Dear Shareholder, we are excited to inform you about an upcoming rights issue that presents a unique opportunity for you to increase your ownership stake in our company. This move not only aims to bolster our financial position but also empowers you to invest further in our growth journey. We understand that the details are crucial, and we want to ensure you have all the information needed to make an informed decision. So, let's dive into the specifics of the rights issue and what it means for you as a valued shareholder.

Clear Subject Line

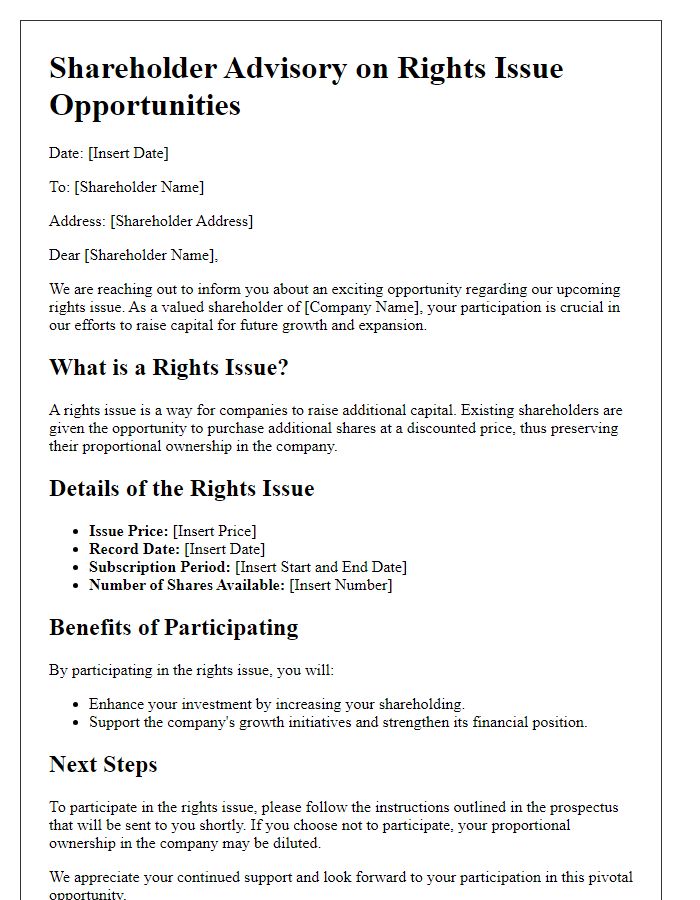

A rights issue allows existing shareholders to purchase additional shares in a company, typically at a discount, to raise capital. Shareholders may be notified through formal communications that outline the details of the rights issue. Such notifications usually include information about the number of shares available, the subscription price, and the timeline for exercising rights. This notification is crucial for shareholders to make informed decisions regarding their investments and maintain their ownership percentage in the company. It is essential to mention the impact of this rights issue on overall company performance, financial health, and future growth prospects to provide a comprehensive understanding of the situation.

Introduction and Purpose

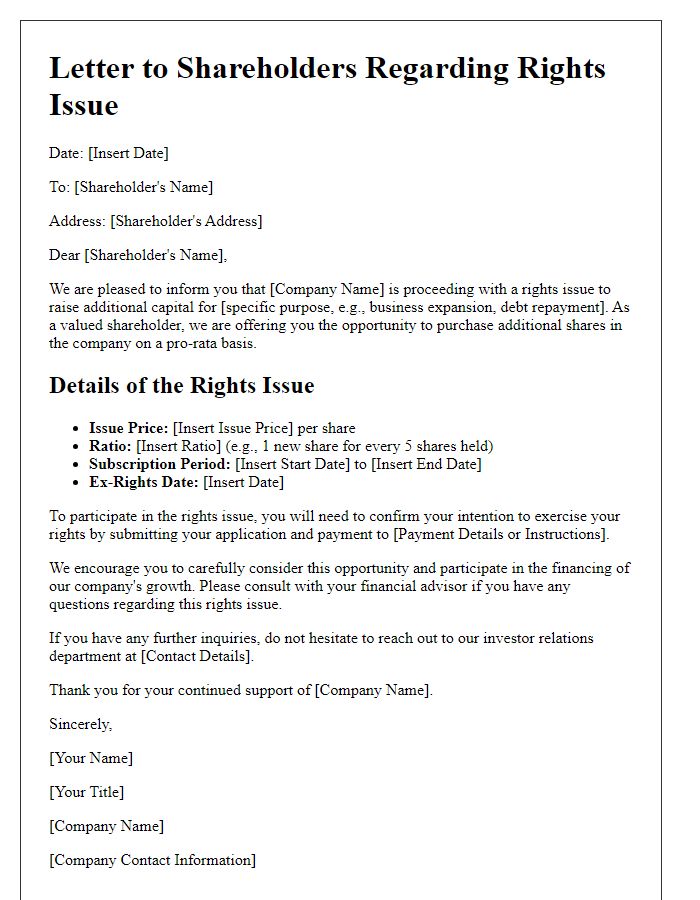

Shareholder notifications regarding rights issues play a crucial role in corporate governance, especially for publicly traded companies seeking to raise capital. A rights issue allows existing shareholders, such as individual and institutional investors, to purchase additional shares, often at a discounted price, ensuring their ownership percentage remains intact. The purpose of this notification is to inform shareholders about the opportunity to acquire these new shares, to provide details about the terms and conditions, including the number of rights allocated per existing share, the subscription price, and the timeline for participation. Transparency in this communication fosters trust and engagement within the shareholder community, reflecting the company's commitment to maintaining strong relationships with its investors.

Details of the Rights Issue

The rights issue presents an opportunity for existing shareholders to acquire additional shares at a predetermined price, typically below the current market value. In this specific rights issue, each shareholder will receive one additional share for every five shares currently held. The offering price is set at $10 per share, while the market price stands at approximately $15 per share. The total number of new shares available in this rights issue amounts to 1 million shares, aiming to raise a capital of $10 million. The rights issue will commence on November 1, 2023, and will conclude on November 30, 2023, providing a 30-day window for shareholders to exercise their rights. Funds raised will primarily be allocated towards debt reduction and strategic investments to enhance corporate growth.

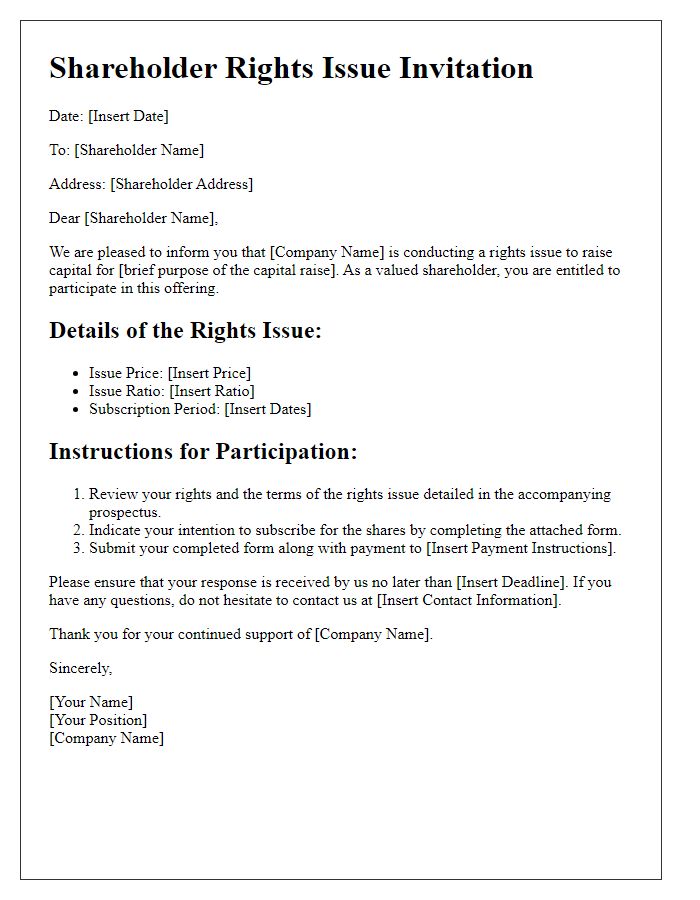

Instructions for Participation

A rights issue allows existing shareholders to purchase additional shares at a discounted rate, typically during times when companies seek to raise capital. Shareholders are officially informed of their eligibility to participate, typically through a formal notification highlighting important details such as the number of rights allocated per share (often expressed as a ratio like 1:5) and the set purchase price that is below market value (this can sometimes be around 20% lower). Shareholders must also be provided with specific instructions on how to exercise their rights, including deadlines for participation (often within a defined period of 14 to 30 days), method of payment, and where to submit documentation, usually outlined in the shareholder's communication channels, such as company websites and financial services platforms.

Contact Information for Queries

A rights issue provides existing shareholders the opportunity to purchase additional shares at a discounted rate, enhancing their investment and involvement in the company. The notification typically includes details such as the number of new shares available, the offering price set below the market value, and the allotted subscription period, often spanning several weeks. Shareholders are encouraged to contact the investor relations department of the company for queries, often through official email addresses or dedicated phone lines, ensuring clarity and transparency in the process. This notification aims to strengthen shareholder engagement and maintain sufficient capital for business growth and operational stability.

Letter Template For Notifying Shareholder About Rights Issue Samples

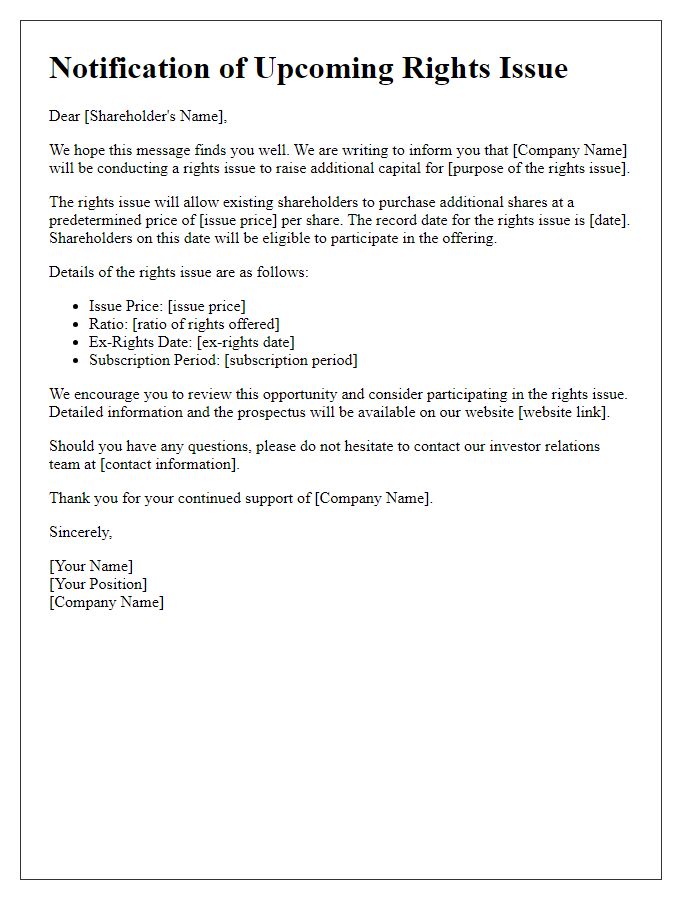

Letter template of shareholder notification regarding upcoming rights issue

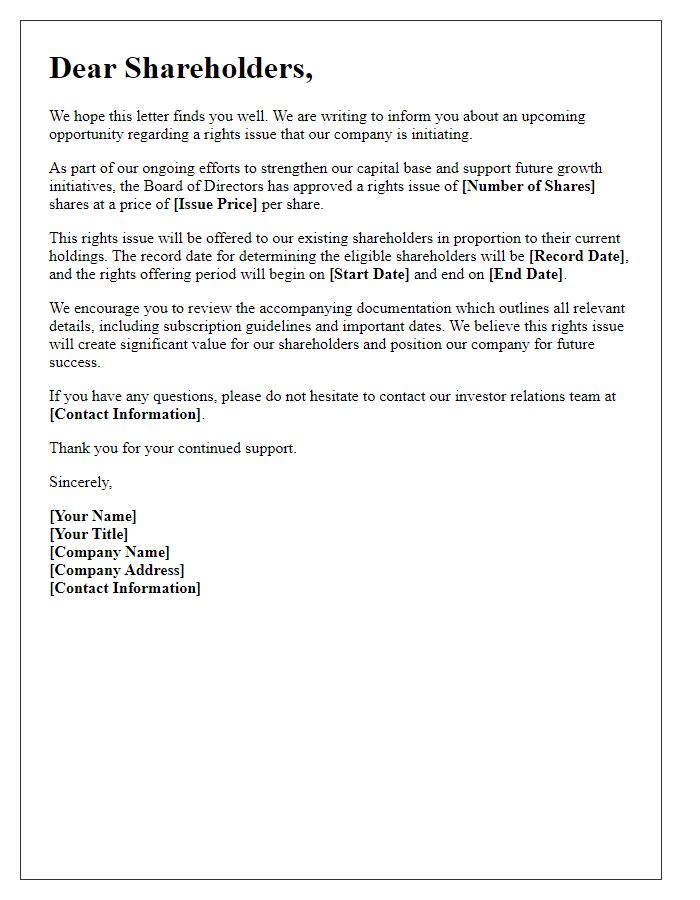

Letter template of formal communication about rights issue to shareholders

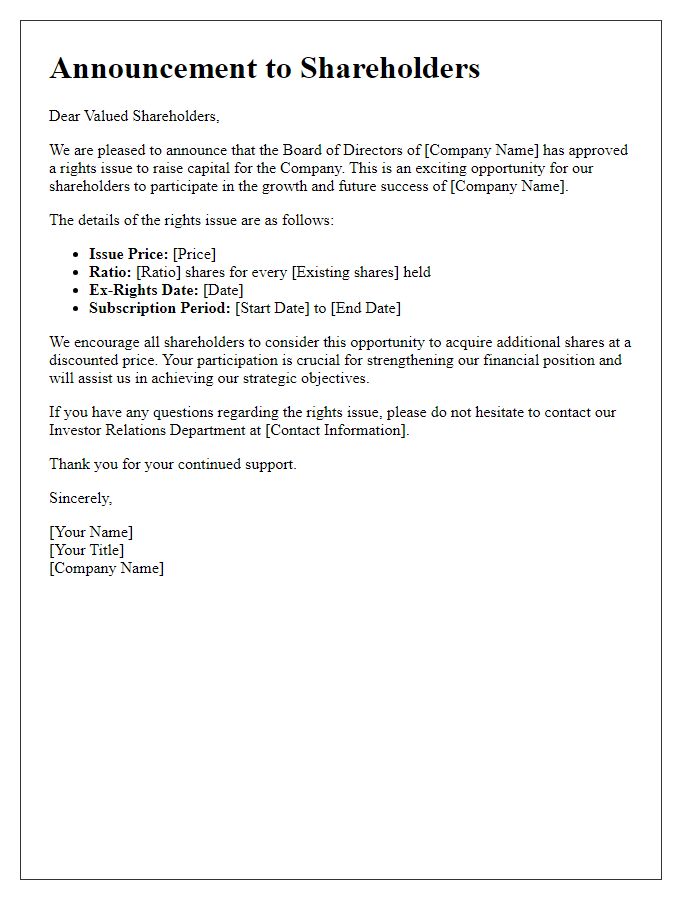

Letter template of announcement for shareholders concerning rights issue participation

Letter template of notification to shareholders about subscription rights

Comments