Are you often puzzled about deductible expenses when it comes to tax season? You're not alone; many find the details a little overwhelming. Understanding these deductions can significantly impact your financial well-being, especially if you're self-employed or own a business. So, let's dive into some key clarifications that can help simplify this important topicâread on to learn more!

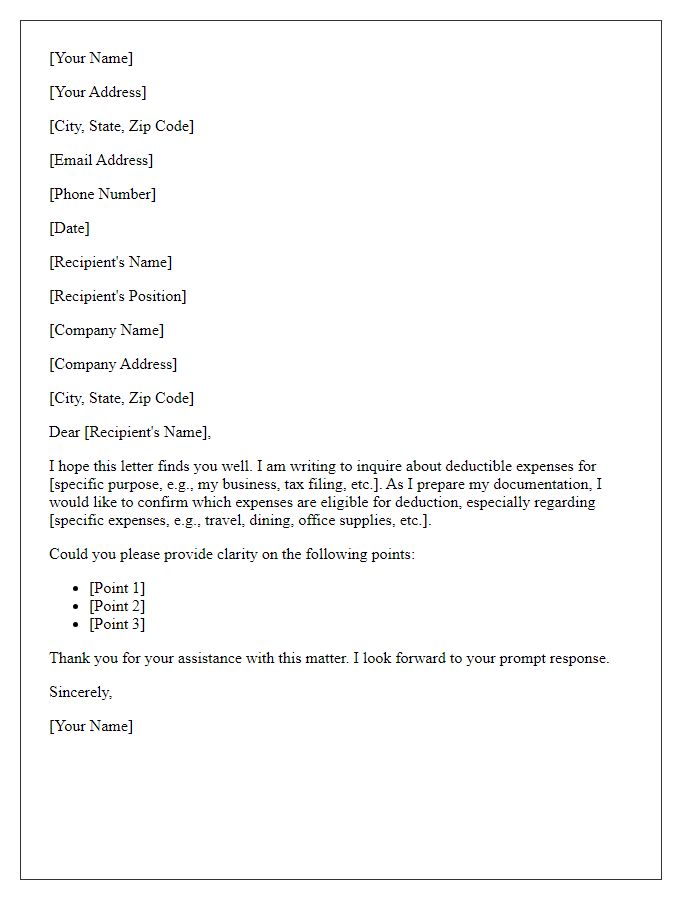

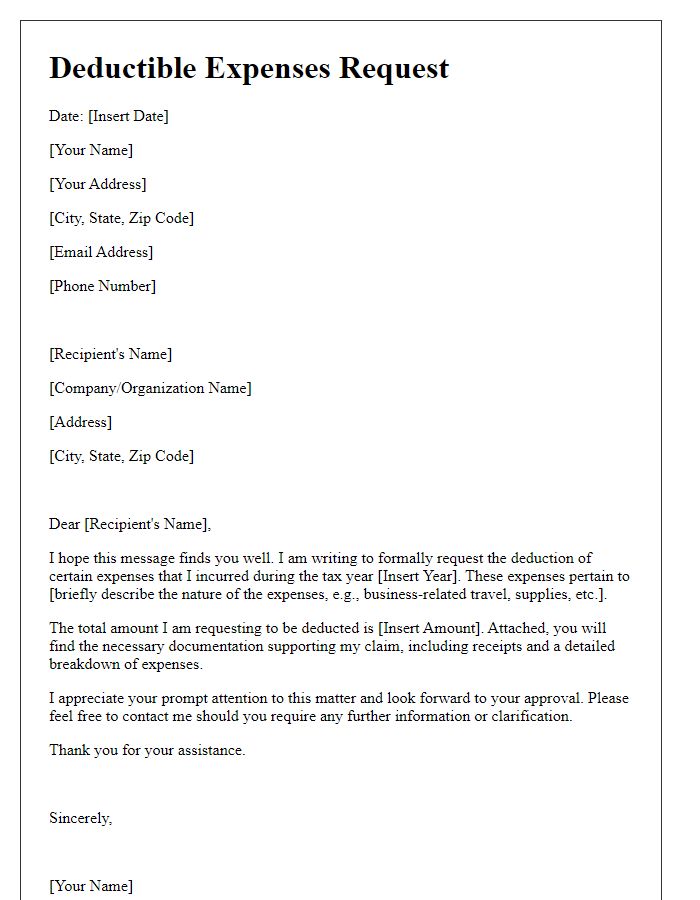

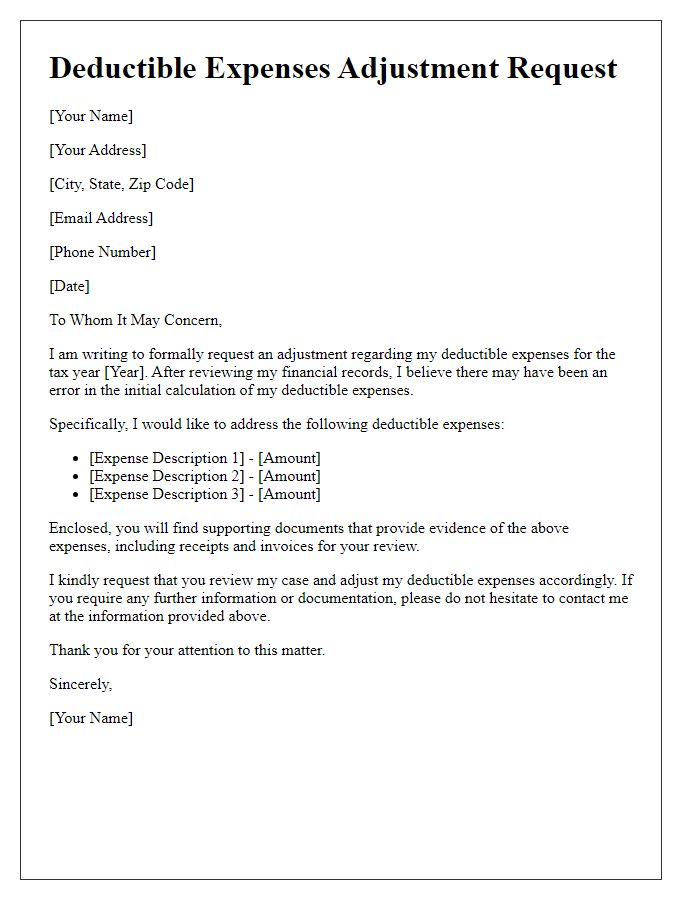

Clearly state the purpose of the letter.

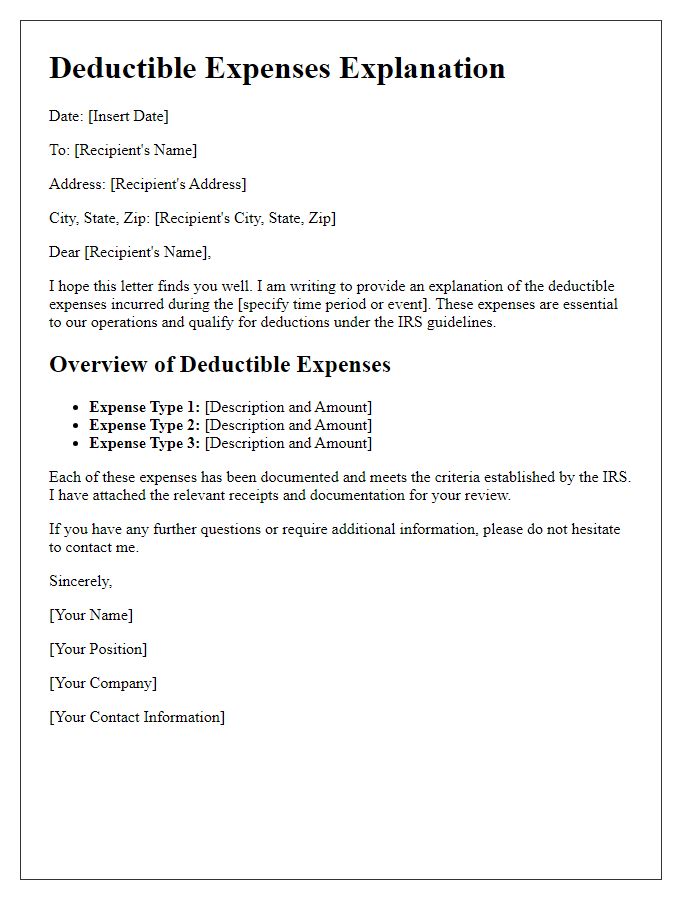

The purpose of this letter is to provide a detailed clarification regarding deductible expenses related to financial accounting for individuals or businesses, especially in accordance with the IRS guidelines. Deductible expenses refer to costs that can be subtracted from gross income to determine taxable income, including categories such as business travel expenditures, medical costs, or charitable donations. Understanding these expenses helps ensure compliance with the Internal Revenue Service, offering clearer insights into tax obligations while maximizing allowable deductions to potentially lower tax liabilities. Providing this clarity is essential for accurate tax reporting and financial planning.

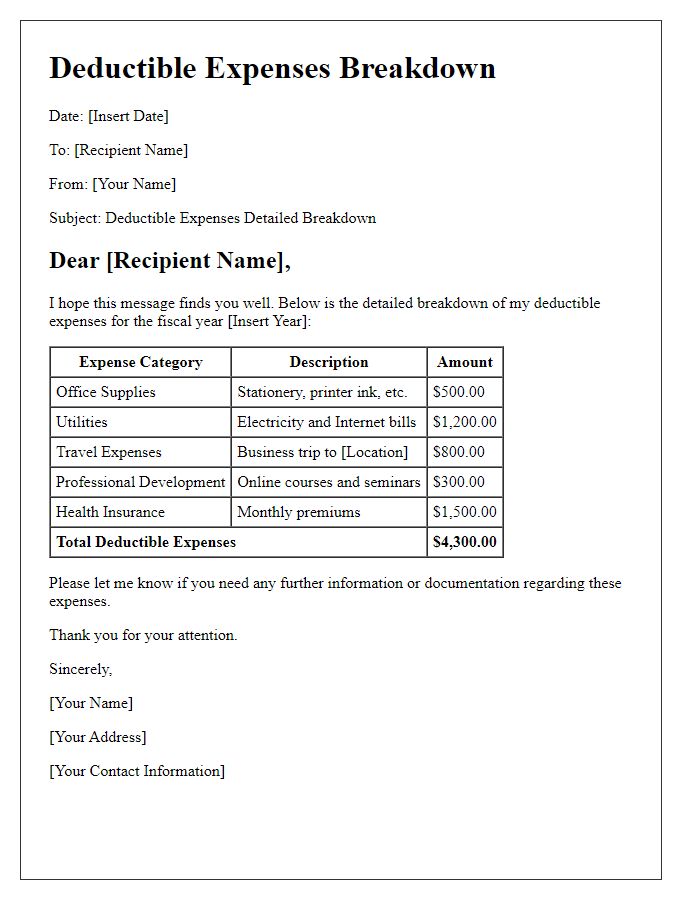

Provide detailed description of expenses.

Deductible expenses, such as medical costs, business travel fees, and education-related costs, play a crucial role in reducing taxable income. Medical expenses may include hospital bills, prescription medications, and preventive care services that exceed 7.5% of adjusted gross income. Business travel expenses encompass airfare (ranging from $200 to $800 for domestic flights), hotel accommodations (averaging $150 per night), and meals (capped at 50% for business meetings) incurred while away from home for work-related purposes. Education expenses, such as tuition fees, books, and supplies for courses that enhance job skills, can also be deductible if they meet specific criteria outlined by the IRS. Maintaining accurate records, including receipts and invoices, is essential for substantiating these expenses during tax filing in the United States.

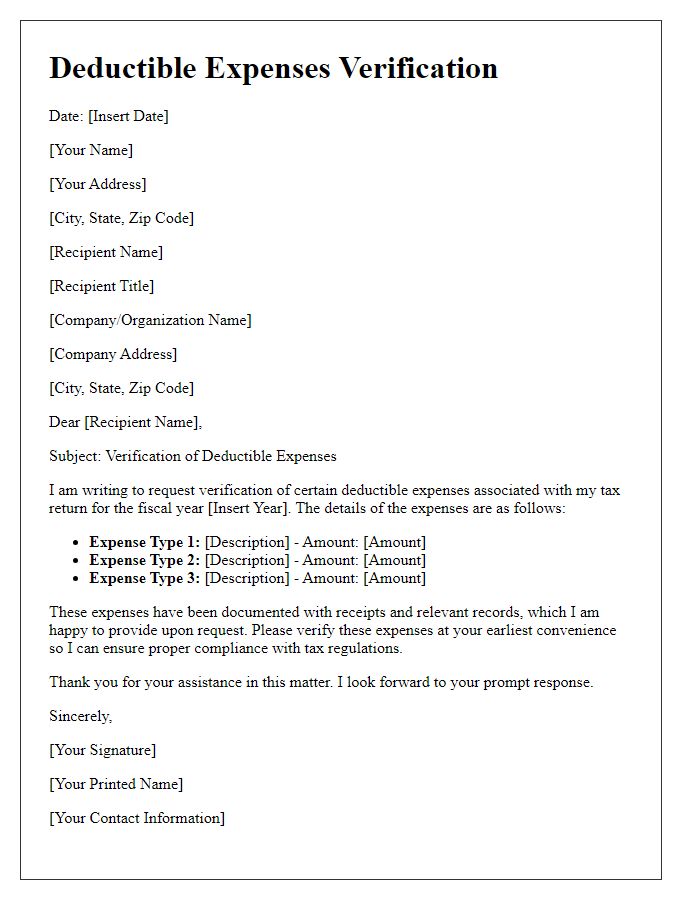

Include relevant financial documentation.

When seeking clarification on deductible expenses, taxpayers often need to provide relevant financial documentation, such as Form 1098-T (Tuition Statement) for educational expenses, receipts for medical costs exceeding 7.5% of adjusted gross income, and detailed bank statements for business-related purchases. Additionally, records of charitable donations, such as acknowledgement letters from organizations for contributions over $250, are essential. Accurate logs of mileage for business travel can substantiate claims, as the IRS allows a standard mileage rate deduction, which fluctuates annually. Taxpayers should also include detail on previous years' tax returns that may showcase carryover deductions or any changes in financial situations that could influence current deductible claims.

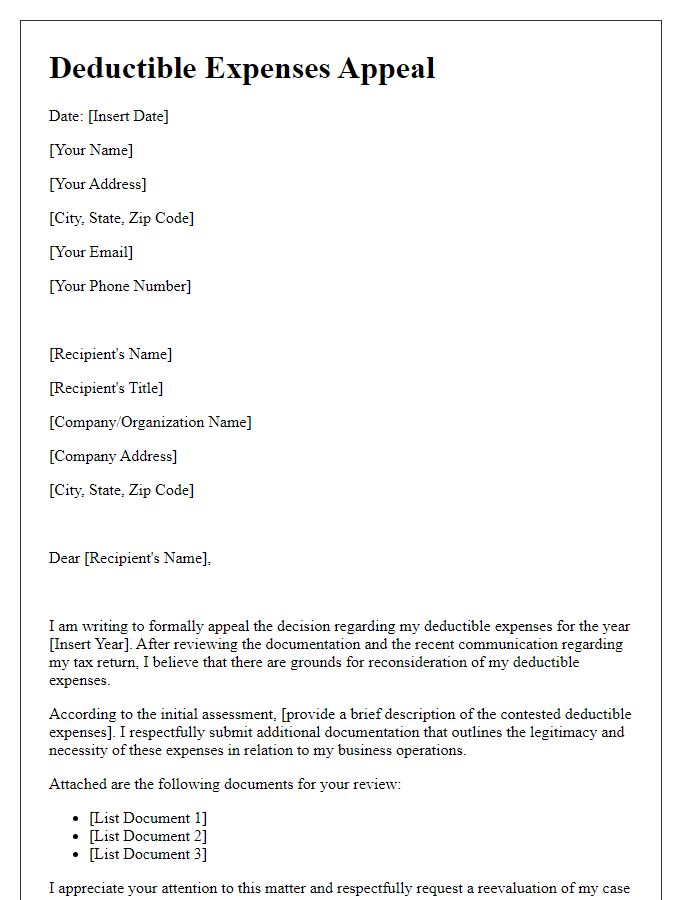

Reference applicable tax codes or regulations.

Deductible expenses, under IRS guidelines specified in Internal Revenue Code (IRC) Section 162, encompass ordinary and necessary expenses incurred in a trade or business. This may include categories such as business travel, meals (limited to 50% deduction in most cases), home office expenses (subject to strict qualification standards), and professional fees (including legal and accounting services). Proper documentation, as outlined by IRS Publication 463 for travel and entertainment expenses, ensures compliance and substantiation. Detailed records of receipts and invoices must be maintained, along with a clear explanation of the business purpose for each expense to align with IRS regulations and maximize tax benefits.

Request specific confirmation or clarification.

deductible expenses such as medical costs can significantly impact tax returns for individuals. Medical expenses must exceed 7.5% of adjusted gross income (AGI) to be eligible for deduction. For example, if the AGI is $50,000, only amounts exceeding $3,750 qualify. Additionally, business-related expenses like travel costs must be documented with receipts to be considered legitimate for tax deductions. This includes airfare, lodging, and meals incurred during business travel, and they must align with IRS regulations and limitations. Clear confirmation on which specific expenses are deductible can ensure compliance and maximize potential tax benefits.

Comments