Are you feeling frustrated with the current management practices at your company? You're not alone! Many shareholders share concerns about how leadership decisions impact long-term value and business direction. In this article, we'll explore how to effectively voice your complaints and advocate for better management practices, so keep reading to find out how you can make your voice heard!

Clear Subject Line

Shareholder complaints regarding management decisions can stem from various issues such as lack of transparency, ineffective leadership, or declining company performance. These concerns often require a focused subject line that encapsulates the essence of the complaint. Examples include "Urgent: Request for Transparency in Management Decisions" or "Concern Over Leadership Effectiveness Impacting Shareholder Value." Each subject line should reflect the specific grievance, fostering clarity and encouraging timely attention from relevant parties.

Specific Issues Overview

Shareholders face increasing concerns regarding management decisions impacting company performance significantly. Recent financial reports indicate a 20% decline in quarterly profits, attributed primarily to uninformed strategic choices. Employee turnover rates have escalated to 15%, leading to operational inefficiencies that hinder productivity. Additionally, lack of transparency in communication regarding the company's future direction has contributed to shareholder apprehension. Stakeholders express frustration over insufficient responses to their inquiries during recent annual meetings, citing a void in leadership accountability for these critical issues. Urgent action is necessary to address these challenges effectively and restore confidence among shareholders.

Evidence and Documentation

Shareholders often express concerns regarding management practices in relation to corporate governance. Documentation includes financial reports, meeting minutes, and performance reviews that may indicate potential mismanagement. Specific incidents, such as sudden executive departures or unapproved expenditures, can raise red flags. These issues could undermine shareholder trust and impact stock performance significantly, especially when public companies, like Fortune 500 firms, are involved. Furthermore, regulations set by the Securities and Exchange Commission (SEC) require transparency; failure to comply can invite investigations and legal challenges. Collecting evidence from reliable sources, such as SEC filings and shareholder agreements, empowers shareholders to present a substantiated complaint to the board of directors.

Impact on Shareholder Value

Shareholder dissatisfaction with management can significantly impact shareholder value, particularly within publicly traded companies. Negative sentiments arising from management decisions can lead to declining stock prices, with investors losing confidence in the company's direction. For instance, a controversial decision, such as a poorly executed merger or acquisition, can result in immediate drops in market capitalization, potentially erasing millions in shareholder equity. Furthermore, increased scrutiny from institutional investors can bring about calls for changes in leadership or governance, adding to instability and uncertainty surrounding the company's financial health. Transparency in decision-making processes, as well as clear communication of strategies to enhance shareholder value, is crucial in maintaining trust and investing confidence among shareholders.

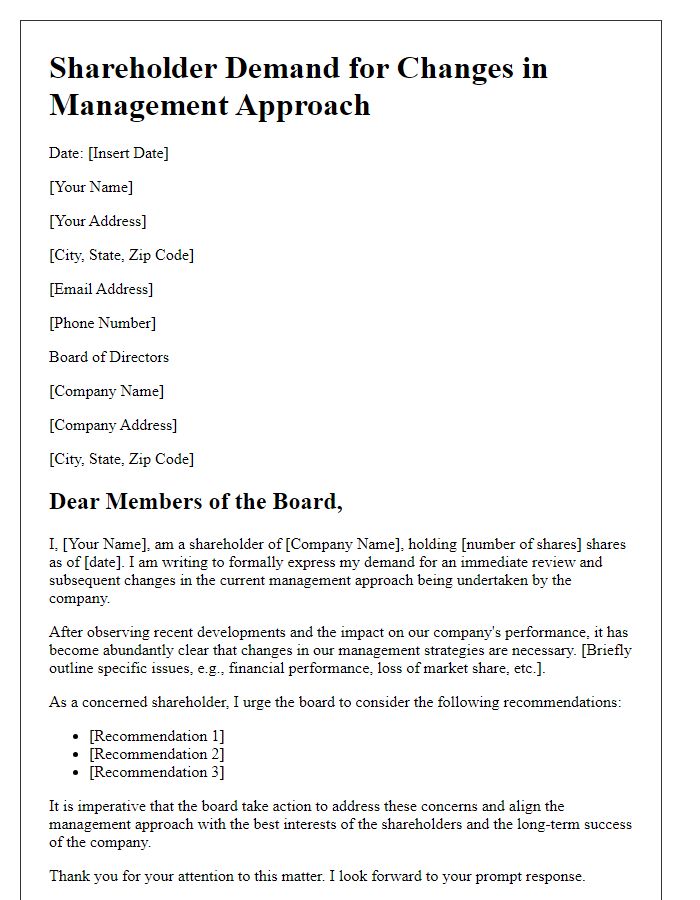

Request for Action or Resolution

Shareholders may express concerns regarding management practices when they perceive misalignment with corporate governance. Ineffective decision-making often impacts company performance, especially in high-stakes environments like finance or technology. For instance, a technology firm experiencing declining stock prices due to delayed product launches could prompt shareholders to voice dissatisfaction. This trend often correlates with lapses in strategic planning or market analysis. Resolving such issues typically requires formal communication, where shareholders outline specific grievances, request accountability, and seek actionable solutions to restore company confidence and enhance shareholder value. Effective resolution can involve board-level discussions and strategic reassessments to align management goals with shareholder interests.

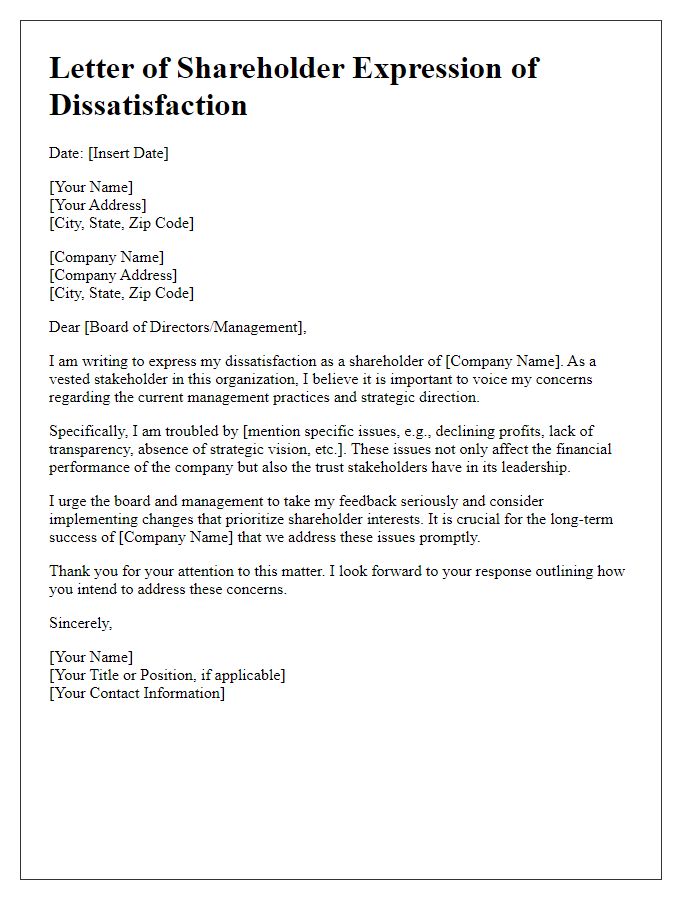

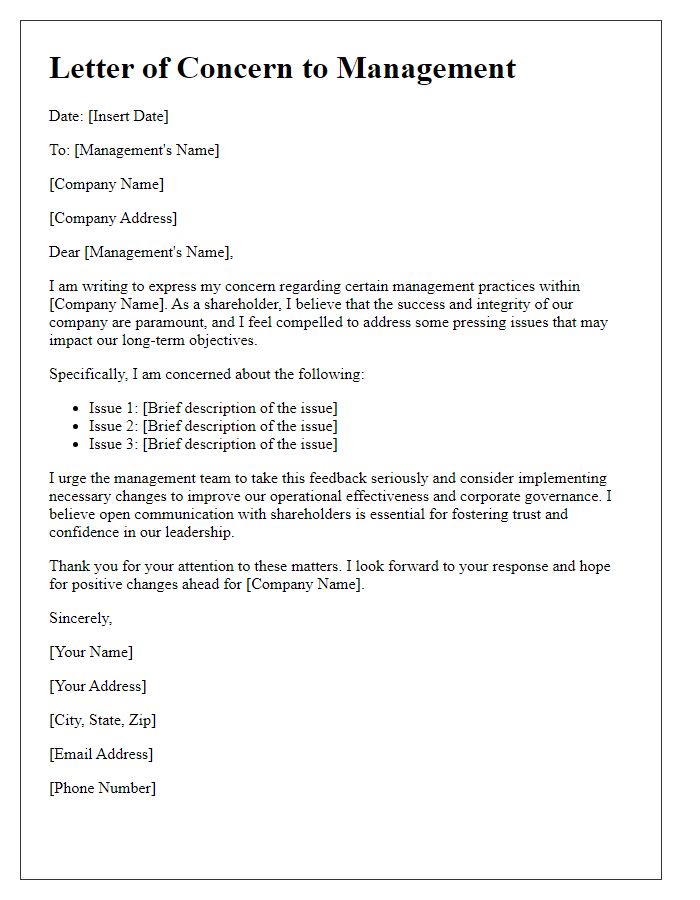

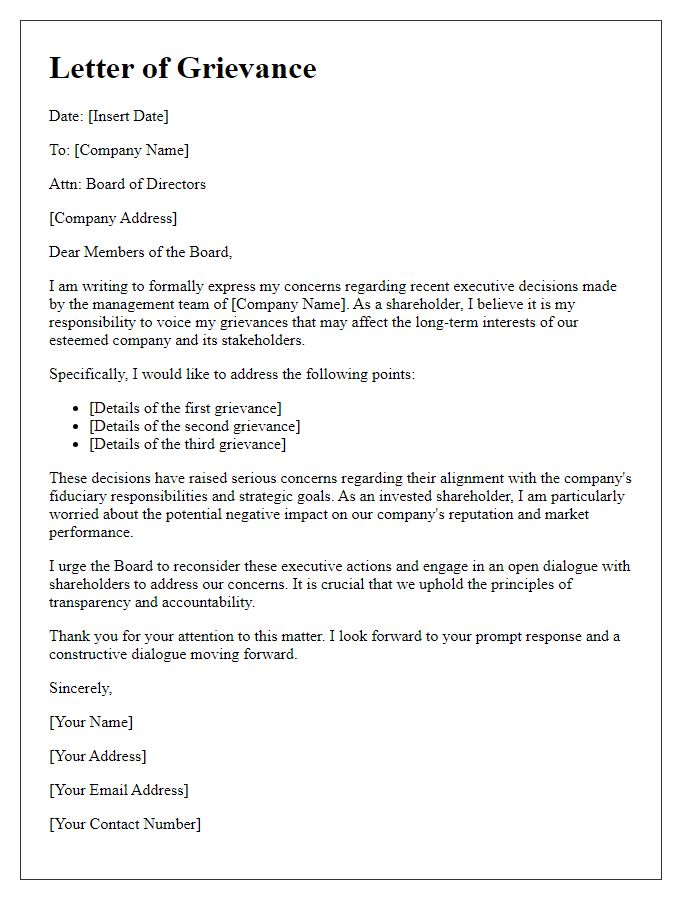

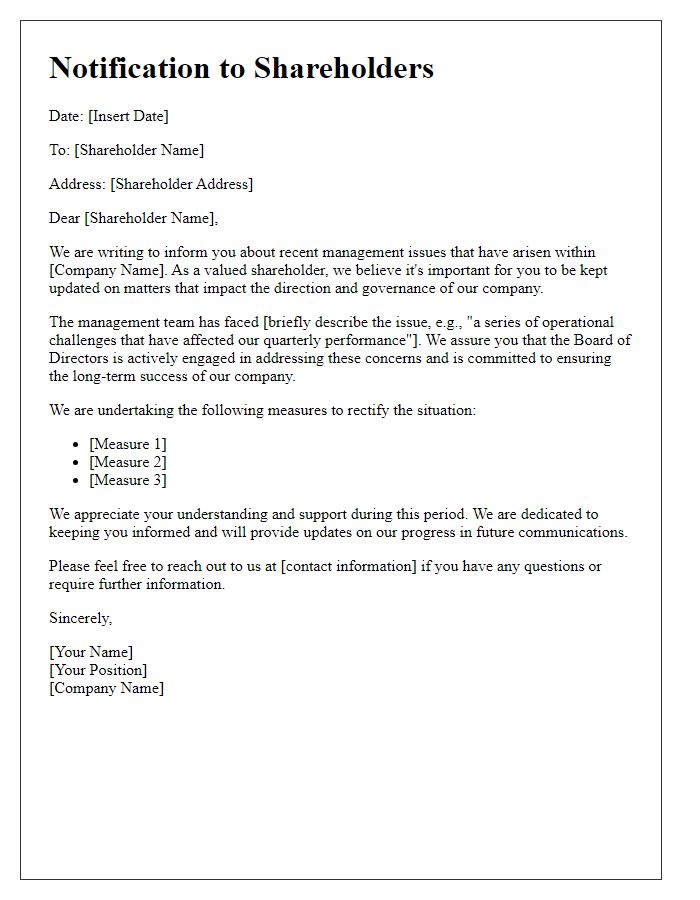

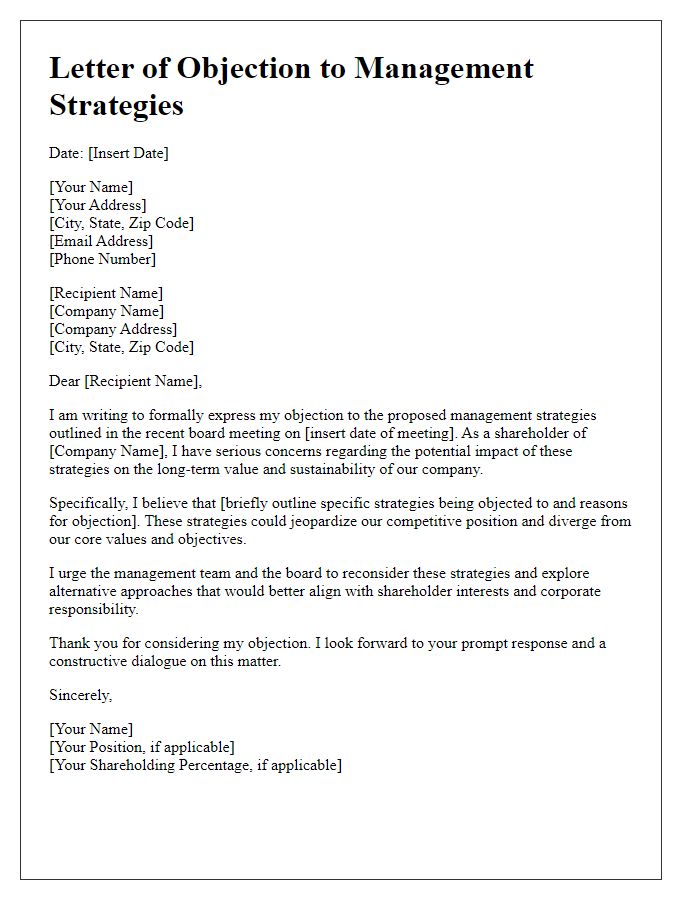

Letter Template For Shareholder Complaint About Management Samples

Letter template of shareholder expression of dissatisfaction with management

Comments