When faced with wage garnishment, it can feel overwhelming and confusing. Whether you're dealing with unexpected financial setbacks or legal obligations, understanding the process is key to regaining control. In this article, we'll provide a straightforward explanation of what wage garnishment is, how it occurs, and your rights as an employee. So, if you're ready to demystify this topic and find out how to navigate it effectively, keep reading!

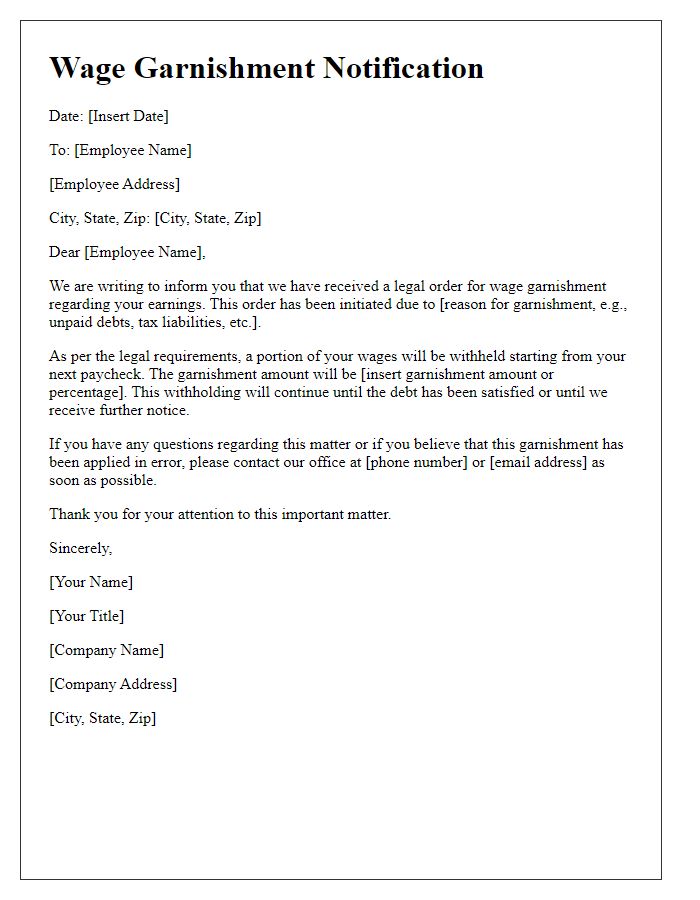

Clarity of Legal Obligations

Wage garnishment can significantly impact an individual's financial stability and is often a result of unpaid debts or legal obligations. Entities like creditors (often companies or collections agencies) may initiate this process through court orders, which legally compel employers to withhold a portion of an employee's wages. Specific percentages dictated by law (up to 25% of disposable income in the U.S.) are typically withheld until debts are satisfied. This process can vary by state, with varying regulations impacting how and when garnishments are processed. Understanding these legal obligations is crucial for individuals who may find themselves facing garnishment, particularly in terms of their rights, potential exemptions, and the necessity to proactively manage their financial affairs to prevent long-term impacts on credit scores and overall fiscal health.

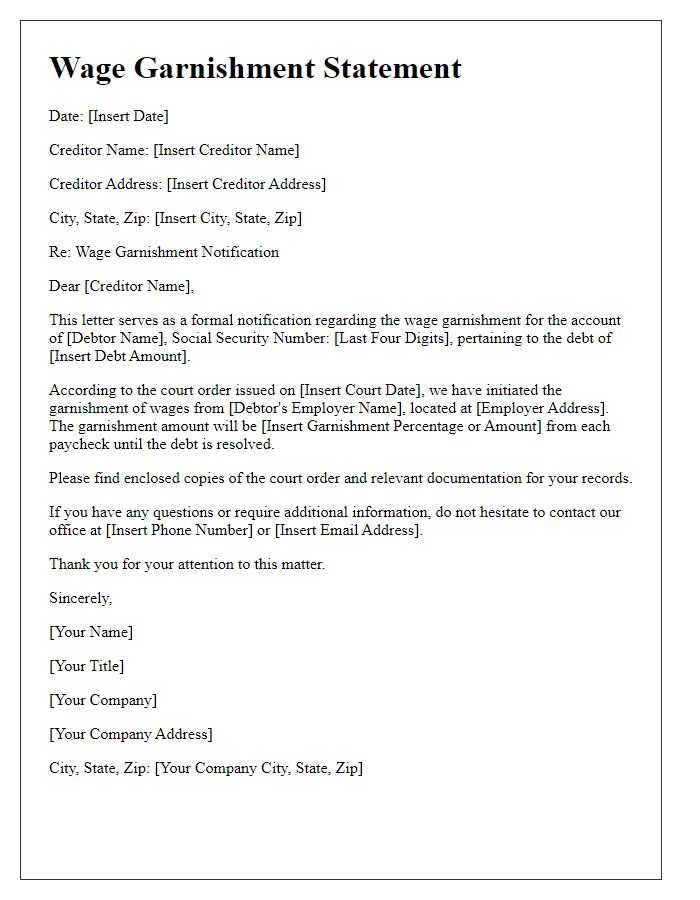

Explanation of Debt and Reason

Debt-related issues often lead to wage garnishment, a legal procedure allowing creditors to take a portion of a person's earnings to satisfy outstanding debts. A common instance involves medical bills, where healthcare providers seek compensation for unpaid services, resulting in a court-issued garnishment order. This order typically allows garnishing up to 25% of disposable income, significantly affecting financial stability. Additionally, unsecured debts like credit card balances can prompt creditors, such as collection agencies, to pursue garnishment as an effective means of recovering owed amounts. Understanding the relationship between personal debt and garnishment can provide insight into consumer rights and highlight the importance of timely debt management.

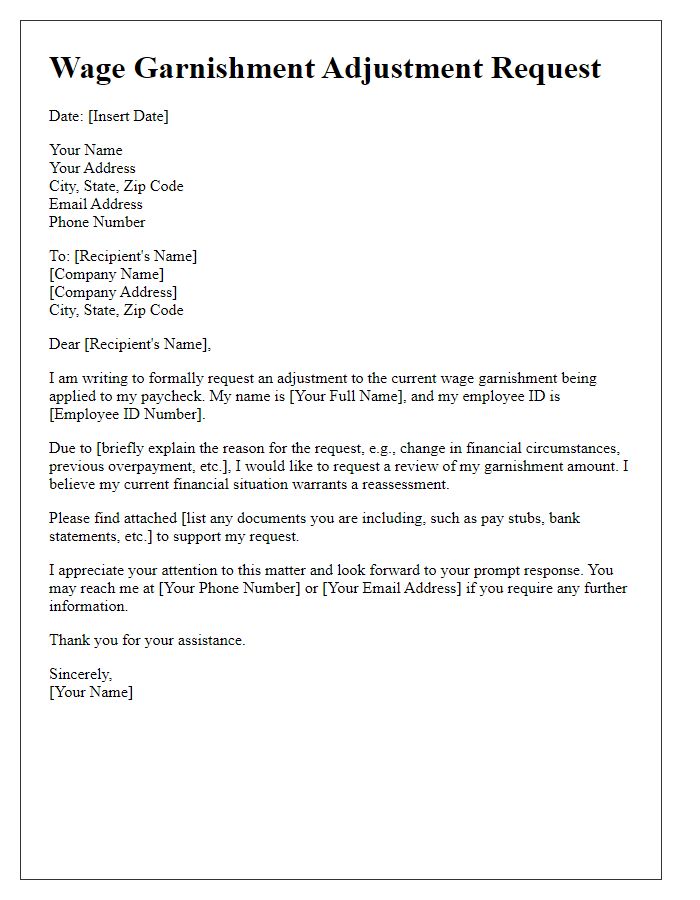

Clear Instructions and Compliance Steps

Wage garnishment refers to the legal process whereby a portion of an individual's earnings is withheld by an employer to satisfy a debt. This typically occurs following a court order or a legal judgment, which can arise from unpaid debts such as child support, tax obligations, or outstanding loans. The garnishment amount often varies but is usually capped at 25% of disposable income, which is the amount remaining after mandatory deductions, such as taxes and retirement contributions. Employers must comply with specific federal and state regulations, ensuring that the garnishment remains within legal limits and is executed following the correct procedures. Employees have rights under laws like the Consumer Credit Protection Act, which prohibits retaliation from employers due to wage garnishment. Understanding compliance steps, such as timely reporting to the court and providing proper documentation, is crucial for related parties, including the debtor, creditor, and employer.

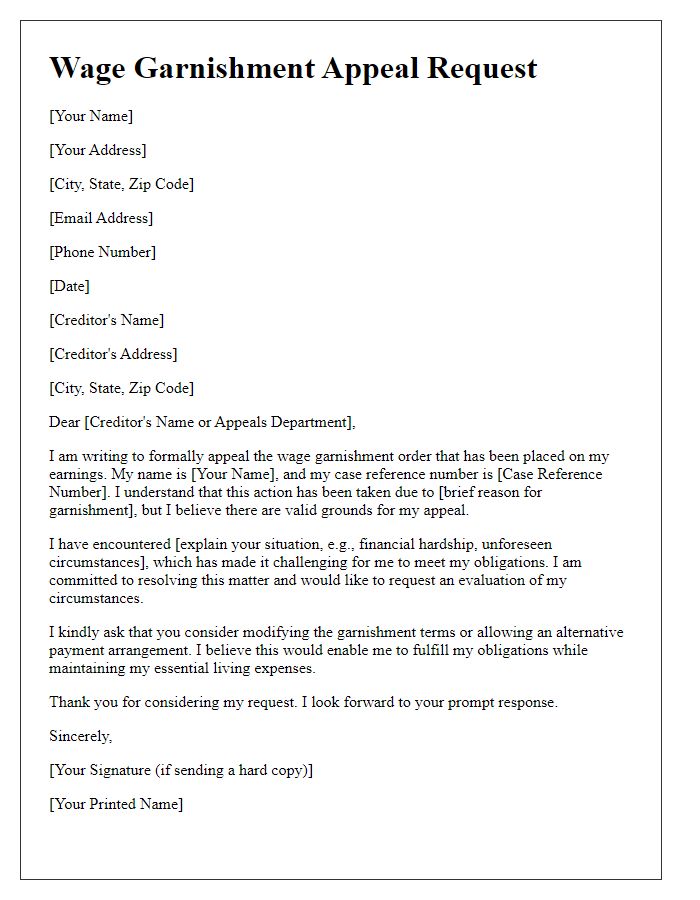

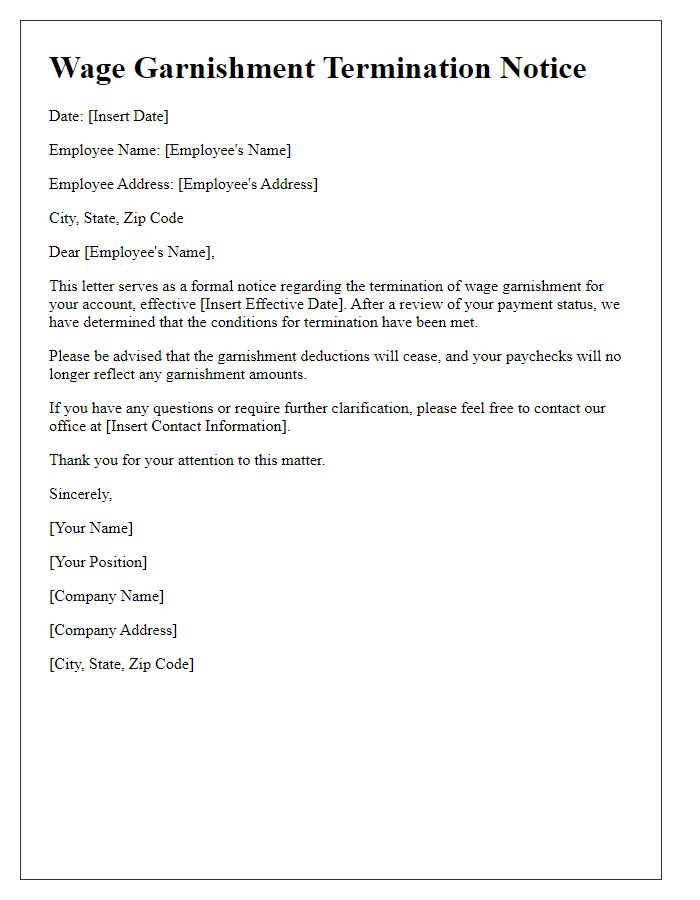

Contact Information for Queries

Wage garnishment is a legal procedure where a portion of an employee's earnings is withheld by an employer to fulfill a debt obligation, often prompted by court orders or creditor requests. In the United States, various factors determine the percentage of wages that can be garnished, generally capped at 25% of disposable income or the amount by which an individual's income exceeds 30 times the federal minimum wage, according to the Consumer Credit Protection Act. Employees facing garnishment may receive official notifications from employers or courts, and it is essential for them to understand their rights and possible exemptions available under state laws. Interested individuals should maintain up-to-date contact information for legal aid organizations or financial advisors for queries related to their specific situations, ensuring access to guidance and support during the garnishment process.

Assurance of Confidentiality and Privacy

Wage garnishment occurs when a legal order directs the withholding of a portion of an employee's earnings to satisfy a debt. Commonly linked to unpaid debts such as student loans, child support, or credit card judgments, this action can impact an individual's financial stability. Confidentiality is paramount during the process, with measures in place to protect sensitive information from unauthorized disclosure. Legal entities, including courts and collection agencies, must adhere to regulations like the Fair Debt Collection Practices Act to ensure that personal data and wage details remain secure. In situations involving wage garnishment, the employee's employer is obligated to handle documents discreetly, maintaining privacy throughout the procedure.

Comments