Are you feeling a bit overwhelmed by the intricacies of depreciation schedules? You're not alone! Understanding how to properly document and manage depreciation is crucial for both personal finances and business accounting. Dive into our comprehensive guide to get clarity and tips on creating an effective depreciation scheduleâyour financial peace of mind awaits!

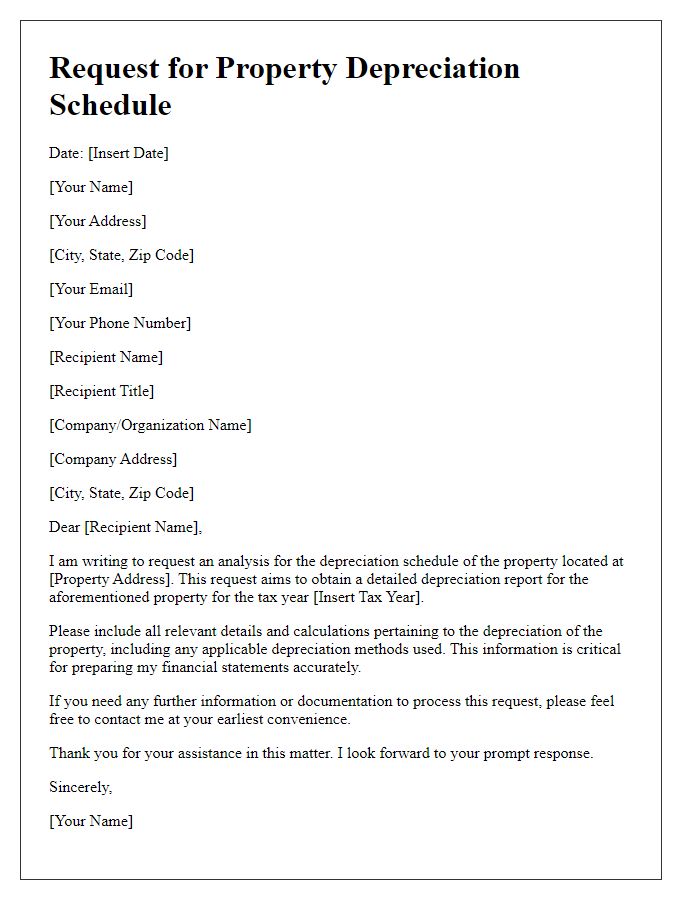

Asset Description and Identification

A depreciation schedule provides essential details regarding the allocation of an asset's cost over its useful life for accounting purposes. Asset identification includes a unique asset identifier, often a numerical code, to streamline tracking within financial records. Asset description entails specific characteristics such as the type (equipment, vehicle, or building), model number, acquisition date (e.g., January 15, 2022), purchase price (such as $50,000), and estimated useful life (typically ranging from 5 to 20 years). Additional information may detail the asset's location (e.g., main office at 1234 Business Rd, City, State) and condition upon acquisition (new or used), which influences depreciation methods like straight-line or declining balance. This comprehensive overview supports accurate financial reporting and asset management.

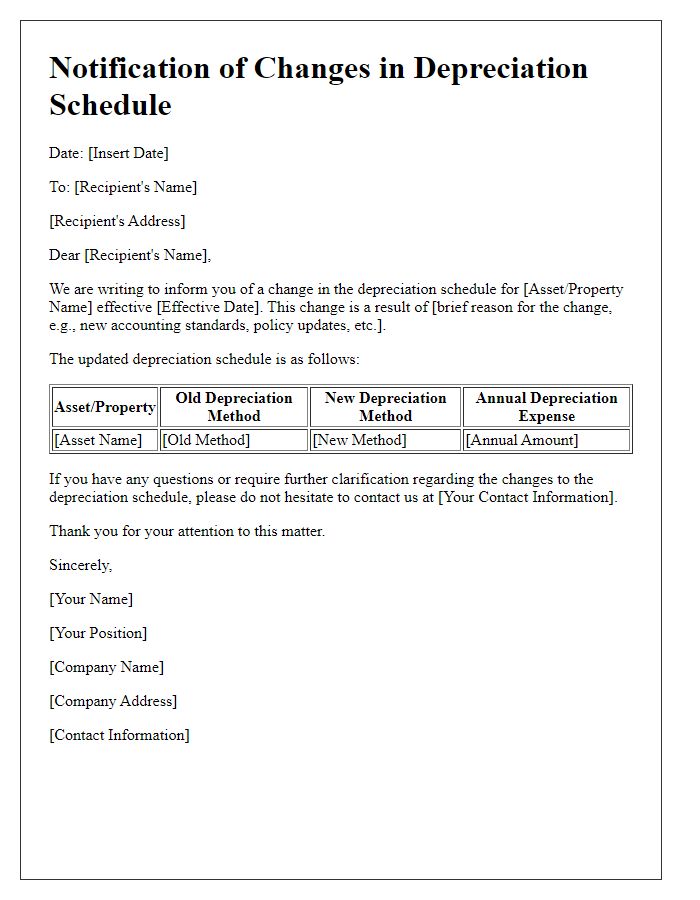

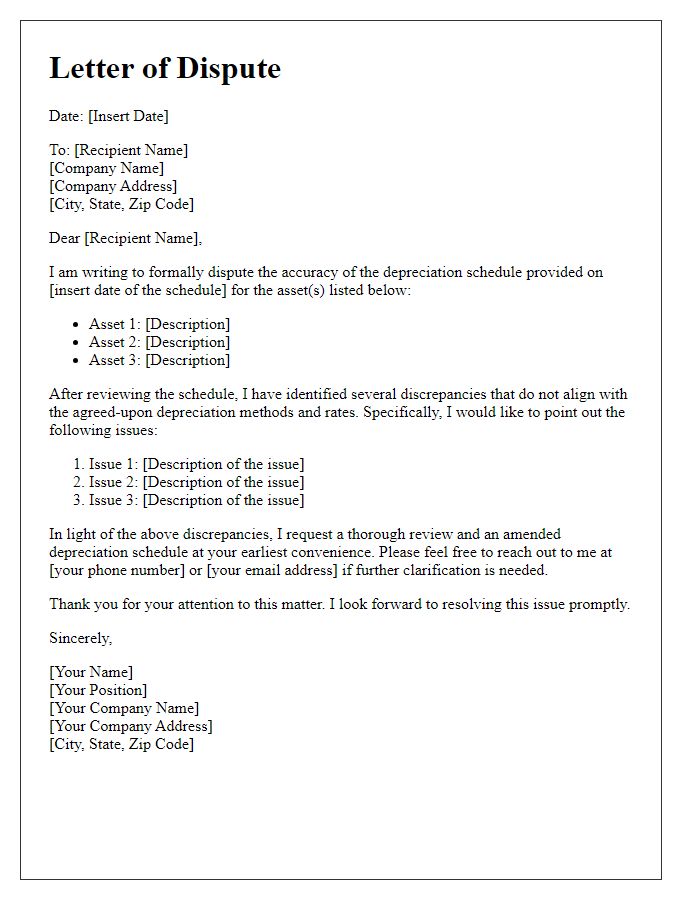

Depreciation Method and Rate

The depreciation method applied for asset valuation, specifically for tangible assets like machinery or equipment, is often the Straight-Line Depreciation method. This method involves evenly distributing the asset's cost over its useful life, typically ranging from 3 to 15 years based on the asset's type and industry standards. The annual depreciation rate can vary, with common rates being 20% for machinery or 10% for vehicles. Additional methods include Double Declining Balance, which accelerates the depreciation early in the asset's life, suitable for assets with rapid obsolescence, and Units of Production method, where depreciation correlates with actual usage, ideal for manufacturing equipment utilized based on production levels. Understanding these methods is crucial for accurate financial reporting and tax compliance.

Acquisition Date and Cost

A depreciation schedule provides key information regarding the financial asset's acquisition date and cost. The acquisition date (defined as the specific date the asset was purchased and officially recorded) marks the beginning of the asset's useful life, typically documented in financial records of entities such as corporations or sole proprietorships. The cost of the asset, which includes the purchase price along with additional expenses such as shipping, installation, and taxes (often amounting to a significant percentage of the total price), is essential in calculating depreciation for tax and accounting purposes. Accurate entries in this schedule are crucial for financial reporting in compliance with the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensuring transparency and consistency in asset valuation over time.

Useful Life Expectancy

A depreciation schedule outlines the useful life expectancy of various assets, guiding businesses in their financial planning. For example, office furniture typically has a useful life of 7 years, while computers may only last about 5 years before becoming obsolete due to technological advancements. Vehicles, depending on usage, usually have a useful life of 5 to 10 years. Buildings often have a longevity of 39 years under IRS guidelines. Such information helps businesses allocate expenses accurately, ensuring compliance with accounting standards and tax regulations. Accurate tracking of asset depreciation, such as the declining value of machinery over time, can significantly impact profitability and overall financial health.

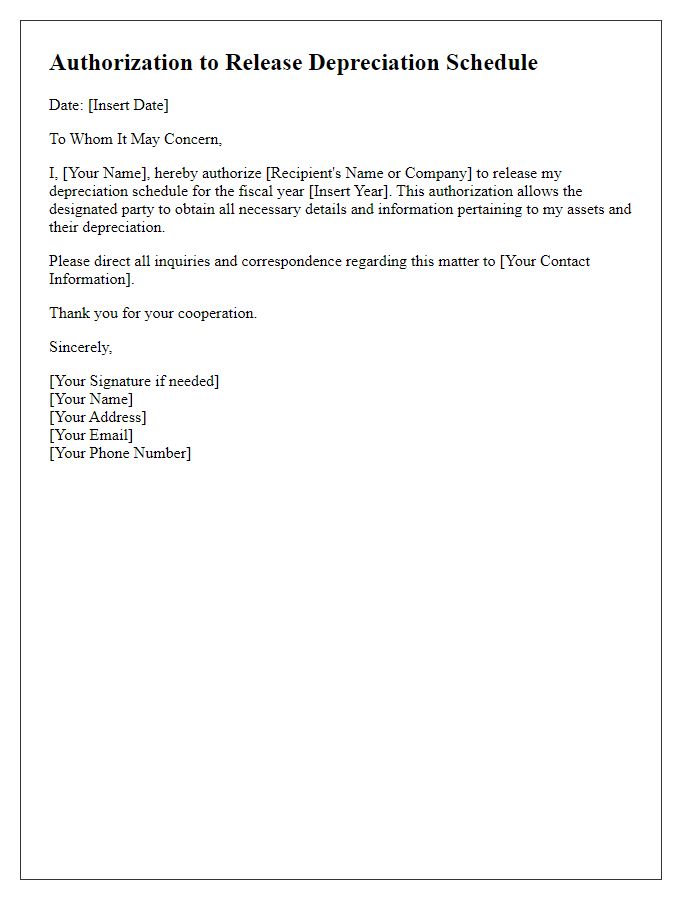

Tax Compliance and Reporting Requirements

A depreciation schedule outlines the systematic allocation of an asset's cost over its useful life for tax compliance and financial reporting. Businesses, following IRS guidelines, categorize assets (like machinery, vehicles, and buildings) under specific classes, influencing the depreciation method to be used (such as straight-line, declining balance, or Modified Accelerated Cost Recovery System - MACRS). The useful life assigned to assets often ranges from three to twenty-seven years, depending on the asset type. Accurate tracking of depreciation is vital for financial statements, impacting net income calculations, and ensuring compliance with local tax regulations. Failure to adhere to these reporting requirements can lead to audits and penalties, underscoring the importance of meticulous record-keeping and adherence to legislation, such as the Tax Cuts and Jobs Act of 2017.

Comments