Are you ready to take the next step in your financial journey? Securing a credit account can open up a world of opportunities, from making essential purchases to building your credit history. In this article, we'll guide you through the pivotal stages of credit account approval and share tips on how to increase your chances of a successful application. So, let's dive in and explore what you need to know!

Applicant's Name and Contact Information

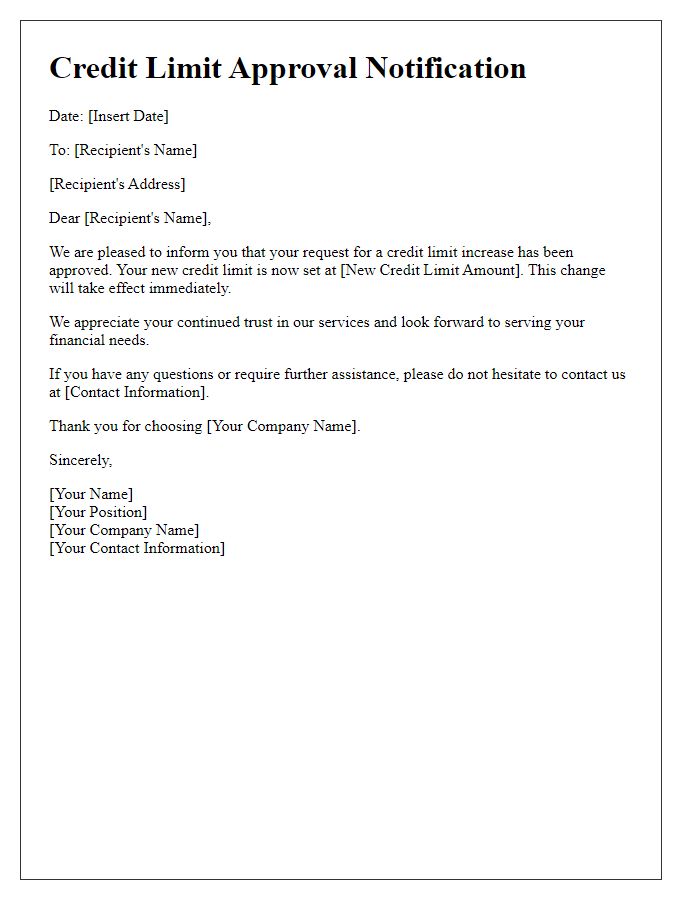

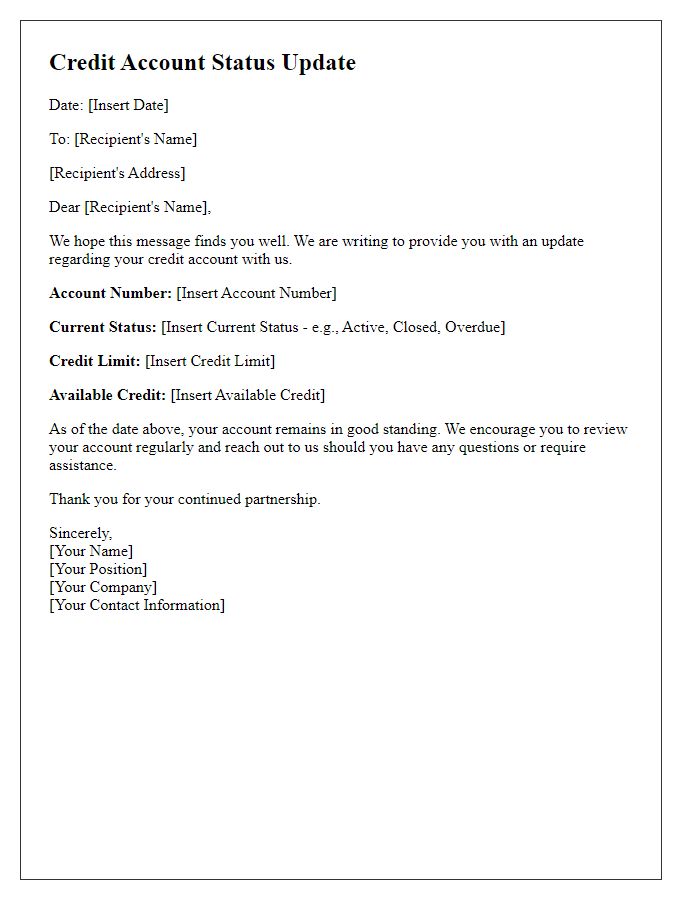

The credit account approval process can greatly influence an individual's financial options and future purchases. Applicants for credit accounts, such as credit cards or personal loans, often provide personal information including their name, address, phone number, and email for verification purposes. Financial institutions regularly assess factors like credit score, income, and debt-to-income ratio to determine eligibility. Upon approval, applicants receive communication detailing credit limits, interest rates, and repayment terms, essential for managing their accounts responsibly. Timely updates and clear communication from the credit provider enhance customer satisfaction and foster trust in the financial system.

Credit Limit and Terms

Your credit account approval communication typically outlines key terms such as the credit limit, interest rates, payment schedule, and account management options. The credit limit, which specifies the maximum amount available for borrowing, often varies based on the applicant's credit history, typically ranging from $500 to $50,000. Interest rates may fluctuate based on market conditions, averaging between 10% to 30% APR. Payment terms usually involve monthly installments, with due dates set on the same day each month. Additionally, account management tools, such as mobile app access or online account portals, offer customers real-time tracking of transactions, remaining credit, and the ability to make payments. Clear communication of these details ensures transparency and helps account holders manage their finances effectively.

Approval Date

The approval date indicates the specific point in time when a credit account application receives confirmation for processing. For instance, a credit card application might receive approval on February 10, 2023, marking the beginning of the account's activity timeline. This date plays a crucial role in establishing the validity of the account, influencing payment schedules and billing cycles. Moreover, it sets the stage for credit utilization metrics and impacts the overall credit score of the applicant. Additionally, the approval date is significant for any promotional offers, such as introductory interest rates or cashback incentives, typically valid within a designated period post-approval.

Payment Instructions and Schedule

An effective payment instruction and schedule can enhance understanding and adherence for new credit account holders. When approved for a credit account, customers generally receive a welcome packet containing clear payment instructions that outline the steps for making monthly payments. Standard payments typically occur monthly, on a predetermined date such as the 15th of each month. Customers often have the option to set up automatic payments via bank transfer or credit card for convenience. In addition, access to an online portal (like MyAccount.com) usually enables users to view statements, update payment methods, and check balances easily. Late payment fees of approximately $35 may apply if payments are not received by the due date. A detailed schedule serves to remind customers of their payment commitments, facilitating timely and responsible credit usage.

Customer Service Contact Details

Effective customer service contact details are essential for facilitating communication regarding credit account approval processes. A dedicated customer service hotline, often accessible via a toll-free number during business hours or through an online chat feature, ensures prompt responses. Email support can provide further assistance, allowing customers to send inquiries directly to a designated email address (e.g., support@company.com) for specific issues. Physical addresses may be necessary for sending documentation or correspondence regarding credit applications, with corporate headquarters typically located in major cities such as New York, Chicago, or Los Angeles. Social media platforms (like Facebook and Twitter) also serve as valuable tools for customers seeking updates or assistance related to their credit accounts.

Comments