Are you considering applying for trade credit but unsure where to start? This letter template can serve as your roadmap, guiding you through the essential elements needed to craft a compelling application. From highlighting your business's strengths to articulating your repayment strategy, each section plays a crucial role in building trust with potential creditors. Dive deeper into our article for more tips and detailed instructions on creating an effective trade credit application!

Applicant's Company Information

The trade credit application process requires applicants to provide detailed company information to facilitate evaluation. Key components include the company name, established date indicating longevity in the market, physical address encompassing the street, city, state, and zip code, essential for identifying local regulatory compliance. The Tax Identification Number (TIN) or Employer Identification Number (EIN) is crucial for tax purposes, while the business structure (LLC, Corporation, etc.) provides insights into liability and operational framework. Contact details such as phone number and email address enable direct communication for follow-up queries. The number of employees reflects the scale of operations, and the annual revenue figures, often in excess of $500,000, can indicate financial stability and creditworthiness. Lastly, a brief history of the company's activities and products or services offered can highlight its market position and potential for growth in the industry.

Credit Amount Requested

A trade credit application seeks financial assistance, determining the line of credit needed for business operations. Credit Amount Requested signifies the total sum a business intends to borrow, often based on projected inventory purchases or operational costs. For instance, a retailer might request $50,000 to stock seasonal merchandise, while a manufacturer may ask for $100,000 to acquire raw materials for upcoming production cycles. Accurate financial forecasting, alongside a robust business plan, enhances the credibility of the requested amount, ensuring sustainability and timely repayments. Lenders typically evaluate this figure against the applicant's financial history, sales projections, and market conditions, establishing the risk associated with extending credit.

Payment Terms Desired

Trade credit applications are essential for businesses seeking to manage cash flow effectively while maintaining supplier relationships. Payment terms desired in such applications may vary widely, typically ranging from 30 to 90 days, influencing product accessibility and financial planning. Common terms, including net 30 or net 60, indicate the duration a business has to fulfill its payment obligations after receiving goods or services. Flexible terms, such as early payment discounts or installment payments, can enhance cash management strategies. Clear communication of payment expectations is crucial for building trust between suppliers and businesses, ultimately fostering a healthy trade partnership.

Financial Statements and History

Financial statements, including balance sheets and income statements, provide crucial insights into a business's overall financial health. Managers analyze these documents (financial reports from the past three fiscal years) to assess liquidity, profitability, and solvency. The balance sheet lists assets, liabilities, and equity, offering a snapshot of financial stability at a specific point in time. Income statements show revenue streams and expenses, indicating operational performance during specific periods. Historical financial data, reflecting ongoing trends, allows for better forecasting and creditworthiness assessments. Additionally, a track record of timely payments (with reference to invoices paid within 30 days) demonstrates reliability, vital for establishing trust with potential trading partners.

References and Contact Information

A trade credit application requires comprehensive references and contact information to assess the creditworthiness of the applicant. Essential details include business references such as suppliers or vendors, who can verify the payment history and credit practices. Contact information should encompass full names, business titles, email addresses, and phone numbers of the references, ensuring easy communication. Additionally, the application might request financial references, including banks or lenders, to provide insights into the financial stability of the applicant. This information is crucial for establishing trust and credibility in the trade relationship.

Letter Template For Trade Credit Application Samples

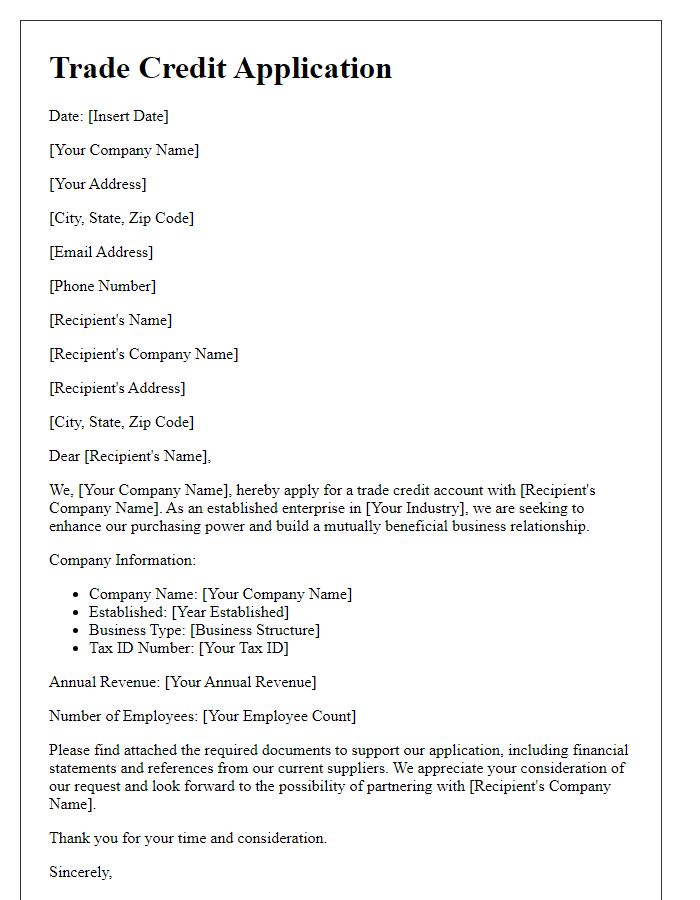

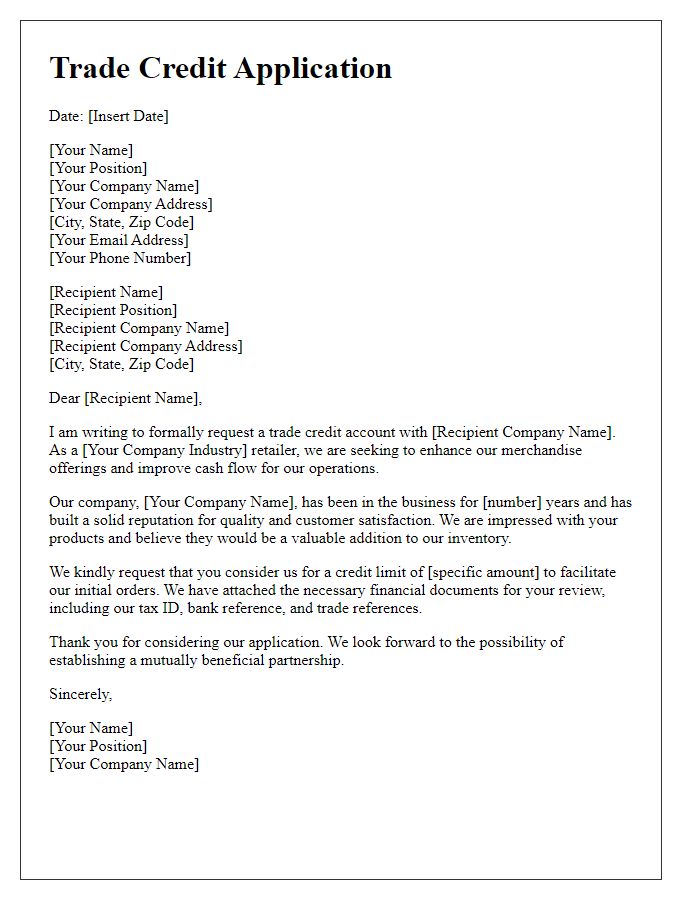

Letter template of trade credit application for established enterprises.

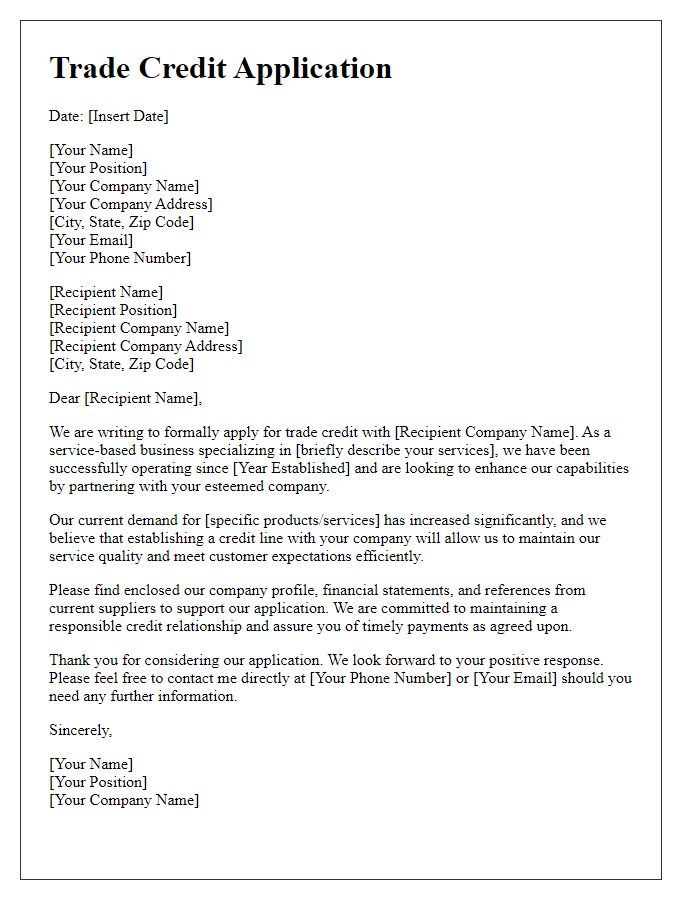

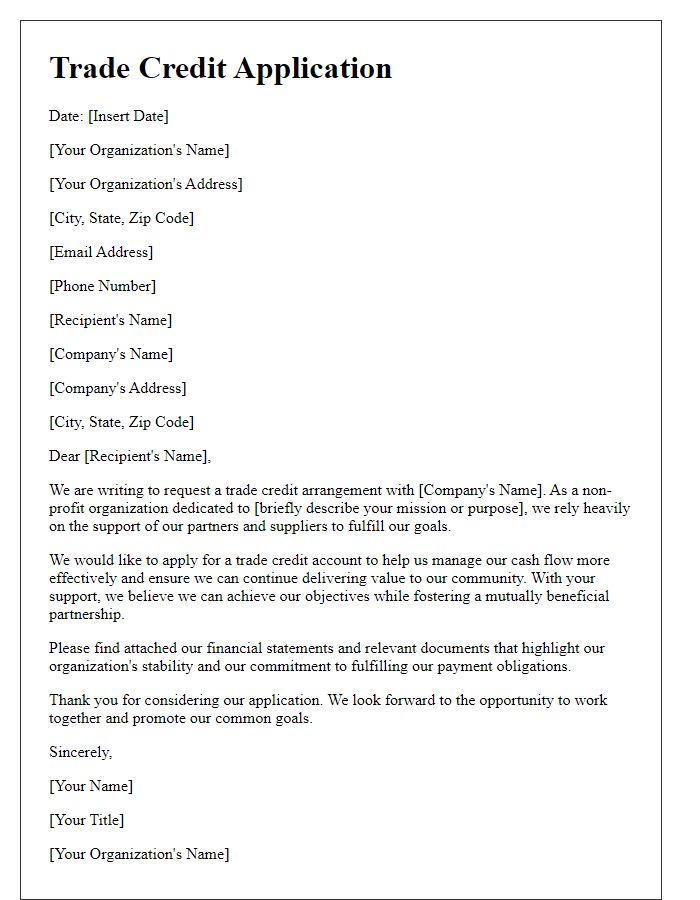

Letter template of trade credit application for service-based businesses.

Comments