Are you in need of a quick and effective way to request a credit note for your recent transaction? Writing a letter can make the process seamless, ensuring you articulate your needs clearly and professionally. In this article, we'll guide you through the essential components of a credit note issuance request letter, making it easier for you to communicate your request with confidence. Dive in to discover tips and a handy template that you can customize for your needs!

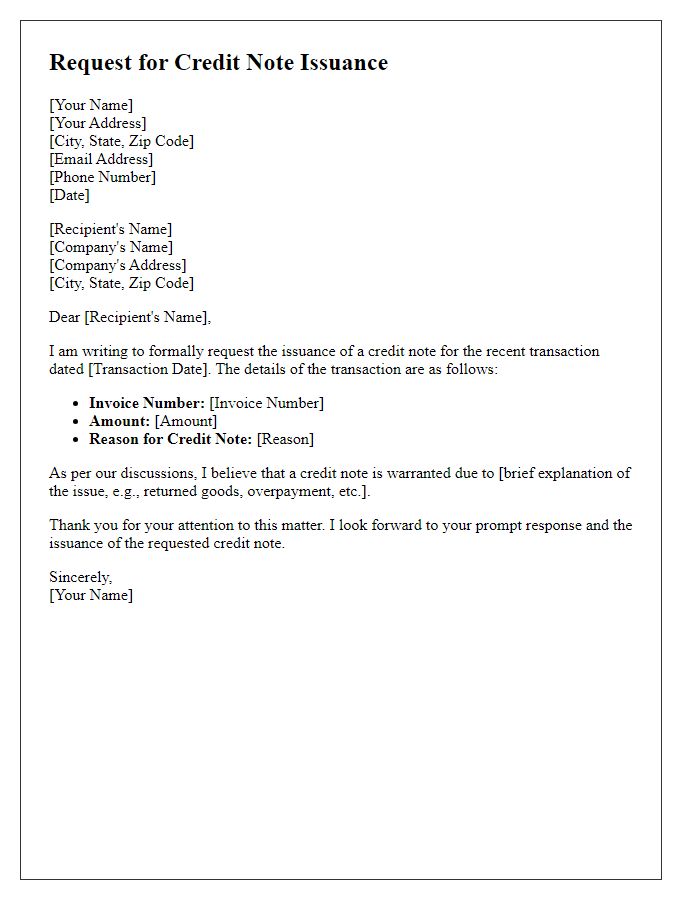

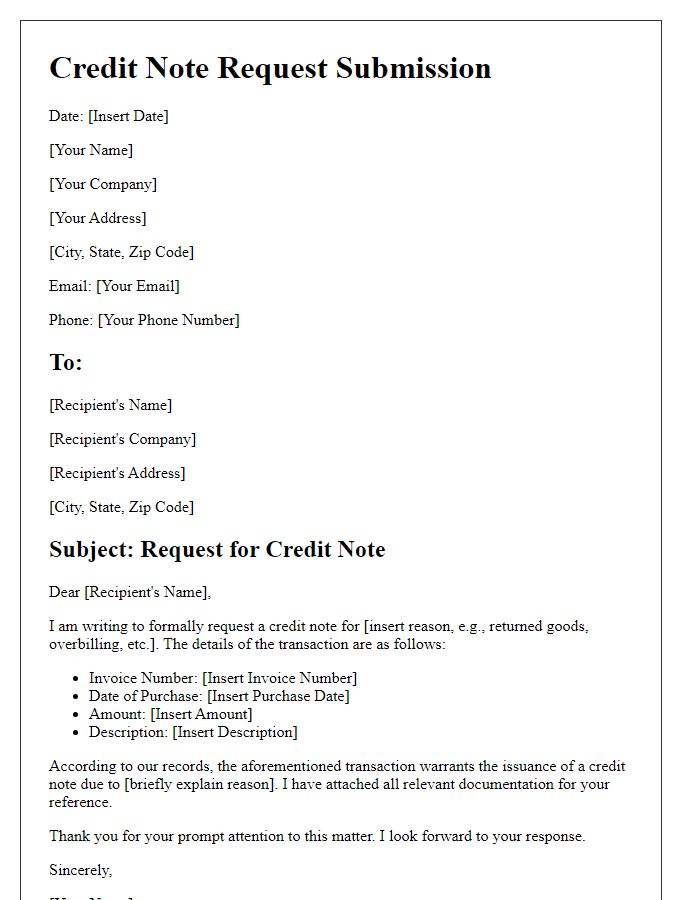

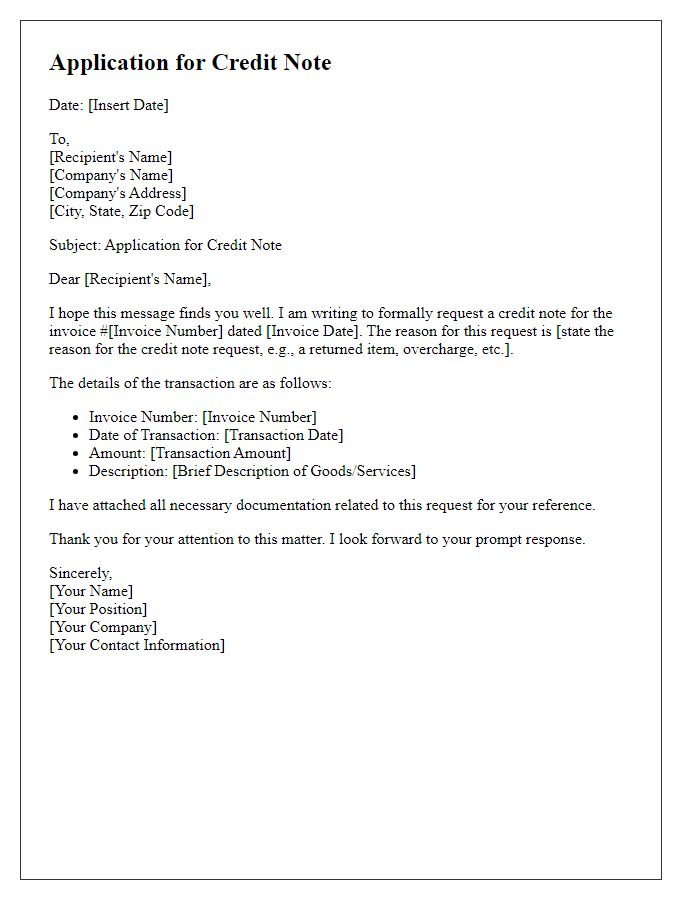

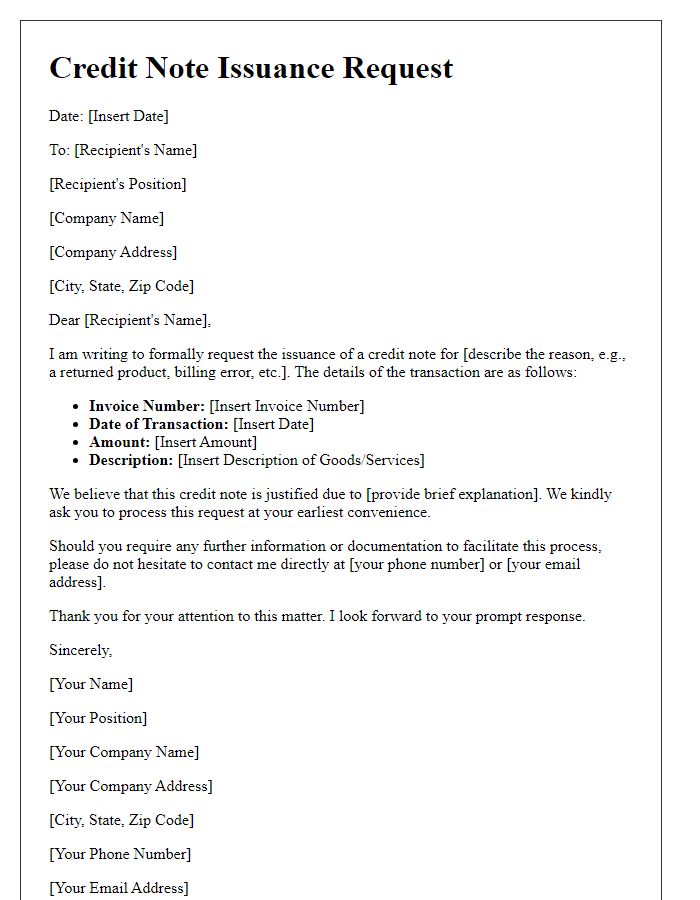

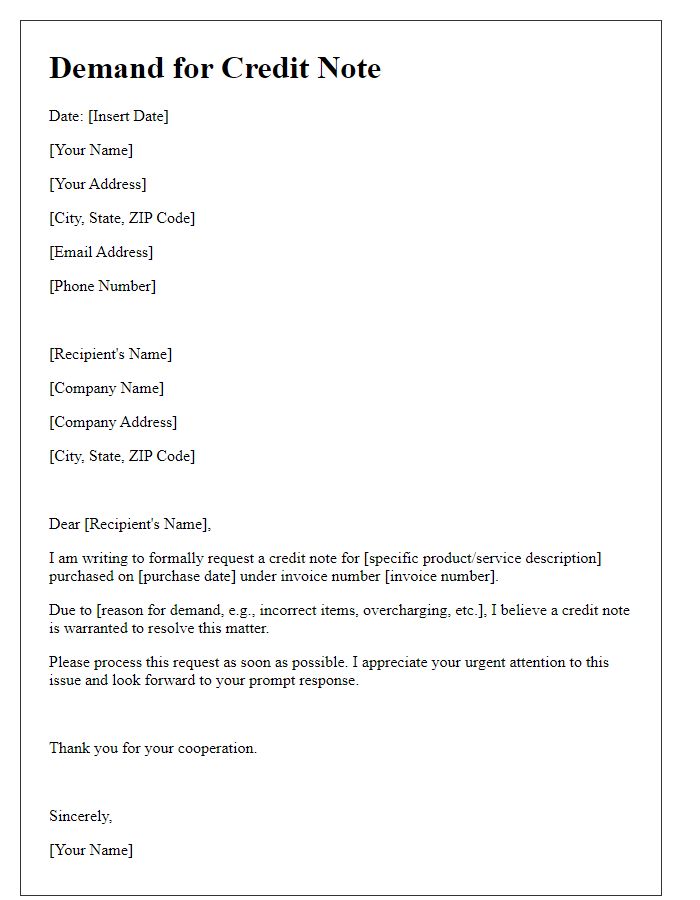

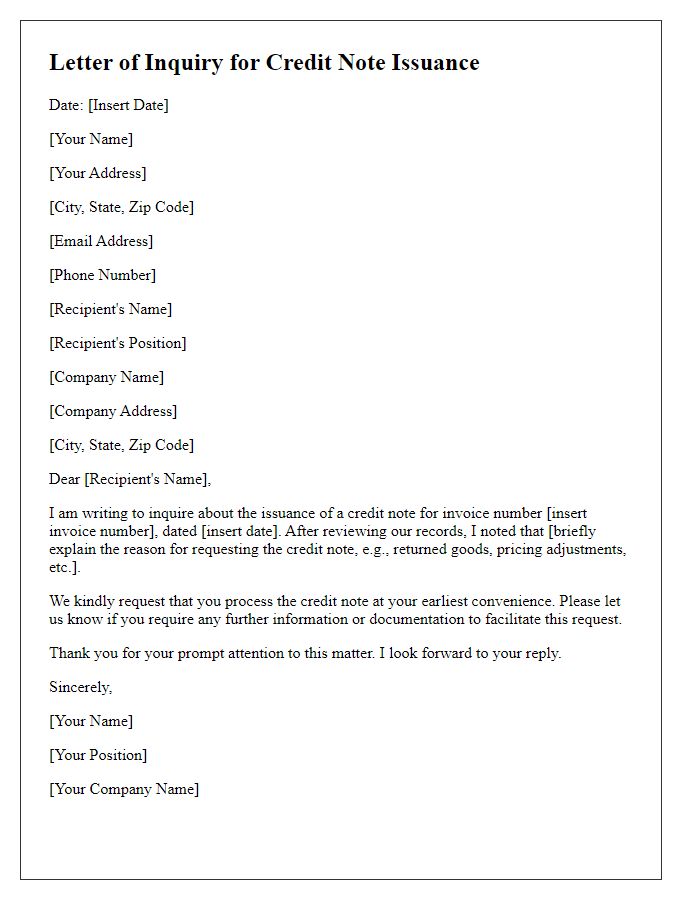

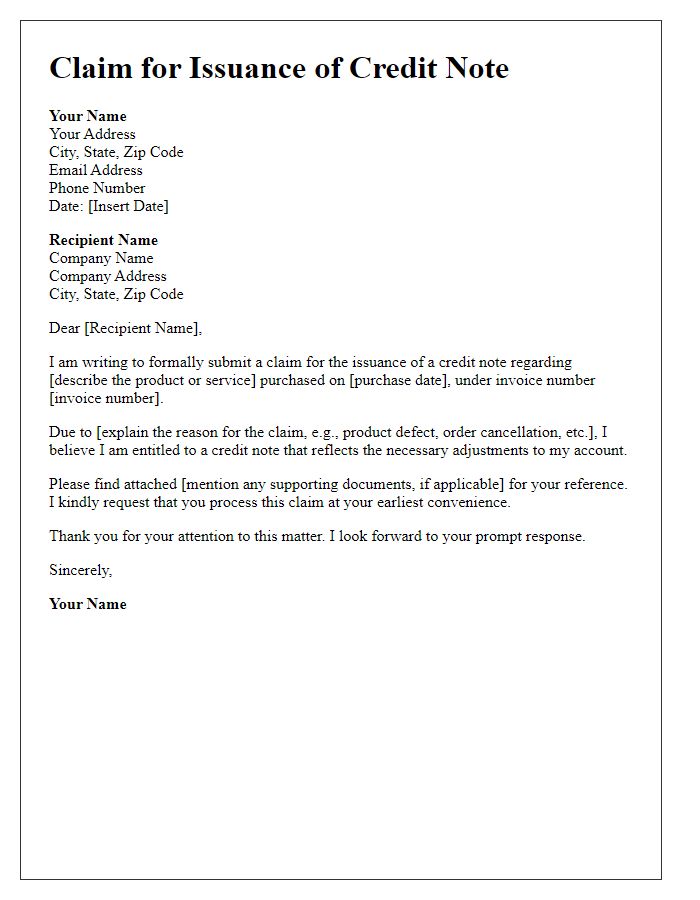

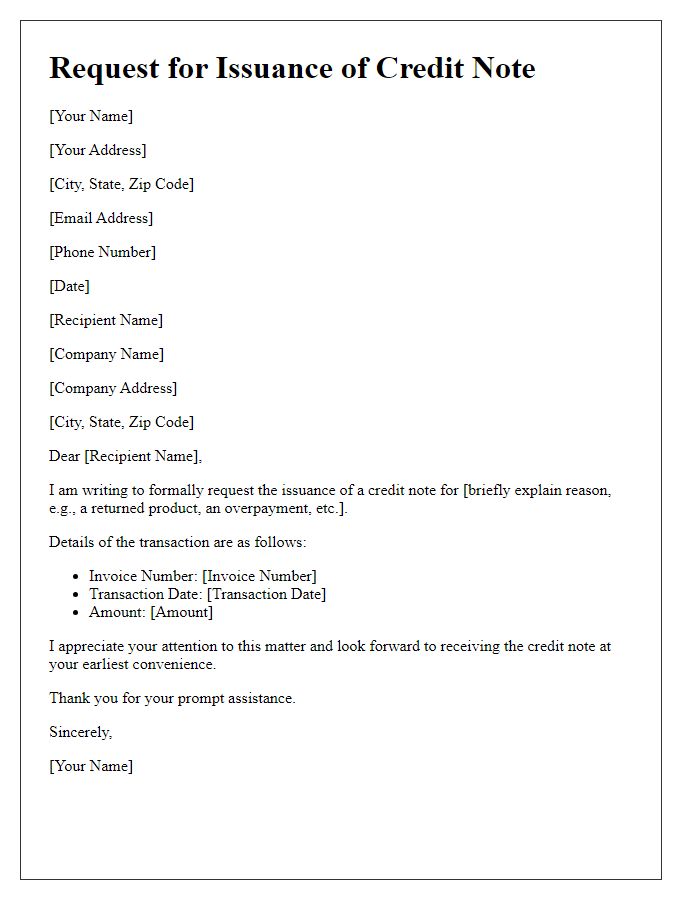

Sender and recipient details

A credit note issuance request involves formal communication between parties. The sender's details typically include their name, company name, address, and contact information, such as phone number and email. The recipient's details encompass similar information: name, company name, address, and contact information. The request outlines the reason for the issuance, often referencing specific transactions, invoice numbers, or purchase dates, and provides details necessary for processing, including the amount to be credited and any relevant terms or conditions tied to the transaction. Clear, professional formatting ensures that both parties can easily identify the specifics involved in the credit note issuance process.

Reference invoice number

A credit note issuance request typically includes details such as the reference invoice number (specifically, the invoice that led to the request), the reason for the credit note (such as goods returned or incorrect billing), and the details of the customer (including name, address, and contact information). This request is generally sent to the accounting department of a company or organization that issued the original invoice and likely adheres to formal business communication standards to ensure clarity and facilitate processing. Key elements include references to relevant policies related to returns and credits, as well as any deadlines for submission related to the request based on company guidelines. Accurate documentation helps streamline the procedure and maintain proper financial records.

Reason for credit note request

A credit note issuance request is often needed for various reasons such as returned products, defective items, or overpayments. When a customer, for instance, returns a damaged electronic device like a smartphone (which usually has a warranty period of one year), they may seek a credit note to reflect this return. Additionally, if a service was paid for but was not delivered, such as a subscription to a digital streaming service that failed to provide access, a customer will request a credit note to redeem the overpayment. Proper documentation such as transaction receipts or return shipping labels is typically required to support this request, ensuring accountability and clarity in the transaction record.

Amount and currency

Issuing a credit note involves various elements including specific amounts and currencies. A credit note of USD 150 should be documented clearly to reflect the purpose, such as overpayment or product returns. Ensure to specify the date of issuance, alongside a detailed description of the transaction that prompted the request, for example, invoice number 12345 issued on September 20, 2023. Additionally, the customer's details (like name and address) should be included for proper identification and record-keeping, adhering to the local regulations and accounting practices.

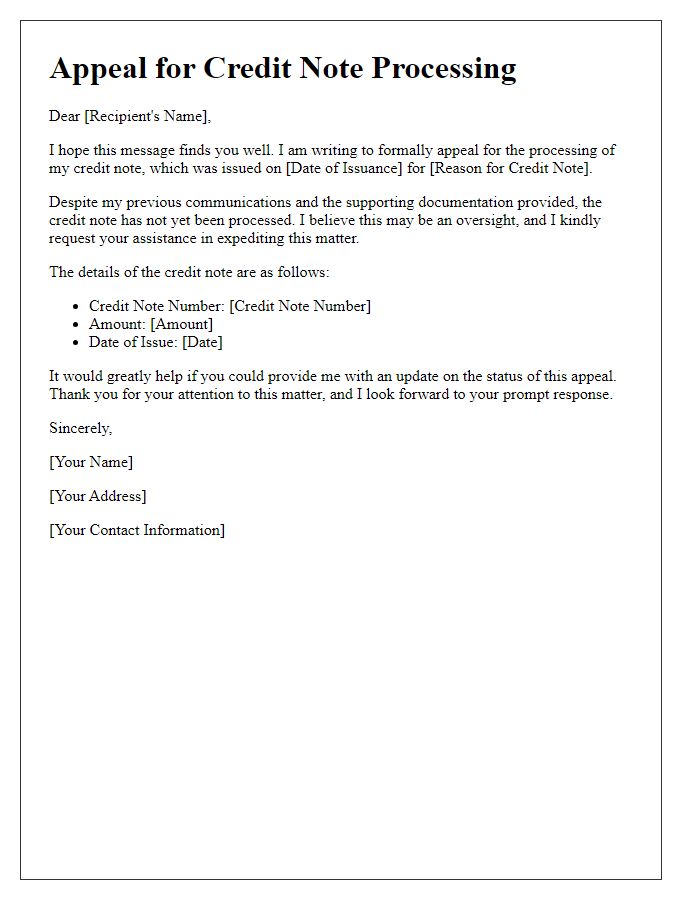

Contact information for follow-up

Issuing a credit note involves several key details that ensure proper processing and tracking. The requestor's contact information, including a valid email address and phone number, facilitates streamlined communication regarding the status of the credit note. The associated transaction details, such as invoice number and date of purchase, provide context for the request. Accurate identification of the reason for the credit note, such as a product return or pricing error, plays a crucial role in justifying the issuance. Additionally, specifying the desired amount for the credit note aligns expectations for resolution. Clear articulation of these elements enhances the efficiency and effectiveness of the request process.

Comments