Are you preparing for a vendor compliance audit and feeling a bit overwhelmed? You're not aloneâmany businesses share the same concern about ensuring their vendors meet regulatory standards and internal policies. In this article, we will guide you through the essentials of preparing for an audit, from gathering necessary documentation to understanding compliance requirements. So, grab a cup of coffee and join us as we dive deeper into the steps you can take to ace your vendor compliance audit!

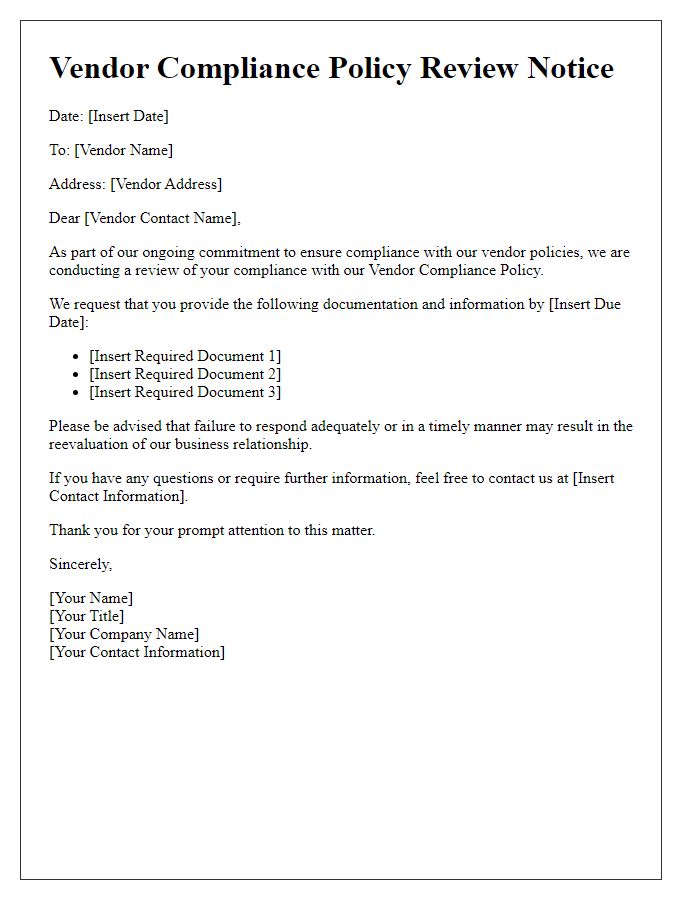

Clear audit objectives and scope

Clear audit objectives and scope establish the framework for a vendor compliance audit, ensuring alignment with regulatory requirements and industry standards. Objectives typically include assessing adherence to quality control measures, verifying contractual obligations, and identifying potential risks related to supply chain integrity. The audit scope outlines specific areas of focus, such as financial practices, data security protocols, and environmental compliance. Additionally, it defines the time frame for the audit, for example, reviewing the previous fiscal year's performance or examining specific high-risk operations. Such clarity facilitates effective collaboration between the audit team and the vendor, ultimately leading to improved compliance outcomes.

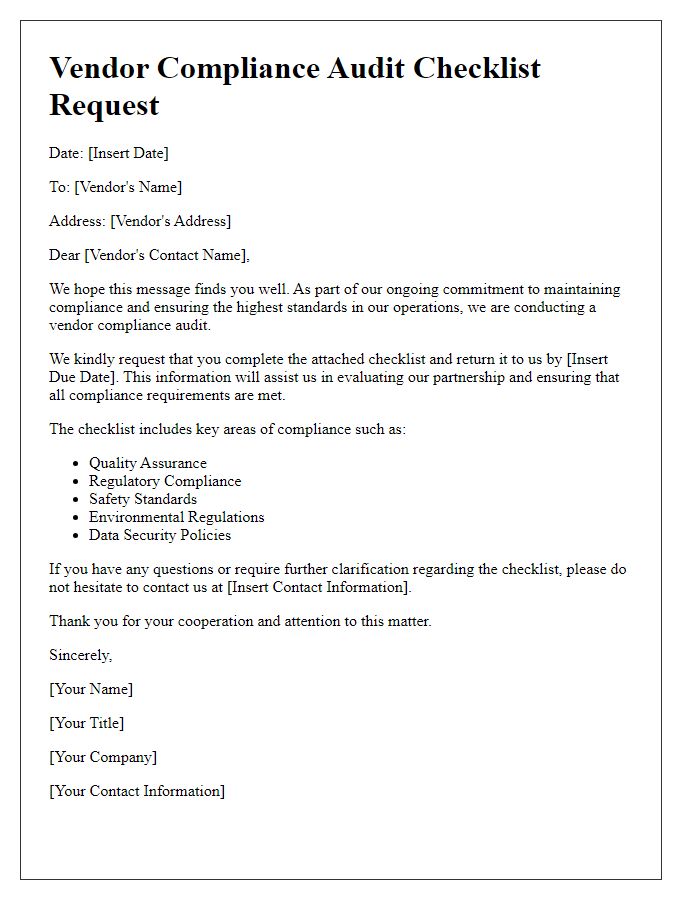

Detailed checklist of compliance requirements

Vendor compliance audits are essential for ensuring that suppliers meet specific regulatory and contractual standards. A comprehensive checklist should include critical elements such as documentation verification, including business licenses, insurance certificates, and safety records. An evaluation of financial stability, notably through the analysis of balance sheets and income statements, is crucial. Assessing adherence to quality standards, such as ISO certification levels (e.g., ISO 9001 for quality management), must be included. Compliance with data protection regulations, especially GDPR for European markets and HIPAA for healthcare-related vendors, is necessary. Additionally, ethical labor practices, verified through employee records and any associated audits, must be examined to ensure adherence to standards such as the Fair Labor Standards Act in the United States. Environmental compliance details, such as waste disposal procedures and sustainable sourcing practices aligned with ISO 14001, should be assessed to gauge the vendor's commitment to environmental responsibility. Finally, product safety compliance, in accordance with industry standards like ASTM or CE marking for various markets, should be documented to ensure that products meet the necessary safety requirements before distribution.

Timeline and deadlines for preparation

Preparing for a vendor compliance audit involves a detailed timeline with specific deadlines to ensure all aspects are covered adequately. The initial phase typically begins four months prior to the audit date, allowing ample time for data collection and analysis. Essential documents such as contracts and compliance reports should be gathered by the three-month mark, ensuring that all necessary agreements and past audit findings are included. By the two-month deadline, the compliance team must conduct a preliminary self-assessment to identify any potential gaps in adherence to regulatory standards, such as ISO 9001 or GDPR. One month before the audit, a comprehensive review meeting should be held to finalize any outstanding issues and organize the audit logistics, ensuring that personnel are prepared and available. Finally, a week before the scheduled audit, all documents must be organized and a mock audit conducted to simulate the actual assessment process, allowing for last-minute adjustments and reinforcing compliance readiness.

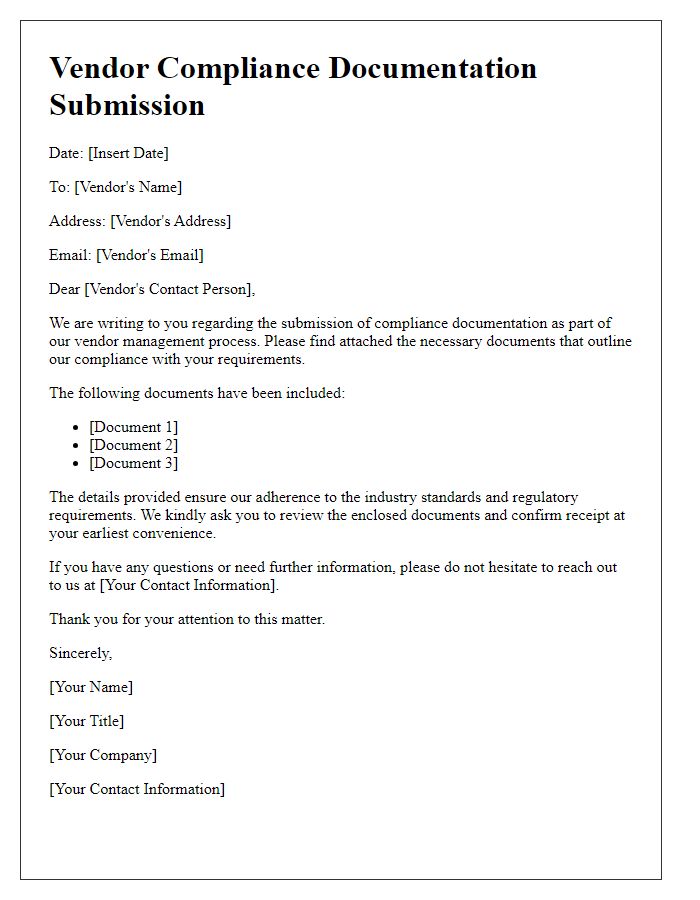

List of required documents and evidence

Vendor compliance audits are essential for ensuring adherence to regulatory standards and internal policies. Essential documents for the audit include the vendor's Certificate of Insurance (COI), showcasing active liability coverage (minimum $1 million). Verification of business licenses must be provided, including state-specific documents such as DBA (Doing Business As). Financial statements from the last fiscal year (income statement, balance sheet) should illustrate fiscal health, while records of previous audits, if applicable, demonstrate compliance history. Quality assurance documents, including Standard Operating Procedures (SOPs), detail operational protocols. Safety compliance records, adhering to OSHA (Occupational Safety and Health Administration) standards, must show training certifications for employees. Additionally, evidence of data protection compliance, such as GDPR (General Data Protection Regulation) policies or relevant cybersecurity measures, is critical. Finally, contracts with subcontractors should indicate compliance with the primary vendor's standards, illustrating a comprehensive approach to regulatory adherence.

Contact information for audit coordinators

Audit coordinators play a crucial role in ensuring vendor compliance during audits. Key figures include Tom Steele (email: tom.steele@company.com, phone: +1-555-0123) and Lisa Nguyen (email: lisa.nguyen@company.com, phone: +1-555-0456) at XYZ Corporation, based in San Francisco, California. Their responsibilities include scheduling audit dates, providing necessary documentation, and facilitating communication between vendors and the audit team. Timely coordination is essential, as audits aim to assess adherence to regulations such as ISO 9001 and cybersecurity standards. Any questions or changes to the audit schedule can be directed to these contacts for efficient resolution.

Comments