Are you facing financial challenges and unsure of the next steps? Initiating an insolvency procedure can seem overwhelming, but it can also provide a fresh start. In this article, we'll break down the essential information you need to navigate the process with confidence and clarity. So, if you're ready to explore how you can take control of your financial future, read on!

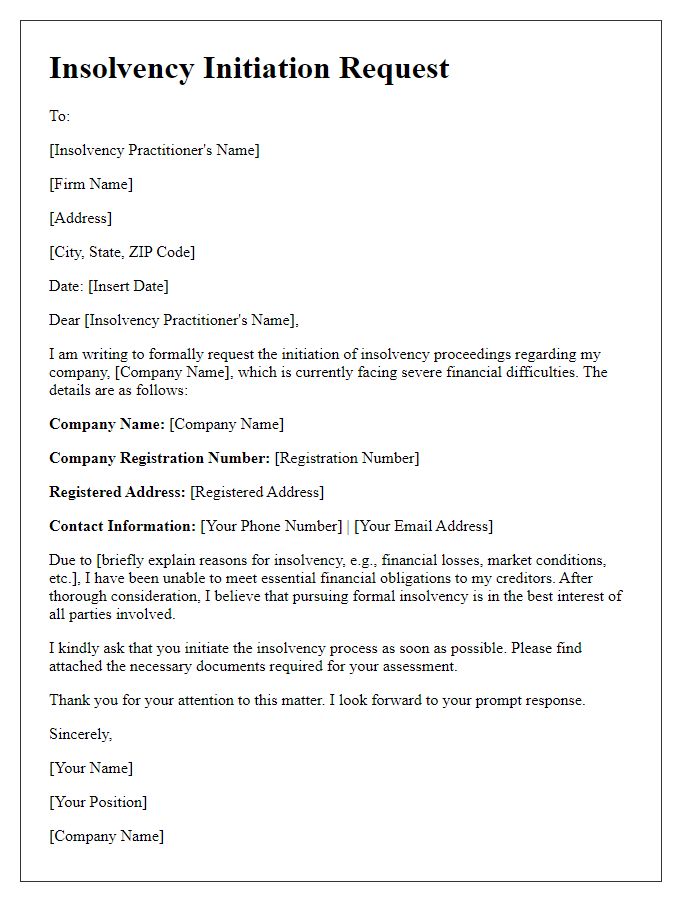

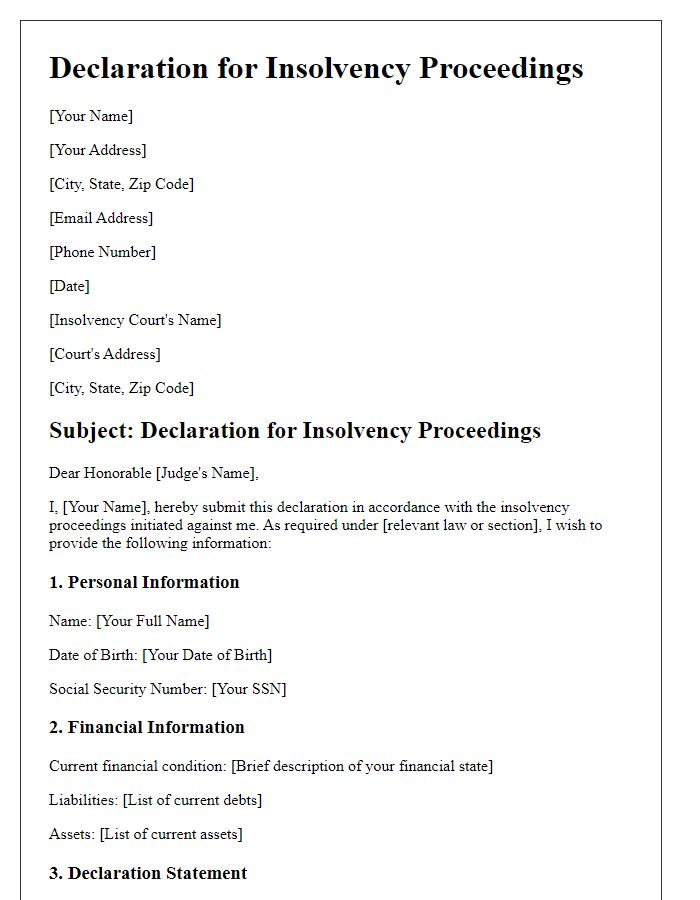

Debtor's Details

Debtor's details, encompassing both individual and organizational identifiers, include essential personal information such as full legal name, date of birth (for individuals, typically a date formatted as MM/DD/YYYY), and the registered address (including street, city, state, and zip code). For corporate entities, details must encompass the business name, registration number (often a unique identifier provided by the relevant government authority), and principal place of business. Additionally, it is vital to include the debtor's contact information (telephone number and email address) to facilitate communication during the insolvency process. Financial status, including total debt amount and liabilities, must also be documented, providing a comprehensive overview of the debtor's financial situation in the context of initiating insolvency procedures.

Insolvency Grounds

Insolvency often arises due to various financial challenges that a business entity faces, such as overwhelming debt or lack of cash flow. Trigger events like a significant drop in sales (over 30% in some sectors) or an inability to meet creditor payments (often exceeding 90 days overdue) can signal financial distress. Legal frameworks, such as the Insolvency and Bankruptcy Code enacted in India in 2016, provide specific grounds under which an insolvency proceeding can be initiated, including defaults in payment obligations or the inability to pay debts totaling more than Rs1,000,000. Timely initiation of an insolvency procedure can help protect valuable assets, allowing for a structured reorganization, which is essential for entities seeking to recover from financial instability.

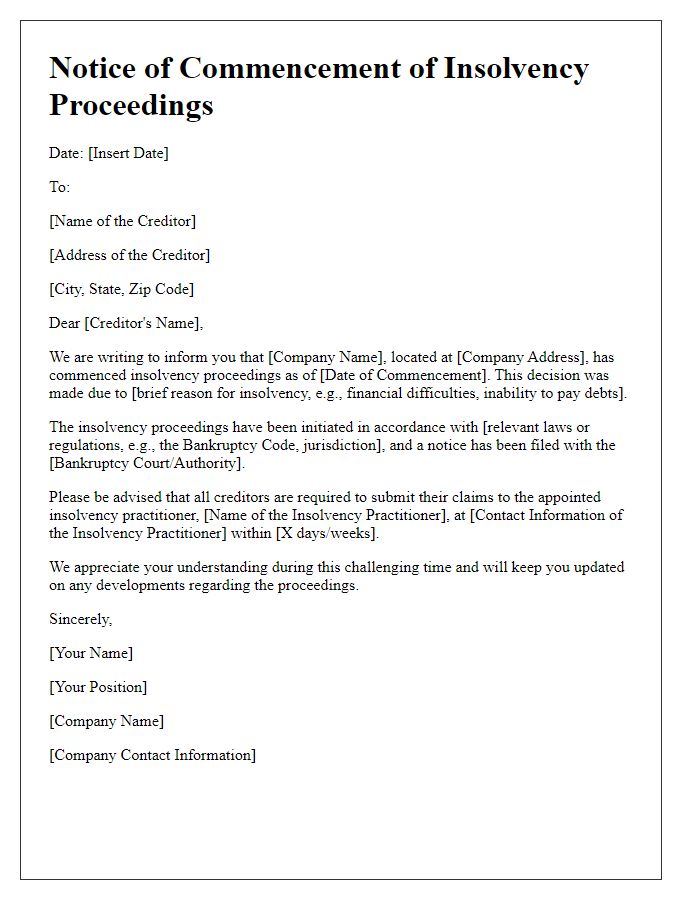

Creditor's Information

The initiation of an insolvency procedure requires a detailed overview of creditor information to ensure compliance with legal obligations. This process involves identifying the creditor's name, including business structure, full address, contact information, and the nature of the credit relationship. For instance, financial institutions such as banks may require documentation of loan agreements, while suppliers could present invoices detailing outstanding amounts. It is crucial to accurately calculate the total debt owed, which can encompass various elements like principal amounts, accrued interest, and penalties. Furthermore, it's essential to categorize creditors into secured, unsecured, and priority classes, as this classification affects repayment sequences during the insolvency proceedings, ultimately determining the distribution of available assets in accordance with local insolvency laws and regulations.

Legal References

Insolvency procedures are initiated under the framework of specific legal statutes designed to address financial distress, such as the Insolvency and Bankruptcy Code (IBC) enacted in India in 2016. The process typically engages provisions stated in Section 7, which allows financial creditors to initiate corporate insolvency resolution. Stakeholders, including creditors and debtors, are affected by the legal implications outlined in Section 9 concerning operational creditors and their rights to initiate the process. Additionally, Section 10 permits corporate debtors to file for insolvency voluntarily. A comprehensive understanding of these regulations ensures adherence to guidelines set forth by the National Company Law Tribunal (NCLT), where insolvency petitions are adjudicated, providing a structured framework for debt resolution and stakeholder negotiations.

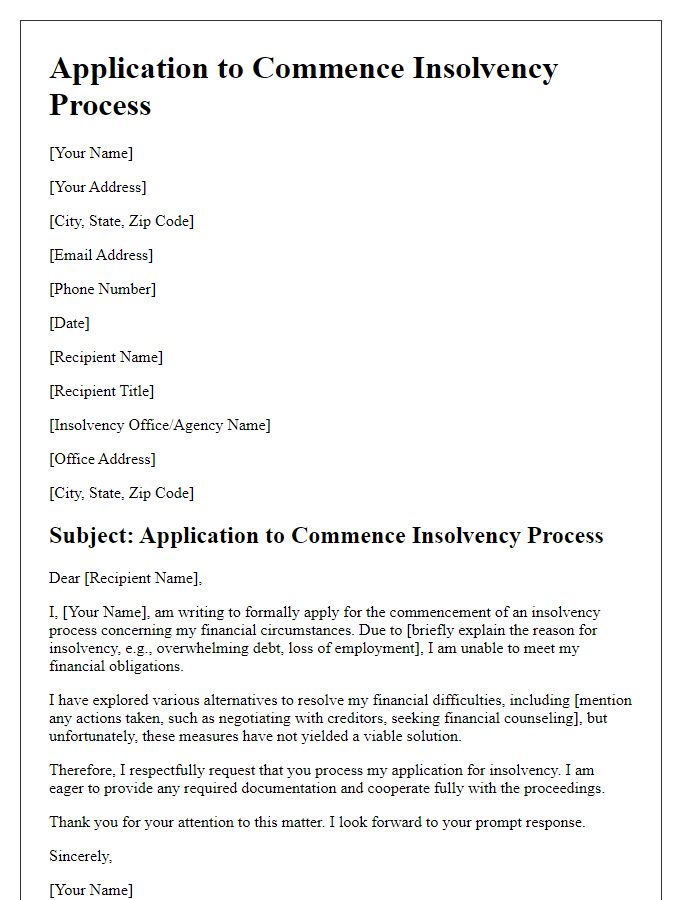

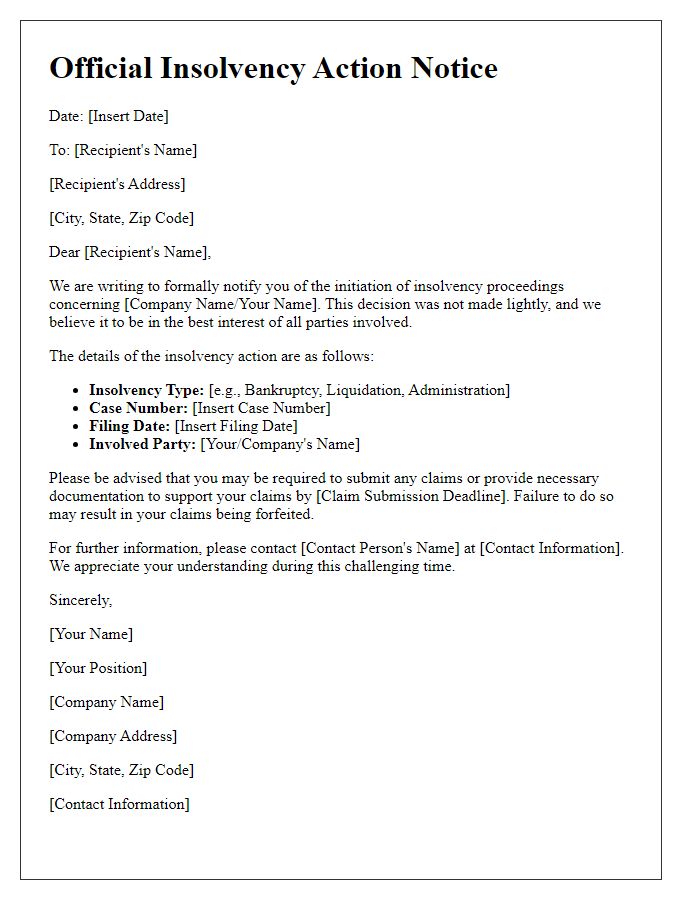

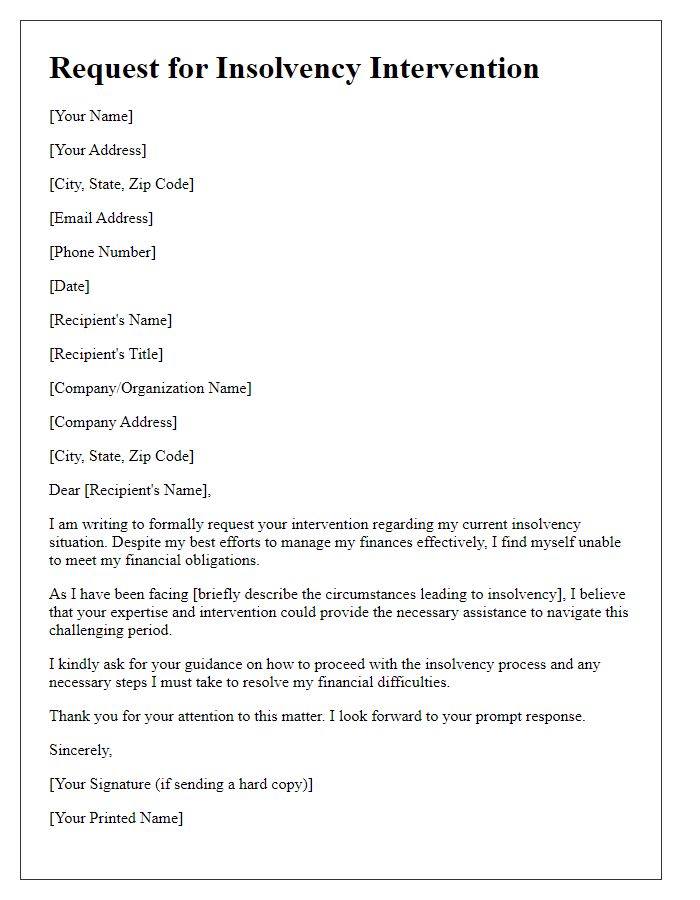

Notification of Intent

Insolvency procedures represent a critical process for businesses facing financial distress, embodying a structured approach for addressing debts and creditors' claims. An initial Notification of Intent serves as a formal communication under various legal frameworks, often initiated in jurisdictions such as the United Kingdom under the Insolvency Act 1986. This document typically outlines the company's intent to seek protection from creditors while engaging licensed insolvency practitioners, such as members of the Association of Chartered Certified Accountants (ACCA). Key elements include details of the company's financial position, the appointed insolvency practitioner's contact information, and any potential meetings with creditors set to occur within a specified timeframe. A well-drafted Notification of Intent can mitigate legal repercussions while providing a pathway for restructuring or liquidation proposals.

Comments