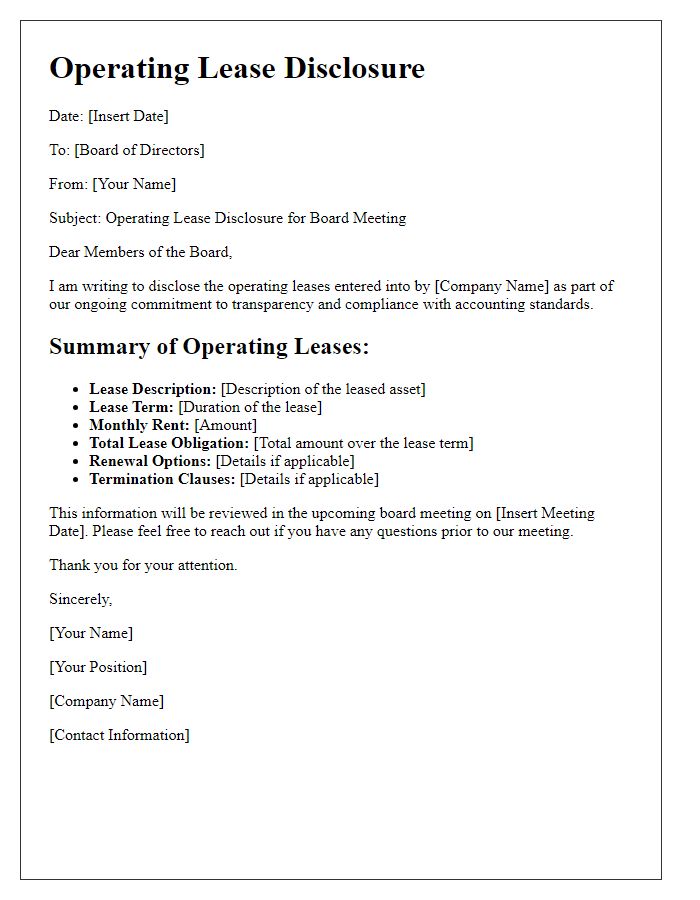

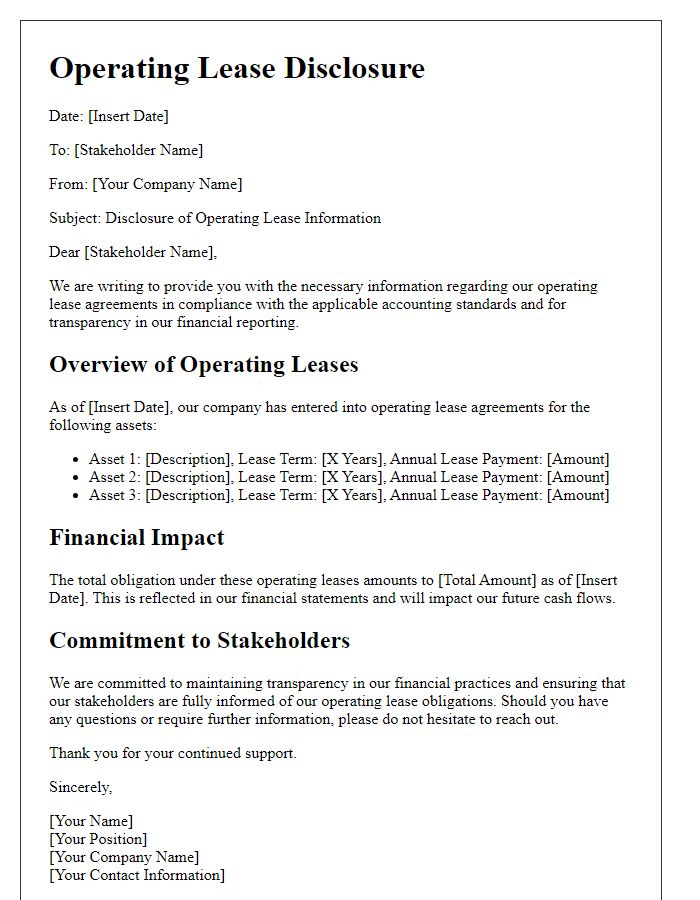

Letter template of operating lease disclosure for management discussion.

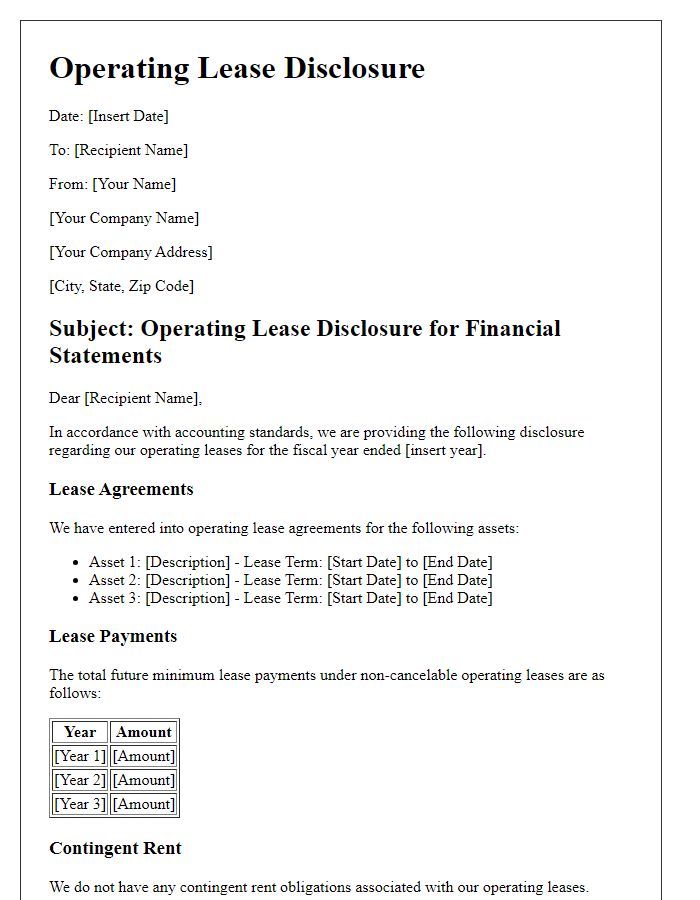

Letter template of operating lease disclosure for regulatory compliance.

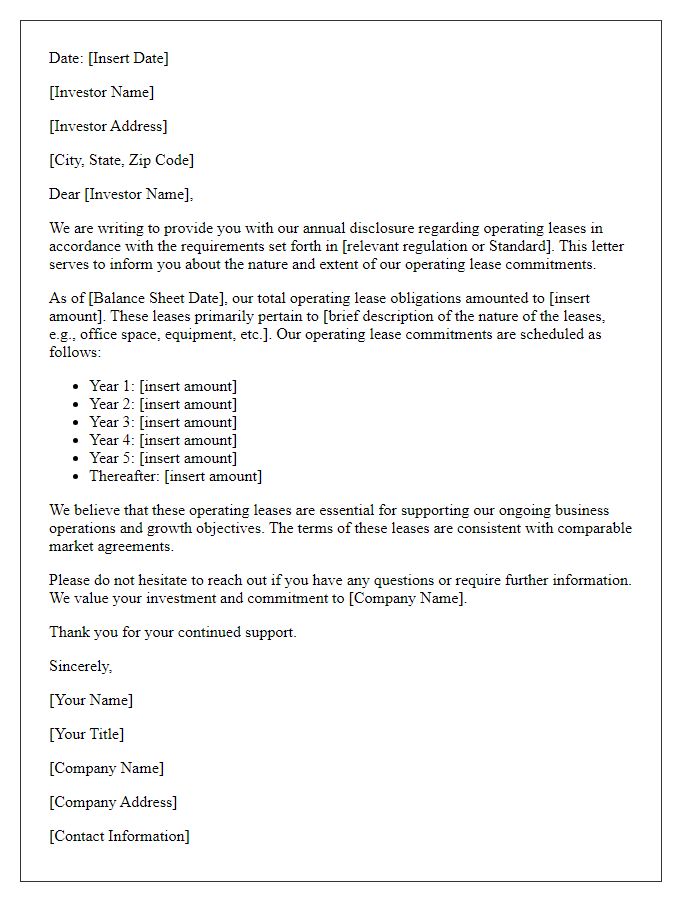

Letter template of operating lease disclosure for internal audit purposes.

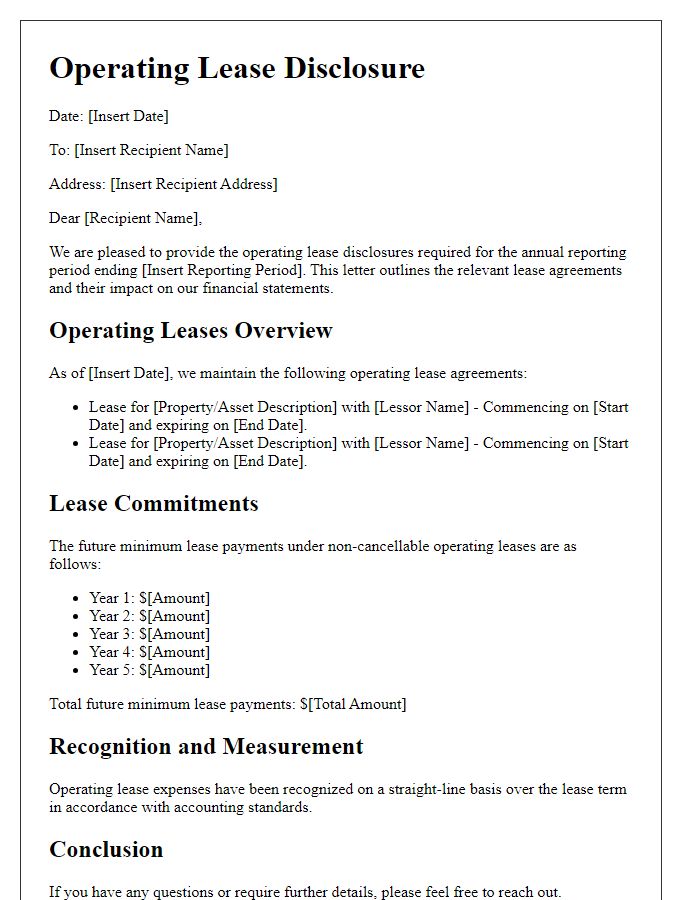

Letter template of operating lease disclosure for contractual agreements.

Comments