Are you feeling the crunch of an unexpected property tax assessment? If so, you're not alone, and it's time to take action. Understanding how to effectively dispute an assessment can save you money and alleviate unnecessary stress. Join me as we explore essential steps and tips that can empower you in your property tax assessment dispute journey.

Accurate Property Details

Accurate property details are crucial when disputing property tax assessments, particularly for residential homes, commercial buildings, or undeveloped land. Property characteristics such as square footage, number of bedrooms, and year built directly influence market value, prompting accurate assessment by local taxation authorities. Therefore, discrepancies in features like lot size (measured in acres or square feet), property condition (including renovations or damages), or zoning classification can lead to over-evaluation of tax liabilities. Furthermore, recent sales of comparable nearby properties, often referred to as "comps," should be included to demonstrate differences in market value. Documenting these details not only aids in clarifying the property's true worth but also strengthens the case against the tax assessment. Accurate representation of the property in official records is vital for a successful dispute resolution.

Comparable Market Analysis

Comparable Market Analysis (CMA) is an essential tool used in property tax assessment disputes to establish a fair market value for real estate properties. This analysis involves evaluating similar properties (comps) in the same location, such as residential neighborhoods in Los Angeles, California, where recent property sales provide critical insight. Key elements of a CMA include assessing recent sales prices (within the last six months) of properties with similar square footage, number of bedrooms, and amenities. Adjustments are made for differences such as pool presence or updates, which can influence market value significantly. Utilizing data from multiple listing services (MLS) or county assessor records ensures accuracy and supports a compelling argument against inflated property tax valuations. Engaging a qualified real estate appraiser in San Francisco can strengthen a dispute with professional insights on market trends and value discrepancies.

Assessment Error Documentation

Property tax assessments can significantly impact homeowners' finances, making it crucial for property owners to verify the accuracy of their evaluations. An assessment error occurs when the property description differs from its actual characteristics, such as square footage, number of bedrooms, or property type (single-family home versus multi-family unit). An incorrect estimated value can lead to overpayment on property taxes, which often exceeds the typical assessment rate of 1.2% to 2.5% of the property's value based on local jurisdiction practices. Gathering supporting documentation, such as recent comparable sales data from nearby properties (known as "comps") or photographs highlighting discrepancies, enhances the argument against the assessed value. Filing a formal dispute within the stipulated timeline, often ranging from 30 to 45 days from the notice date, is essential for homeowners aiming to rectify financial burdens linked to inaccurate property assessments.

Legal and Regulatory References

Property tax assessments can significantly impact financial obligations for homeowners. Local government agencies, such as county tax assessor offices, are responsible for determining property values, often based on comparable sales data (often referred to as "comps") from the last twelve months. Common legal regulations related to property tax disputes are outlined in state property tax codes, which vary widely by jurisdiction. For instance, in California, Proposition 13 sets a limitation on annual assessment increases, while in New York, Real Property Tax Law provides a framework for grievances, allowing property owners to challenge assessed values. Specific forms and procedural guidelines, such as the filing timeline (typically a 30-day window after assessment notices), are mandated by local statutes, ensuring property owners have a formal avenue to dispute perceived inaccuracies in assessments.

Clear and Concise Statement

Property tax assessments can be challenged if deemed inaccurate. Tax assessments in areas like San Francisco or New York City often involve complicated algorithms considering property size, market trends, and location valuation. A property owner might argue a overstatement of values due to fluctuations in comparable real estate sales, especially during economic downturns. Supporting documents such as recent sale prices of similar properties, tax assessment records, and photographs indicating property condition can substantiate claims. Additionally, deadlines for filing disputes, commonly set annually, must be strictly adhered to, emphasizing the need for timely action in jurisdictions.

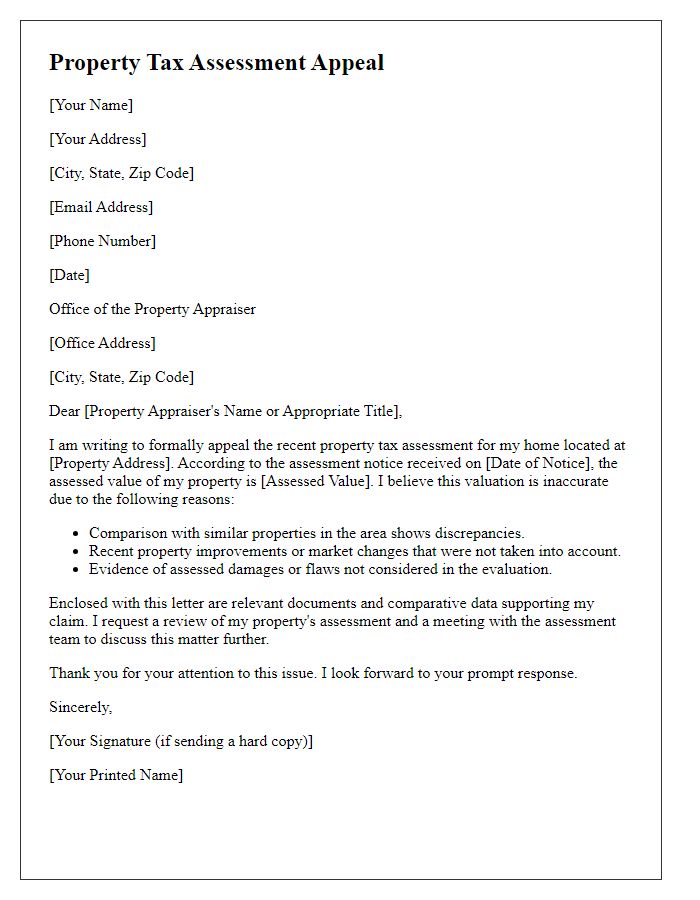

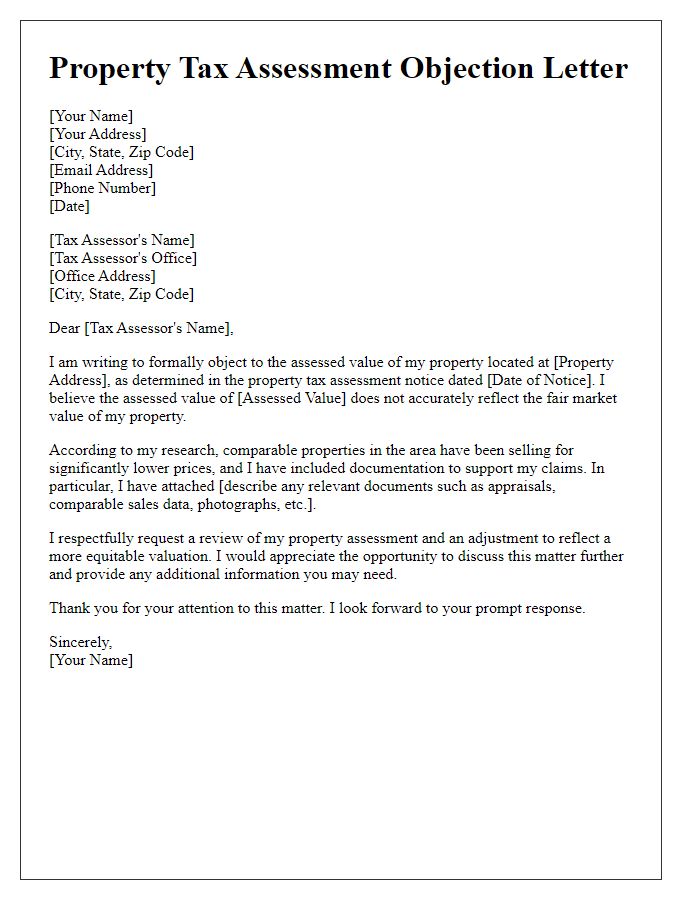

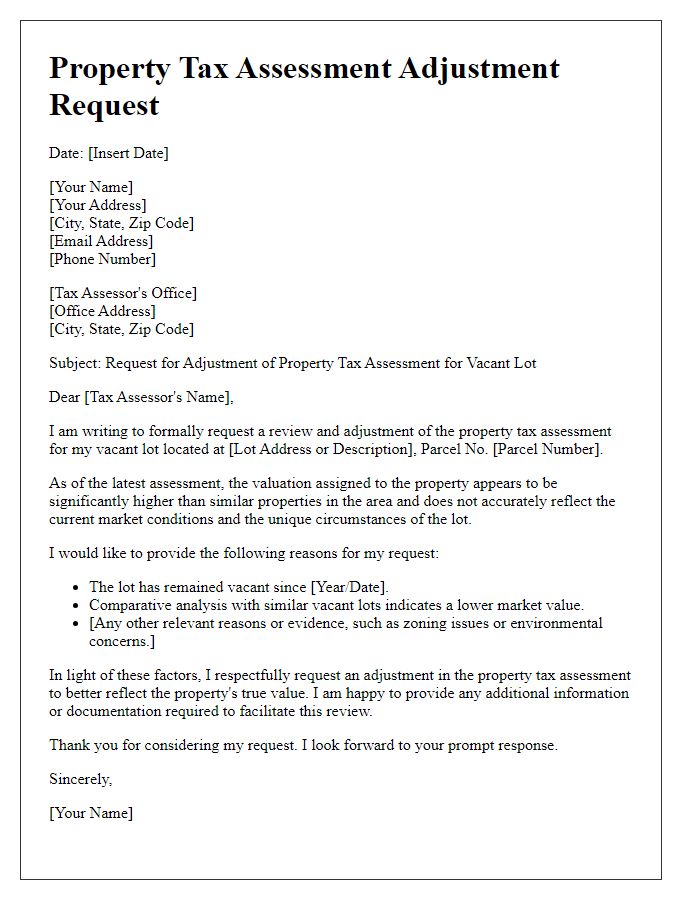

Letter Template For Property Tax Assessment Dispute Samples

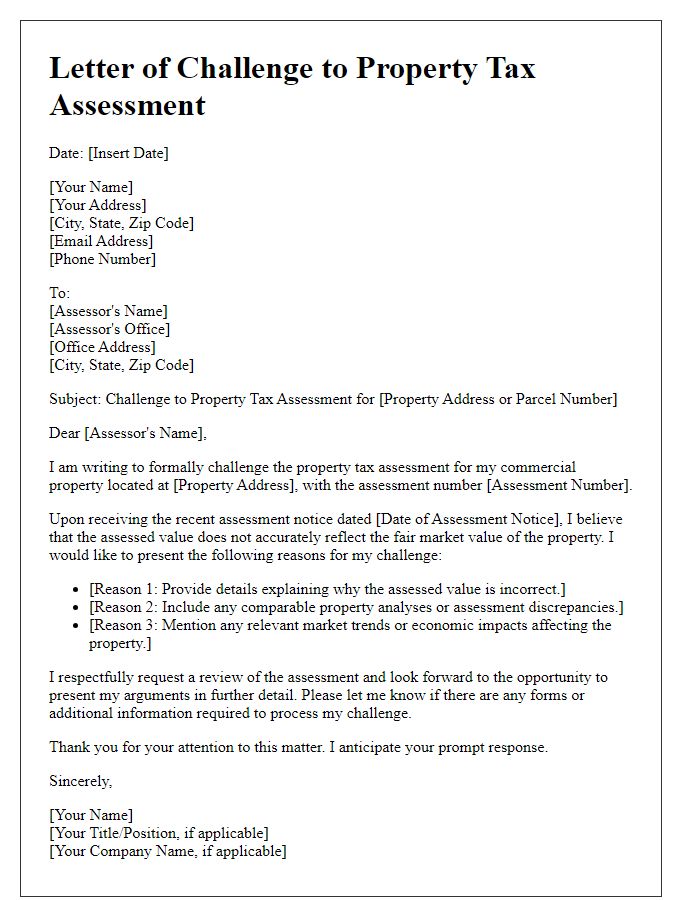

Letter template of property tax assessment challenge for commercial properties

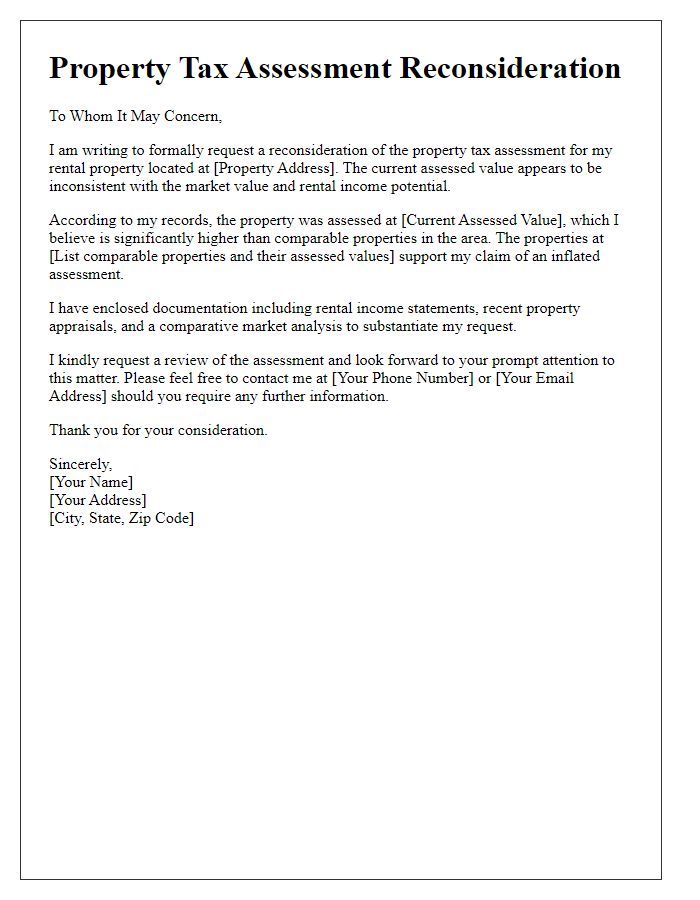

Letter template of property tax assessment reconsideration for rental properties

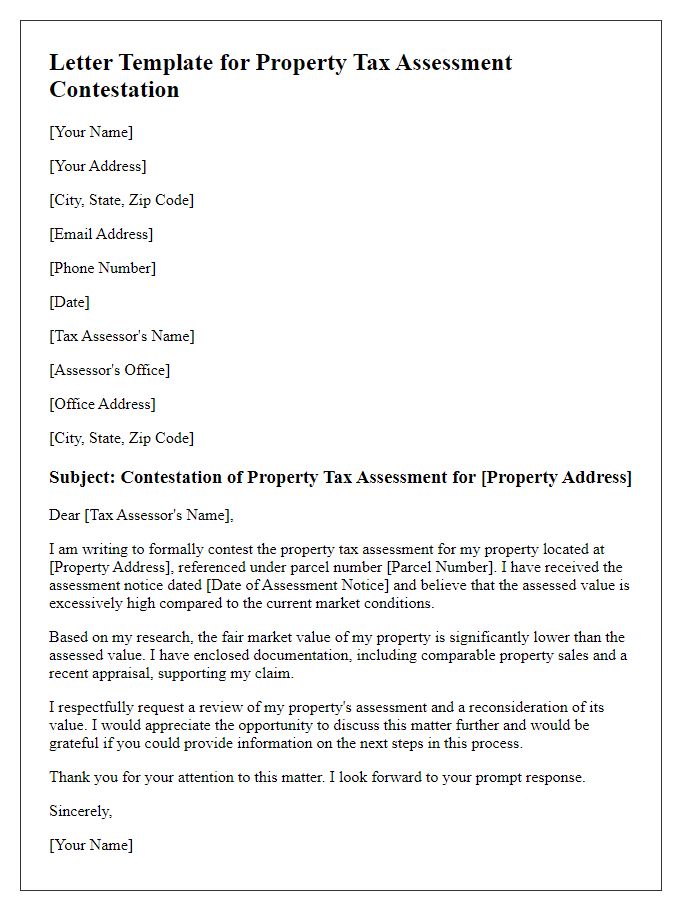

Letter template of property tax assessment contestation for real estate investors

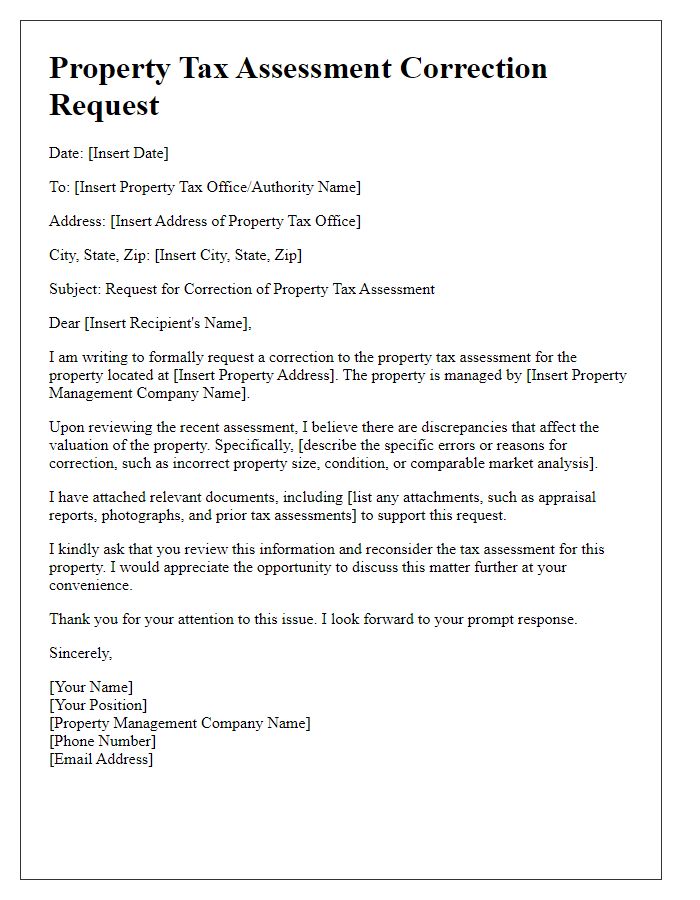

Letter template of property tax assessment correction request for property management

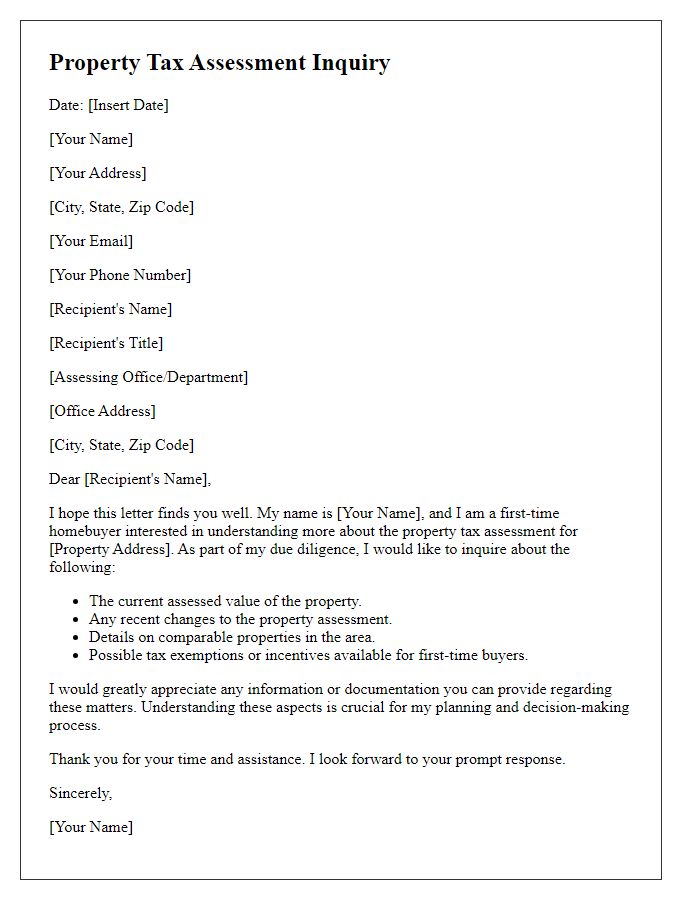

Letter template of property tax assessment inquiry for first-time buyers

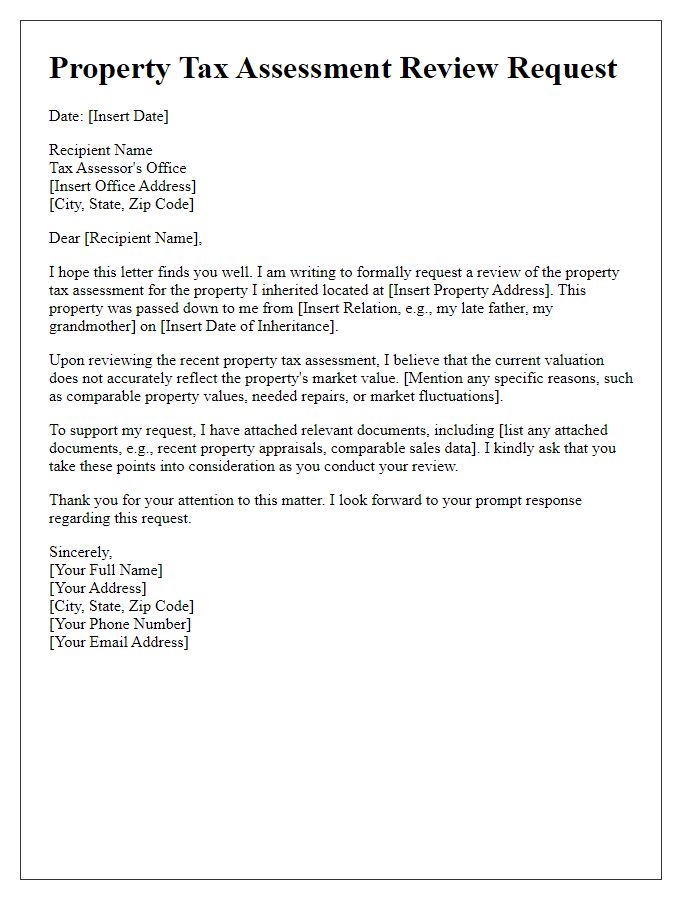

Letter template of property tax assessment review for inherited properties

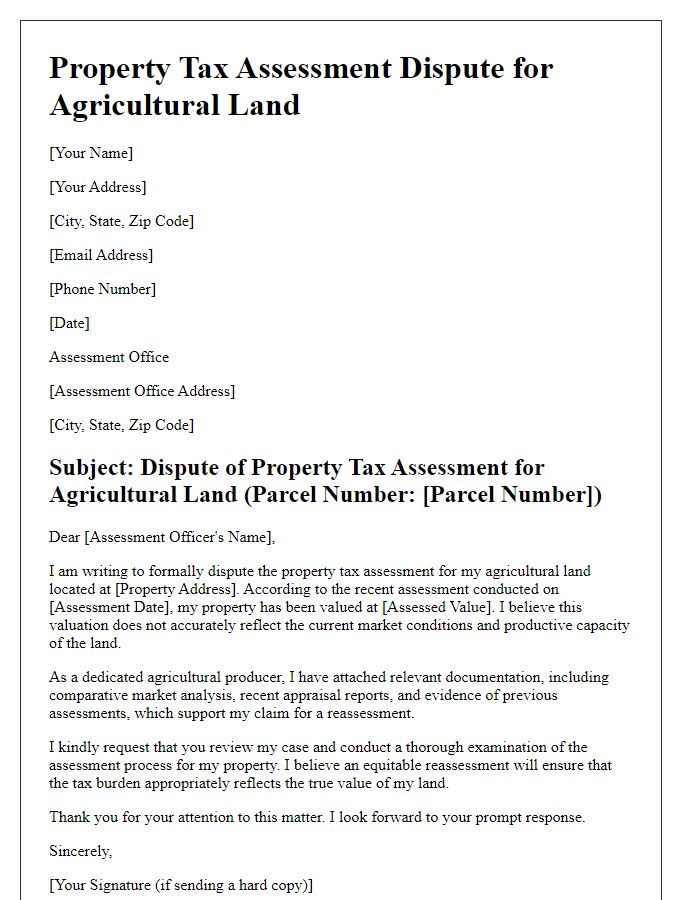

Letter template of property tax assessment dispute for agricultural land

Comments