Have you ever faced the frustration of an online payment failure? It can be alarming when your transaction doesn't go through, especially when you're counting on that purchase to be completed. In this article, we'll guide you through understanding the common reasons behind payment issues and provide actionable steps to resolve them. Stick around to discover tips and tricks to navigate these hiccups with ease!

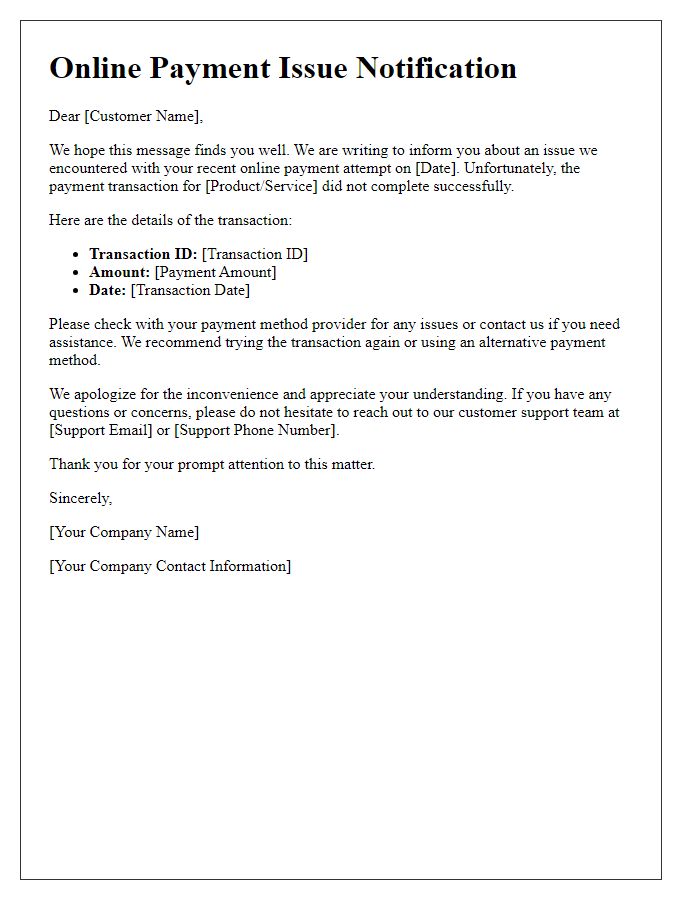

Account Information

Online payment failures can disrupt user experience, especially in e-commerce scenarios where immediate transaction completion is crucial. Reasons such as insufficient account balance or card expiration can lead to transaction denials. Payment processors, like PayPal or Stripe, may flag such issues, prompting error messages. Users often receive notifications containing essential details, such as transaction ID, attempted amount, and suggested actions. Maintaining accurate account information, including updated billing addresses and valid payment methods, is vital for seamless transactions. Users should check their bank statements regularly to avoid future discrepancies and ensure access to prompt customer support services for troubleshooting issues.

Transaction Details

Transaction failures can result from various issues such as insufficient funds, incorrect payment details, or technical glitches in the payment gateway. In October 2023, numerous users reported issues with credit card transactions on platforms like PayPal and Stripe. For instance, transactions over $100 frequently encountered errors due to security checks. It is crucial to check transaction details such as the amount, invoice number, and user account settings to troubleshoot the failure effectively. Additionally, verifying bank information and contacting customer support can expedite the resolution of such issues.

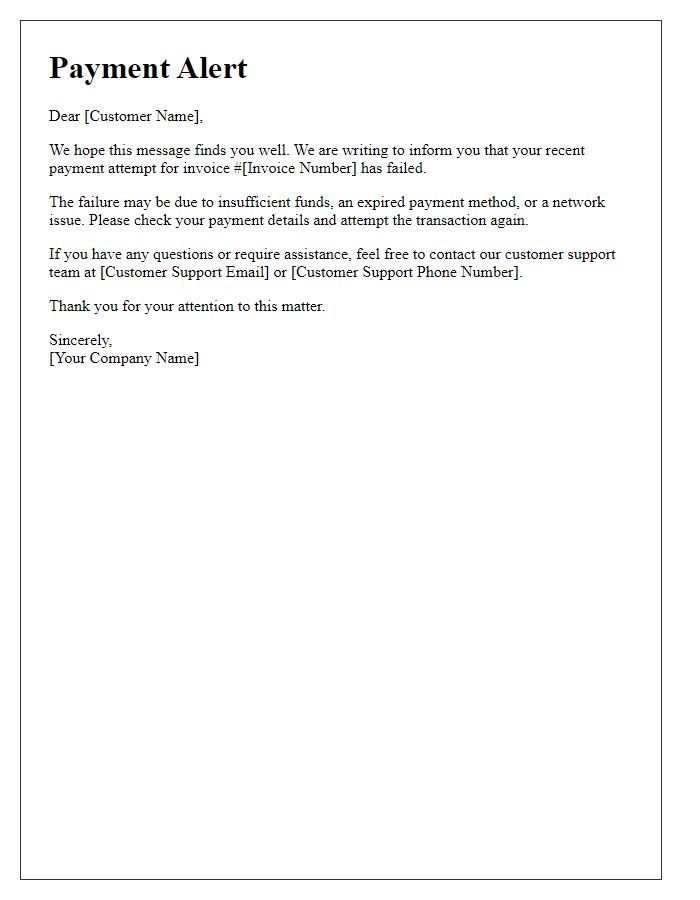

Reason for Payment Failure

Payment failures can occur due to various reasons impacting transaction completion, such as insufficient funds in the bank account or on the credit card, invalid payment method details like outdated expiration dates, or exceeded credit limits. Issues related to credit card verification can also lead to payment failures, including discrepancies in billing address or CVV code. Additionally, technical errors from the payment gateway or network connectivity issues can interfere with processing the transaction, resulting in a delay or outright failure of the payment. Users may also encounter restrictions due to fraud detection systems flagging unusual transactions, prompting the need for additional verification steps to ensure security.

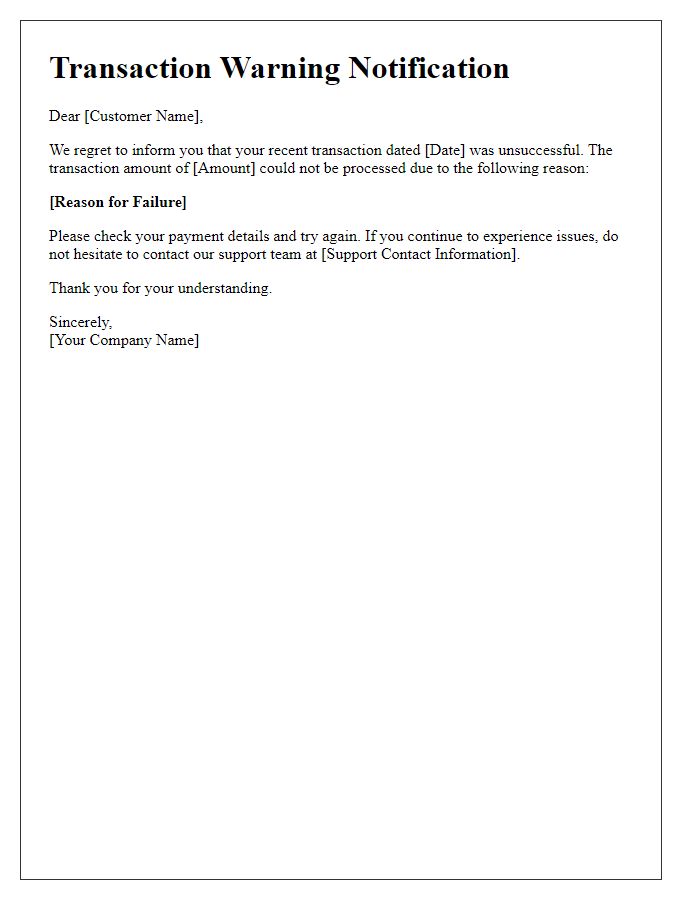

Next Steps or Instructions

Online payment failures can occur due to various reasons, including insufficient funds or incorrect payment information. When a transaction fails, the system typically sends a notification to the user detailing the issue. Users are advised to verify their banking details, check the transaction limits set by their banks, or ensure that their credit card (such as Visa or MasterCard) has not expired. Instructions usually include steps to retry the payment process, contact customer support (potentially via a hotline number or email), or explore alternative payment methods (like PayPal or bank transfer). Additionally, users may need to review their account status to ensure no holds or restrictions are affecting their ability to process payments.

Contact Information for Support

Online payment failures can lead to customer frustration and confusion. When a transaction, such as an e-commerce purchase from platforms like Shopify or WooCommerce, fails, it's crucial to provide clear support contact information. Customers should be informed about the failure and guided to support teams who can assist, typically accessible through email (like support@company.com) or customer service hotlines (such as 1-800-123-4567). Utilize a dedicated support portal or chatbot for immediate assistance. Providing accurate hours of operation, such as Monday to Friday, 9 AM to 5 PM EST, enhances customer experience. Making this information visible on the website or transaction confirmation emails promotes quick resolution of payment issues.

Comments