Are you looking to optimize your investment strategy or enhance your portfolio's performance? Our asset management consultation services are designed to provide expert insights tailored to your financial goals. Whether you're a seasoned investor or just starting, we've got the tools and knowledge to help you navigate the complexities of the market. Join us on this journey to financial empowerment and read more about how we can assist you!

Client Information and Details

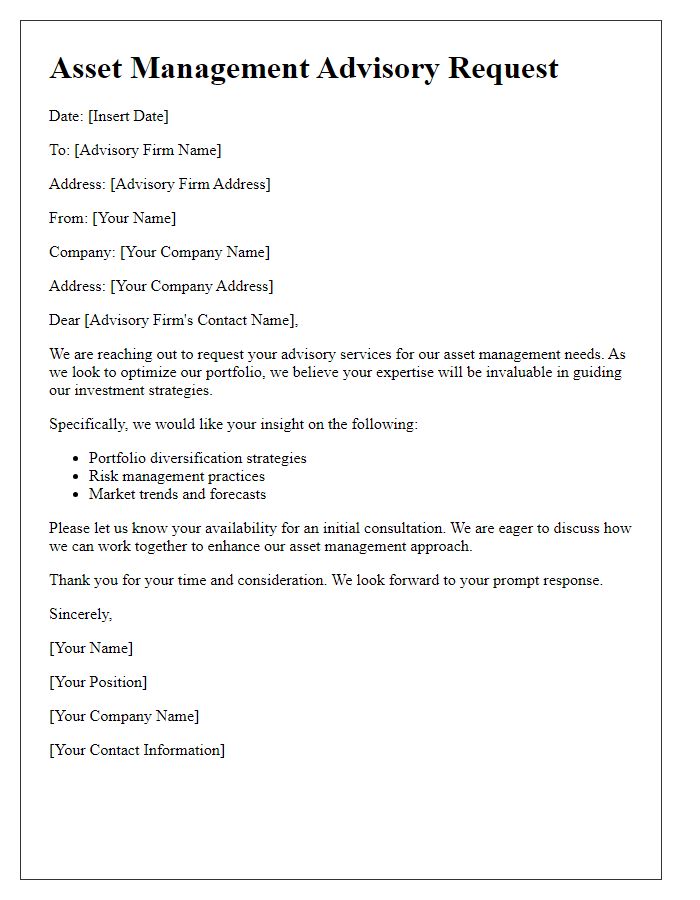

Client consultations in asset management often begin with detailed information collection to tailor strategies effectively. Essential data includes client name, such as John Smith, and contact details like email address and phone number. Financial background is critical, encompassing assets under management (AUM) valued at $1 million, income information averaging $150,000 annually, and liabilities, including a mortgage worth $300,000. Investment objectives should be clearly defined, whether wealth preservation, capital growth, or retirement planning, with specific timelines, such as a 10-year horizon for retirement goals. Risk tolerance assessment, ranging from conservative to aggressive, also impacts strategy formulation. Additional factors may include existing investment portfolio diversification, geographic preferences, tax considerations, and estate planning needs. This comprehensive profile allows for personalized recommendations aligned with the client's financial dreams and objectives.

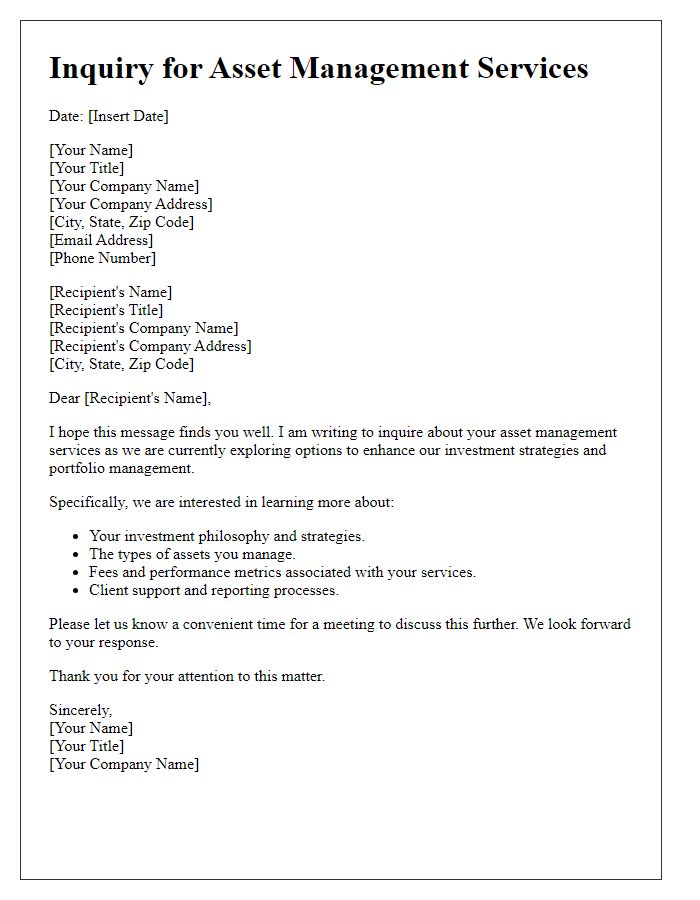

Objective and Goals of Consultation

Asset management consultation encompasses comprehensive strategies for optimizing financial portfolios, focusing on risk assessment, investment diversification, and performance monitoring. Objectives typically center on aligning investment strategies with specific client goals, such as wealth growth and income generation, while addressing market volatility and regulations. Goals include creating tailored asset allocation plans, enhancing portfolio returns through strategic management of equities, fixed income, and alternative investments, and establishing a robust framework for ongoing performance evaluation. Furthermore, consultations aim to improve clients' understanding of market trends and proactive adjustment of asset strategies, ultimately securing long-term financial stability.

Asset Portfolio Overview

Asset portfolio overviews provide crucial insights into investment strategies and overall performance. Analyzing asset classes such as equities, bonds, and real estate reveals the diversification level, risk exposure, and potential returns. A balanced portfolio typically includes a mixture of high-risk assets like emerging market stocks and low-risk investments like government bonds. The performance of the portfolio can be further enhanced by monitoring key metrics such as the Sharpe ratio, which measures risk-adjusted returns. Market conditions, influenced by economic indicators like GDP growth rates and inflation figures, also play a significant role in shaping the asset allocation strategies. Regular assessments, at least quarterly, ensure alignment with financial goals and risk tolerance.

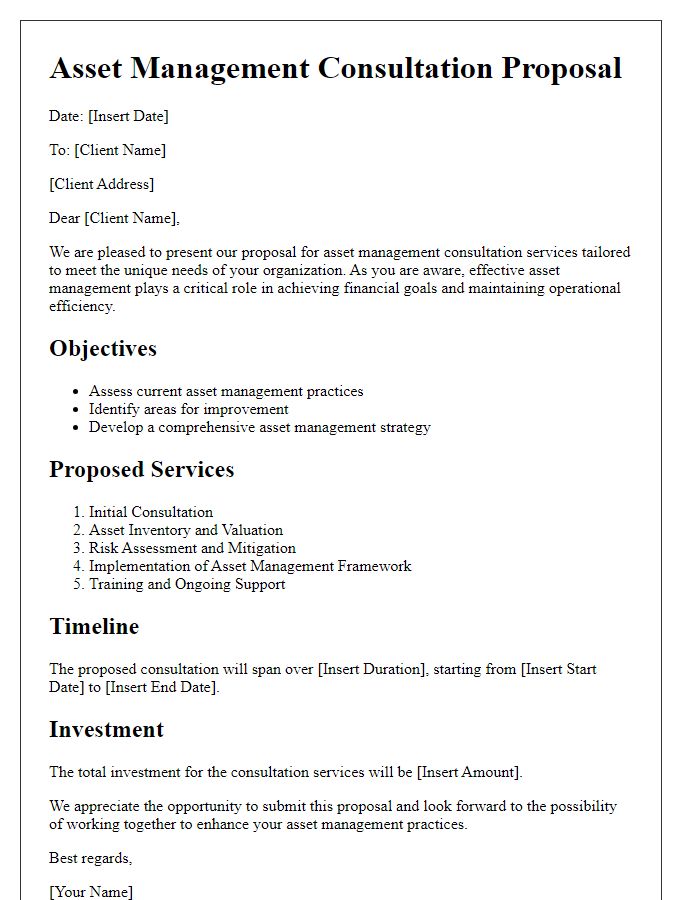

Proposed Strategy and Recommendations

A comprehensive asset management consultation focuses on strategic planning and implementation to optimize portfolio performance. The proposed strategy includes diversification across various asset classes, including equities, fixed income, and real estate, aimed at mitigating risk while maximizing returns. Key recommendations involve regular performance reviews, adjustment of asset allocation based on market conditions, and adherence to compliance standards such as the CFA Institute's Global Investment Performance Standards (GIPS). The importance of utilizing sophisticated analytics tools to analyze market trends and facilitate informed decision-making cannot be overstated. Additionally, adopting an ESG (Environmental, Social, and Governance) approach can attract socially conscious investors and align with sustainable growth objectives. Regular stakeholder communication ensures transparency and effective alignment with strategic goals, strengthening long-term relationships.

Compliance and Confidentiality Assurances

Compliance and confidentiality assurances are fundamental aspects of asset management consultations. Regulatory frameworks, such as the SEC guidelines in the United States or MiFID II in Europe, mandate strict adherence to rules governing client information protection and financial disclosures. Asset management firms implement robust compliance programs to ensure alignment with these regulations, including regular audits and training sessions for employees. Confidentiality agreements, typically ranging from one to five years, protect sensitive client data from unauthorized access. Secure data management practices involve encrypted communication channels and secure storage solutions to mitigate risks associated with data breaches. Trust and transparency in these processes foster strong client relationships and ensure adherence to fiduciary responsibilities.

Comments