Are you navigating the intricate world of shareholder capital calls and looking for the perfect way to frame your notice? Crafting a clear and concise capital call letter is essential for maintaining transparency and fostering strong relationships with your shareholders. This article will guide you through the essential components of an effective capital call notice, ensuring that you're well-equipped to communicate your needs. Join us as we dive deeper into the details that make your letters not just informative, but also engaging!

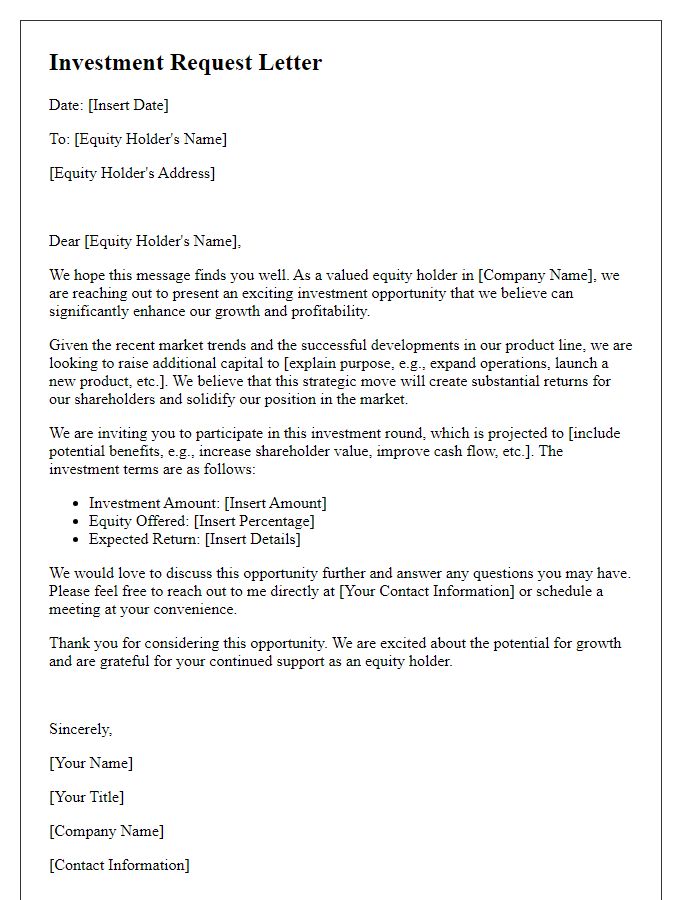

Introduction with Purpose

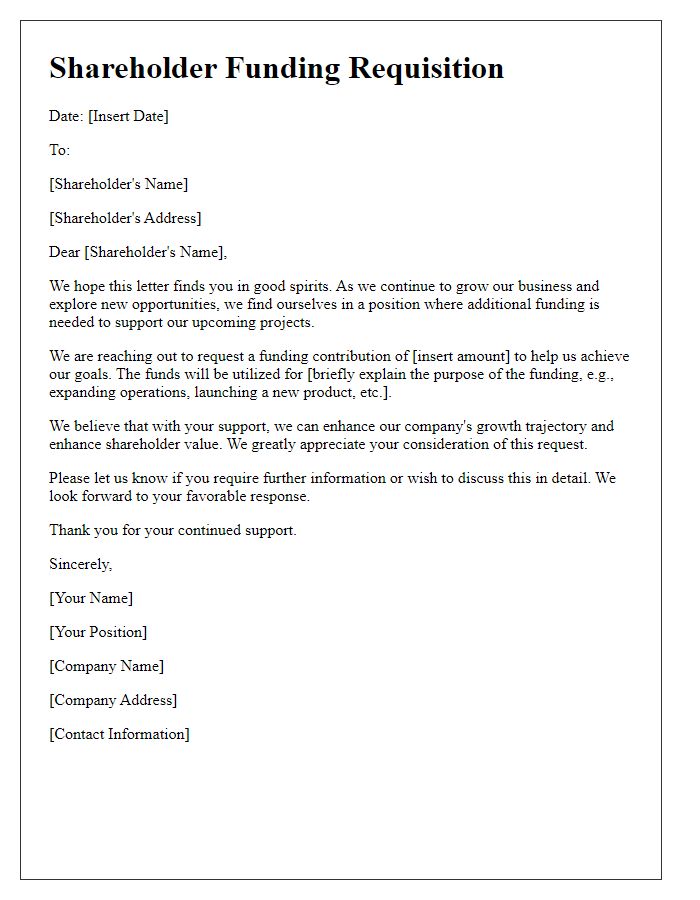

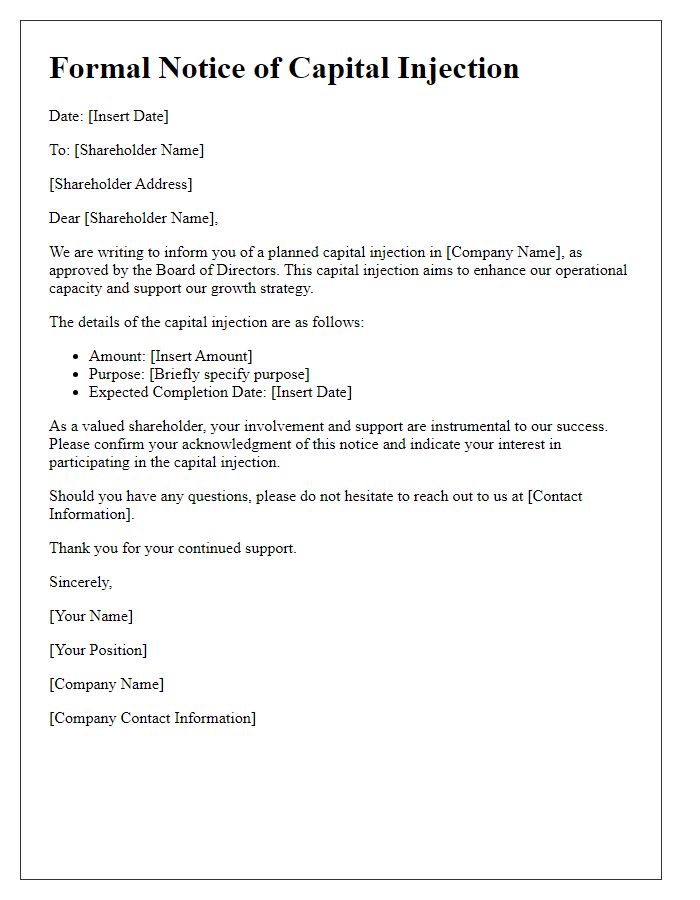

A shareholder capital call notice serves as a formal communication to investors, requesting additional funding for a specific purpose, such as business expansion or debt repayment. This notice outlines the amount of capital needed, the deadline for contributions, and the intended use of the raised funds, which may include initiatives like launching a new product, investing in technology upgrades, or enhancing operational efficiency. Clarity in the notice ensures that shareholders understand the necessity of the request and the anticipated benefits, thus fostering continued engagement and support within the investor community.

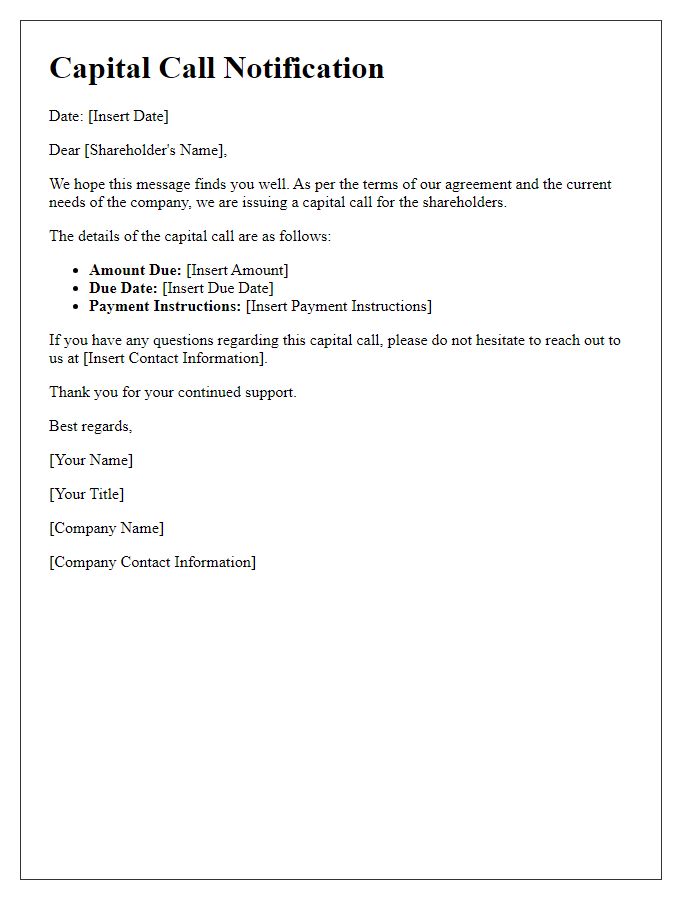

Capital Call Details

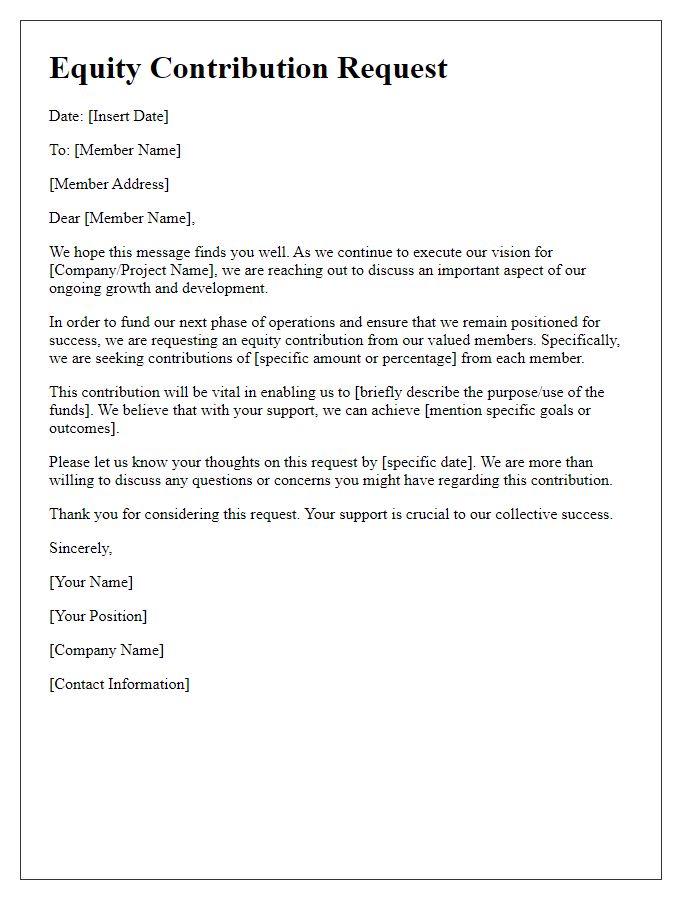

A capital call notice outlines essential information for shareholders regarding forthcoming capital contributions. This notice typically includes details such as the total amount required from each investor, informed deadlines for payment submission, and the specific uses intended for the capital, often related to business expansion or operational funding. Additionally, the notice may detail the legal framework governing the capital call, referencing pertinent sections of the company's operating agreement or bylaws. Shareholders are urged to review their investment agreements closely, as failure to respond to the capital call may affect their equity stake and voting rights in the company. Clear communication and transparency are crucial during this process to maintain shareholder trust and collaboration.

Payment Instructions

Shareholder capital call notices require clear communication to ensure timely contributions. The notice typically outlines the amount owed by each shareholder, payment due date, and accepted payment methods. For example, shareholders may be instructed to deposit funds into a specified bank account or to send a check to a designated address. Clear emphasis on the importance of timely payment can prevent delays in capital projects. Additionally, providing contact information for inquiries regarding the capital call can foster transparency and enhance shareholder trust in the management team's decisions.

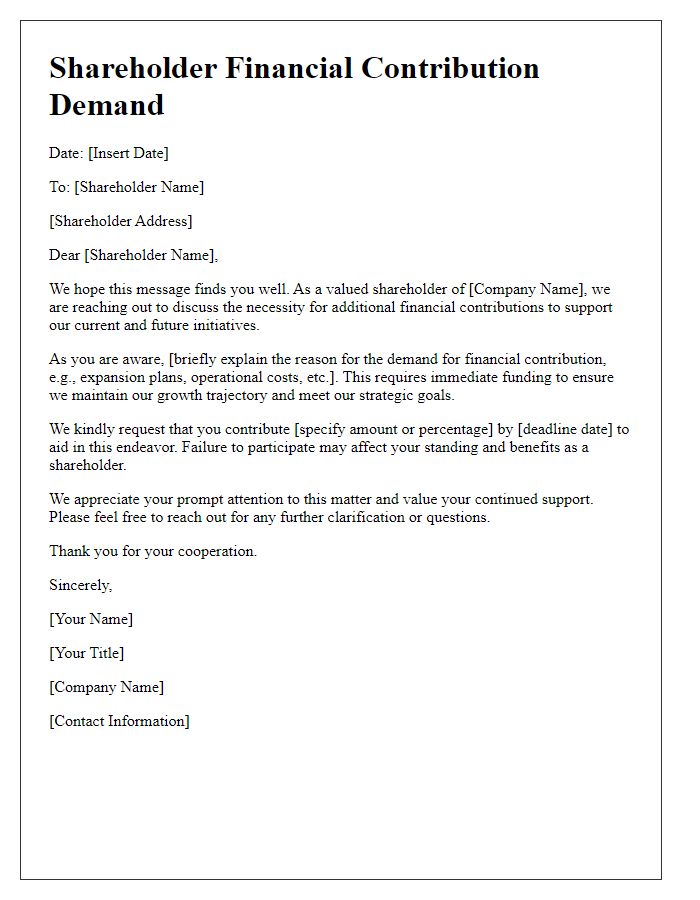

Deadline and Consequences

A shareholder capital call notice informs stakeholders about the necessity to contribute additional funds to maintain company operations or capitalize on growth opportunities. The deadline for submissions typically falls within a specified time frame, often 30 to 60 days from the notice date, ensuring prompt access to necessary liquidity. Failing to respond within this period can lead to consequences such as dilution of ownership, loss of voting rights, or other penalties outlined in the shareholder agreement. This notice serves to underscore the importance of timely participation to preserve equity and strengthen the company's financial position, especially in competitive markets.

Contact Information for Inquiries

Shareholder capital call notices serve as formal communications to notify investors about obligations to contribute additional funds to support business operations or projects. These notices typically include essential details such as the amount due, payment deadlines, and company progress. Clear and concise contact information is critical for inquiries, often listing a designated representative, email address, and direct phone number for efficient communication. Investors appreciate prompt responses to their questions regarding the capital call, helping to maintain trust and transparency within the investment community. Providing multiple contact options, including a dedicated inquiry hotline or online chat service, can enhance accessibility and support for shareholders.

Comments