When it comes to managing subcontractor relationships, tax documentation can be a daunting task for many businesses. Ensuring that all forms are completed accurately and submitted on time is crucial for maintaining compliance and avoiding costly penalties. In this article, we'll explore a simple letter template that will streamline your communication with subcontractors regarding their tax documentation. So, if you're ready to simplify your subcontractor tax process, keep reading to discover practical tips and helpful resources!

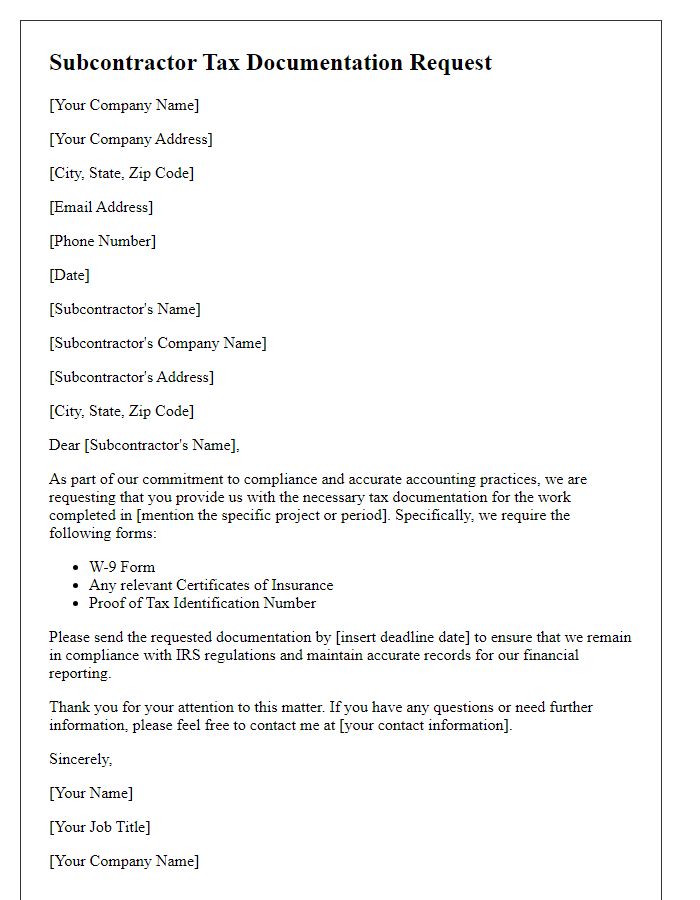

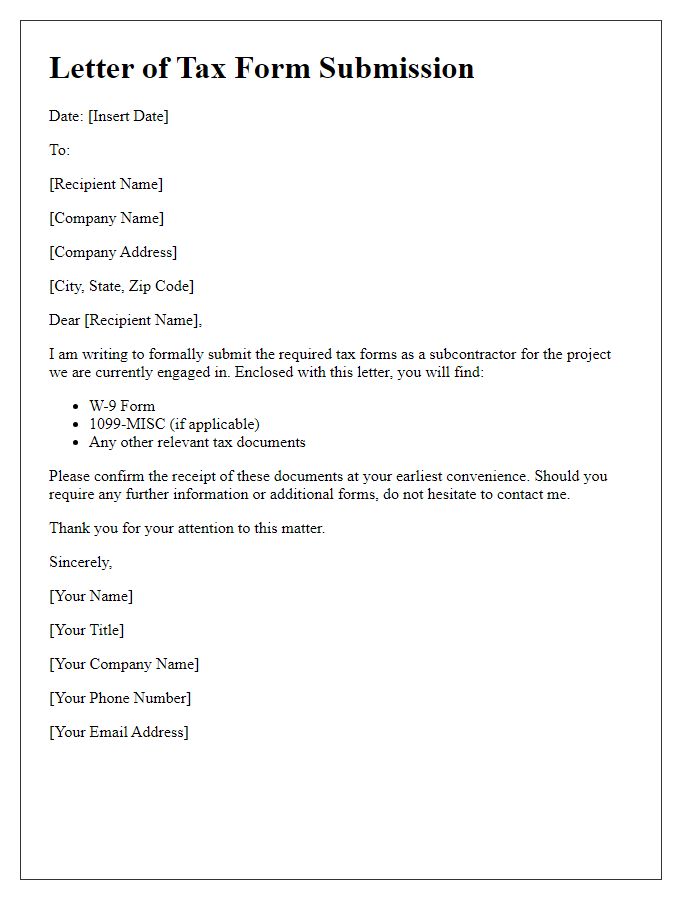

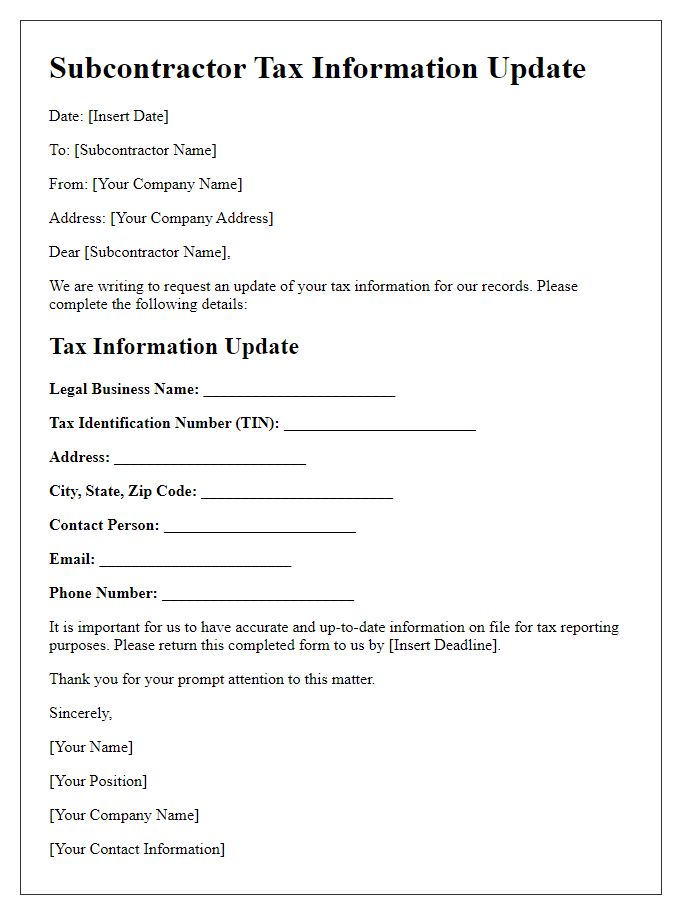

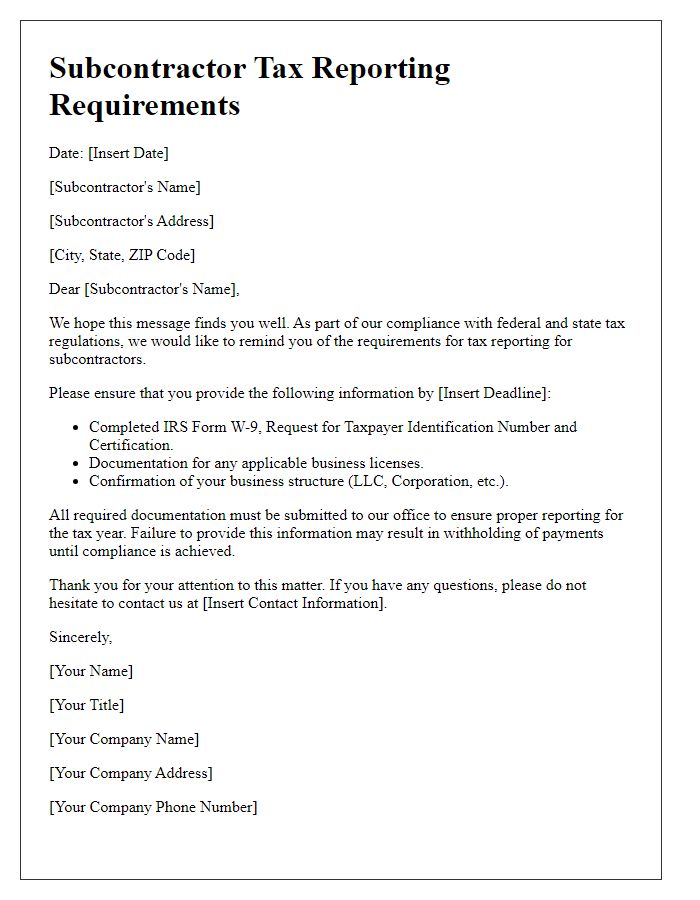

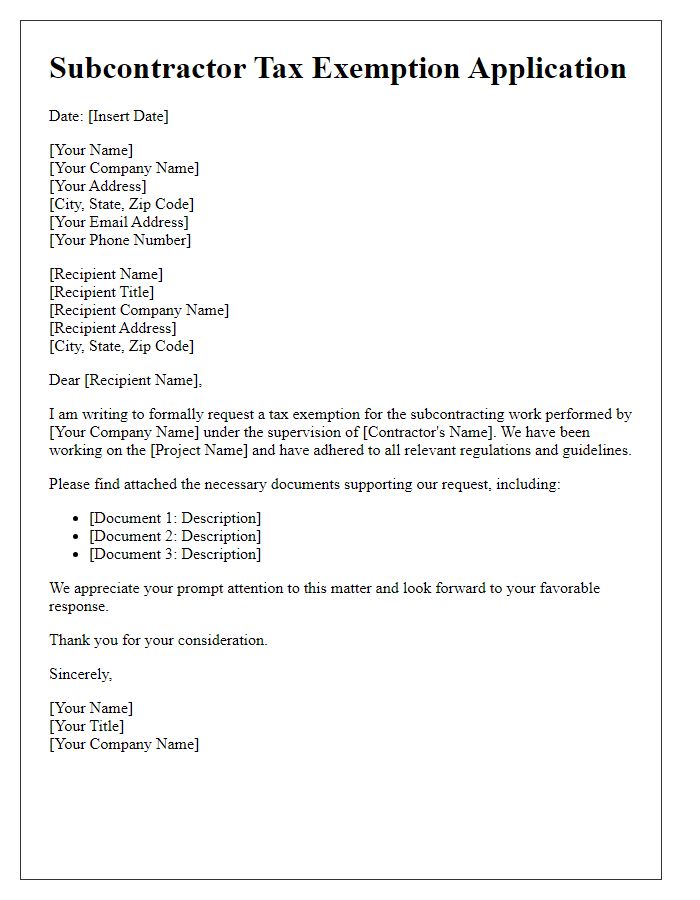

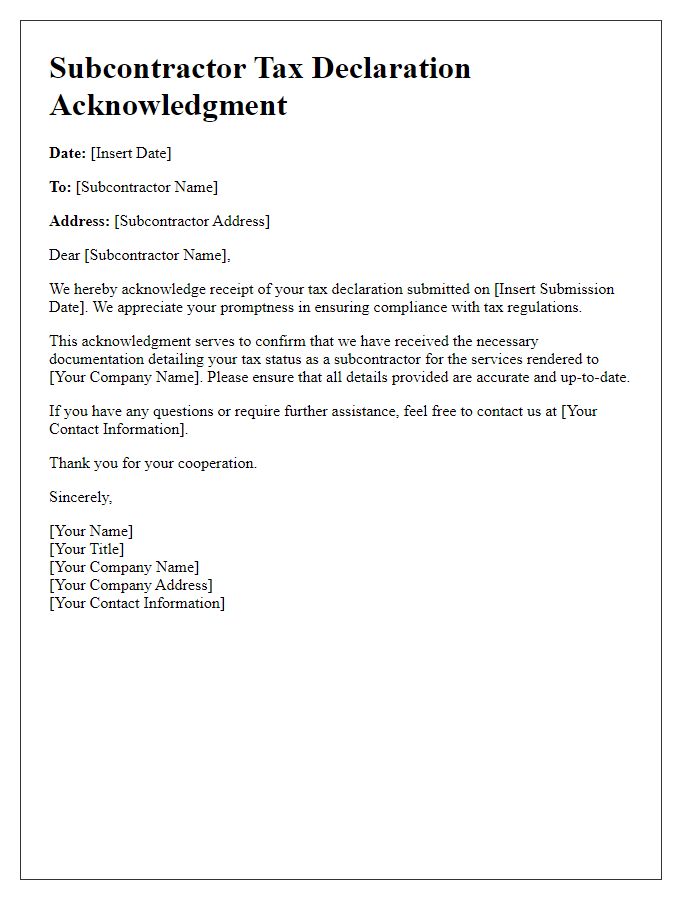

Header with Contact Information

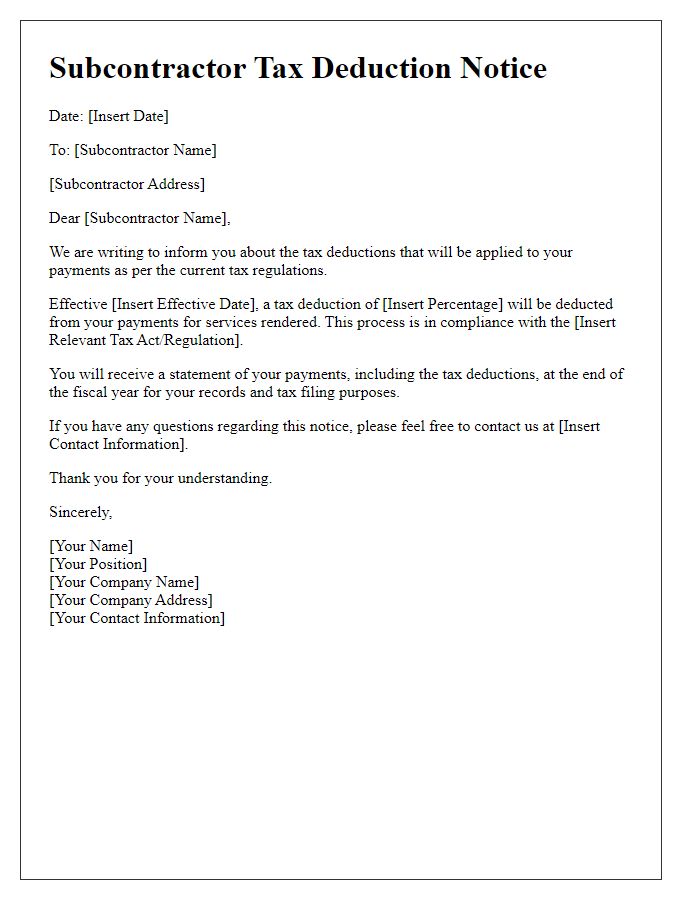

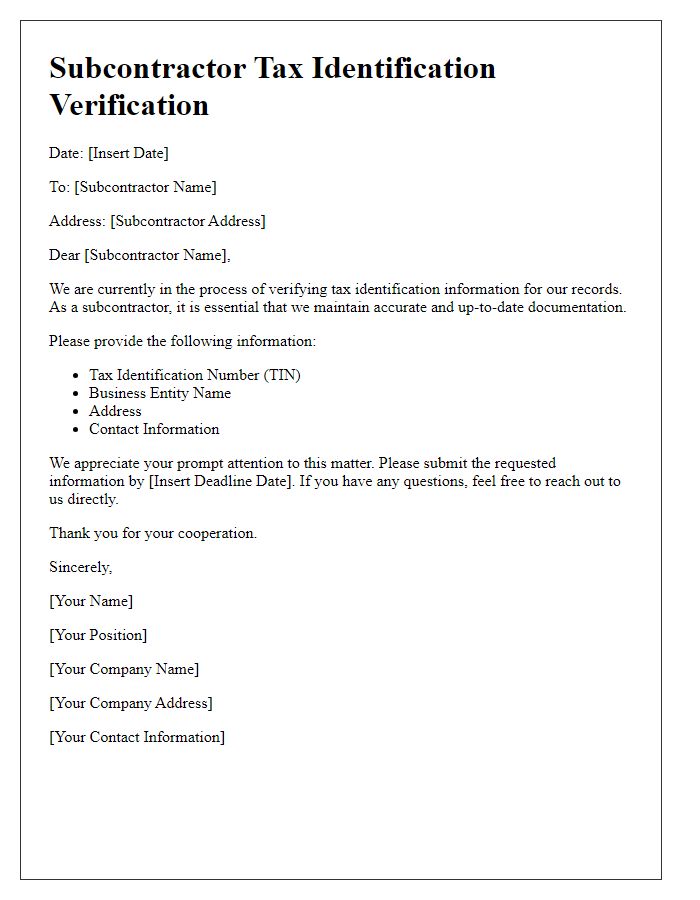

Subcontractor tax documentation is essential for maintaining compliance with federal and state regulations. Accurate records allow businesses to report payments made to subcontractors, such as LLCs or sole proprietorships, to the Internal Revenue Service (IRS) using Form 1099-MISC. This form is required for payments exceeding $600 within a calendar year. Details such as names, addresses, and taxpayer identification numbers are crucial for proper identification. Keeping these documents organized facilitates efficient record-keeping and minimizes the risk of audits or penalties. It's important to be aware of deadlines for submission, typically January 31st for providing 1099 forms to subcontractors and February 28th for submitting them to the IRS.

Subject Line for Clarity

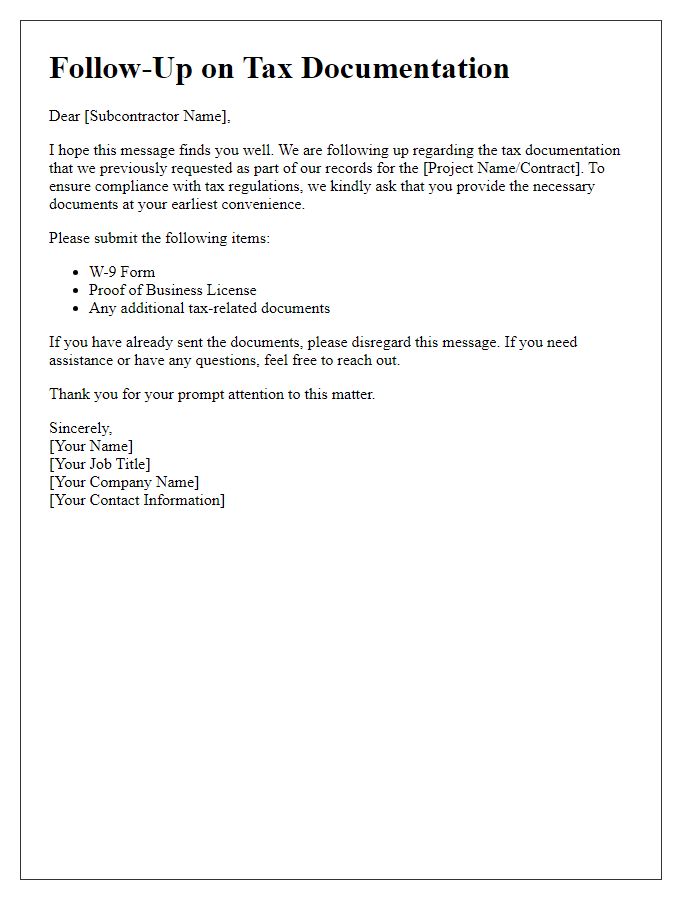

Subcontractor Tax Documentation Submission Request for [Project Name/Contract Number]

Clear Instructions and Deadlines

Subcontractor tax documentation must be completed accurately and submitted by the specified deadlines to ensure compliance with the Internal Revenue Service regulations. Each subcontractor, including freelancers and independent contractors, must fill out Form W-9, providing their taxpayer identification number and certification. Accuracy is crucial to avoid delays in processing payments or tax issues. The documentation is to be submitted no later than January 31, 2024, to ensure that all financial records for the year ending December 31, 2023, are in accordance with Federal guidelines. Please ensure that all forms are signed appropriately and that any required supporting documents, such as proof of business registration, are attached. Contact the tax compliance officer for clarification or assistance regarding specific documentation requirements.

Required Tax Documents List

Subcontractors involved in construction projects must gather essential tax documentation to ensure compliance with federal and state regulations. Required forms include IRS Form W-9, providing accurate taxpayer identification information, and IRS Form 1099-NEC, which reports non-employee compensation for payments exceeding $600 within a fiscal year. Additionally, proof of state-specific licensing may be necessary, depending on jurisdiction, along with any applicable sales tax permits, particularly for construction-related services. Federal Employer Identification Number (EIN) registration documents are crucial for businesses employing others. Keeping meticulous records of invoices detailing services rendered and payments received fosters transparency and aids in the preparation of annual tax returns, contributing to a hassle-free auditing process.

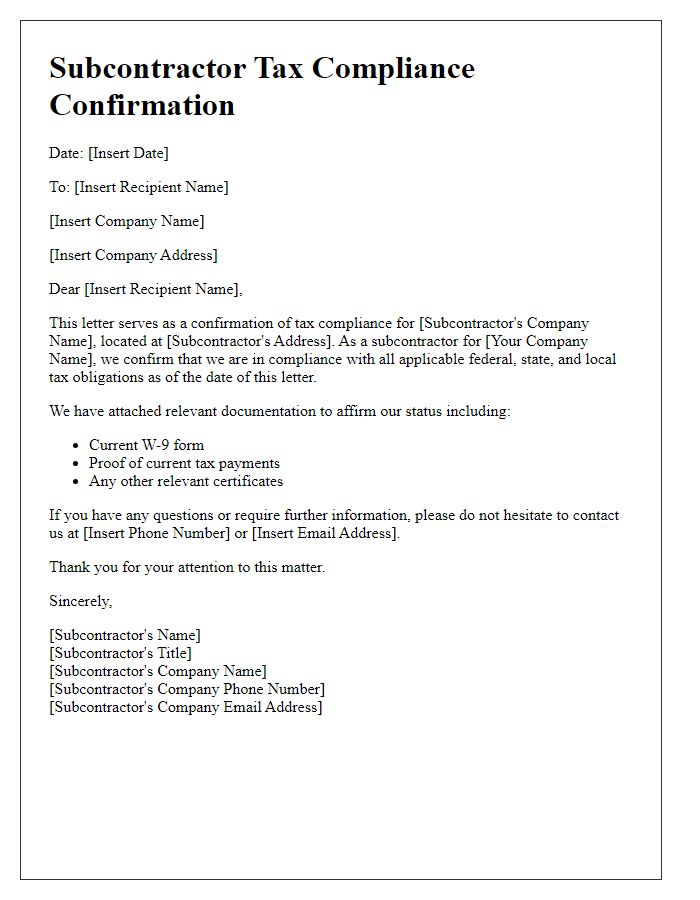

Compliance and Confidentiality Statement

A subcontractor tax documentation process involves essential aspects of compliance and confidentiality, ensuring adherence to regulations such as the Internal Revenue Service guidelines in the United States. This documentation includes the collection of tax identification numbers, such as Social Security Numbers (SSNs) or Employer Identification Numbers (EINs), vital for accurate reporting of income. Confidentiality protocols must safeguard personal information, preventing unauthorized access during data handling or electronic submission. Compliance with the General Data Protection Regulation (GDPR) ensures that subcontractor data is processed lawfully, transparently, and securely, reflecting a commitment to ethical business practices. Regular audits and training on confidentiality measures for staff handling these documents further enhance security and trust in the subcontractor relationship.

Comments