Are you feeling the pressure as the corporate tax filing deadline approaches? You're not aloneâmany businesses find themselves in need of an extension to gather all the necessary documentation and ensure accuracy. While it's essential to stay compliant with tax regulations, requesting an extension can provide that much-needed breathing room. Curious about how to craft the perfect letter for a corporate tax filing extension? Read on for helpful tips and a handy template!

Business Information and Identification

A corporate tax filing extension request requires precise business information and identification to facilitate processing by the Internal Revenue Service (IRS) or relevant tax authority. The submission should include the business name, such as "Tech Innovations LLC," along with the Employer Identification Number (EIN), which is a unique nine-digit number assigned for tax administration purposes, e.g., "12-3456789." Additionally, the business address must be listed, including the street, city, state, and ZIP code, for example, "1234 Innovation Drive, Silicon Valley, CA 94043." The primary contact person's name and phone number ensure efficient communication, while the tax year end date, typically December 31 for calendar-year taxpayers, must be specified to confirm the correct filing period. Including these details guarantees a smooth extension request process, allowing businesses to meet their tax obligations accurately.

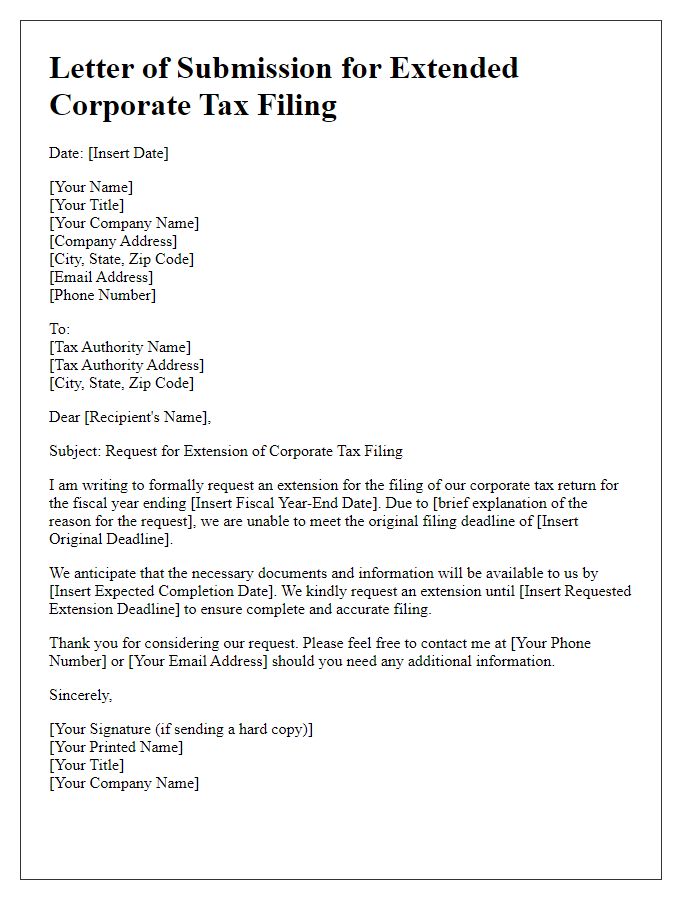

Clear Extension Request Statement

Corporate tax filings require careful consideration of deadlines, often guided by regulations set forth by the Internal Revenue Service (IRS) in the United States. A clear extension request statement articulates the intention to request additional time beyond the typical due date, which is usually March 15 for corporations, to prepare and file tax documents accurately. This statement should include details such as the business's legal name, Employer Identification Number (EIN), and the specific filing forms involved, like Form 1120 for C corporations or Form 1120-S for S corporations. Noting the extension request deadline--often six months, until September 15 for C corporations--should accompany the acknowledgment of the potential for late fees or penalties should the filing miss the original timeframe.

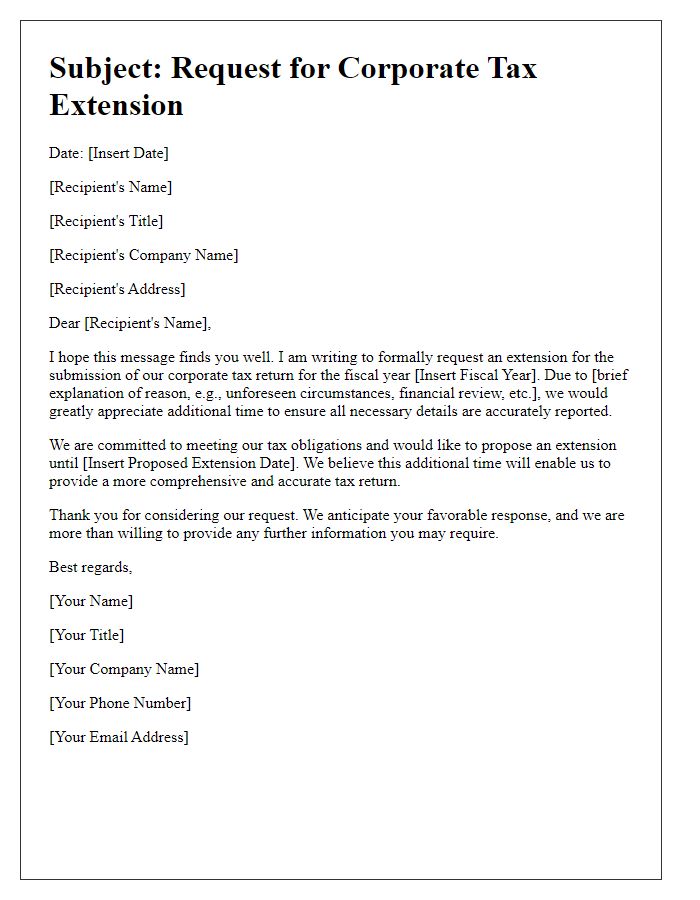

Justification for Extension

Corporate tax filing extensions are often necessary for firms facing unique challenges, such as unforeseen financial complexities or significant changes in accounting personnel. The new accounting software implemented at the headquarters (New York City) requires additional training and adjustments, resulting in a delay in compiling accurate financial reports. Moreover, recent acquisitions in the technology sector (with firms like Acme Tech and Quantum Innovations) have introduced new revenue streams that require careful integration into existing accounts. Employees are finalizing extensive reconciliations, which impacts timely submission. With the tax deadline approaching in April 2024, the requested extension aims to ensure compliance with IRS regulations while maintaining the accuracy and integrity of financial statements. This proactive measure safeguards the company's reputation and mitigates risks associated with late filing penalties.

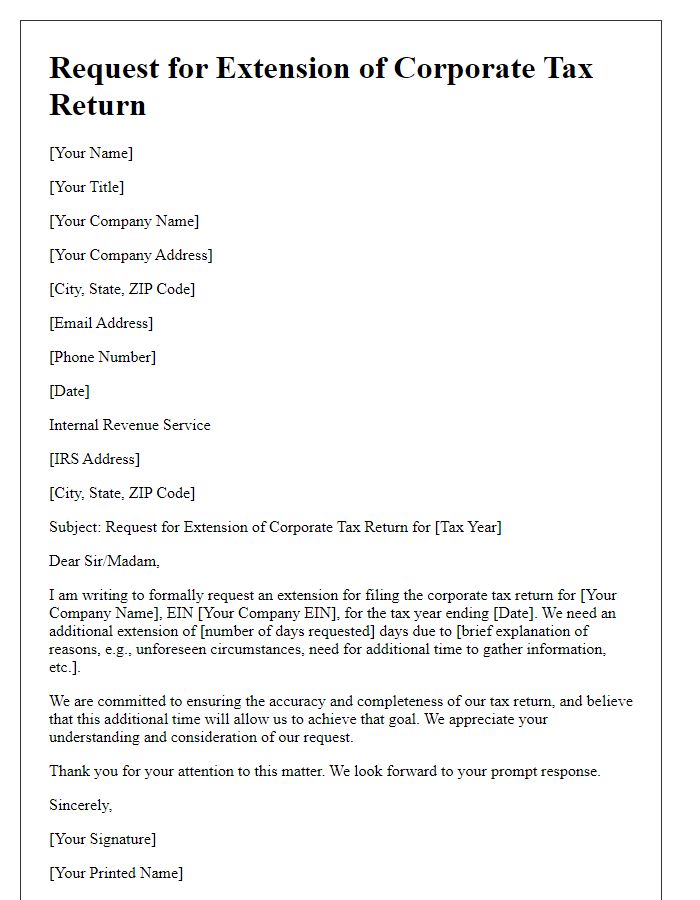

Deadlines and Compliance Assurance

Corporations often seek tax filing extensions to ensure compliance with government regulations. The Internal Revenue Service (IRS) mandates that corporations, such as C Corporations and S Corporations, file their tax returns by March 15 or April 15, depending on their fiscal year. A filing extension allows up to six additional months to submit the necessary documents. This temporary reprieve aims to provide businesses time to compile complete and accurate financial information, minimizing the risk of noncompliance penalties. Filing Form 7004 is crucial for obtaining an automatic extension, ensuring corporations remain in good standing with tax authorities. Adhering to these deadlines is imperative to avoid interest accrual and possible legal issues stemming from late submissions, emphasizing the importance of strategic tax planning.

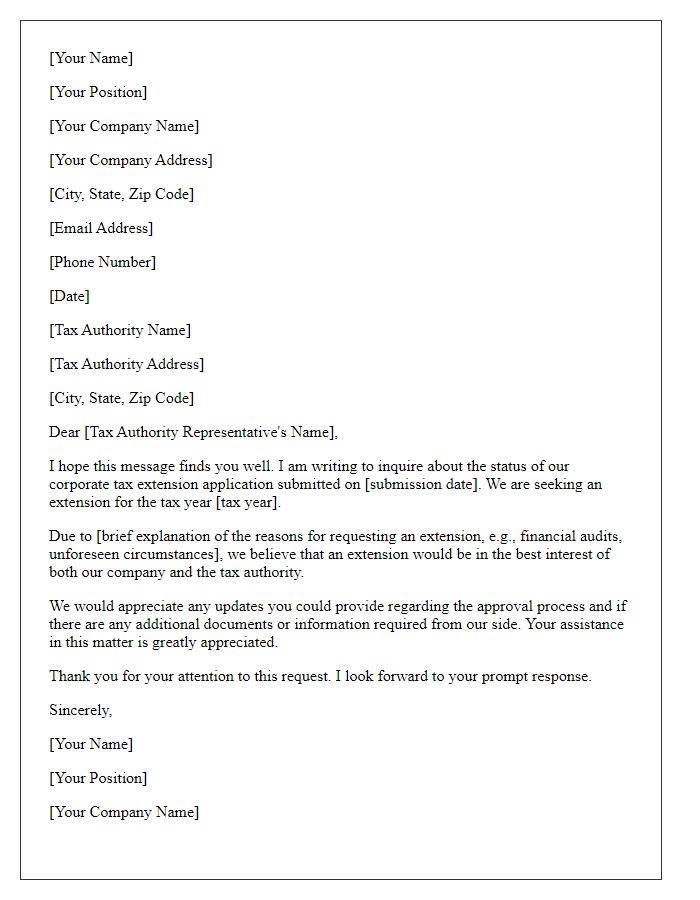

Contact Information and Signature

Filing for a corporate tax extension requires precise attention to relevant details. The request needs to include essential contact information such as the company's legal name, which must match the IRS records, the employer identification number (EIN), and the primary business address located in the jurisdiction where taxes are filed. Furthermore, ensure the contact person's details are accurate, including a direct phone number and email address for any IRS correspondence. The signature at the bottom must belong to an authorized officer of the company, such as a CEO or CFO, affirming the request is legitimate and compliant with federal law. The IRS deadline for filing an extension typically falls on April 15 for calendar-year filers, ensuring timely submission to avoid unnecessary penalties.

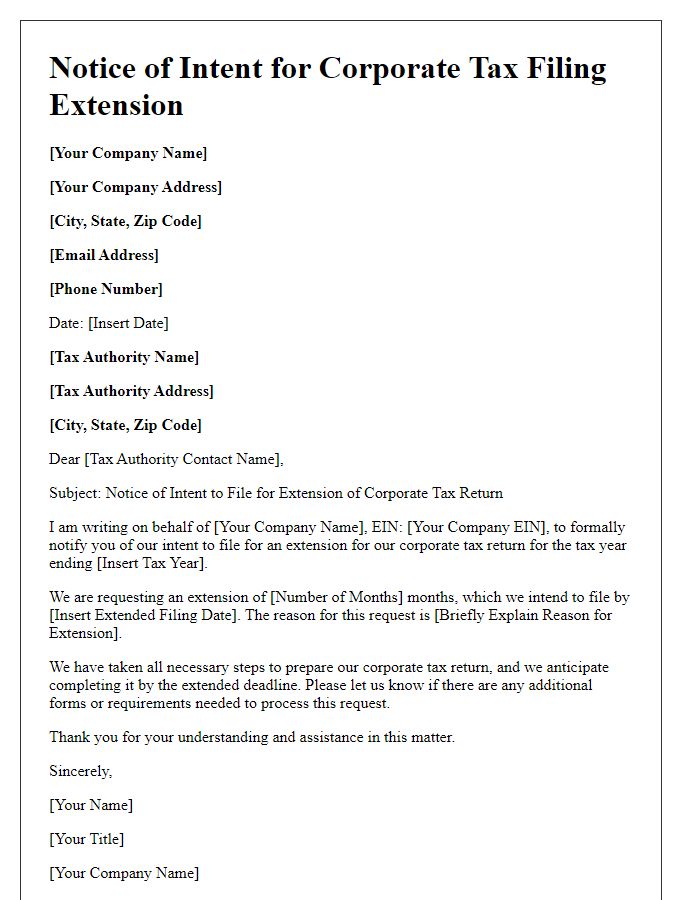

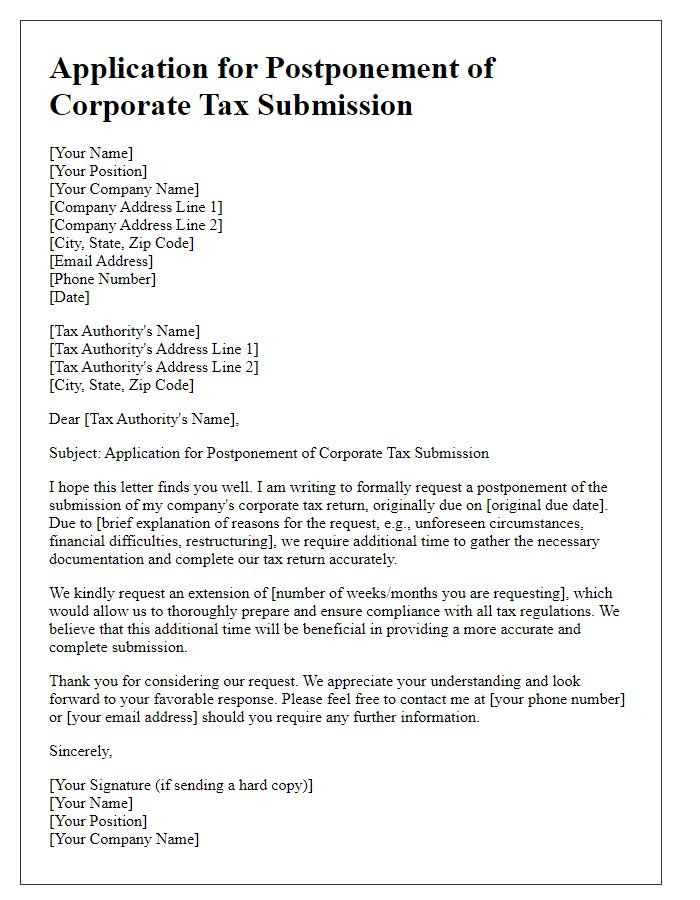

Letter Template For Corporate Tax Filing Extension Samples

Letter template of petition for additional time for corporate tax filing

Comments