Are you looking to take charge of your financial future but don't know where to start? We understand that navigating the world of finances can be overwhelming, which is why we're here to help guide you through every step of the process. Our tailored consultancy services are designed to meet your unique needs, ensuring you receive personalized advice and strategies. Join us on this journey to financial empowerment and read more about how we can assist you!

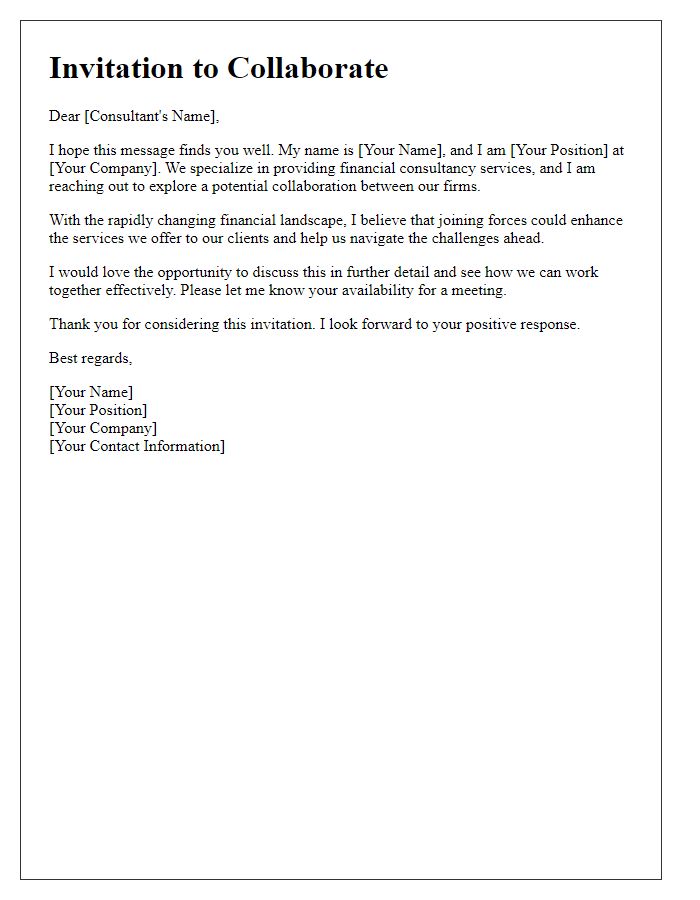

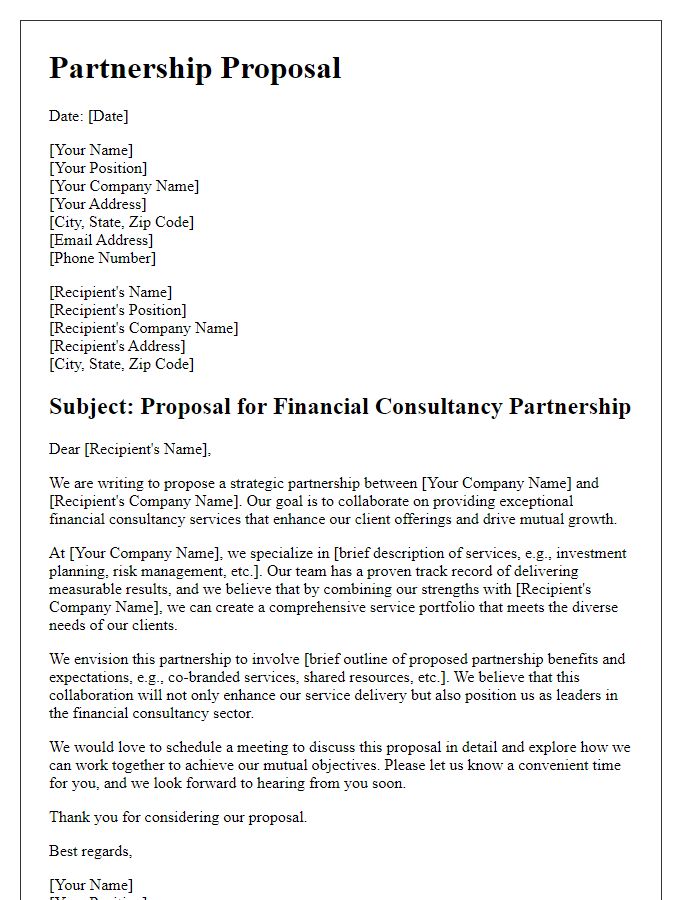

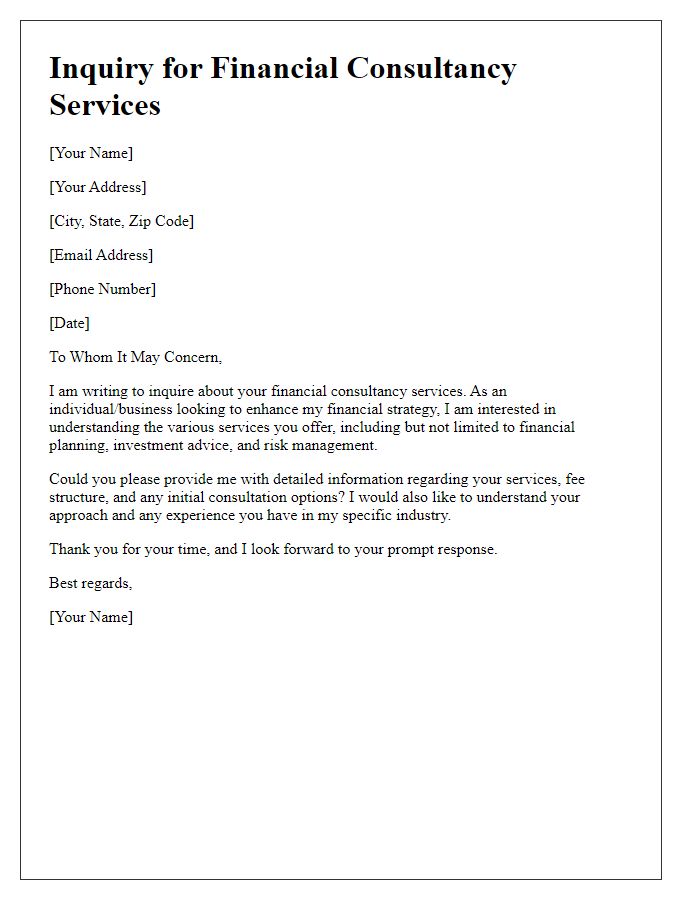

Professional greeting and introduction

Financial consultancy services provide essential guidance for individuals and businesses navigating complex financial landscapes. A reputable consultancy can assist clients in investment strategies, tax planning, and risk management. Customized financial assessments (utilizing detailed analysis of assets and liabilities) enable informed decision-making. Advisors often use up-to-date market data to recommend suitable financial products and strategies tailored to client goals. Key factors include evaluating investment portfolios (considering diversification based on market trends), analyzing cash flow (monitoring income versus expenses), and retirement planning (encompassing pension funds and savings). Engaging with a financial consultant can lead to improved financial health and long-term wealth preservation.

Clear purpose and objectives

A financial consultancy invitation aims to provide expert guidance to individuals or businesses seeking to improve their financial health. The clear purpose of this invitation includes offering tailored financial advice, investment strategies, and risk management solutions. Objectives encompass understanding client-specific financial needs, analyzing current fiscal situations, and presenting actionable plans to enhance financial stability and growth. Key elements in the invitation may include scheduling a consultation meeting, identifying targeted areas for financial improvement, and establishing a long-term partnership for ongoing financial success. A well-defined agenda will ensure effective communication and address all client inquiries and concerns.

Key financial services offered

The financial consultancy firm provides a comprehensive range of services designed to enhance financial health and strategic decision-making for clients. Services include investment management, where expert advisors analyze market trends and asset performance to optimize portfolio returns. Tax consulting focuses on maximizing deductions and minimizing liabilities through strategic planning, particularly around complex government regulations and changing tax laws. Wealth management services deliver personalized strategies for individuals and families, taking into account unique financial goals and risk tolerance. Additionally, risk assessment involves identifying potential threats to financial stability and devising plans to mitigate those risks through insurance and diversification strategies. Financial planning services encompass budgeting, retirement planning, and estate planning, ensuring clients' resources are effectively allocated for current needs and future aspirations. The firm also provides market research and financial analysis to support informed business decisions and investment opportunities, leveraging data analytics and industry insights.

Benefits and value proposition

Financial consultancy can provide numerous benefits for individuals and businesses navigating complex financial landscapes. Expert insights can lead to informed decision-making, particularly in investment strategies and risk management. Tailored financial plans can align with specific goals, whether retirement savings or business expansion. Regular financial assessments ensure strategies adapt to market changes, maximizing growth potential. Additionally, professional consultations can uncover hidden opportunities, such as tax savings or cost reductions, enhancing overall financial health. Access to specialized knowledge can streamline compliance with regulations, reducing risks associated with financial penalties. Overall, engaging with a financial consultancy promotes proactive financial management that fosters long-term success.

Contact information and call to action

Financial consultancy services can greatly enhance financial planning and investment strategies for businesses and individuals. Experienced consultants analyze data, market trends, and personal financial situations to provide tailored advice. In an ever-evolving financial landscape, navigating tax regulations and investment opportunities requires expert knowledge. The consultancy firm, located in [City Name], specializes in retirement planning, risk management, and wealth accumulation, ensuring clients achieve their financial goals. Interested clients can reach out through the provided contact information for a personalized consultation and explore opportunities for financial growth and security.

Comments