Navigating the intricate web of tax regulations in the food industry can feel overwhelming, but it doesn't have to be! With the right information and guidance, you can ensure compliance while maximizing your potential for growth. Understanding these regulations is essential not only for legal adherence but also for optimizing your business operations and finances. So, let's dive deeper into the specifics of food industry tax regulations and discover how they can impact your successâread on to learn more!

Compliance requirements

Food industry businesses, such as restaurants, food processors, and grocery stores, must adhere to specific tax regulations that ensure compliance with local, state, and federal guidelines. These regulations often include maintaining accurate records of sales and purchases (including receipts and invoices), reporting sales tax collected on food items and beverages, and understanding exemptions granted to certain food products--like unprepared food in some jurisdictions. Compliance requirements also encompass filing periodic tax returns (monthly, quarterly, or annually based on revenue), remitting the appropriate sales taxes to the relevant authorities, and staying updated with any changes in tax legislation, which can vary significantly by state, such as California's Proposition 15. Engaging a tax professional familiar with food industry nuances is advisable for proper navigation of these complex regulations and to avoid potential penalties.

Tax incentives and exemptions

Tax incentives and exemptions in the food industry provide significant benefits for businesses engaged in agriculture, processing, distribution, and retail. Programs such as the federal Enhanced Deduction for Food Inventory encourage food businesses to donate surplus edible food to nonprofit organizations, allowing businesses to deduct the cost of donated food and reduce tax liabilities. States like California offer sales tax exemptions on certain machinery and equipment used in food processing, fostering capital investment to improve operational efficiency. Furthermore, the Agriculture Improvement Act, commonly known as the Farm Bill, includes provisions for tax credits related to sustainable farming practices and conservation efforts, supporting eco-friendly initiatives and encouraging responsible resource management. Understanding these specific tax regulations enables food industry stakeholders to leverage financial advantages while contributing to community welfare through food donation and sustainable practices.

Documentation and record-keeping

Effective documentation and record-keeping practices play a critical role in ensuring compliance with food industry-specific tax regulations. Businesses in sectors such as restaurants, food manufacturing, and catering must maintain accurate records of transactions, inventory, and payroll to meet the standards set by governing bodies like the Internal Revenue Service (IRS) in the United States. Essential documents include sales receipts, purchase invoices, and employee wage records, which should be retained for a minimum of three to seven years, depending on the regulations in various jurisdictions. Additionally, implementing reliable accounting software can streamline the tracking of expenses and revenues, facilitating efficient audits. By adhering to meticulous documentation standards, food industry enterprises can avoid penalties and ensure their financial practices align with the ever-evolving tax landscape.

Industry-specific tax rates

Food industry tax regulations present unique challenges for businesses, influenced by factors such as location, product type, and economic conditions. In the United States, state-level sales tax on food items varies significantly, with some states imposing reduced rates or exemptions for groceries. For example, Arkansas has a 1.5% state sales tax on food, while New York allows exemptions for most grocery items but levies taxes on prepared foods. Additionally, federal excise taxes apply to certain products, such as soda and alcohol, impacting pricing strategies. Navigating these complex regulations requires a thorough understanding of local tax codes and compliance requirements, ensuring that restaurants, grocery stores, and food manufacturers remain compliant and optimize tax liabilities. Moreover, periodic updates to tax legislation emphasize the necessity for ongoing education and adaptability among food industry professionals.

Filing deadlines and procedures

Food industry tax regulations require adherence to specific filing deadlines and procedures to maintain compliance. In the United States, the Internal Revenue Service (IRS) mandates quarterly estimated tax payments for businesses, calculated based on projected revenue, usually due on April 15, June 15, September 15, and January 15 of the following year. Additionally, annual tax returns for corporations, such as Form 1120, must be submitted by the 15th day of the fourth month following the end of the fiscal year. The food industry, particularly sectors like restaurants and distributorships, faces unique regulations such as sales tax reporting on consumables, varying by state. Certain local jurisdictions may also impose specific food and beverage taxes, and compliance requires accurate record-keeping of sales, purchases, and inventory levels to support tax filings. Understanding these timelines and regulations ensures businesses avoid penalties and optimize their tax liabilities.

Letter Template For Food Industry Specific Tax Regulations Samples

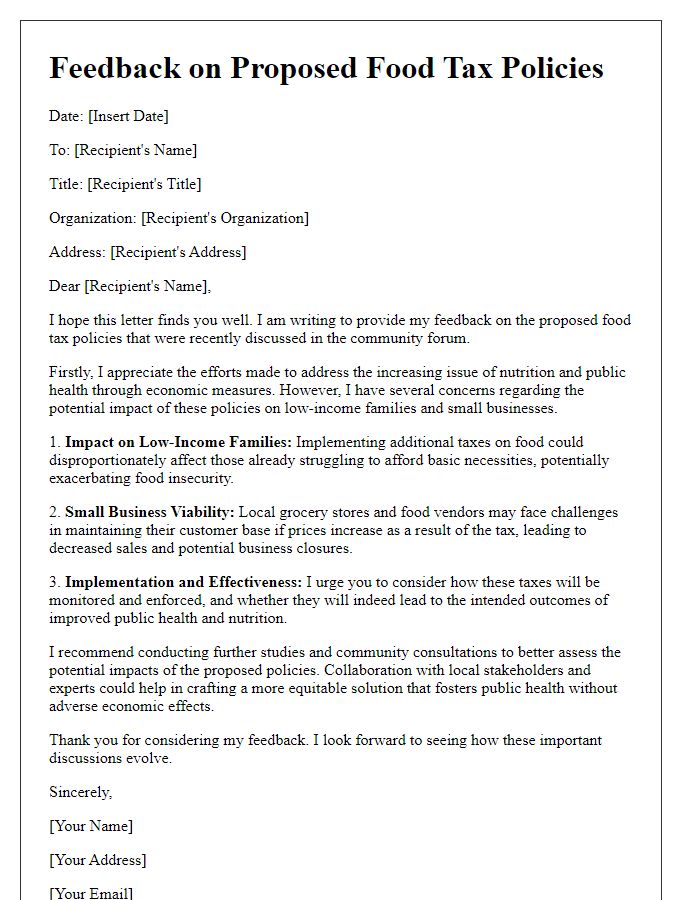

Letter template of notification regarding changes in food tax legislation

Comments