In today's ever-evolving business landscape, addressing shareholder ethical concerns is more crucial than ever. It's essential for companies to foster transparency and build trust with their investors, ensuring that all decisions align with shared values. By openly discussing these issues, we not only strengthen our relationship with shareholders but also enhance the integrity of our organization. Join us as we delve deeper into strategies for effectively managing and addressing ethical concerns in our upcoming discussion.

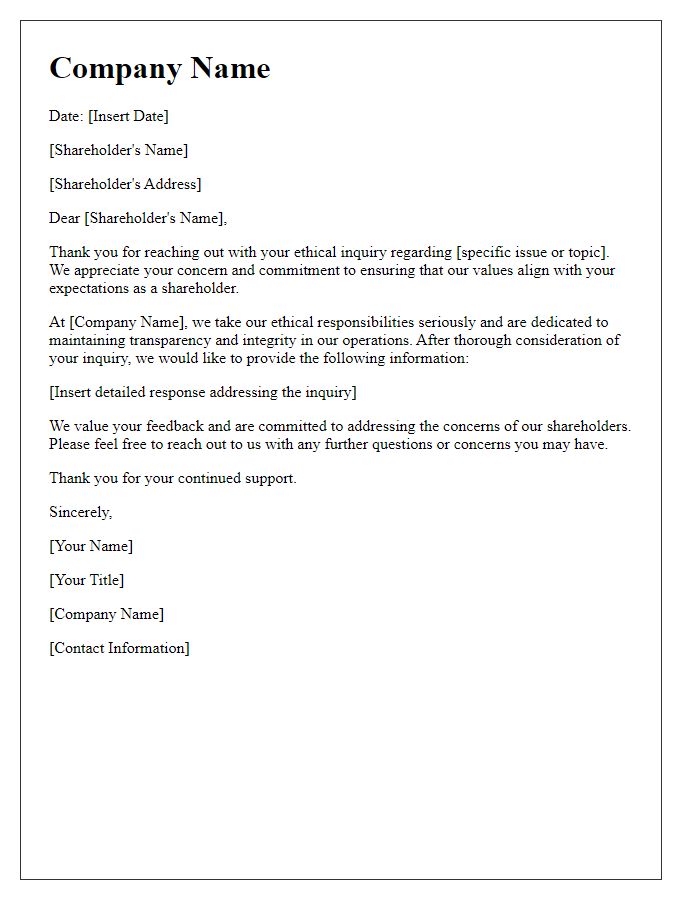

Transparency and Honesty

Addressing shareholder ethical concerns often revolves around transparency and honesty, foundational principles in corporate governance. Companies like Enron and Volkswagen faced immense scrutiny due to a lack of transparency in financial reporting and honesty regarding emissions standards. In the wake of such scandals, maintaining open communication channels with shareholders has become essential. Regular updates must include detailed financial disclosures, ethical codes of conduct, and the outcomes of any investigations or audits. Implementing robust whistleblower protections can foster an environment where employees feel safe reporting unethical behavior, further enhancing trust. By being proactive in addressing these ethical concerns, companies aim to build sustainable relationships with shareholders while protecting their brand reputation and ensuring compliance with regulatory standards, such as the Sarbanes-Oxley Act in the United States.

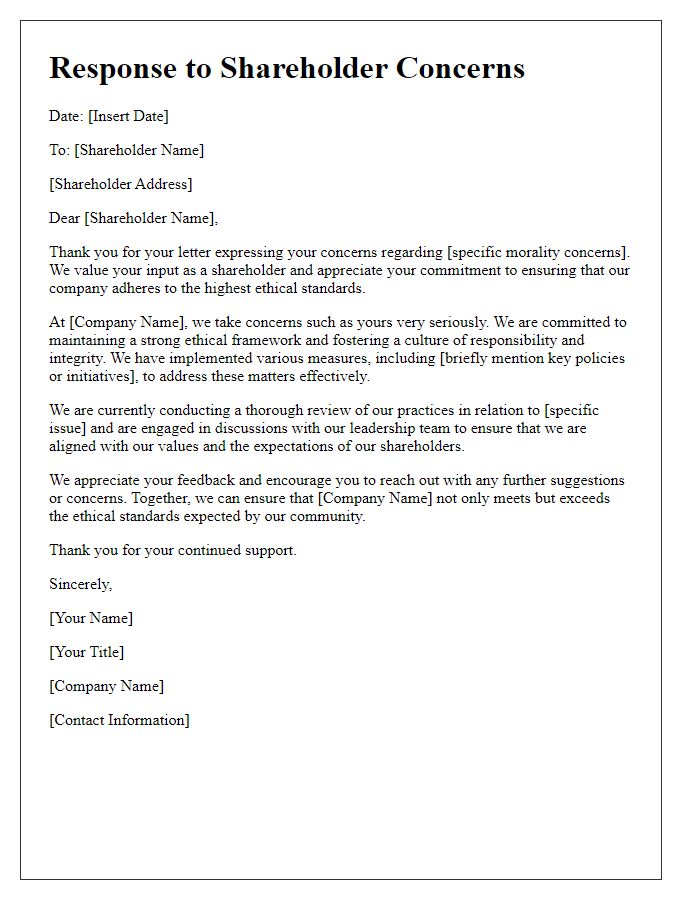

Commitment to Corporate Social Responsibility

Corporate Social Responsibility (CSR) reflects a company's dedication to ethical practices, social responsibility, and sustainable development. At XYZ Corporation, we prioritize stakeholder engagement and community support through initiatives focused on environmental stewardship, economic equity, and social well-being. Recent challenges, including climate change and social injustices, emphasize the importance of transparent policies and actions. We have implemented comprehensive reporting frameworks aligned with Global Reporting Initiative (GRI) standards to enhance accountability. Furthermore, our partnerships with nonprofits and local organizations aim to address pressing issues, such as poverty and education access, contributing to a broader positive impact on society. Employee participation in volunteer programs and environmentally-friendly practices within our operations showcases our commitment to ethical standards. We invite shareholders to engage in this crucial dialogue, ensuring our growth aligns with societal values and expectations.

Implementation of Ethical Business Practices

The implementation of ethical business practices is critical for maintaining shareholder trust and fostering sustainable growth within corporations. Ethical conduct in the workplace involves adherence to company policies, legal regulations, and industry standards, which promotes transparency and accountability. Statistics show that 70% of consumers prefer to purchase from companies that demonstrate strong ethical principles, enhancing brand loyalty and long-term profitability. Public scandals, such as the 2008 financial crisis, highlight the dire consequences of unethical behavior and mismanagement in corporate governance. Establishing a robust code of ethics involves regular training sessions for employees, creating an ethics committee, and implementing whistleblower protections to encourage reporting of unethical activities. Companies must also conduct routine audits to ensure compliance with ethical practices, thereby safeguarding their reputation and aligning with the interests of shareholders.

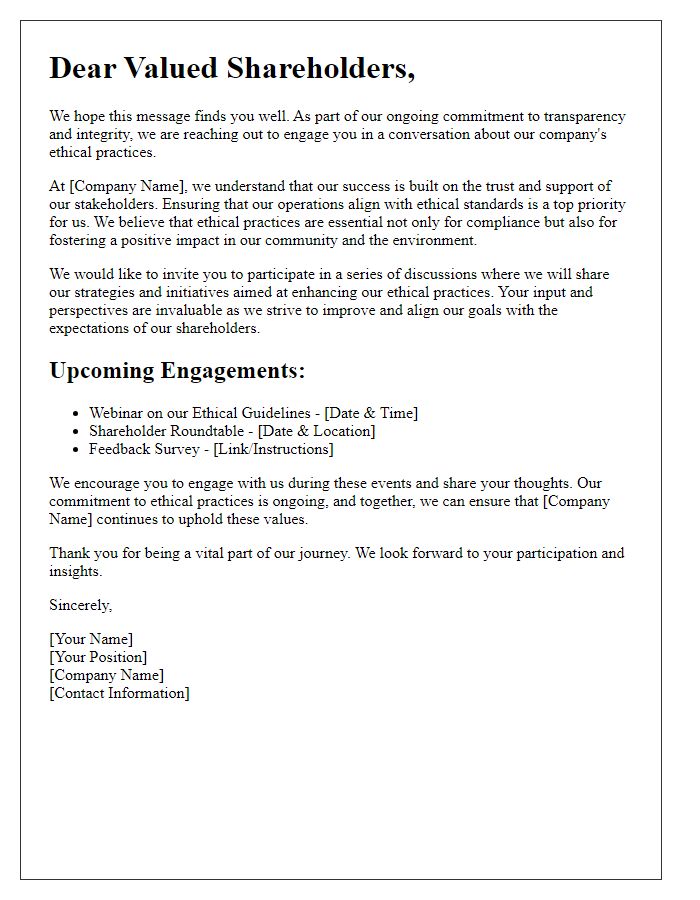

Active Engagement and Communication

Active engagement and communication with shareholders regarding ethical concerns are essential for maintaining trust and transparency within an organization. Regular shareholder meetings, often held quarterly, provide a platform for discussing pressing ethical matters, such as corporate governance practices and sustainability initiatives. Utilizing digital communication channels, including emails and dedicated investor relations websites, allows for timely dissemination of information regarding ethical audits or compliance updates. Additionally, shareholders can be invited to participate in feedback surveys or roundtable discussions to voice their concerns directly. Demonstrating a commitment to ethical standards not only enhances corporate reputation but also fosters shareholder loyalty, ultimately contributing to long-term financial success.

Impact Assessment and Continuous Improvement

In addressing shareholder ethical concerns, an Impact Assessment focuses on understanding the implications of company practices on stakeholders, such as employees, customers, and the community. This thorough evaluation aims to identify potential risks related to environmental sustainability, labor practices, and corporate governance. Continuous Improvement initiatives foster an ongoing commitment to ethical standards, ensuring that processes evolve in response to stakeholder feedback and changing regulations. Companies, particularly those traded on stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ, must remain vigilant in adapting corporate policies to reflect best practices in ethics, transparency, and accountability. Engaging shareholders through regular reports and open dialogues enhances trust and demonstrates a proactive stance in addressing concerns.

Comments