Are you curious about how much your business is worth? Whether you're planning to sell, seeking investors, or just want a clearer picture of your company's financial health, understanding business valuation is crucial. It's more than just numbers; it's about grasping your company's potential in the marketplace. Dive into our article to uncover the key factors and methodologies behind business valuations!

Recipient's Name and Contact Information

Business valuation is a critical process for assessing the worth of a company, often necessitated during mergers and acquisitions or investment decisions. It incorporates various methods such as the Discounted Cash Flow (DCF) analysis, which forecasts future cash flows and discounts them to present value, or Comparable Company Analysis (CCA), which evaluates similar companies' valuation metrics like Price-to-Earnings (P/E) ratios in the same industry. Geographic factors, especially within different economic regions such as Silicon Valley or London, can significantly influence valuation due to varying market demand and competition levels. Key documents in this process often include financial statements, tax returns, and growth projections, which provide the necessary data for accurate assessment. Understanding the industry standards and recent market trends is essential, as these elements can impact investor sentiment and overall valuation outcomes.

Purpose of the Inquiry

The purpose of the inquiry regarding business valuation focuses on evaluating the financial worth of a specific enterprise, often a small to mid-sized entity, located in a dynamic market such as the technology sector. Accurate assessment of intangible assets, including intellectual property and customer relationships, is essential. Especially during factors like acquisition negotiations or potential investments, the determination of fair market value, including multiples derived from EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), is critical. Understanding current market conditions, such as competitive analysis and economic indicators, provides context to this valuation process. This inquiry aims to facilitate informed decision-making for stakeholders, including potential buyers, investors, or financial institutions interested in a strategic financial assessment.

Specific Business Details (Industry, Size, etc.)

A business valuation inquiry regarding a technology startup specializing in artificial intelligence solutions is essential for understanding its market worth. The enterprise, located in Silicon Valley, California, comprises approximately 50 employees and generates annual revenue exceeding $10 million. Significant milestones include securing Series A funding of $5 million in 2022 and partnering with major corporations such as Google and Microsoft, enhancing its credibility within the software industry. Industry growth projections suggest a compound annual growth rate (CAGR) of 42% for artificial intelligence, creating a favorable environment for valuation. Understanding these elements aids in making informed decisions regarding potential investments or acquisitions.

Preferred Valuation Methodologies

Preferred valuation methodologies include various approaches essential for assessing the worth of a company. The Income Approach, commonly employed, estimates future cash flows discounted to present value, ideal for businesses with predictable earnings. Alternatively, the Market Approach compares similar companies, often within the same industry, to provide context through pricing multiples. The Asset-Based Approach focuses on company assets' liquidation value, significant for firms with substantial tangible assets. Each methodology offers insights crucial for stakeholders in investment decisions, mergers, and acquisitions, especially in competitive markets like technology or healthcare. Understanding the specifics, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples or comparable transaction analysis, shapes overall valuation accuracy.

Contact Details for Follow-Up

Business valuations involve assessing the worth of a company or its assets. Professionals in finance, such as certified valuators (CVA) or investment bankers, typically perform these evaluations to aid stakeholders in making informed decisions regarding mergers, acquisitions, or sales. A comprehensive valuation may include factors like cash flow analysis, earnings projections, market comparisons, and asset valuations. For instance, small businesses often command different multipliers based on industry standards, while larger corporations like Fortune 500 companies undergo rigorous assessments that reflect their market capitalization and revenue streams. Accurate valuations can greatly influence investment strategies, tax obligations, and succession planning.

Letter Template For Business Valuation Inquiry Samples

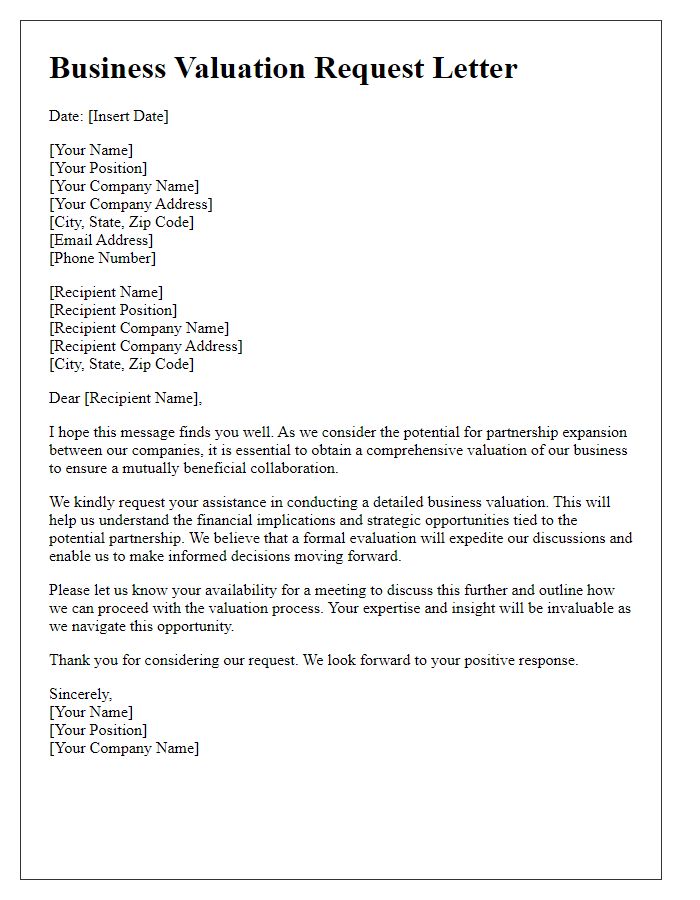

Letter template of business valuation request for partnership expansion.

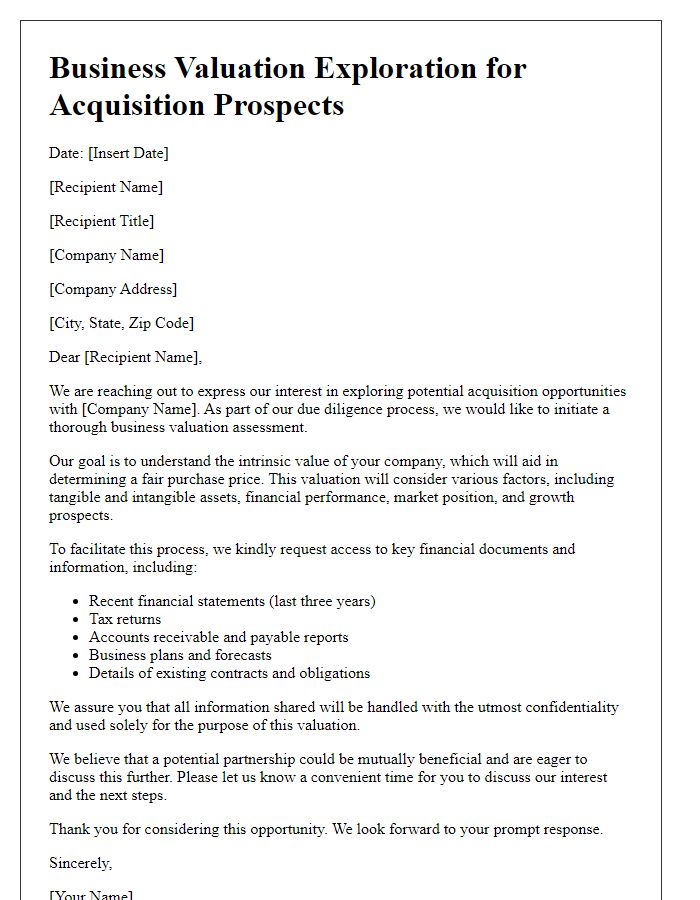

Letter template of business valuation exploration for acquisition prospects.

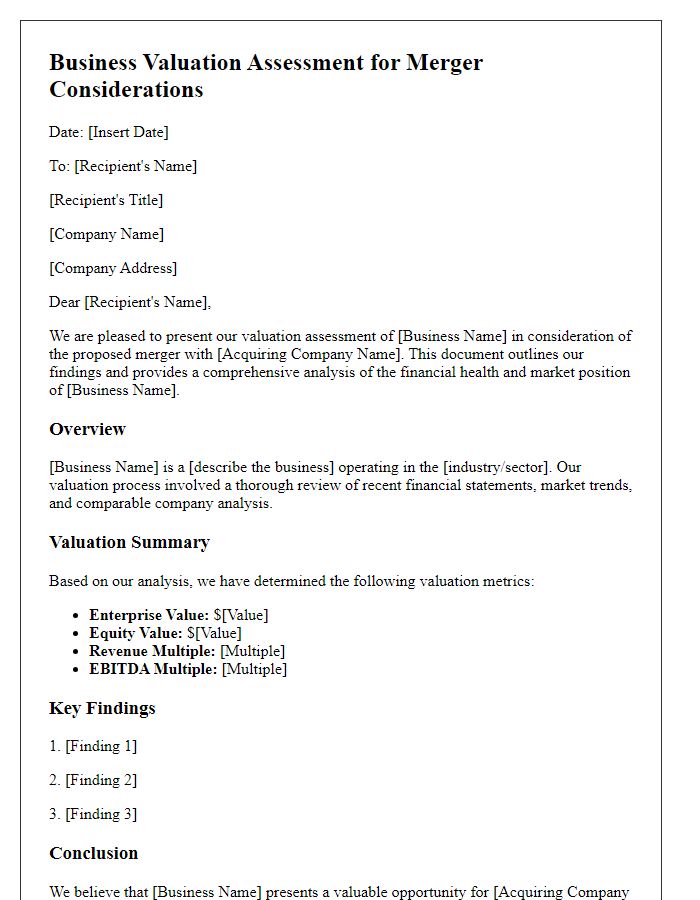

Letter template of business valuation assessment for merger considerations.

Letter template of business valuation report inquiry for estate planning.

Letter template of business valuation documentation request for tax purposes.

Letter template of business valuation proposal for franchise evaluation.

Comments