Are you looking to streamline your travel expense reporting process? Creating a clear and concise travel expense reporting policy can make all the difference in ensuring everyone understands how to stay compliant while managing their expenses effectively. This article will guide you through crafting a tailored letter template that outlines everything from eligible expenses to reimbursement procedures in a way that's easy for everyone to grasp. So, let's dive in and explore how you can enhance your travel expense reporting today!

Purpose and Scope

Travel expense reporting policies establish guidelines for employees regarding the reimbursement process for business-related travel expenses. This policy applies to all employees who incur travel expenses while conducting business activities on behalf of the organization. It outlines eligible expenses, documentation requirements, and approval processes to ensure consistency and compliance with company regulations. Employees must keep receipts for all expenses exceeding the defined threshold, commonly set at $25. The policy aims to promote accountability, transparency, and responsible spending, ultimately ensuring the organization efficiently manages its financial resources during travel-related activities.

Eligible Expenses

Eligible expenses in a travel expense reporting policy typically encompass a range of costs incurred during business travel. Common categories include transportation fees (airfare, train tickets, car rentals), which must be documented with receipts and conform to company travel guidelines. Accommodation costs (hotel stays) are allowable if they follow per diem rates or advance approval by management. Meals (breakfast, lunch, dinner) are reimbursable up to specified daily limits, often differentiated between in-state and out-of-state travel. Additional expenses, such as parking fees, tolls, and internet access at hotels, may also be eligible for reimbursement when substantiated with appropriate receipts. Adherence to this policy ensures accountability and helps maintain financial integrity within the organization.

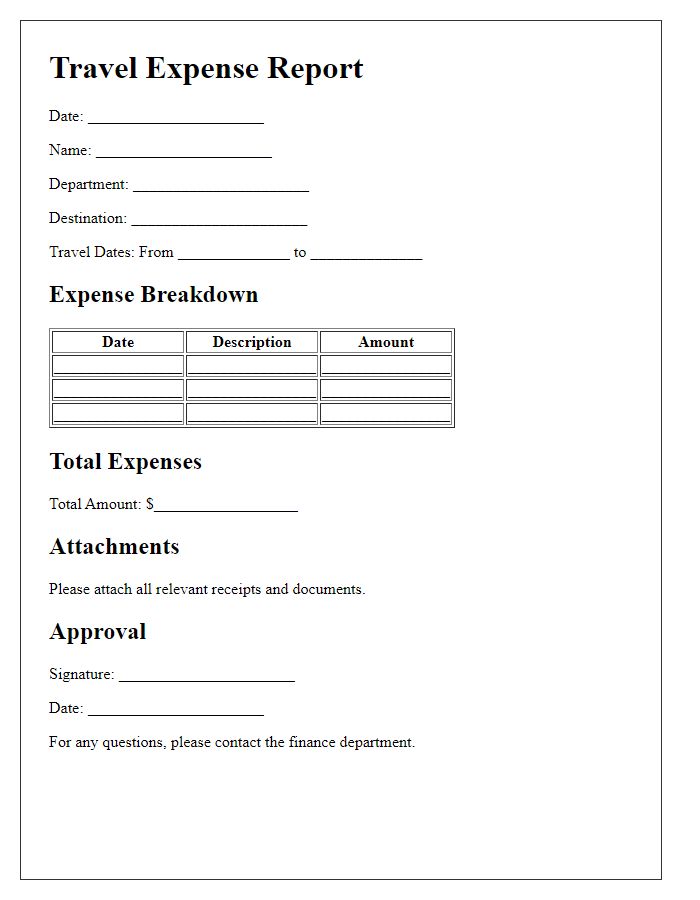

Reimbursement Process

Travel expense reporting is critical for maintaining accurate financial records within organizations. Employees must submit travel-related expenses, including airfare, hotel accommodations, and meals, to receive reimbursement. Each submission should include receipts and documentation, outlining the purpose of the travel, dates, and related expenses incurred. Standard practices dictate that expense reports be filed within a specific period, typically 30 days post-travel to ensure timely processing. Additionally, company policies may specify limits on certain costs, such as daily meal allowances, which vary by location, including both domestic and international travel destinations, to manage overall expenses effectively.

Documentation Requirements

Travel expense reporting policies require meticulous documentation to ensure transparency and compliance with company regulations. Receipts must be retained for all expenditures exceeding $25, including transportation costs for air travel (such as tickets from major airlines like Delta or American Airlines), accommodation charges from hotels (like Marriott or Hilton), and meal allowances (with itemized bills for meals exceeding $15). Mileage logs need to be detailed, including the starting and ending addresses, the date of travel, and total mileage driven, following IRS guidelines for personal vehicle reimbursement. Electronic submissions via designated platforms (such as Concur or Expensify) should accompany all necessary documentation, submitted within 30 days of the travel completion date to facilitate timely reimbursement. Additionally, any expenses that deviate from the initial travel plan must include a valid explanation to be considered for reimbursement.

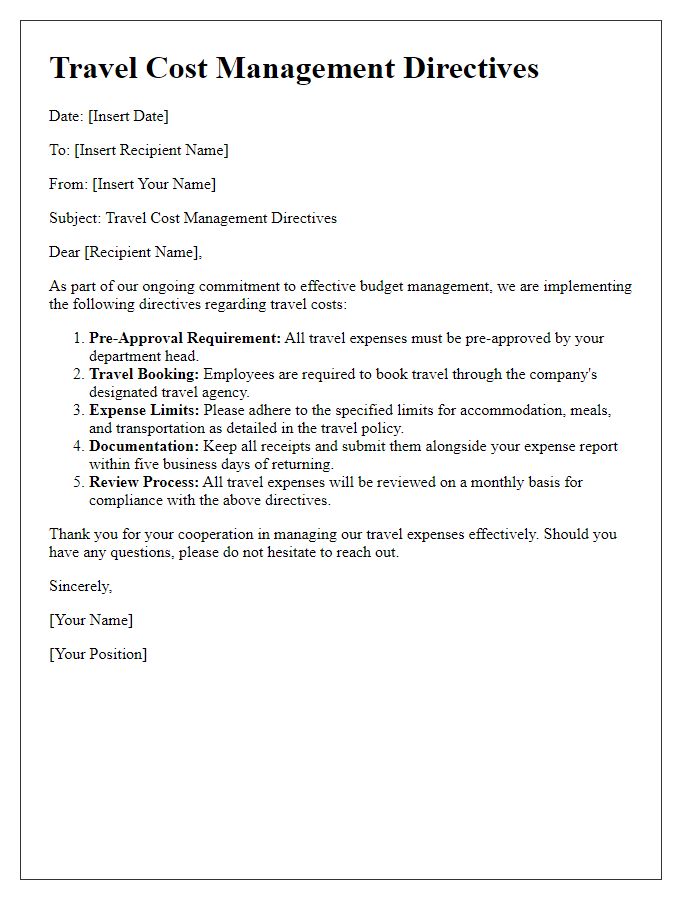

Compliance and Approval

The travel expense reporting policy outlines the compliance and approval processes necessary for employees to receive reimbursement for travel-related expenses incurred during business trips. Each employee must document expenses such as flights, accommodations, meals, and transportation while adhering to company guidelines. The policy requires that all submitted receipts are itemized and accompanied by a travel itinerary, detailing dates, locations, and purposes of travel. Before submitting for reimbursement, employees must obtain approval from their direct supervisors to ensure expenses meet the criteria outlined in the employee handbook. Non-compliance with this policy may result in delayed reimbursements or denial of claims. Regular audits will be conducted by the finance department to ensure adherence to these policies and to identify any discrepancies in expense reporting.

Comments