Are you starting a new business and need confirmation of your entity registration? This essential letter serves as proof that your business officially exists in the eyes of the law, giving you the credibility needed to engage with suppliers, clients, and financial institutions. Understanding the components of a well-drafted registration confirmation can simplify the process and ensure you have everything in order. So, if you're ready to learn how to create a powerful confirmation letter that reflects your professionalism, keep reading!

Business Name

The confirmation of business entity registration signifies the successful establishment of the business, such as XYZ Innovations, as a legal entity under the jurisdiction of the state where it operates. This process includes the approval of necessary documents like Articles of Incorporation, reflecting the entity's structure and purpose. With the registration confirmed on October 15, 2023, XYZ Innovations can now legally conduct business activities, open bank accounts, and enter contracts. Additionally, this registration is essential for compliance with local regulations and for obtaining any necessary business licenses or permits.

Registration Number

Registration confirmation for a business entity occurs following a successful application process with a state or national registry, such as the Secretary of State. A unique Registration Number, typically consisting of a 10-15 alphanumeric code, is assigned to identify the business officially. This number is essential for legal and administrative purposes, including tax filings and compliance with regulations. Businesses located in major cities like New York or Los Angeles might require additional documentation, such as proof of business address or identification of the owner's Social Security Number. Maintaining proper records of the registration confirmation ensures seamless operations and fosters trust with stakeholders.

Confirmation Date

Business entity registration confirmation is essential for establishing a legal presence in the marketplace. The registration process, which typically culminates on the Confirmation Date, varies by jurisdiction. In the United States, states such as California (with filing fees ranging from $70 to $800) or New York (which charges $125 for specific business types) require documentation submission to their respective Secretary of State's office. Upon successful registration, entities receive a confirmation letter detailing the business name, entity type (e.g., LLC, Corporation), and the registration number. This confirmation acts as proof of compliance with local business laws and regulations, facilitating operations such as opening bank accounts and obtaining licenses. Proper record-keeping from this point forward is crucial for tax and legal purposes, ensuring all subsequent filings align with the guidelines set forth by the state.

Regulatory Compliance

Business entity registration confirmation is crucial for regulatory compliance, ensuring that organizations adhere to local, state, and federal laws. Upon successful registration, entities receive official documentation, typically including a certificate of incorporation or a business license. These documents serve as proof of legal standing and are essential for establishing legitimacy in the marketplace. The registration process often includes submitting detailed information about the business structure, such as Limited Liability Companies (LLCs) or corporations, and the specific industry sector, along with relevant identification numbers and contact information. Timely registration within designated periods, often specified by jurisdictional guidelines, avoids penalties and maximizes operational efficiency, paving the way for future financial opportunities, including potential funding or tax benefits.

Contact Information

Business entity registration confirmation entails the receipt of official documents validating the establishment of a legal business entity, such as an LLC or Corporation. Important entities include the Secretary of State's office, which processes registration papers for businesses in various states across the United States. The confirmation usually includes a unique Entity Identification Number for reference, along with the official registration date, which is crucial for compliance and operational commencement. Essential details such as the business name, registered agent information, and business address must be clearly outlined, as incorrect information can lead to legal complications. It is necessary to keep this confirmation for tax and operational purposes, ensuring all subsequent filings maintain accuracy and timeliness.

Letter Template For Business Entity Registration Confirmation Samples

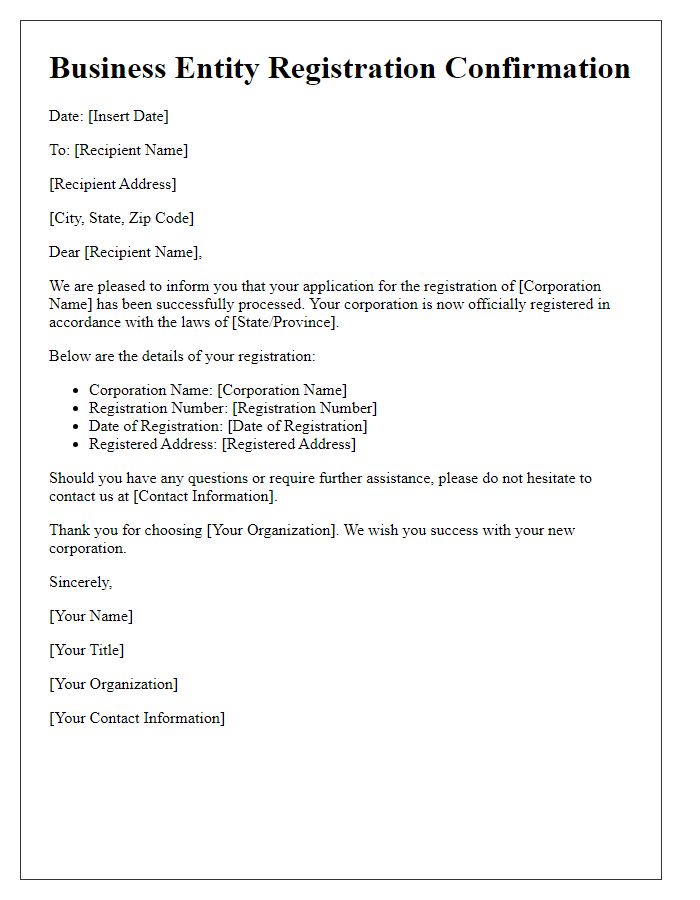

Letter template of business entity registration confirmation for corporation.

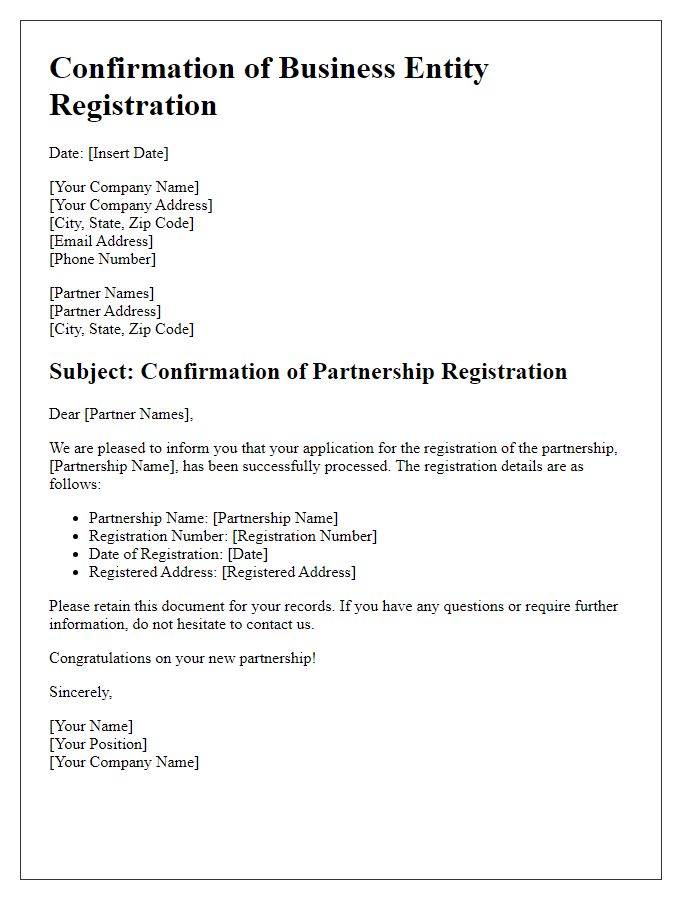

Letter template of business entity registration confirmation for partnership.

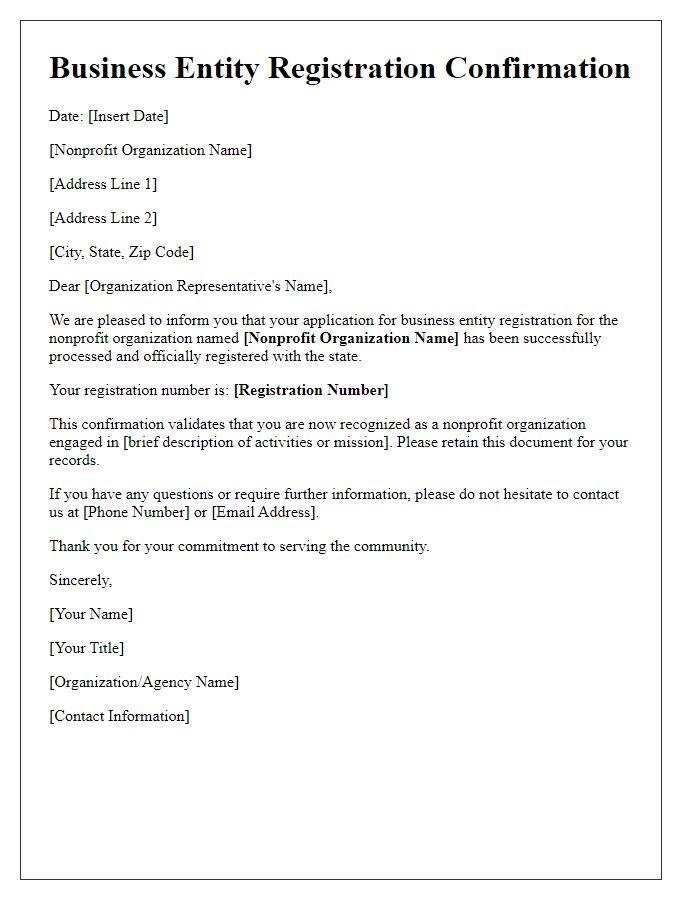

Letter template of business entity registration confirmation for nonprofit organization.

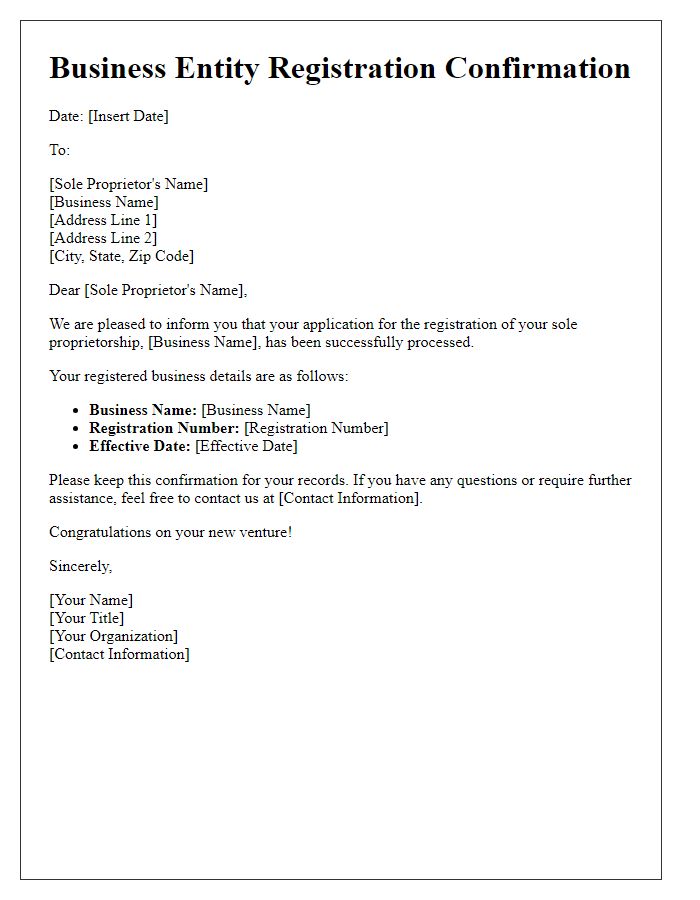

Letter template of business entity registration confirmation for sole proprietorship.

Letter template of business entity registration confirmation for franchise.

Letter template of business entity registration confirmation for foreign business entity.

Letter template of business entity registration confirmation for cooperative.

Letter template of business entity registration confirmation for startup company.

Comments