Are you looking to streamline your fund transfer processes but unsure how to get started? An effective fund transfer authorization request letter can help you communicate your intentions clearly and professionally. In this article, we'll walk you through a simple template that ensures your request is understood and acted upon promptly. So, grab a pen and paper, and let's dive into the details together!

Recipient's Details

A fund transfer authorization request requires precise information about the recipient involved in the transaction, ensuring secure and accurate processing. Essential details include the recipient's full name, typically formatted as First Name and Last Name, distinct from any aliases or corporate identities. The recipient's bank account number must be accurately recorded, safeguarding against errors during the transfer process. Additionally, a clear specification of the recipient's bank name, such as Bank of America or HSBC, is critical for proper destination identification. Including the recipient's contact information, such as an email address or phone number, provides a means for communication in case of any issues. Furthermore, including the recipient's address may be necessary for certain types of transfers, particularly for compliance with regulatory requirements.

Authorizing Party's Information

The fund transfer authorization request requires detailed information about the Authorizing Party, which typically includes full name, designation, and contact information such as phone number and email address. Additionally, critical banking details like account number, bank name (e.g., First National Bank), and routing number must be provided to ensure the correct transfer process. Date of the request and signatures may be necessary to validate the authorization. The mentioned elements are crucial for legal compliance and to prevent unauthorized transactions in financial operations.

Transfer Amount and Currency

A fund transfer authorization request typically includes essential details such as the transfer amount, specified in both numeric and written form, along with the currency type. For instance, a request might specify a transfer amount of $5,000 USD (Five Thousand United States Dollars) to ensure clarity and prevent errors. Additionally, the request should outline the recipient's bank details, including the account number, recipient's name, and the bank's SWIFT/BIC code, which is vital for international transactions. It may also include a purpose for the transaction, such as payment for services rendered or a charitable contribution, which can ensure compliance with banking regulations. Clear communication of these details enhances the efficiency and accuracy of the fund transfer process.

Purpose of Transfer

Transfer authorization requests are critical for ensuring secure financial transactions. A typical fund transfer might include entries for specific purposes such as educational fees, health care expenses, or investment contributions. For instance, a request for transferring $5,000 for university tuition at Stanford University during the fall semester could specify the exact account details and the urgency, particularly if payment deadlines are approaching. Similarly, health care funding transfers might involve payments of up to $2,500 for medical bills from a specific hospital, emphasizing the importance of timely fund allocation to avoid late fees or diminished services. Identifying the precise reason for each transfer aids in maintaining accurate financial records and adheres to compliance regulations established by financial institutions.

Security and Verification Procedures

Fund transfer authorization requests require strict security and verification procedures to ensure data integrity and prevent unauthorized access. Identifying the requesting party, such as the account holder or authorized user, is crucial. Utilizing multi-factor authentication (MFA) methods, such as one-time passwords (OTPs) or biometric scans, adds an extra layer of security. Verifying unique identifiers, including Social Security numbers or account numbers, underscores the importance of protecting sensitive information during transactions. Adherence to regional financial regulations, such as the Bank Secrecy Act in the United States, ensures compliance and fortifies the overall security framework. Implementing encryption protocols during data transmission, such as SSL/TLS, protects against potential cyber threats, maintaining confidentiality throughout the process.

Letter Template For Fund Transfer Authorization Request Samples

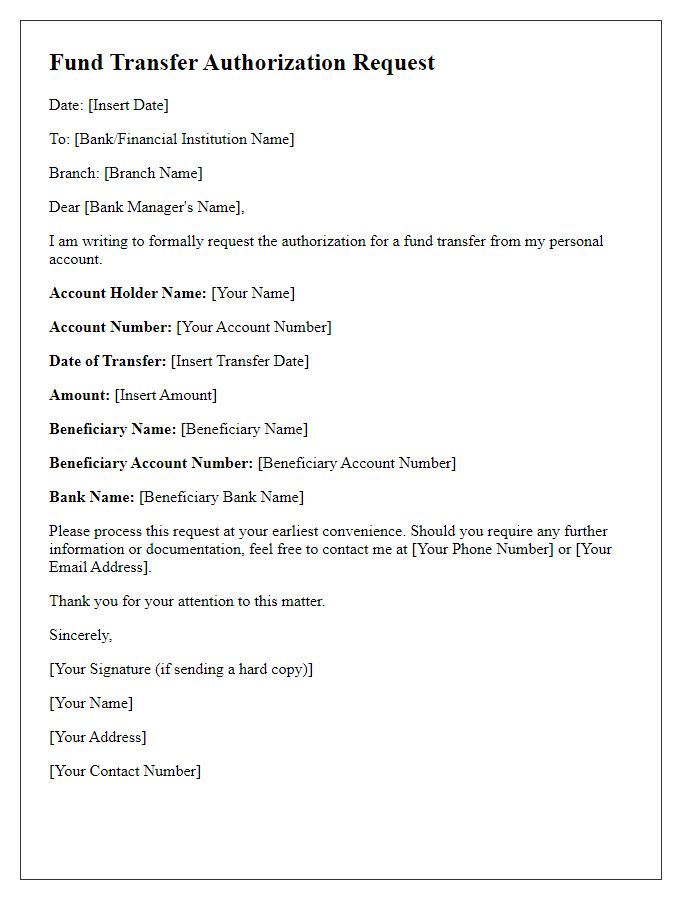

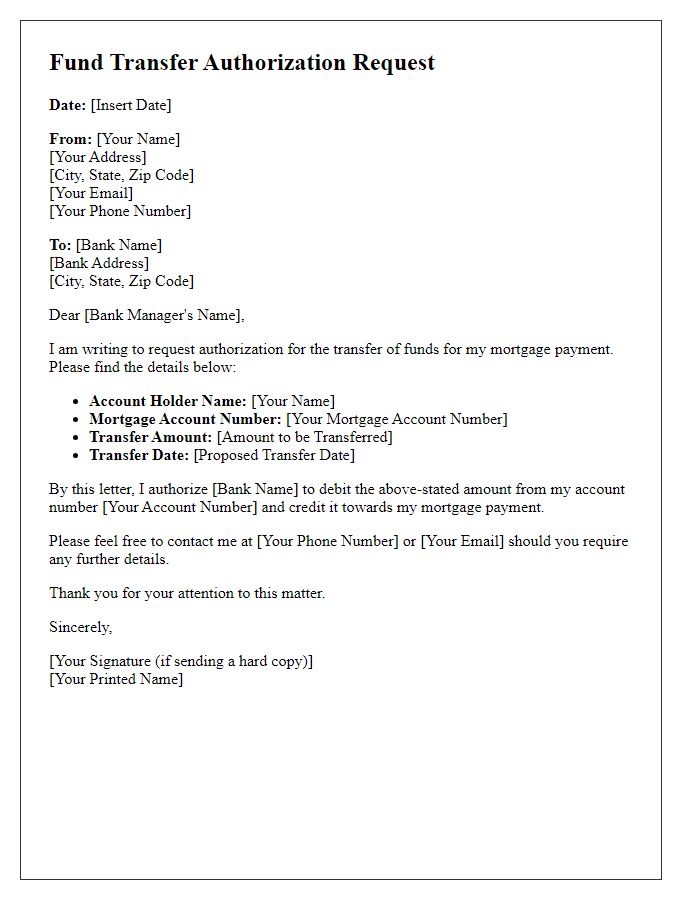

Letter template of fund transfer authorization request for personal accounts.

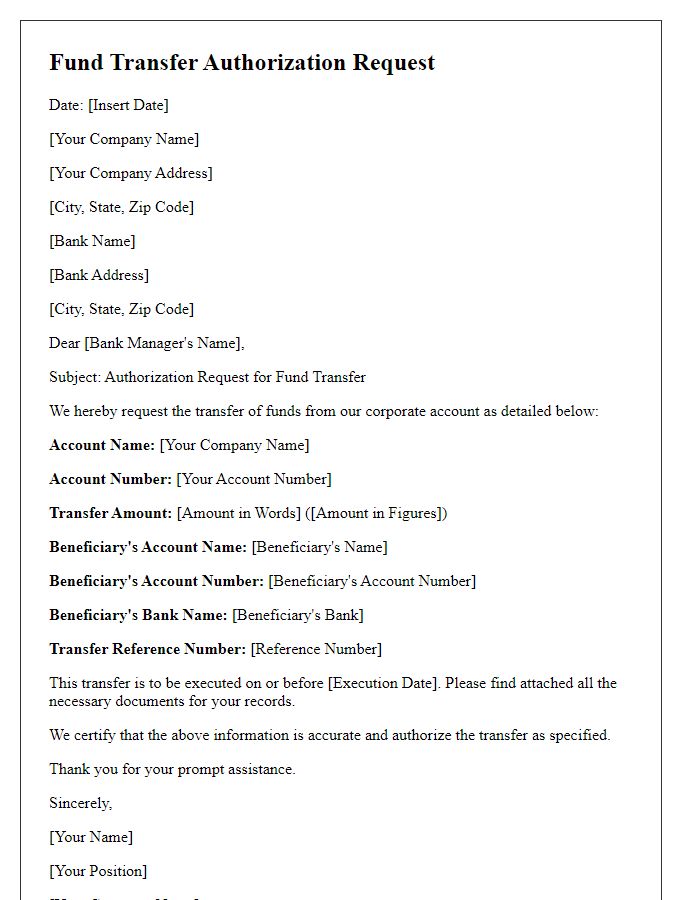

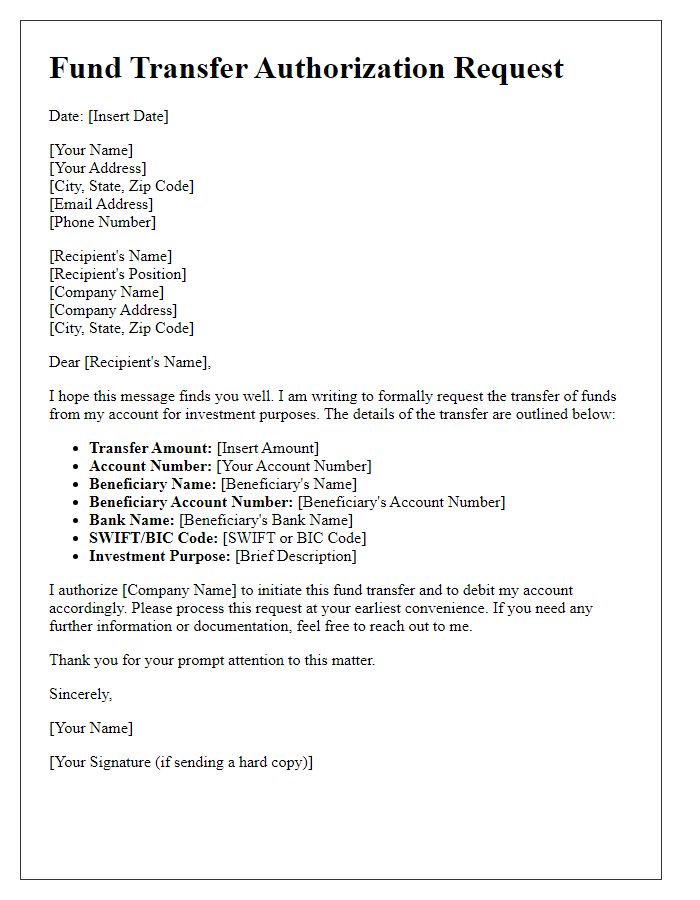

Letter template of fund transfer authorization request for corporate accounts.

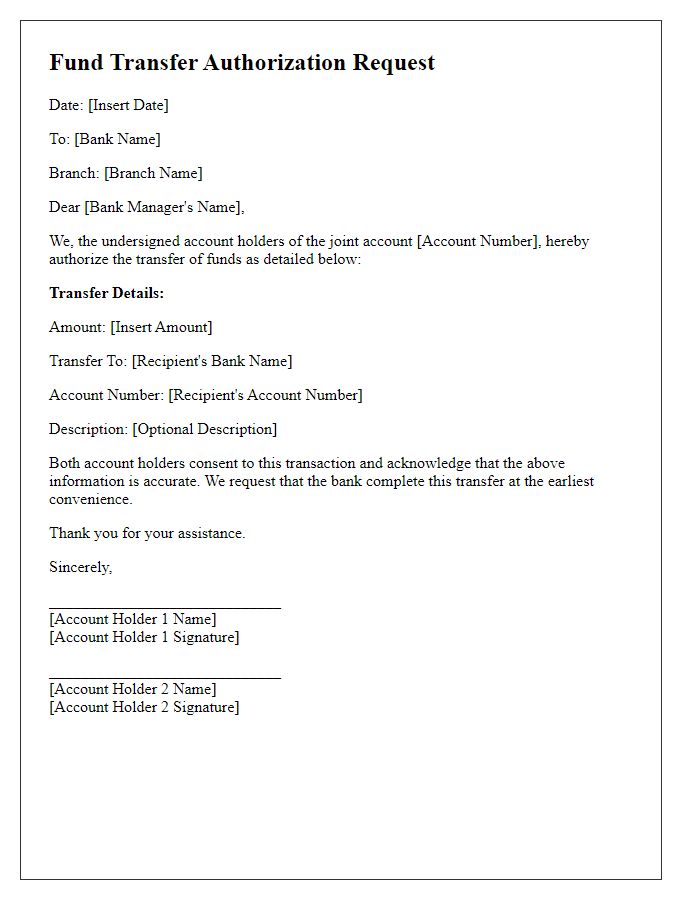

Letter template of fund transfer authorization request for joint accounts.

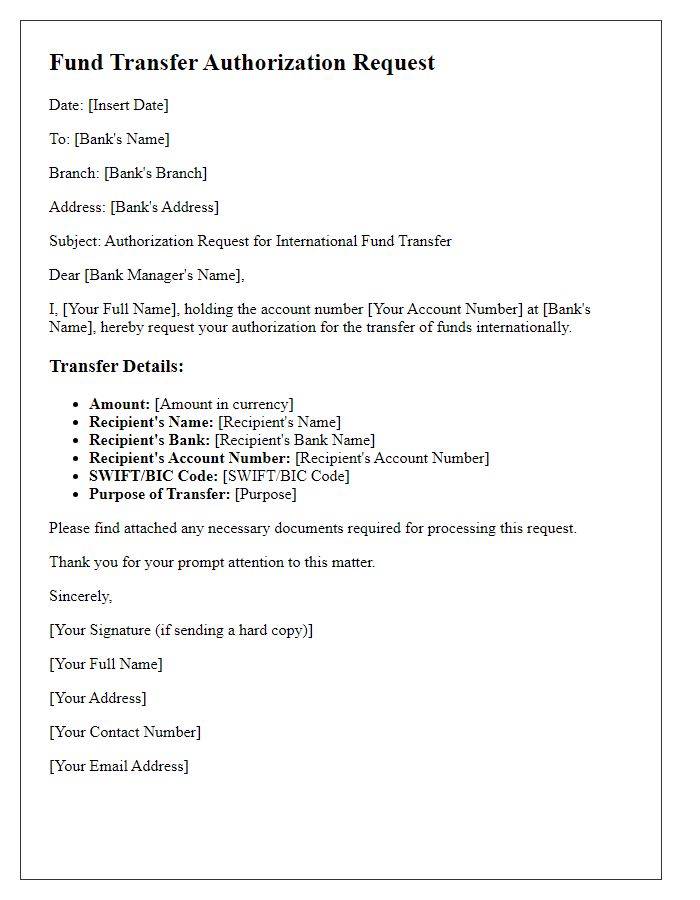

Letter template of fund transfer authorization request for international transfers.

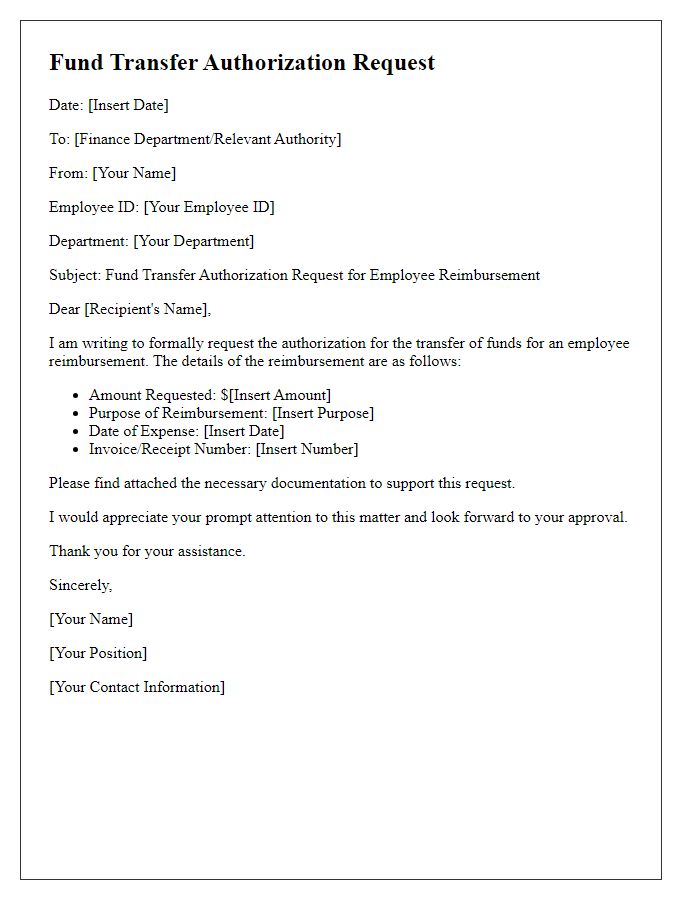

Letter template of fund transfer authorization request for employee reimbursements.

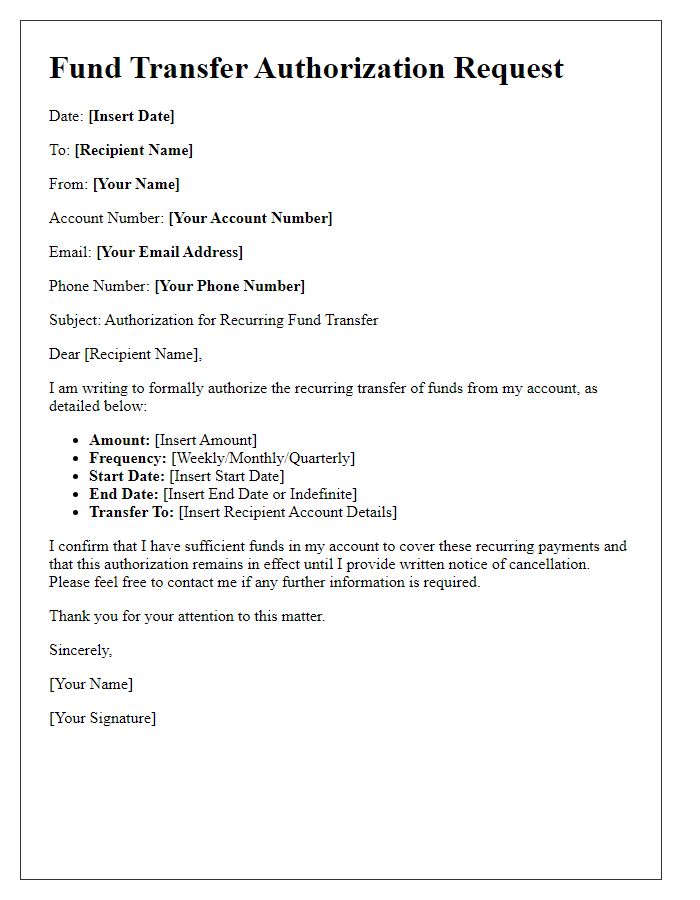

Letter template of fund transfer authorization request for recurring payments.

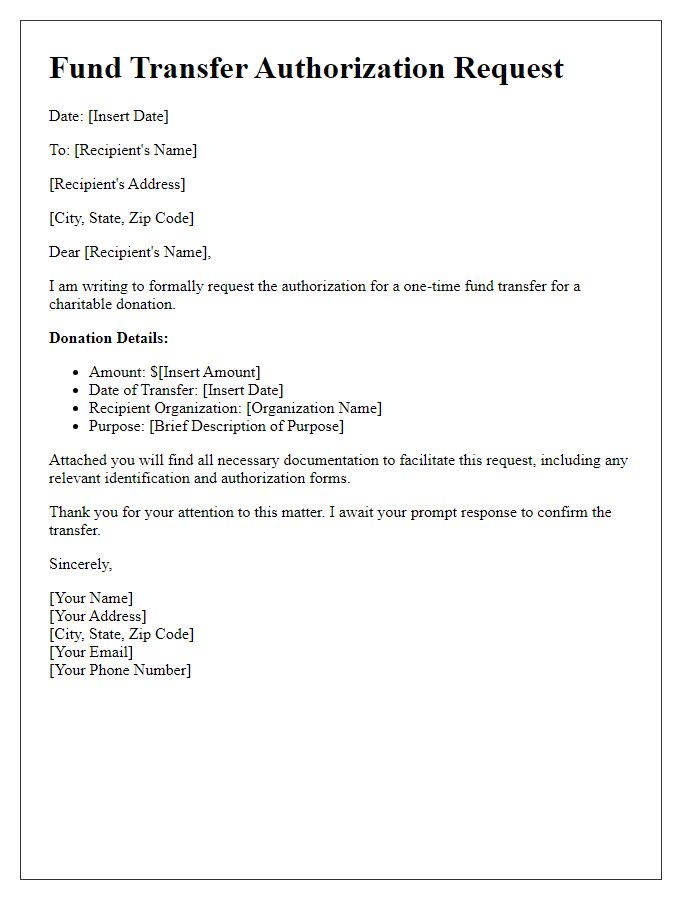

Letter template of fund transfer authorization request for one-time donations.

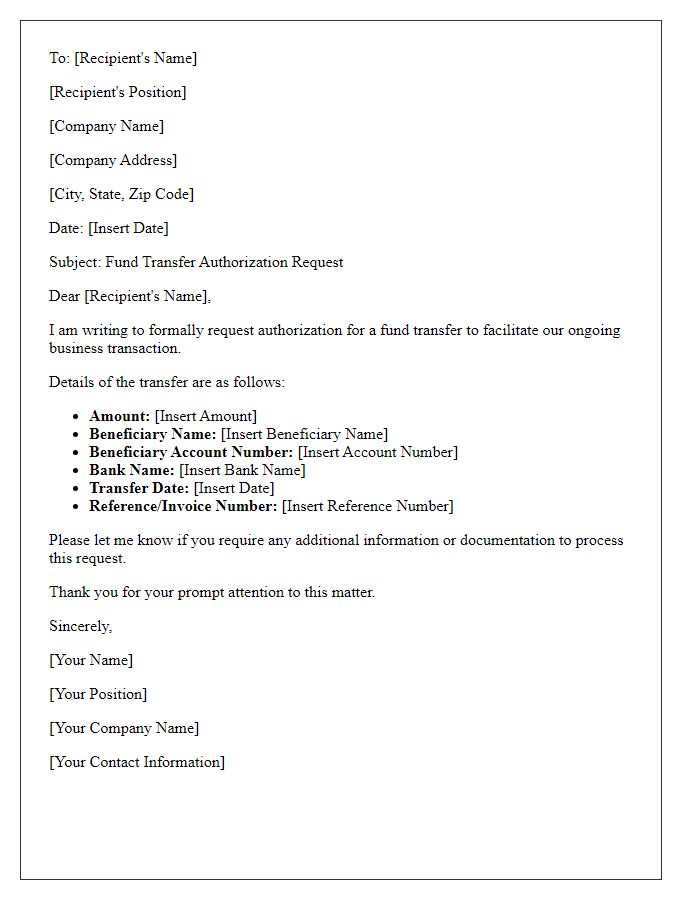

Letter template of fund transfer authorization request for business transactions.

Letter template of fund transfer authorization request for mortgage payments.

Comments