Navigating a tax compliance audit can feel overwhelming, but having the right response letter template can make all the difference. In this article, we'll break down the essential components of a well-crafted letter that reassures auditors and demonstrates your commitment to transparency. We'll also share tips to help you articulate your points clearly and effectively, ensuring that your correspondence leaves a lasting impression. Ready to simplify your audit response process? Keep reading for valuable insights!

Clear subject line

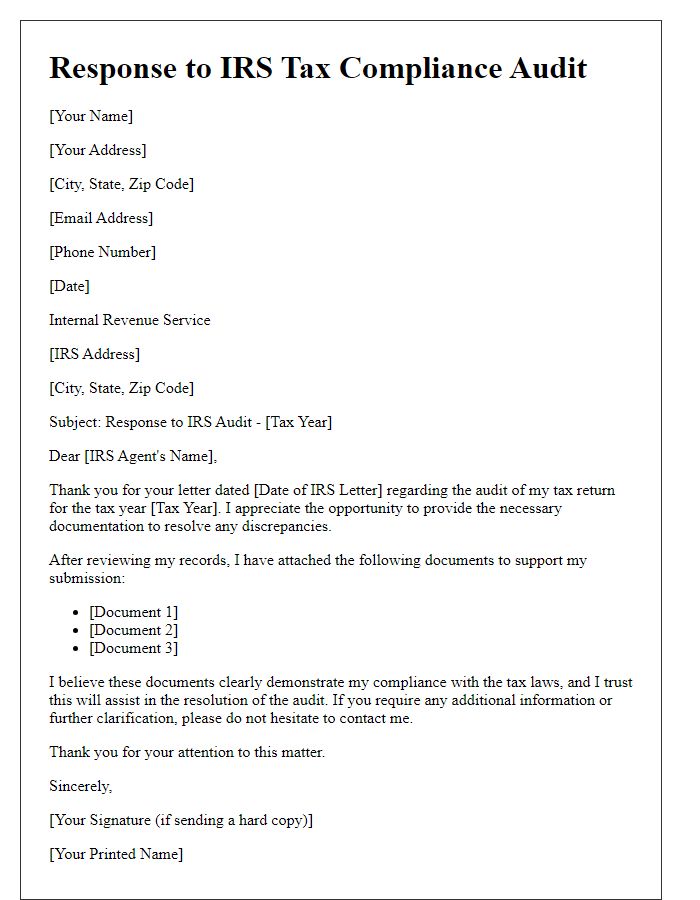

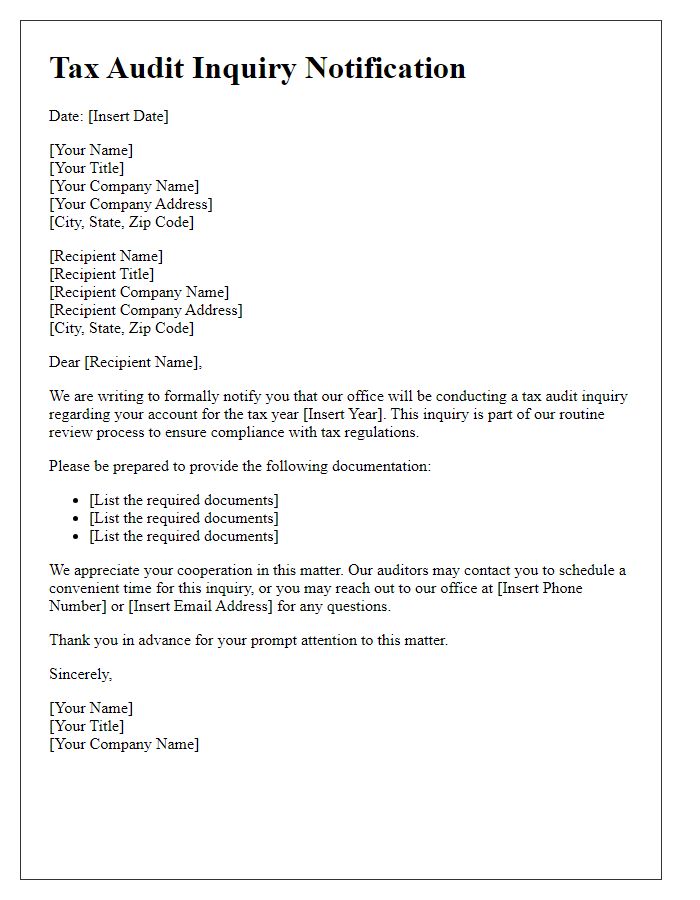

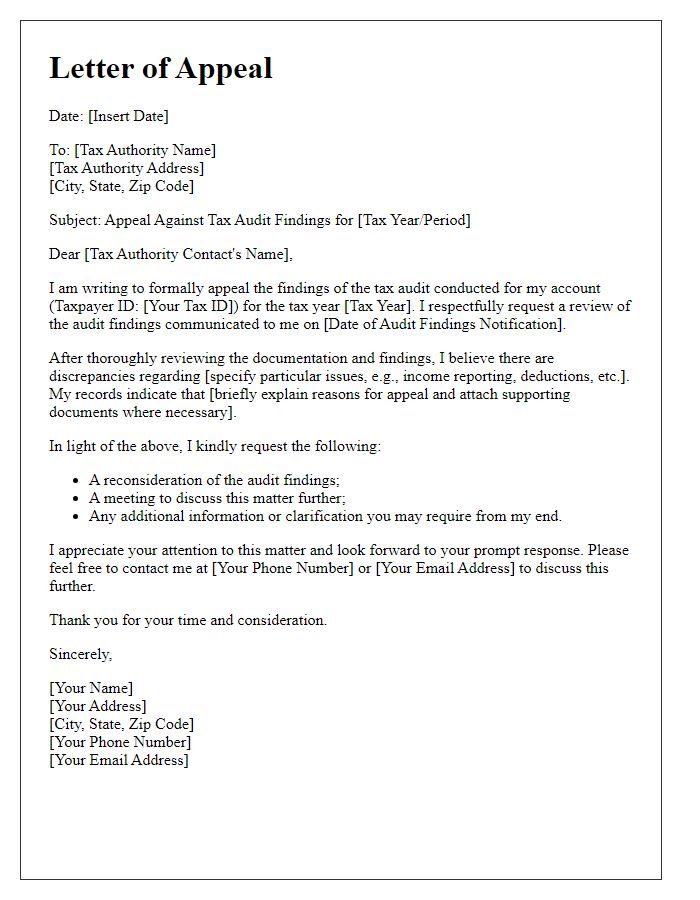

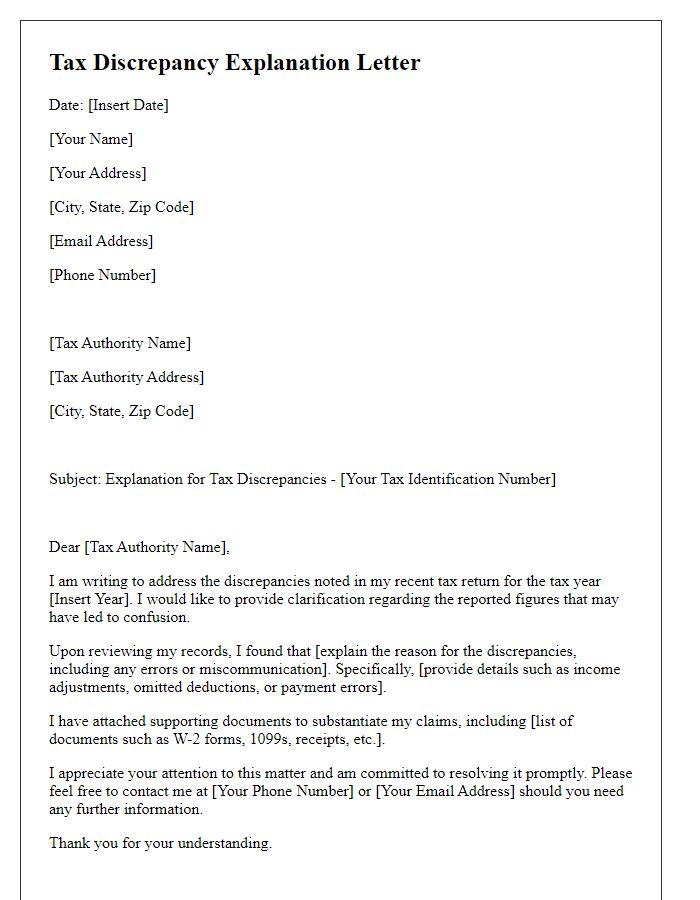

Tax compliance audits often require detailed responses that clarify and rectify the circumstances surrounding reported discrepancies. An effective audit response should include a clear subject line such as "Response to Tax Compliance Audit - [Tax Year]". This precise subject allows the tax authority to immediately understand the context and urgency of the communication. The body of the response should outline the specific issues raised in the audit notification, referencing relevant tax codes and regulations. Supporting documents such as bank statements, receipts, and prior tax filings should be organized and referenced for clarity. Timeliness is crucial; audits typically have strict deadlines. Addressing the auditor's concerns comprehensively helps ensure compliance and may mitigate potential penalties.

Reference tax code and regulations

Tax compliance audits necessitate a thorough understanding of specific tax codes and regulations, such as the Internal Revenue Code (IRC) Sections 6011-6015 that outline filing requirements. Responding to an audit request involves compiling detailed documentation which includes tax returns from the previous three years, supporting financial records, and relevant correspondence with tax authorities. Accurate organization of this information is crucial; it facilitates the auditor's review process and demonstrates adherence to tax obligations. Additionally, awareness of key regulations, such as IRS Publication 1 regarding taxpayer rights and IRS Revenue Procedure 2021-30, which outlines procedures for responding to inquiries, can significantly impact the outcome of the audit. Submissions should be delivered within the specified deadline, typically 30 days, to ensure compliance with the auditor's requests.

Detailed documentation list

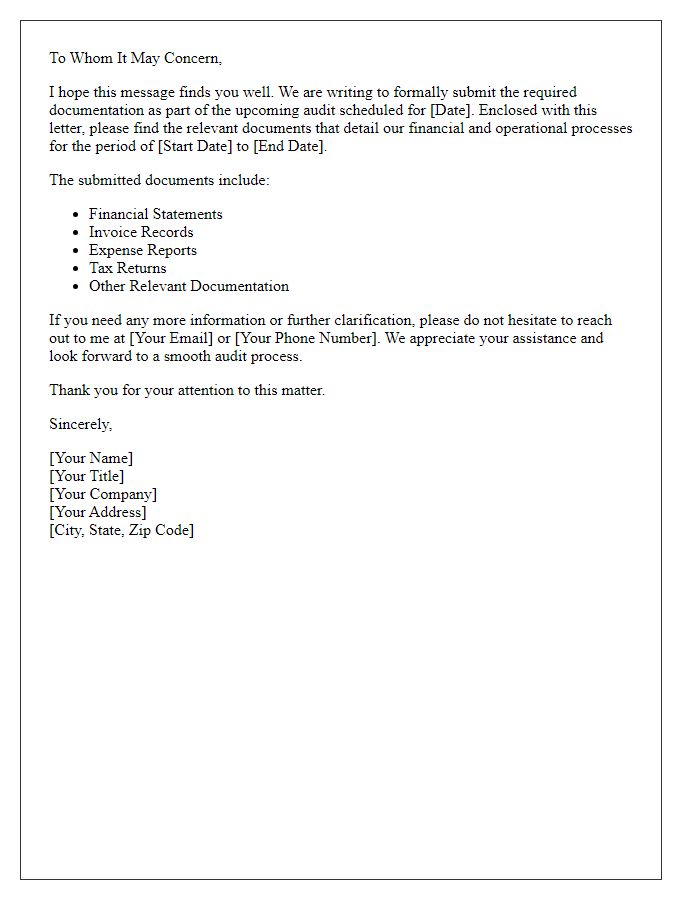

A thorough documentation list is vital for a successful response to a tax compliance audit conducted by the Internal Revenue Service (IRS). Essential documents include tax returns filed for the past three years, such as Form 1040 for individuals or Form 1120 for corporations. Detailed financial statements, including balance sheets and income statements, should also be included, displaying accurate figures from reputable accounting software like QuickBooks or FreshBooks. Supporting documents for claimed deductions, such as receipts for business expenses, and bank statements from each relevant financial institution must be organized chronologically. Payroll records, including Form W-2s and 1099s for employees and contractors, provide clarity on income distribution. Additional materials might involve correspondence with tax advisors and records of estimated tax payments made throughout the year, important for showing compliance with tax obligations. Proper organization of these documents will facilitate a smoother audit process and showcase a commitment to transparency.

Contact information for clarification

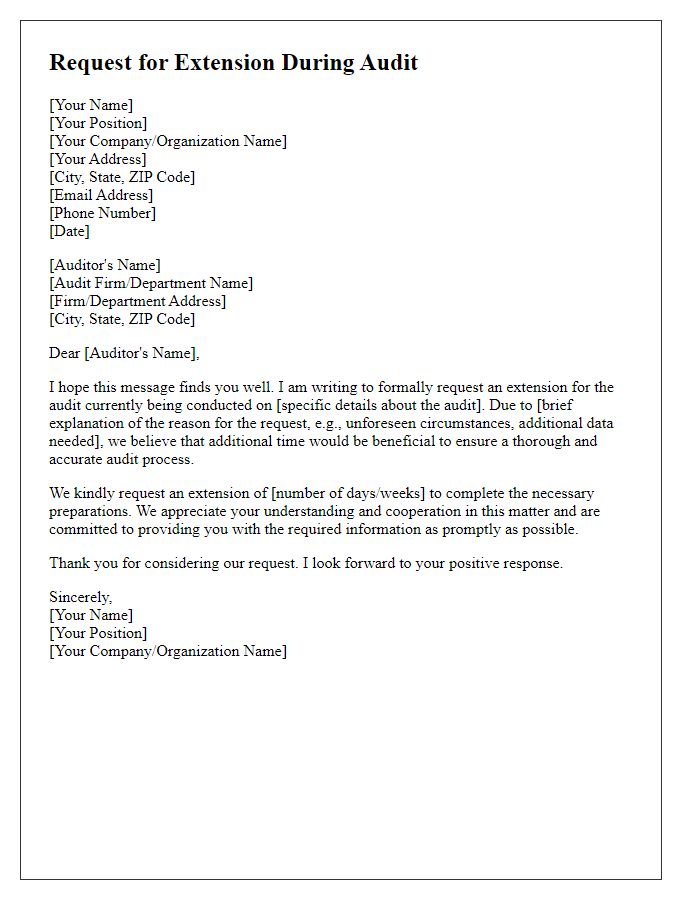

In response to the tax compliance audit, please reach out for clarification regarding any inquiries. The contact information is as follows: John Smith, Senior Tax Consultant, at phone number (555) 123-4567 or email address john.smith@taxconsulting.com. Prompt communication will ensure timely resolution of any questions related to the audit process, including documentation requirements and compliance nuances. Addressing these inquiries will also facilitate understanding of federal regulations, which govern our reporting obligations and ensure alignment with IRS standards.

Polite and professional tone

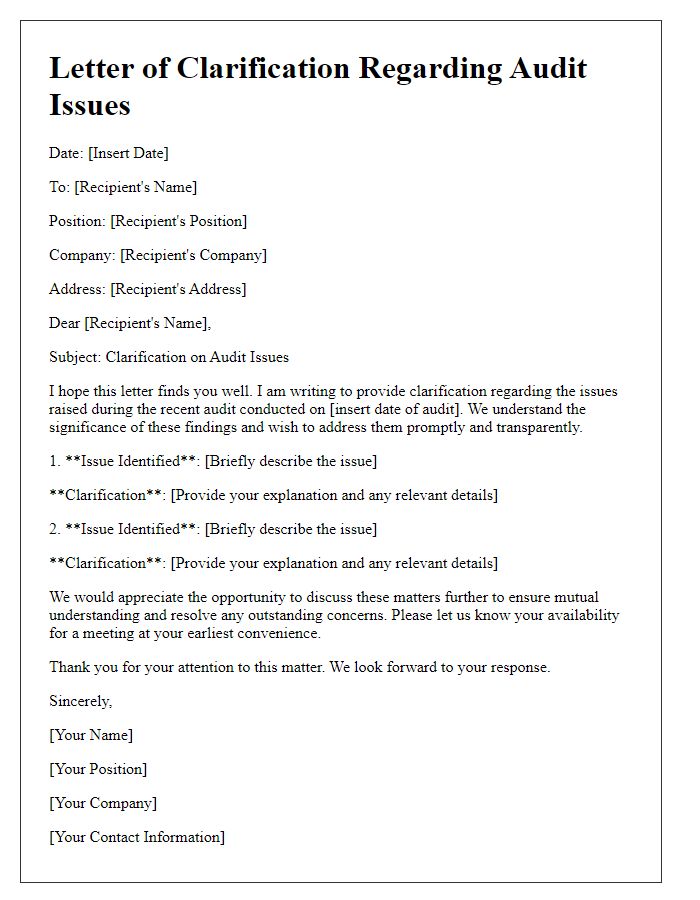

Tax compliance audits require careful attention to detail and a professional response. The letter should reflect an understanding of regulatory requirements, express a willingness to cooperate, and clarify any discrepancies noted by the auditing agency. Provide complete documentation, such as financial records from the previous three fiscal years, payment confirmations, and related correspondence. Additionally, addressing any specific concerns from the audit notice can strengthen the response. Demonstrating transparency and a commitment to resolving issues is crucial for a successful outcome in these situations.

Comments