Welcome to our latest update on financial forecasting, where we delve into the exciting trends shaping our fiscal outlook. In this article, we'll explore key insights that can guide your financial strategies and decision-making. Understanding these forecasts not only empowers businesses but also enhances personal financial planning strategies. So, let's dive in and discover what the future holdsâread on for more!

Clear Objective and Purpose

Financial forecasting plays a crucial role in the strategic planning processes of businesses. Accurate projections allow companies to allocate resources appropriately, anticipate cash flow needs, and make informed investment decisions in a rapidly changing market. The primary objective of financial forecasting involves estimating future revenues, expenses, and profitability based on historical data, current market trends, and economic indicators. This process not only aids in setting realistic financial goals but also helps identify potential financial risks ahead of time. Ensuring clarity and precision in these forecasts significantly enhances stakeholders' confidence and supports effective decision-making. Analytics software, modeling tools, and team collaborations across finance, sales, and operations departments serve as key components in generating robust financial forecasts.

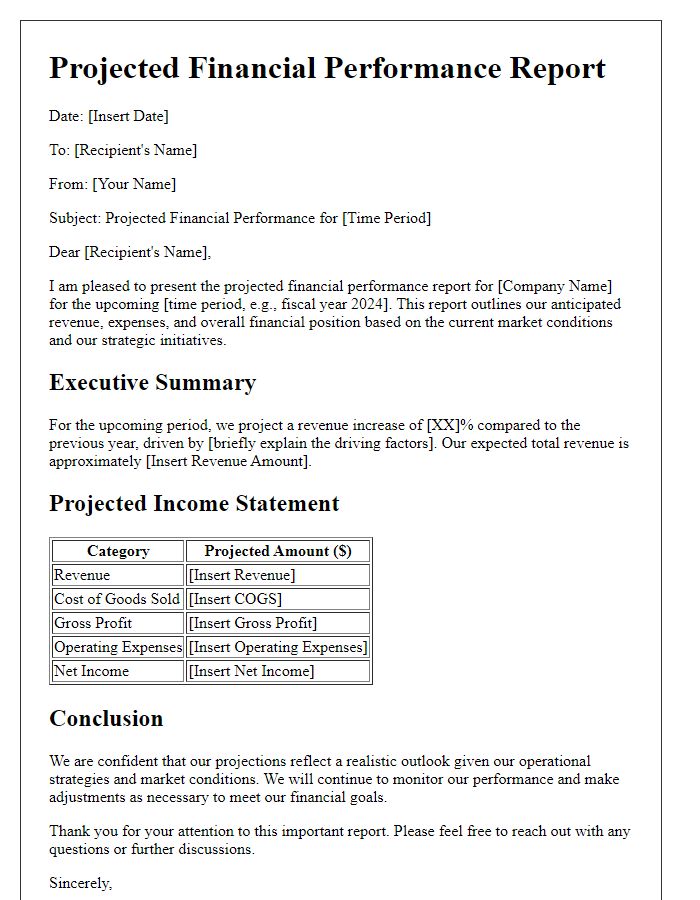

Key Financial Metrics

Financial forecasting updates often focus on key financial metrics critical for assessing a company's performance and future prospects. These metrics include revenue growth rates, net profit margins, operating cash flow, and return on investment percentages. For instance, a projected revenue increase of 15% for the upcoming fiscal year could indicate strong market demand, while a net profit margin of 20% might reflect effective cost management strategies. Moreover, analyzing operating cash flow can provide insights into liquidity and the company's ability to sustain operations without relying heavily on external financing. A return on investment exceeding 12% is typically considered favorable, indicating that capital investments are generating adequate returns. Each of these financial metrics offers valuable data for informed decision-making and strategic planning.

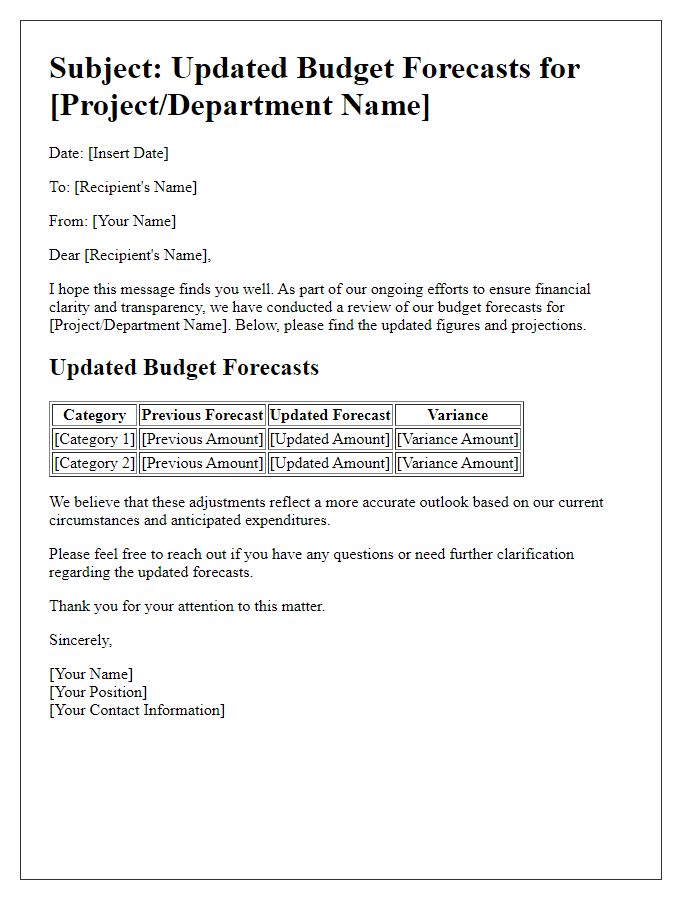

Assumptions and Scenarios

Financial forecasting updates rely heavily on clearly defined assumptions and scenarios to ensure accuracy and reliability. Key assumptions include economic indicators like GDP growth rates, interest rates, and inflation levels which directly influence revenue projections. Scenarios such as optimistic, pessimistic, and baseline must be outlined to interpret potential variations in financial performance. An optimistic scenario may assume a 10% increase in sales due to enhanced marketing strategies, while a pessimistic scenario could predict a 5% decrease from unexpected market challenges. Specific fiscal periods, like Q1 of 2024, and external factors such as regulatory changes or market competition must also be considered to provide a comprehensive outlook.

Data Sources and Methodology

In financial forecasting, data sources and methodology play crucial roles in ensuring accuracy and reliability of projections. Primary data sources include historical financial statements, industry reports from notable firms such as McKinsey & Company, and market research data from organizations like Statista, which provides statistical insights on various sectors. Secondary sources encompass government economic indicators, such as GDP growth rates averaging 2.3% annually over the past five years in the United States, inflation rates tracked by the Bureau of Labor Statistics, and trade data from the Census Bureau, highlighting trends in imports and exports. Methodology outlines the quantitative and qualitative approaches utilized, including regression analysis to identify correlations between variables, time-series analysis for trend forecasting, and scenario analysis to assess potential risks and opportunities. Adopting these rigorous methods ensures the reliability of financial forecasts, guiding strategic decision-making for entities like multinational corporations and small businesses alike.

Actionable Insights and Recommendations

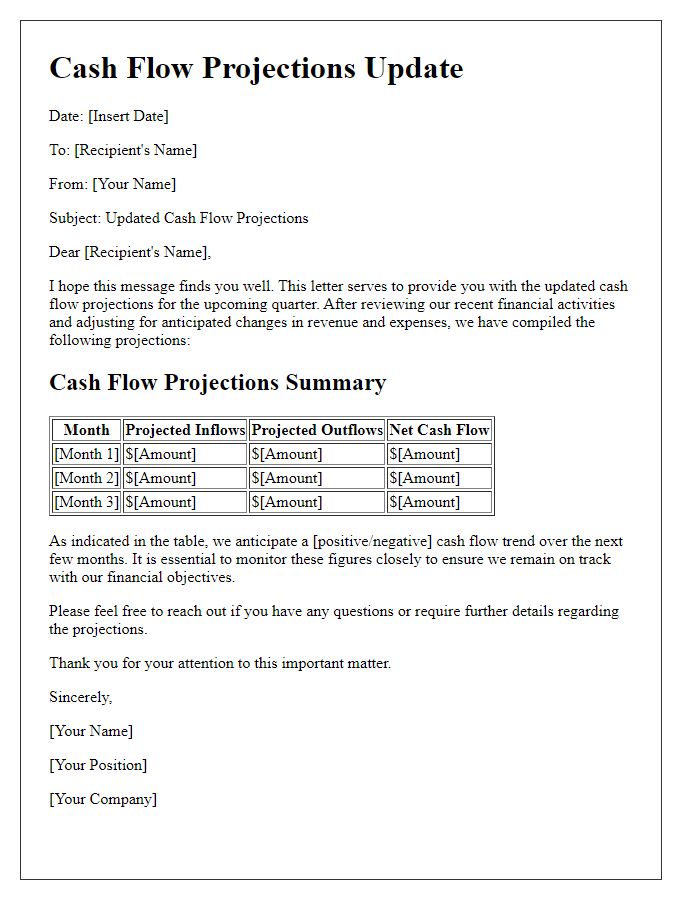

Financial forecasting updates provide essential insights for businesses aiming to navigate economic conditions effectively. Accurate forecasts rely on comprehensive data analysis encompassing historical revenue patterns, market trends, and competitive benchmarks. Businesses should focus on key performance indicators (KPIs), such as gross profit margin percentages, customer acquisition costs, and average deal size. Employing predictive analytics tools can enhance forecasting accuracy, allowing management to adjust strategies proactively. Key recommendations include monitoring cash flow projections, optimizing inventory levels to avoid stockouts, and reassessing expenditure based on updated market conditions. Regularly scheduled financial reviews (monthly or quarterly) enable timely decision-making, ensuring alignment with overarching business objectives.

Comments