Are you ready to take control of your crowdfunding journey? In this article, we'll explore the essential elements of creating an effective letter template for reporting your crowdfunding income. By streamlining this process, you can ensure transparency and keep your supporters informed about how their contributions are making an impact. Join us as we dive deeper into crafting the perfect letter that resonates with your backers and encourages ongoing support!

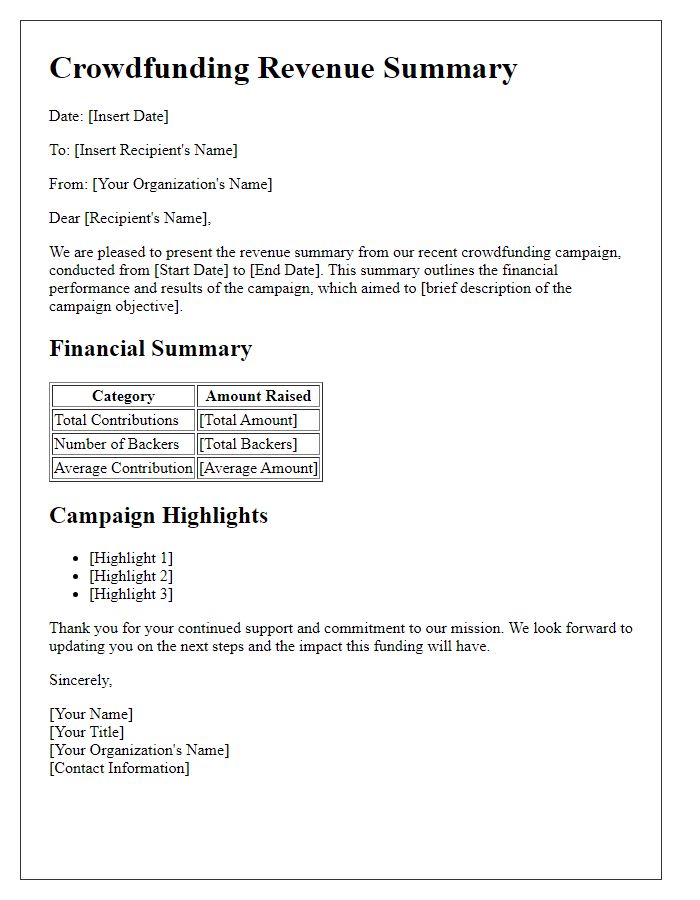

Accurate income summary

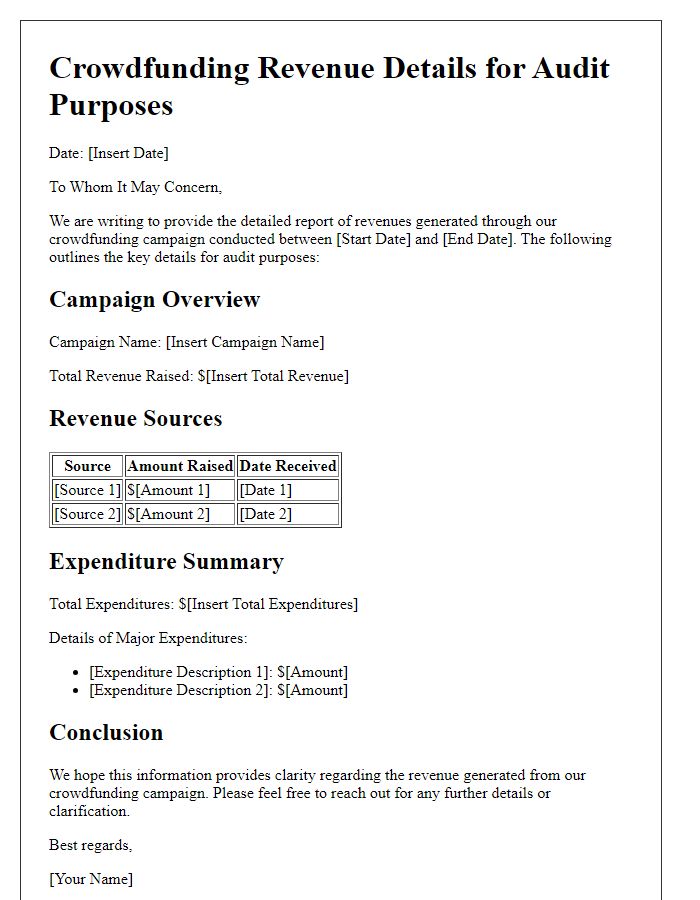

Accurate income summary provides essential insights into a crowdfunding campaign's financial health, showcasing the total amount raised from backers in various tiers (e.g., $10, $25, $100), along with the breakdown of funds allocated for different project needs (e.g., production costs, shipping expenses). Key metrics like the number of contributors (e.g., 150 supporters for a small business startup) give a clearer picture of community engagement and interest. Transparency in reporting helps maintain trust among the backers (e.g., family, friends, public supporters) and can enhance future crowdfunding endeavors by providing a reliable reference for potential investors. This reporting should also identify sources of income, indicating whether funds came from platforms like Kickstarter or GoFundMe, and detail any fees deducted during the transaction process to ensure an accurate net income calculation.

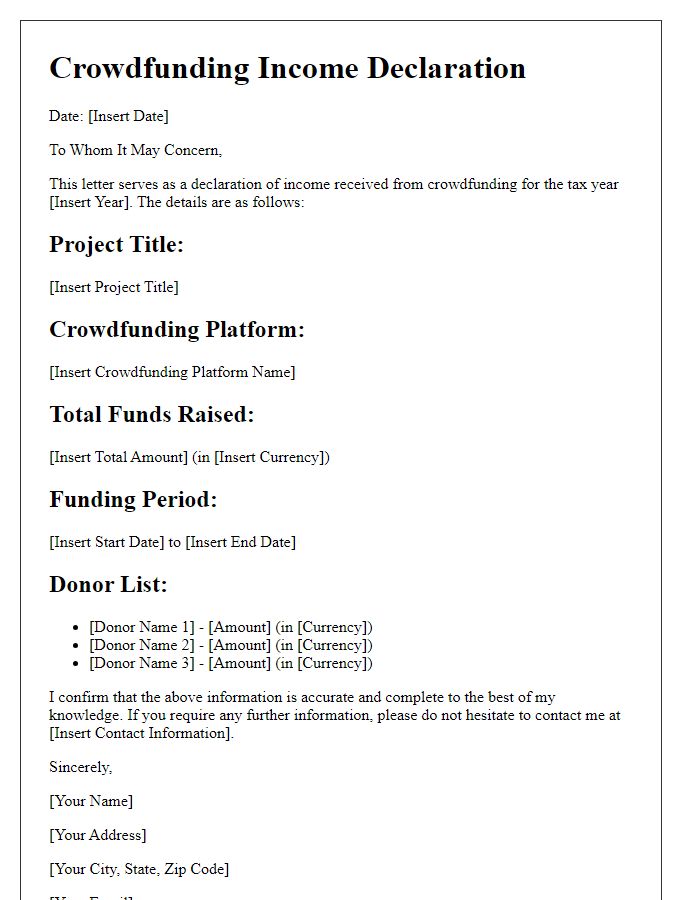

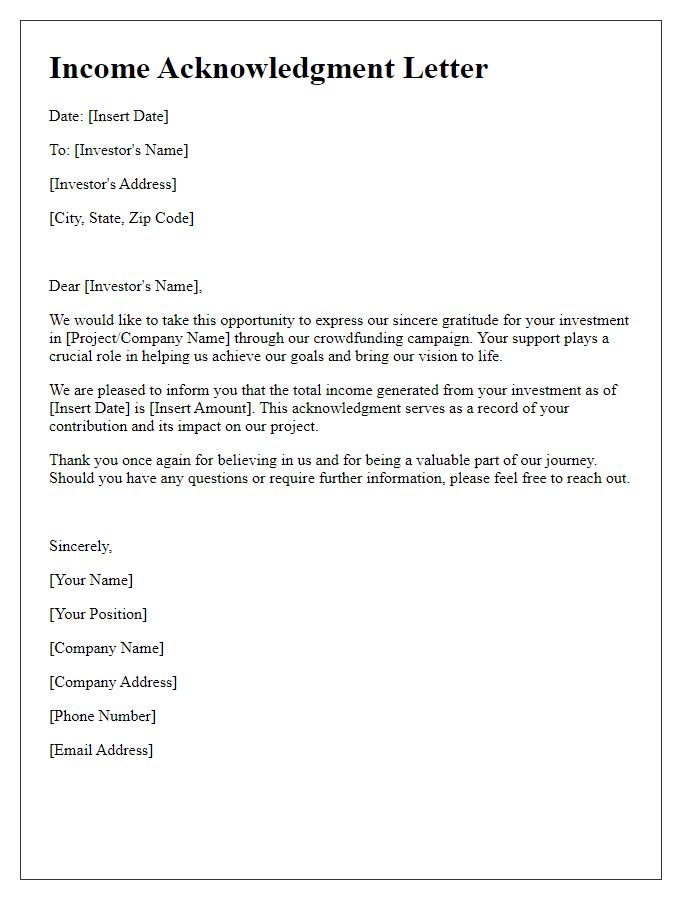

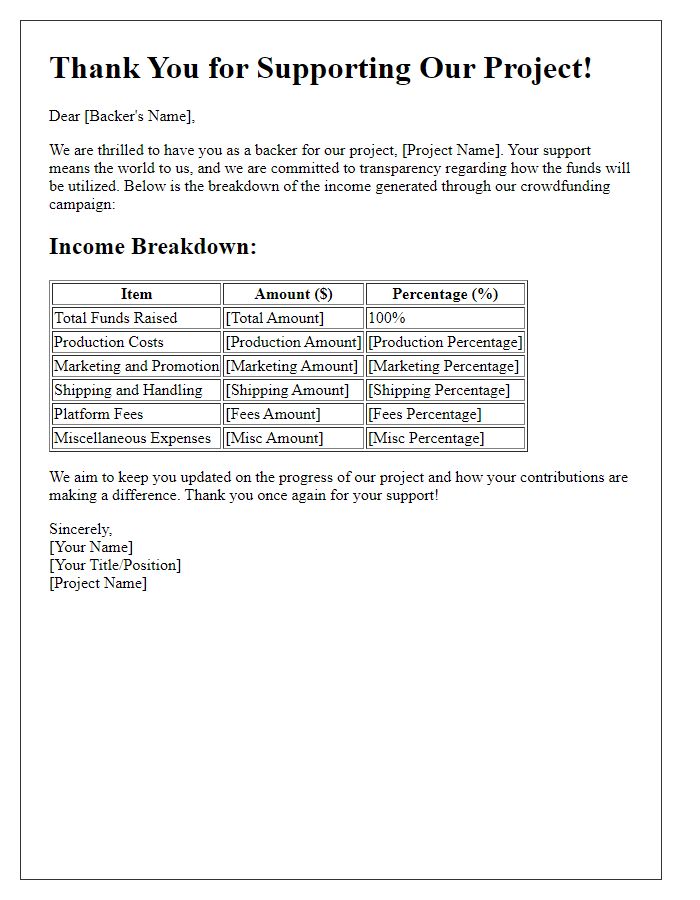

Donor acknowledgment and details

Crowdfunding platforms often emphasize transparency in income reporting and donor acknowledgment. Accurate records of donations allow organizations to provide comprehensive reports to supporters. For instance, documenting donor names, amounts contributed, and specific campaigns ensures accountability. Sending personalized acknowledgment letters to donors, especially for contributions exceeding $250, satisfies IRS requirements for tax deductions in the United States. Including campaign details, such as project goals and funding utilization, enhances trust. Additionally, mentioning the impact of their contributions on community initiatives or project success can foster long-term relationships. Clear communication of fundraising goals, timelines, and event updates keeps donors informed about the project's progress and financial status.

Funding goal and progress

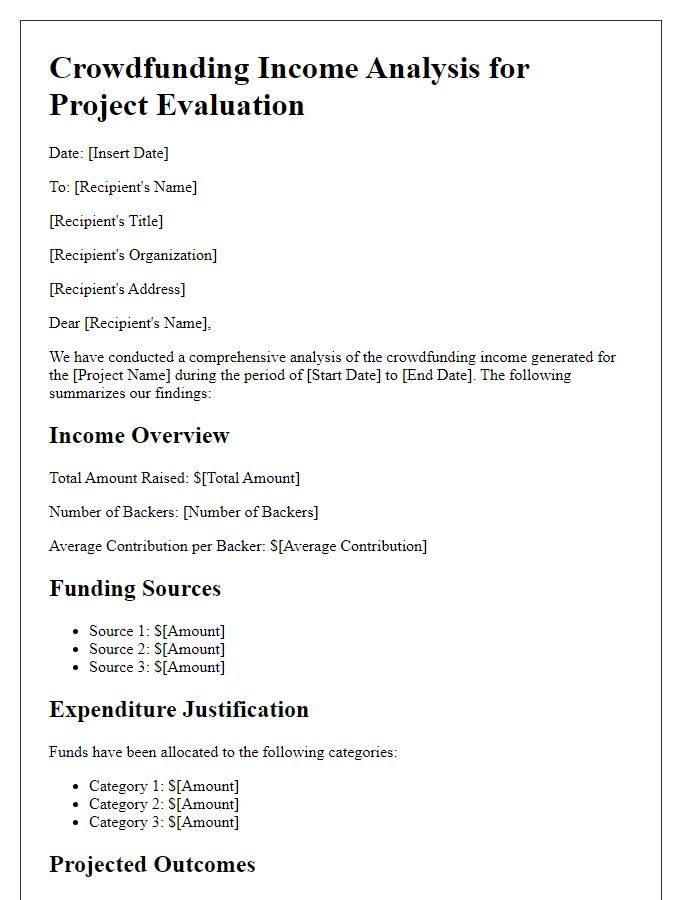

Crowdfunding campaigns often rely on clear communication regarding funding goals and progress. A well-defined funding goal sets the target amount needed for a project, which can range from thousands to millions of dollars depending on its scale. Progress towards this goal is typically tracked through visual indicators, such as progress bars, showing percentage completion. Engaging with backers through regular updates can foster a sense of community, providing insights into milestones reached, funds raised, and overall project timelines. Transparency in reporting not only builds trust but can also motivate additional contributions, allowing the project to gain momentum as it approaches its deadline. Effective crowdfunding also utilizes social media platforms and email newsletters to disseminate progress reports, encouraging wider participation and leveraging the power of networks to reach the funding goal.

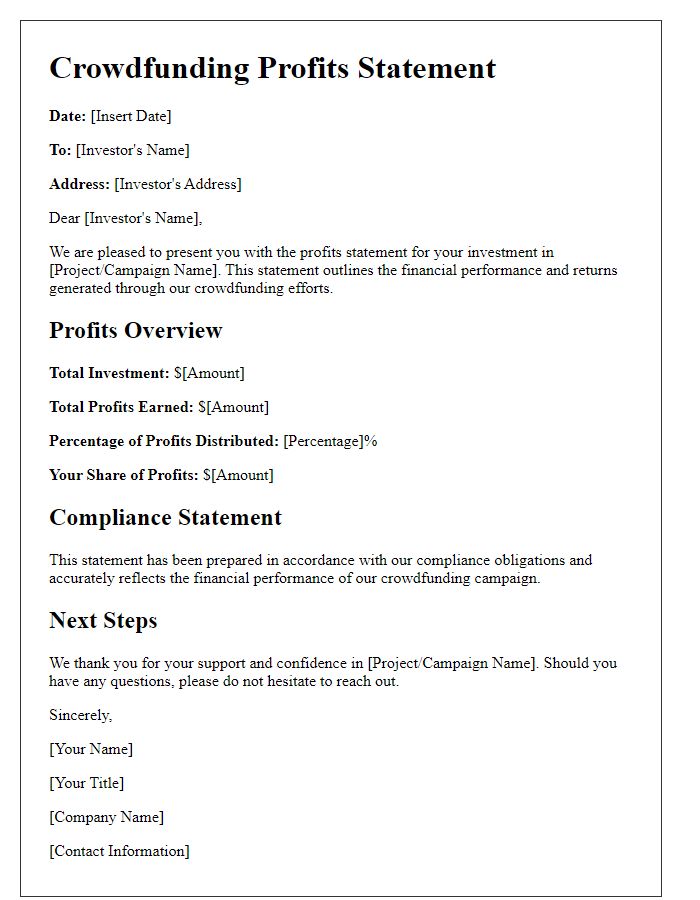

Tax compliance information

Crowdfunding campaigns can generate a variety of income types, impacting tax obligations significantly. Income derived from platforms such as Kickstarter, GoFundMe, or Indiegogo may be classified as taxable income by the IRS, especially when funds exceed $600 within a calendar year. Campaign creators must maintain accurate records of contributions, including donor names, amounts, and the purpose of the funding. Additional considerations include treating funds as gifts or business income. Depending on the entity type, self-employed individuals or entities might face different tax rates or deductions. Compliance with tax regulations entails submitting appropriate forms, such as IRS Form 1040 for individuals or Form 1065 for partnerships, ensuring all income sources are reported accurately. Consulting with a tax professional can clarify individual obligations and ensure adherence to federal and state income tax laws.

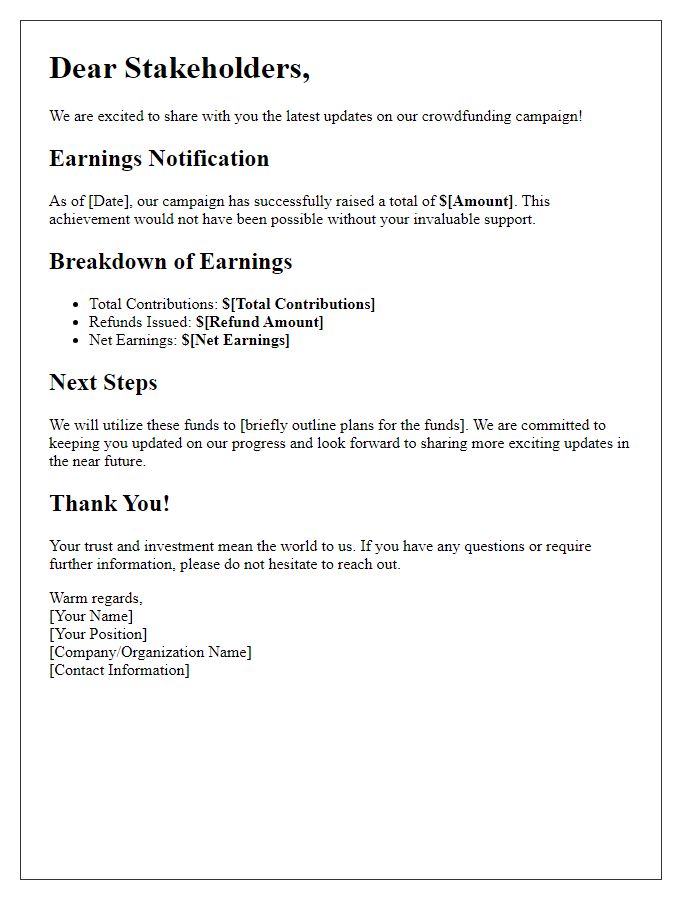

Project updates and outcomes

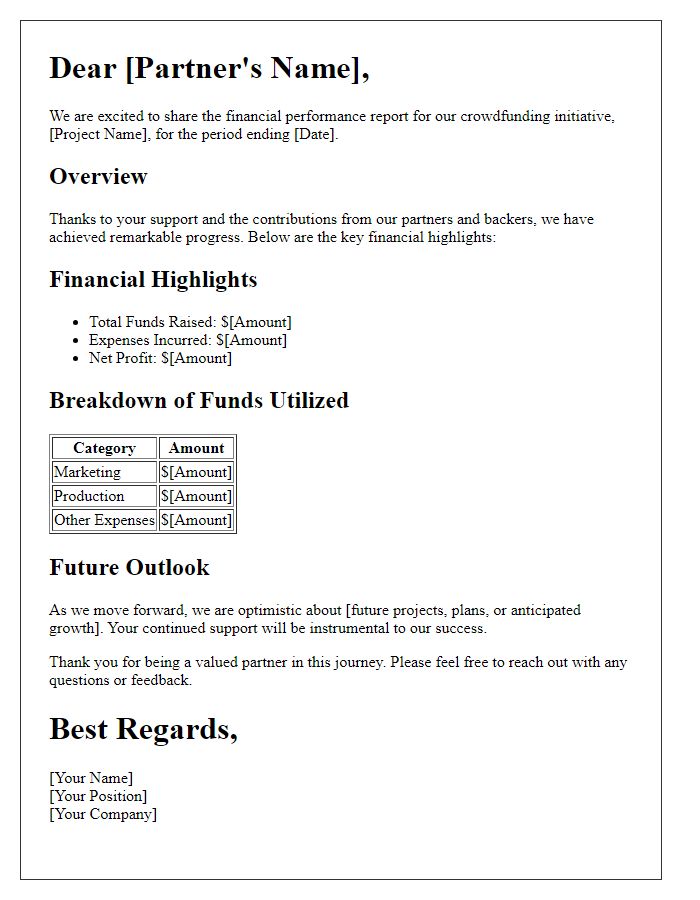

Crowdfunding campaigns often deliver substantial updates on project milestones and financial outcomes. Effective communication ensures transparency and engages backers. Regular reporting typically includes milestones reached, such as achieving key fundraising goals (like $50,000 in 30 days), development progress (like prototype testing completed by March 2023), and community engagement metrics (including social media interactions, such as 1,000 new followers on Instagram). Financial summaries might cover total funds raised (for instance, $200,000 by June 2023), spending breakdowns (such as 40% allocated to marketing and 30% to production), and future financial projections that outline expected revenue streams post-launch. Detailed narratives can enhance reports, sharing stories of beneficiary impact or product testing results that resonate with supporters. Timely updates foster trust and encourage ongoing backer involvement.

Letter Template For Crowdfunding Income Reporting Samples

Letter template of crowdfunding financial performance report for partners

Comments