Are you ready to tackle your tax compliance needs? Understanding the nuances of tax regulations can be a daunting task for many, but it's essential for staying on track. This article will guide you through the key elements of ensuring your tax documentation is up to date and compliant with the latest requirements. So, grab a cup of coffee and join us as we explore the ins and outs of tax compliance standards!

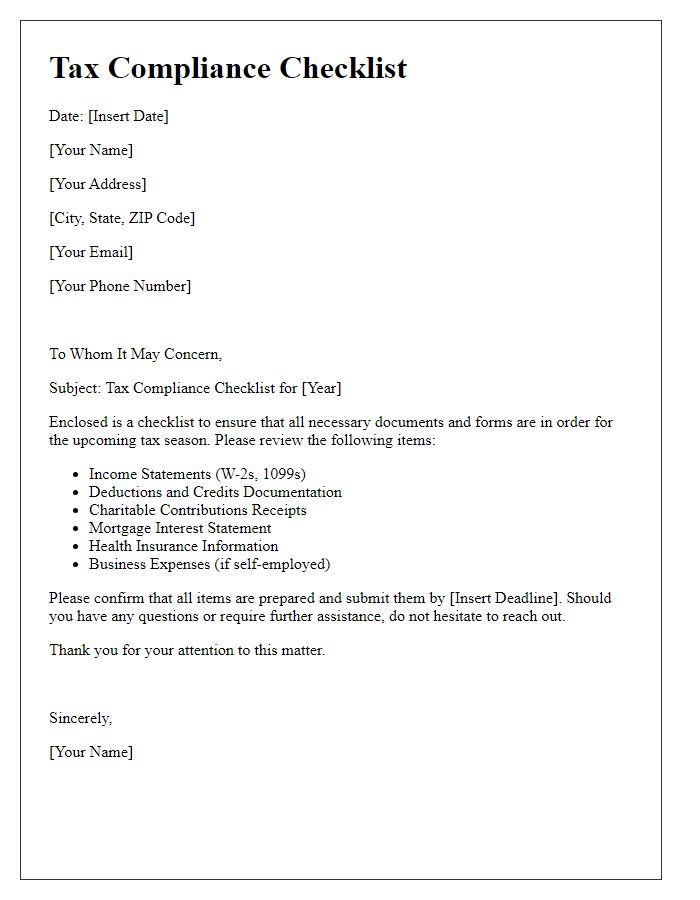

Clear Introduction

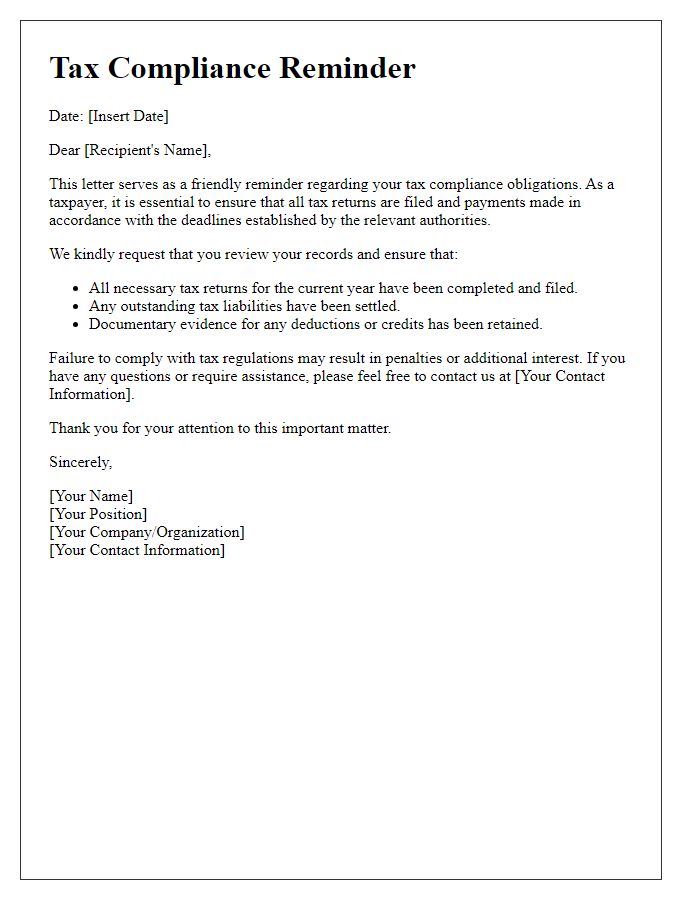

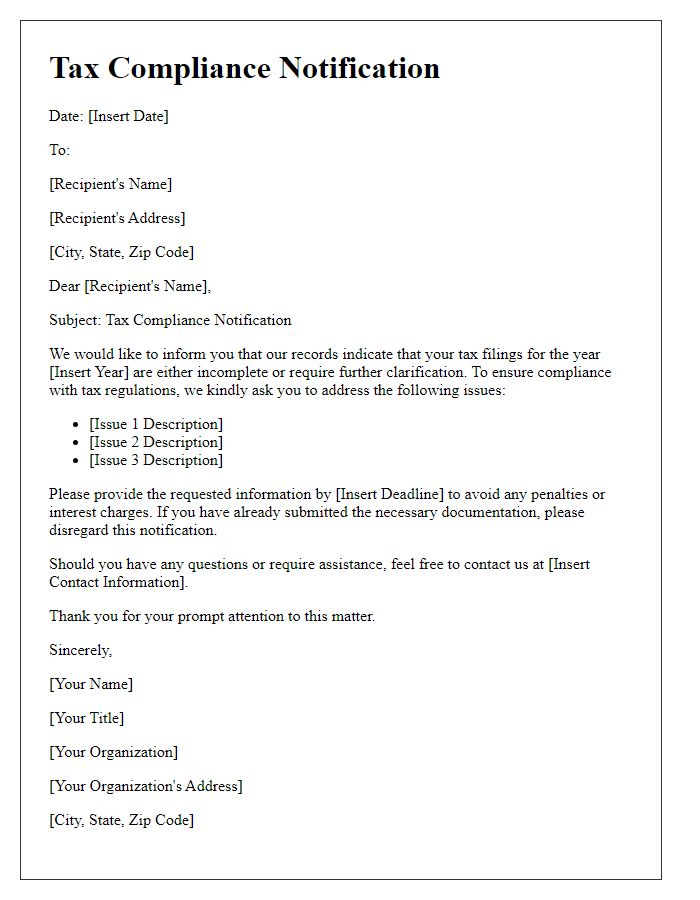

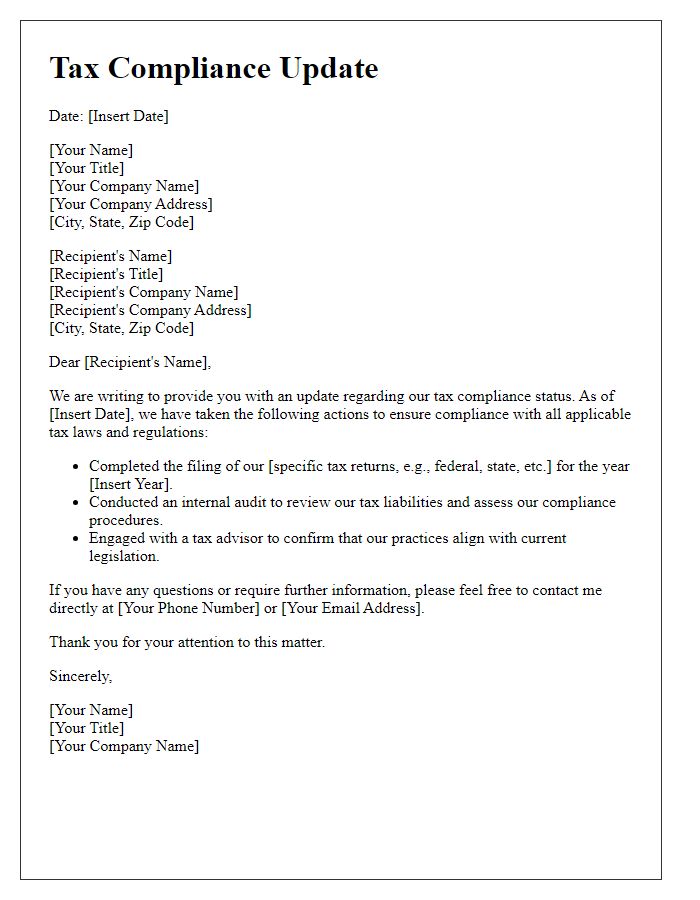

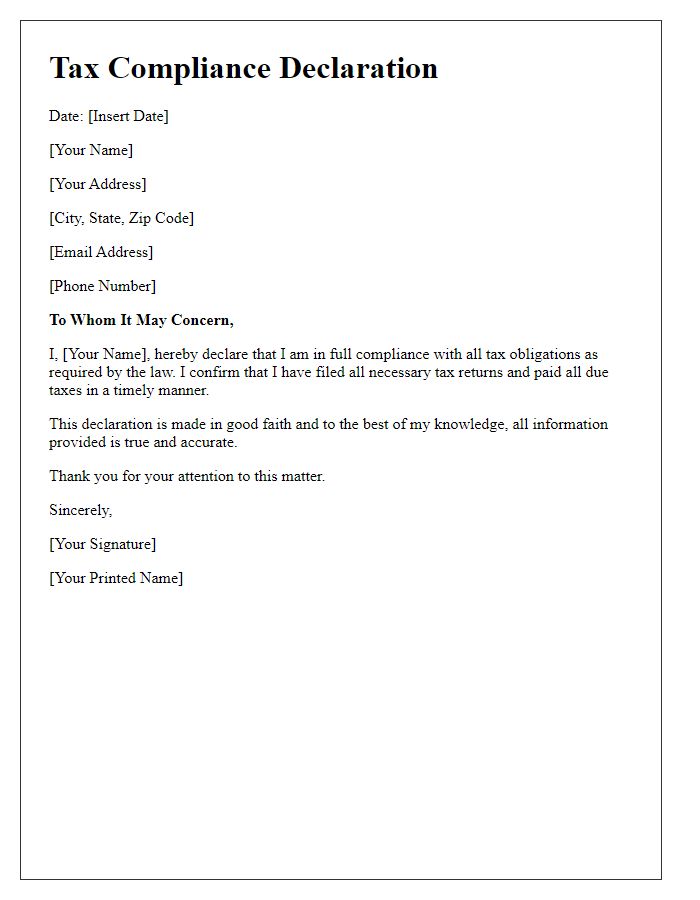

Tax compliance notifications serve as crucial reminders for individuals and businesses regarding their responsibilities towards tax obligations. Clear communication is important to ensure that recipients understand their requirements. These notifications typically highlight deadlines for filing tax returns and paying owed taxes. They may also provide insights into the consequences of non-compliance, such as penalties or interest. Additionally, contact information for further inquiries can be included, allowing recipients to seek clarification on the matters addressed. Ensuring the notification is professional and straightforward promotes compliance and fosters a cooperative relationship between tax authorities and taxpayers.

Compliance Requirements

Tax compliance notifications are essential communications issued by government tax authorities to inform taxpayers about their obligations. These notifications often detail critical deadlines, such as the April 15th filing date for individual income taxes in the United States and highlight necessary documentation, like W-2 forms or 1099 forms, which report various types of income. Taxpayers must also be aware of their responsibilities regarding estimated tax payments, which are required quarterly for self-employed individuals or those with significant non-wage income. Failure to adhere to these compliance requirements may result in penalties, interest charges, or even audits by agencies such as the Internal Revenue Service (IRS). Staying informed about local tax laws, such as changes enacted by the Tax Cuts and Jobs Act of 2017, is crucial to maintaining compliance and avoiding financial repercussions.

Deadline Information

Tax compliance notifications play a crucial role in informing taxpayers about important deadlines related to filing taxes and submitting necessary documentation. The IRS (Internal Revenue Service) sets specific dates, such as April 15 for individual tax returns, which vary for different forms, including 1040 (U.S. Individual Income Tax Return) or 941 (Employer's Quarterly Federal Tax Return). Missing these deadlines may incur penalties, such as a failure-to-file penalty of up to 5% per month on the unpaid tax amount. Furthermore, state tax agencies, like the California Franchise Tax Board, often have their deadlines that align closely with federal timelines but may include additional considerations for estimated tax payments. Timely compliance ensures that taxpayers remain in good standing and avoid unnecessary fines or interest charges.

Consequences of Non-Compliance

Non-compliance with tax regulations can lead to serious repercussions for individuals and businesses alike. Financial penalties may incur, ranging from 5% to 25% of the unpaid taxes, depending on the severity of the offense. In the United States, the Internal Revenue Service (IRS) may impose interest rates on unpaid balances, which compound daily. Legal actions can result, including liens placed on property or bank accounts, further complicating financial stability. In severe cases, criminal charges can arise, carrying potential jail time for fraudulent activities. Tax audits may occur more frequently for non-compliant entities, leading to increased scrutiny and stress. Complying with tax laws ensures contributions to public services and amenities, which benefit society as a whole.

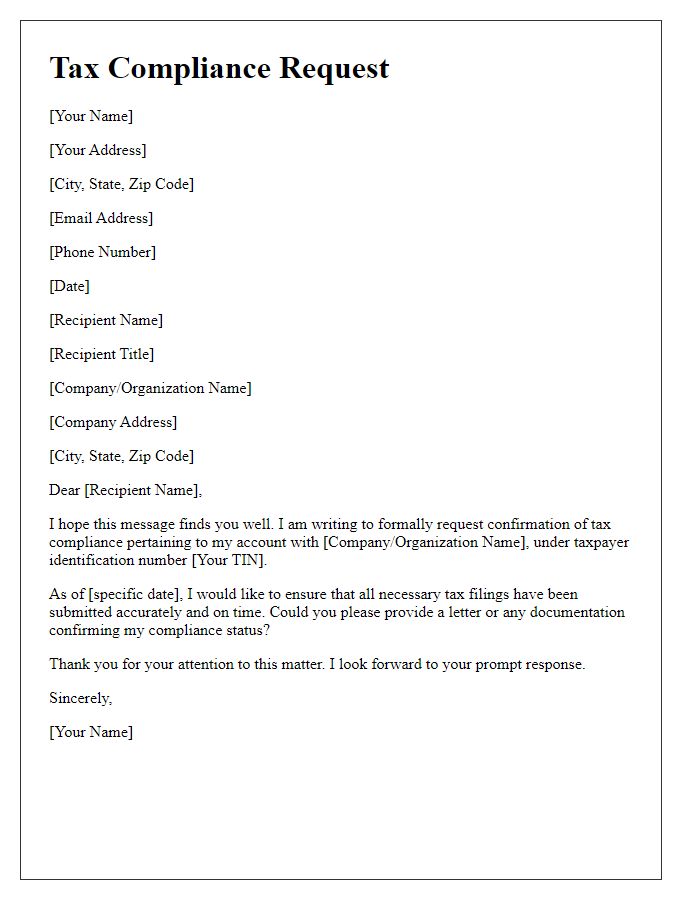

Contact Information and Support

Tax compliance notifications serve as essential reminders for individuals and businesses regarding their tax obligations. Essential elements include clear contact information for tax authorities, ensuring beneficiaries have immediate access to support resources. Phone numbers, email addresses, and websites facilitate direct communication. Additionally, including links to helpful guides or frequently asked questions can enhance user experience. Properly formatted documentation underscores the importance of deadlines, penalties associated with non-compliance, and available support services, ensuring taxpayers are well-informed and prepared for their fiscal responsibilities.

Comments