Hey there! When it comes to vendor payment reconciliation, having a clear and concise letter template can make all the difference in ensuring smooth communication and accurate record-keeping. This essential tool not only helps streamline your reconciliation process but also fosters positive relationships with your vendors. So, if you're looking to simplify and enhance your payment reconciliation efforts, keep reading for a helpful template that will guide you along the way!

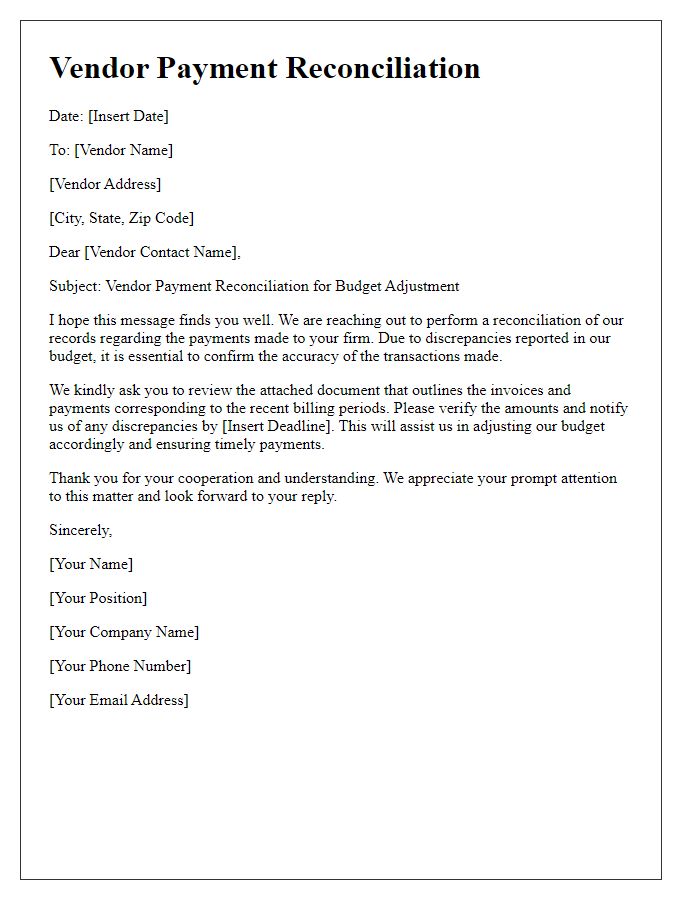

Vendor Name and Contact Information

Vendor payment reconciliation is a crucial process for maintaining accurate financial records and ensuring timely payments. Key details such as Vendor Name, which identifies the company or individual providing goods or services, and Contact Information, including phone number and email address, are essential for clear communication. Accurate reconciliation involves cross-referencing invoices, payment dates, and amounts, ensuring all transactions are logged correctly. Regular reviews of these records help prevent discrepancies, maintain trust in vendor relationships, and ultimately support efficient operations and financial accountability in organizations.

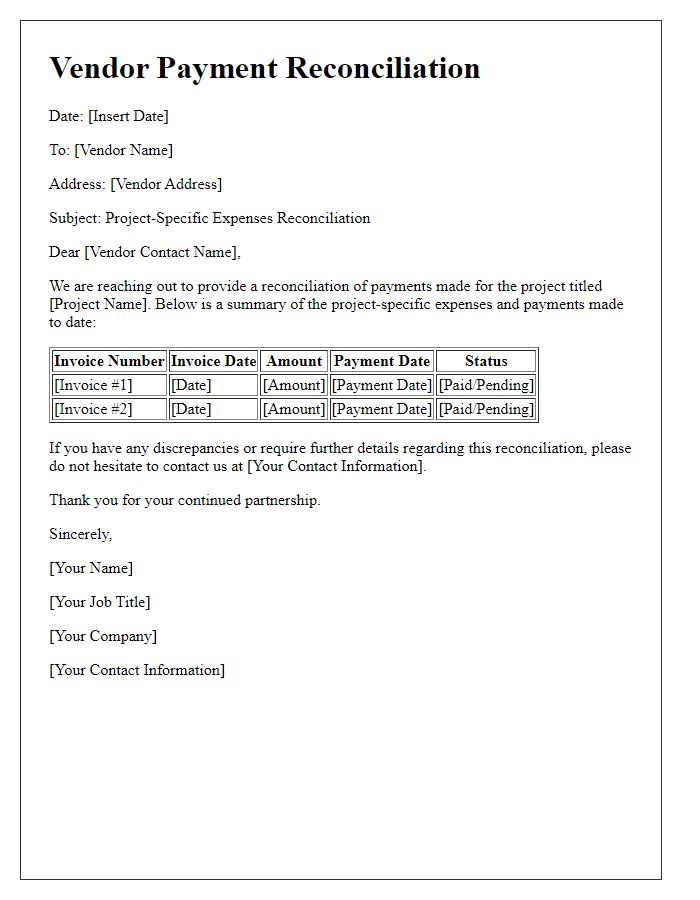

Invoice and Payment Details

In the process of vendor payment reconciliation, accurate tracking of invoices and payment details is crucial. Invoice identification numbers, typically consisting of unique alphanumeric codes assigned by vendors, facilitate easy reference. Payment dates, often falling within a standard 30 or 60-day period post-invoice issuance, must be compared against agreed terms. Invoice amounts, often specified in local currency like USD or EUR, need verification with issued payments to avoid discrepancies. Payment methods, which might include electronic transfers or checks, should also be documented alongside transaction reference numbers. Detailed records of any disputes or adjustments, such as credits or partial payments, enhance clarity in reconciliation efforts. A comprehensive overview of these elements ensures a smooth and accurate reconciliation process, ultimately promoting stronger vendor relationships.

Reconciliation Discrepancies and Explanations

Vendor payment reconciliation involves examining financial records against invoices to identify discrepancies. Common discrepancies may include invoice amounts not matching payment records or missing transactions that potentially result from human error or system glitches. A detailed review process usually requires comparing the vendor's invoice (which specifies the services provided and associated costs) against the payment history available in the accounting system. Essential information includes date ranges of transactions, payment IDs, and specific line items that outline charges. Effective communication with the vendor, often based in a particular region or industry, is critical for resolving issues and ensuring accurate record-keeping to maintain positive business relationships.

Requested Action and Timeline for Resolution

In vendor payment reconciliation processes, accurate alignment of invoices and payments is critical, especially for organizations managing large accounts payable. Timely reconciliation prevents cash flow issues while maintaining vendor relationships. The reconciliation involves reviewing transactions, confirming outstanding amounts, and identifying discrepancies. A typical timeframe for this process spans five business days, allowing for thorough auditing of records. Vendors, such as ABC Supplies (founded in 2002), can expect communication regarding any discrepancies by the end of the week. Prompt resolution of payment issues not only enhances operational efficiency but also supports ongoing supplier partnerships.

Contact Information for Further Inquiries

For vendor payment reconciliation, provide detailed contact information to facilitate smooth communication. Include company name, such as Innovative Solutions Corp., physical address, for instance, 123 Business Rd, Suite 456, New York, NY 10001. Specify main contact person, such as Sarah Johnson, Accounts Payable Manager, along with direct phone number, e.g., (555) 123-4567, and email address, for instance, sjohnson@innovativesolutions.com. Make sure to mention office hours, typically Monday to Friday, 9 AM to 5 PM EST, ensuring availability for prompt inquiries and clarifications related to payment discrepancies or related concerns, thereby enhancing the reconciliation process.

Letter Template For Vendor Payment Reconciliation Samples

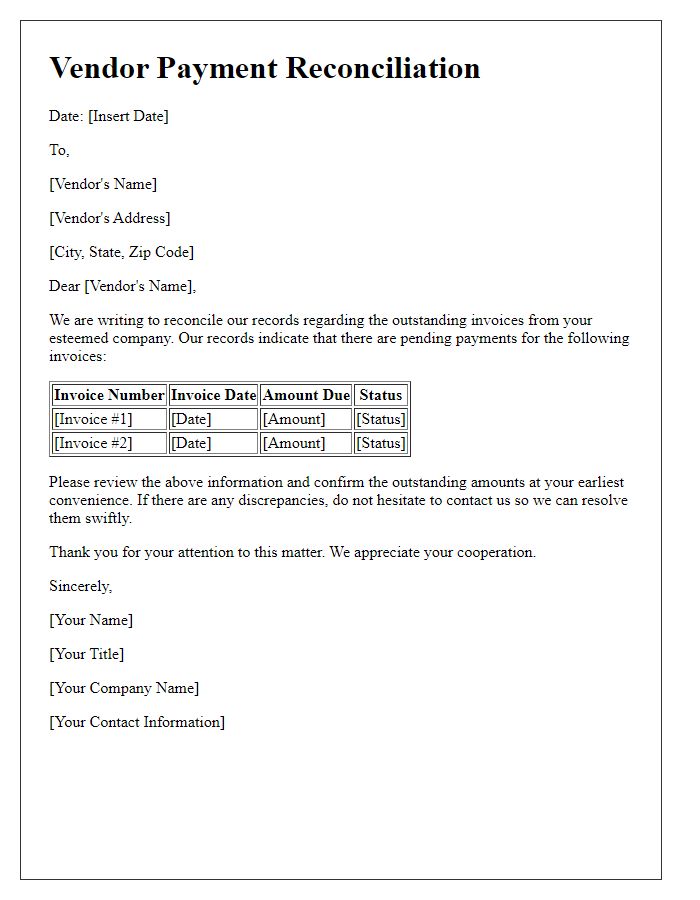

Letter template of vendor payment reconciliation for outstanding invoices

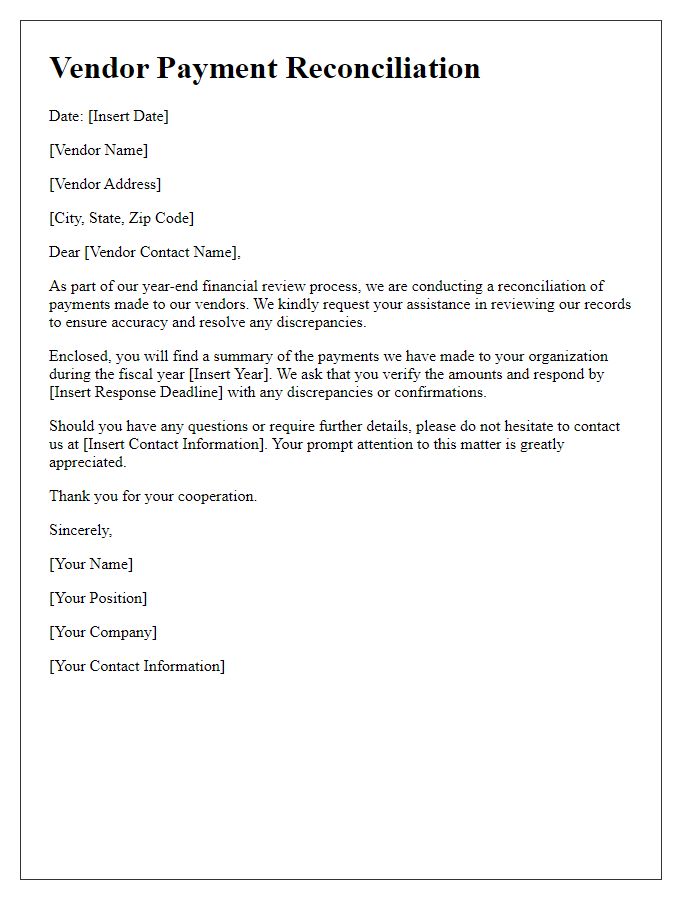

Letter template of vendor payment reconciliation for year-end financial review

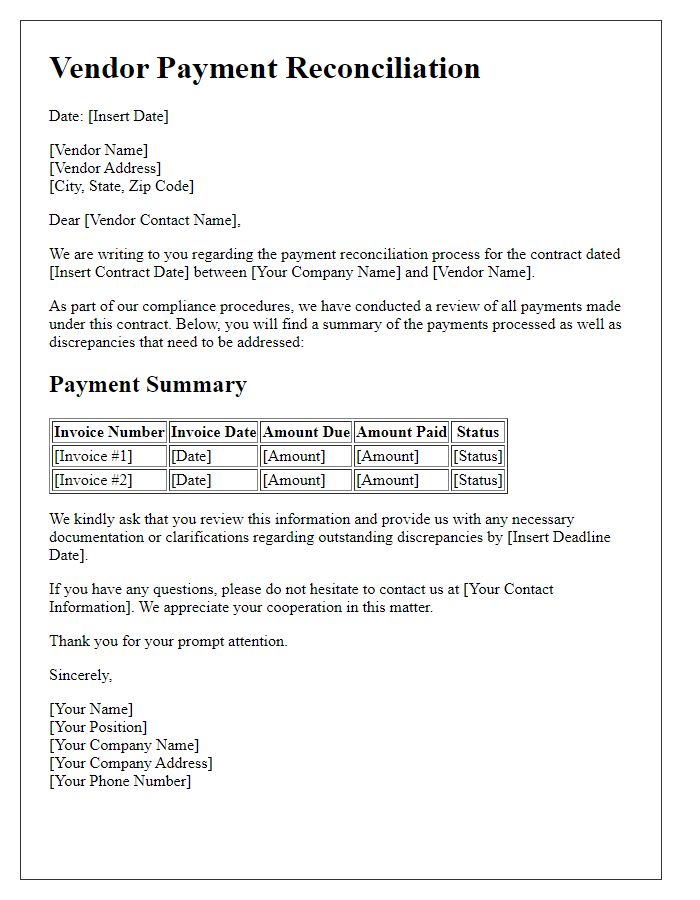

Letter template of vendor payment reconciliation for contract compliance

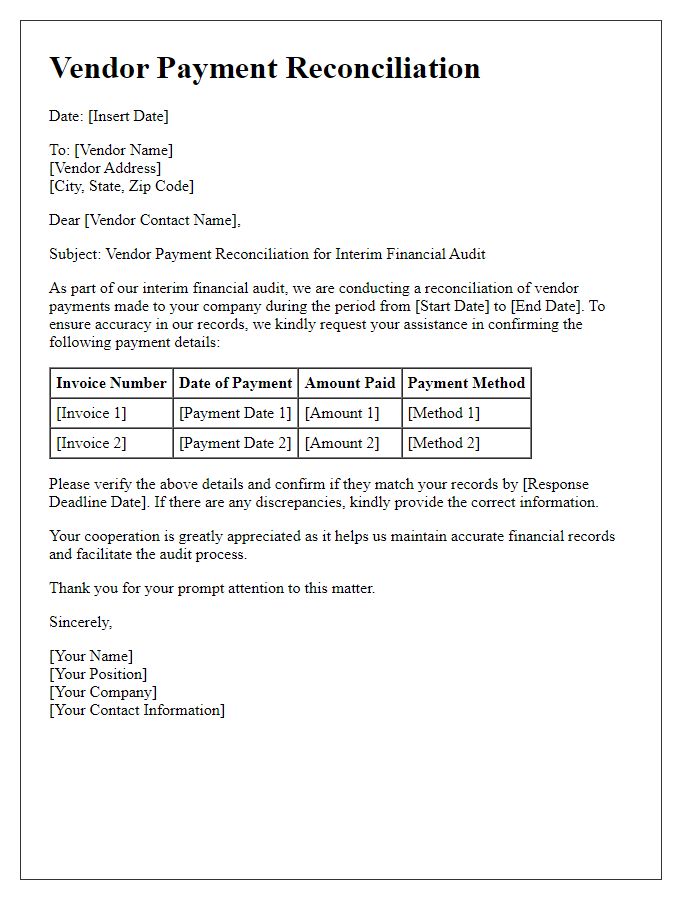

Letter template of vendor payment reconciliation for interim financial audit

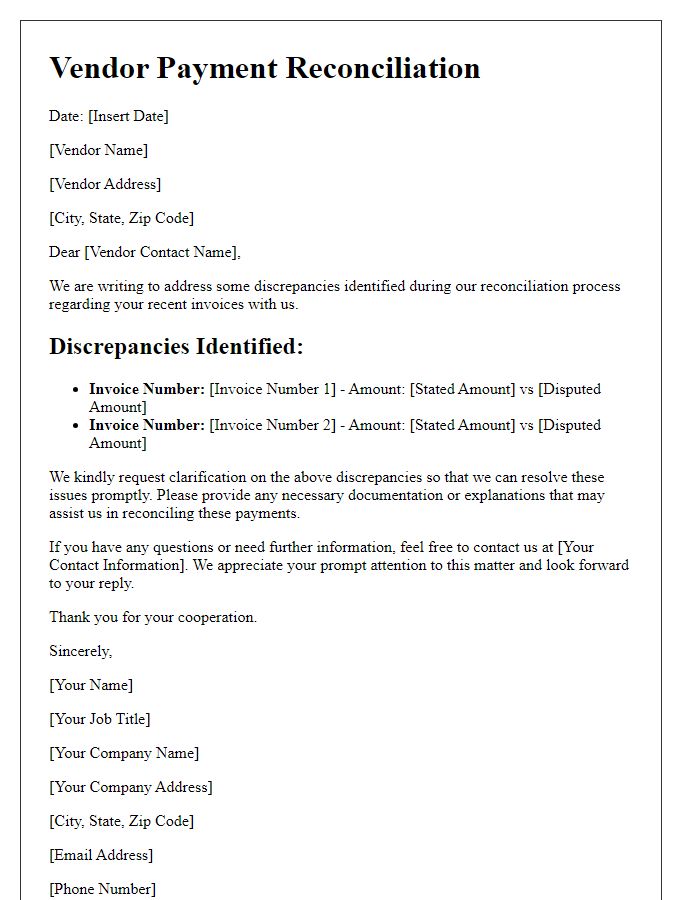

Letter template of vendor payment reconciliation for invoice discrepancies

Letter template of vendor payment reconciliation for supplier performance evaluation

Comments