Are you finding it challenging to manage your finances due to unexpected expenses or changes in your income? You're not alone, and many people face similar situations that require a little flexibility in their payment arrangements. In this article, we'll explore the ins and outs of crafting a persuasive extended payment plan proposal, covering everything from what to include in your letter to tips for maintaining open communication with your creditors. Curious about how to make your proposal stand out? Keep reading to discover expert insights!

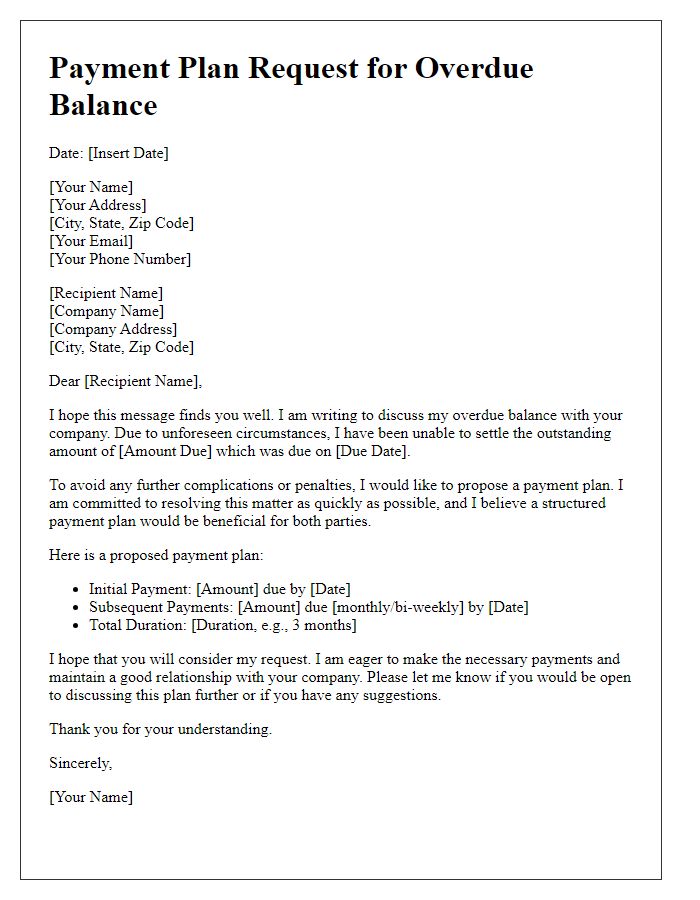

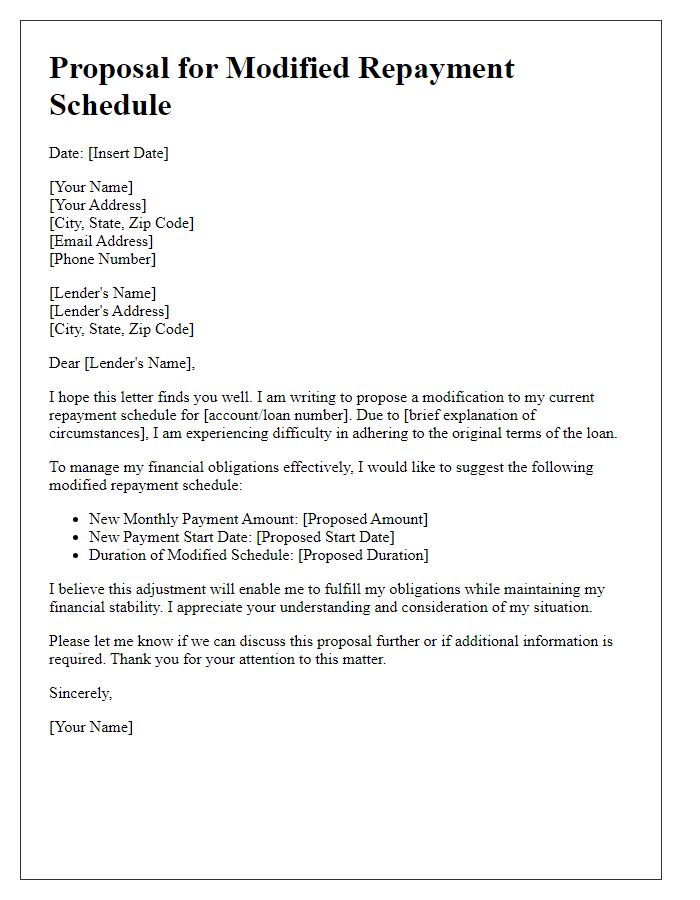

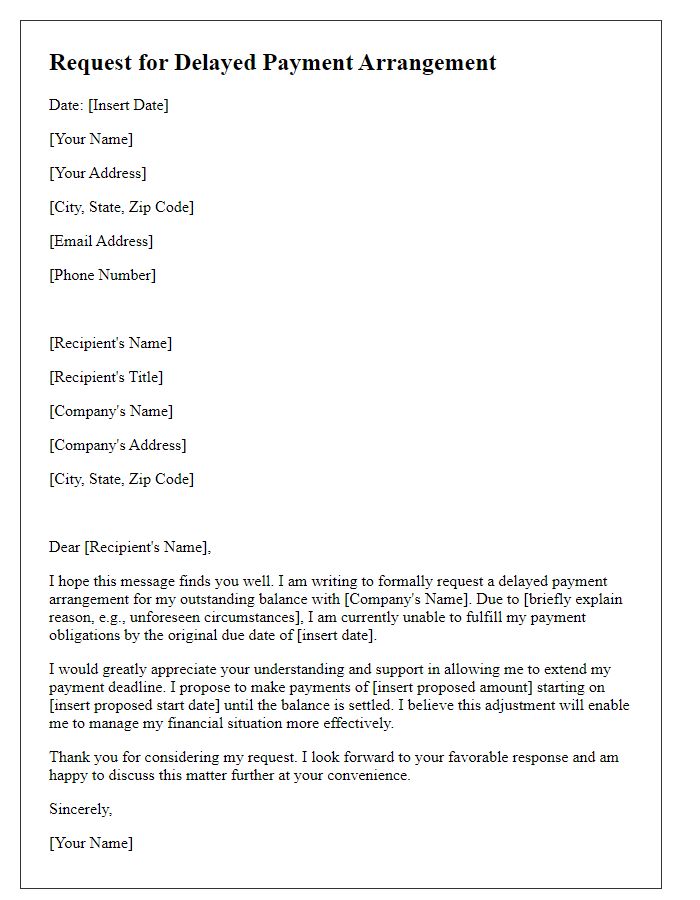

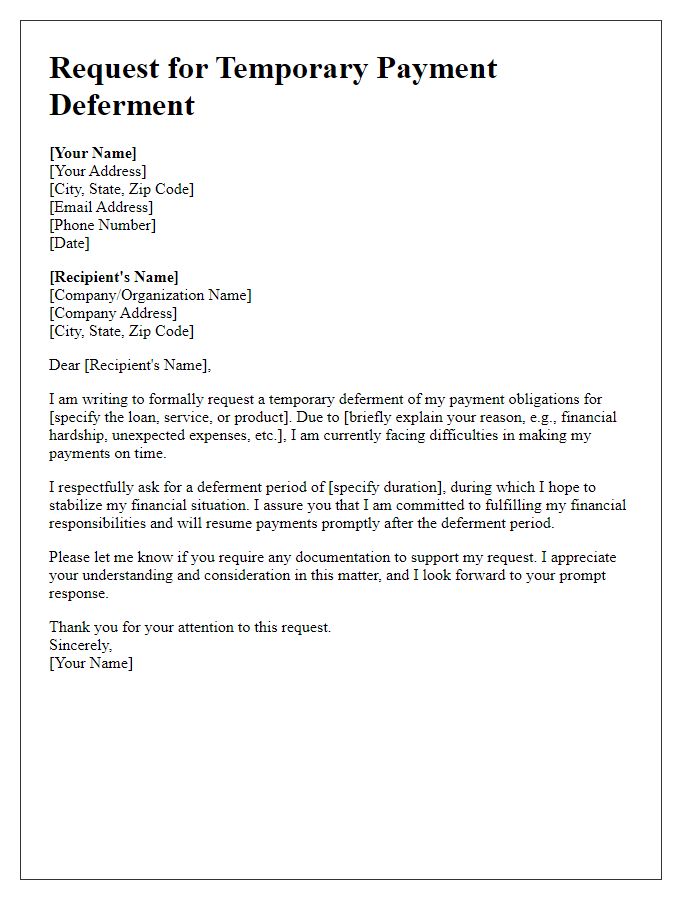

Formal Salutation

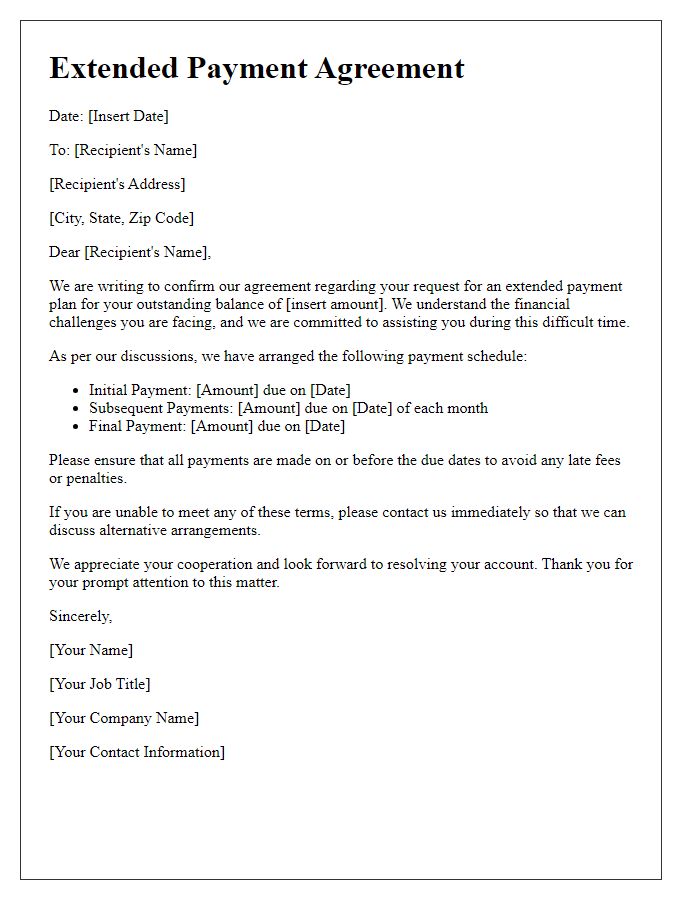

A thoughtfully structured extended payment plan proposal can facilitate financial relief by allowing individuals or businesses to manage their obligations over a more extended period. Clear communication is essential to outline the payment terms, including specific dates and the total amount owed. A professional salutation, addressing the recipient by name, establishes respect and a personal connection, especially in a formal context. Including reference information such as account number or invoice details ensures accuracy and aids in swift processing. Additionally, providing a rationale for the request, such as unforeseen circumstances or financial challenges, can enhance the proposal's credibility and foster understanding from the recipient.

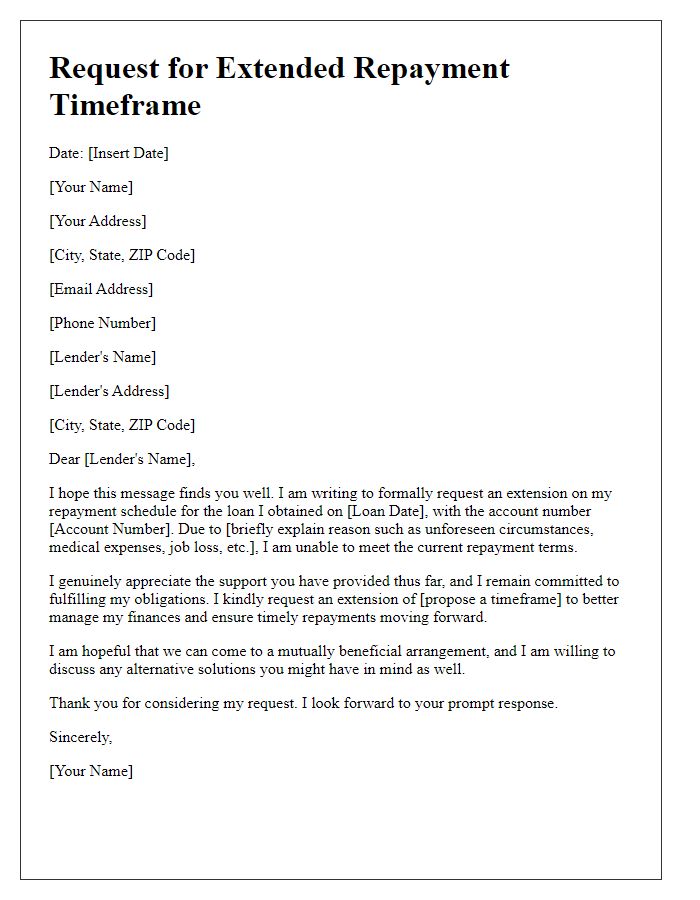

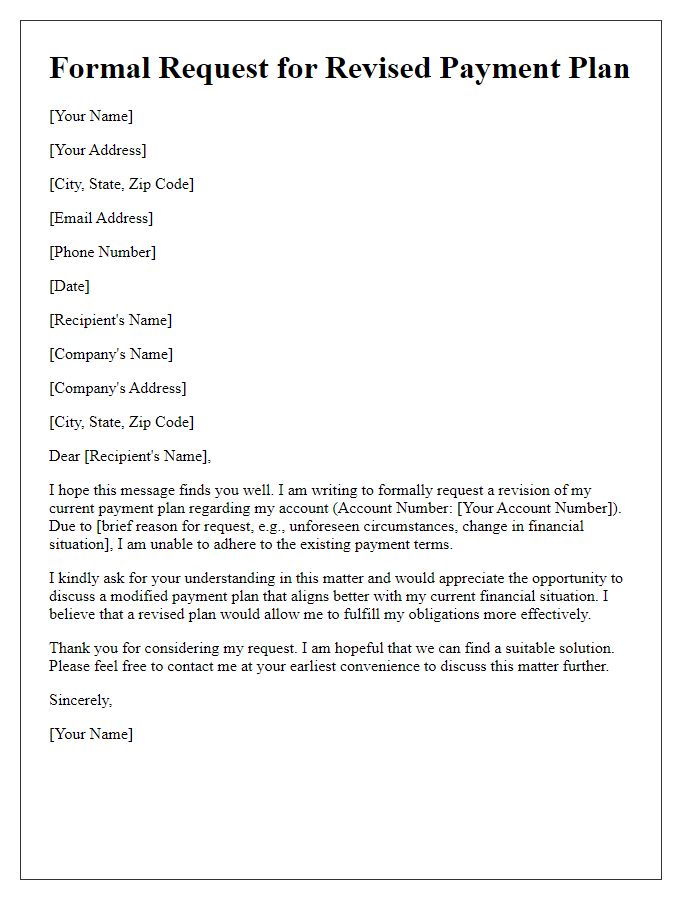

Explanation of Financial Situation

A financial situation involving substantial outstanding debt can place significant stress on individuals and families. Monthly expenses, including rent, utilities, and groceries, often exceed income, leading to a deficit that accumulates over time. For instance, average monthly rent in cities like San Francisco can reach up to $3,500, while average salaries may not keep pace with such costs, often falling below $6,000 before taxes. Additionally, unforeseen expenses such as medical bills or car repairs can further strain budgets. Consequently, individuals might find it challenging to meet regular payment obligations on loans or credit cards, resulting in potential late fees or credit score penalties. Establishing an extended payment plan may provide a more manageable approach for repaying outstanding balances, enabling individuals to stabilize their finances and regain control over their economic situation.

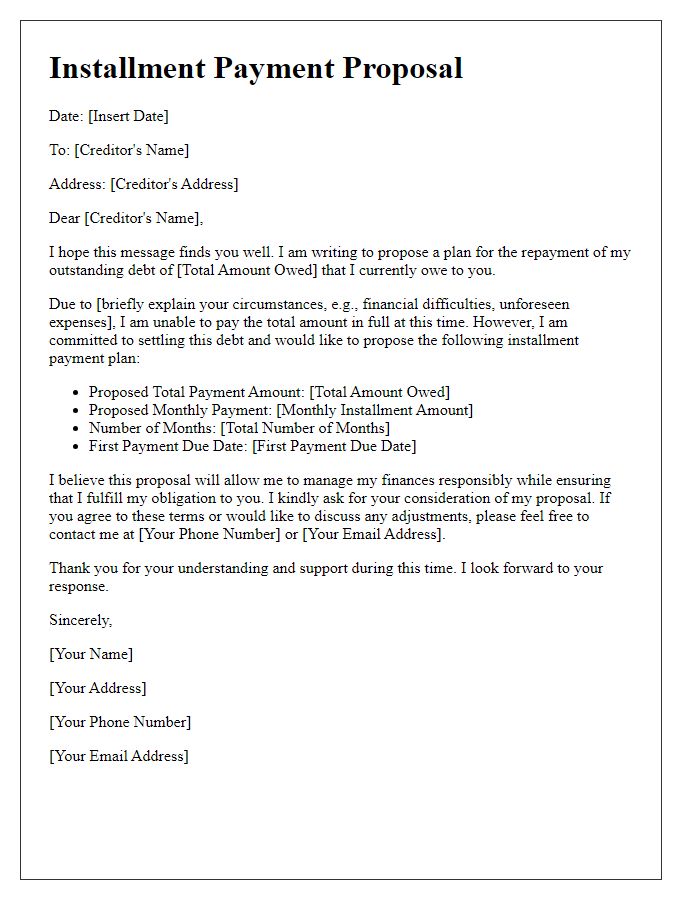

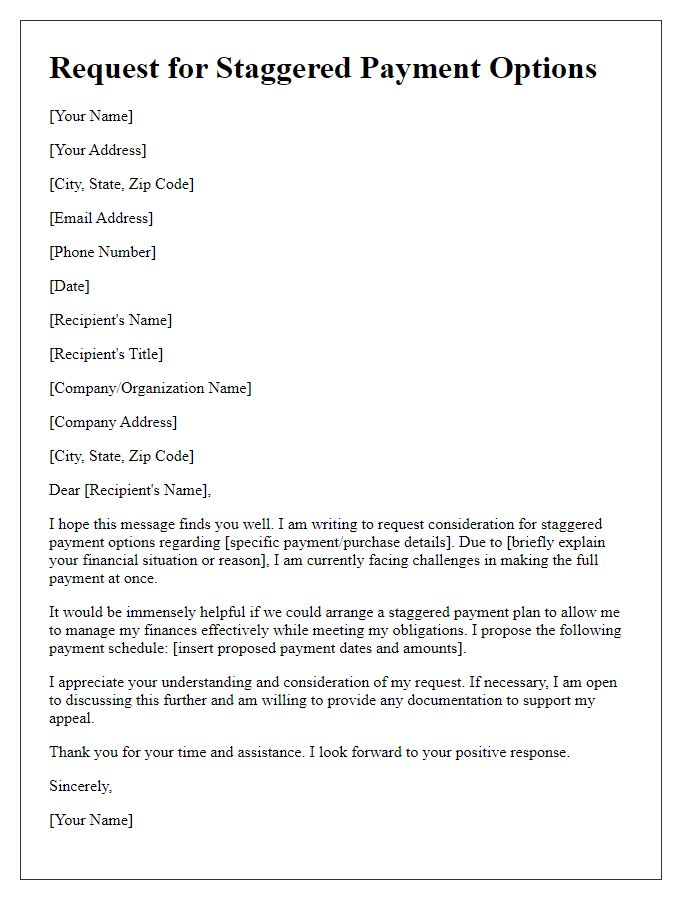

Proposed Payment Plan Details

An extended payment plan offers individuals significant financial relief, allowing them to manage payments over time. For instance, a $5,000 debt might be structured into manageable installments over 12 months, resulting in payments of approximately $416.67 each month. This approach helps reduce immediate financial strain, particularly in high-interest scenarios, where accumulated costs can increase the total debt significantly. Additionally, flexibility in payment terms, such as interest rates around 5%-10% and adjusted schedules based on income variances, can enhance affordability and encourage timely repayment. Implementing this structure can lead to improved financial health and stability for individuals facing economic challenges.

Assurance of Commitment

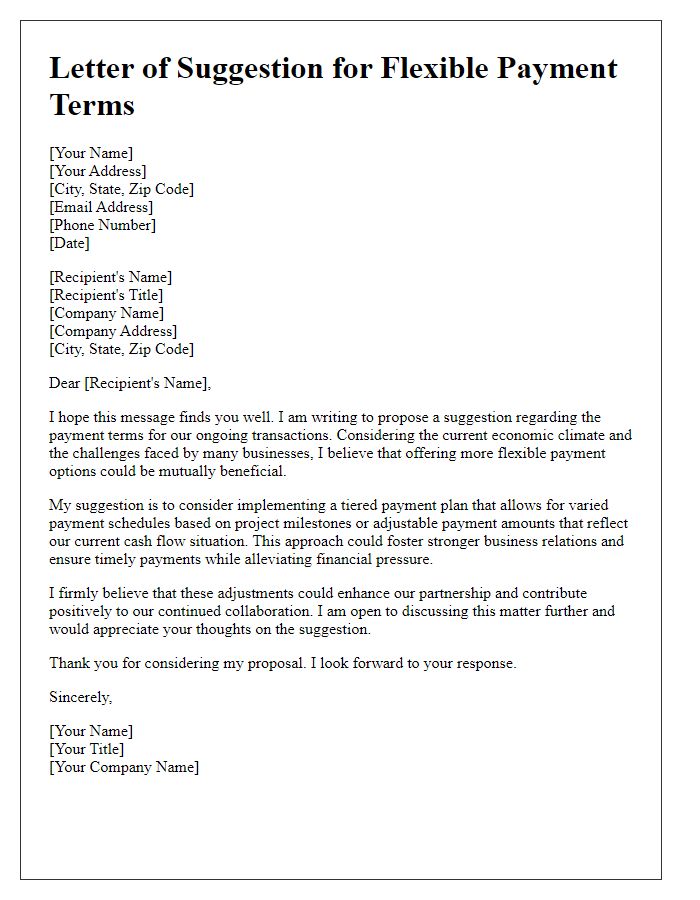

An extended payment plan proposal showcases assurance of commitment through structured repayment schedules and clear communication. A well-detailed plan outlines specific payment amounts, due dates, and total duration, fostering transparency and building trust. This proposal can be critical for financial situations, allowing individuals or businesses facing economic hardship to manage debts effectively. By proposing reasonable terms, such as monthly payments over a predefined period, often spanning several months, parties can agree on conditions that suit both needs. Additionally, providing contact information for queries emphasizes the willingness to collaborate and resolve concerns proactively, facilitating a positive dialogue and reinforcing the commitment to fulfilling financial obligations responsibly.

Closing Remarks and Contact Information

In the pursuit of financial flexibility, an extended payment plan can provide a practical solution for managing outstanding obligations over a more manageable timeline. Clear communication about terms and conditions is vital in ensuring mutual understanding and agreement. Taking into account the specific needs and circumstances surrounding the payment structure fosters a cooperative approach to resolving financial commitments. Should you require further clarification or wish to discuss the proposal in detail, please do not hesitate to reach out directly via email or telephone, ensuring the lines of communication remain open for any adjustments necessary to facilitate a successful arrangement.

Comments