Are you feeling overwhelmed by your mortgage payments and looking for a way to ease your financial burden? Negotiating with your lender can seem daunting, but it's a crucial step towards finding a suitable repayment plan that works for you. In this article, we'll guide you through essential tips and strategies for approaching your mortgage lender effectively. So, if you're ready to take control of your mortgage situation and explore your options, keep reading!

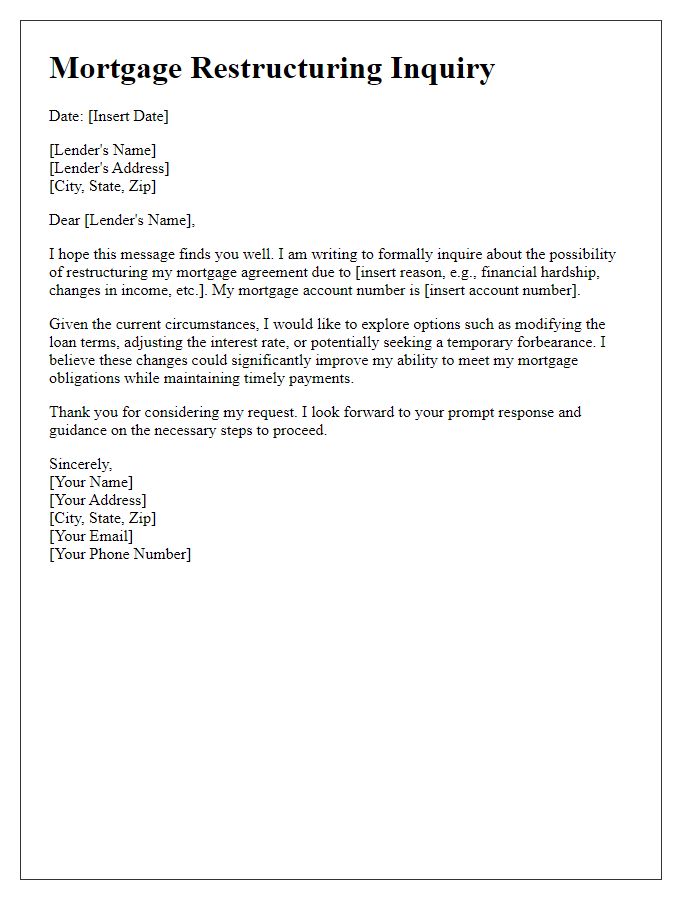

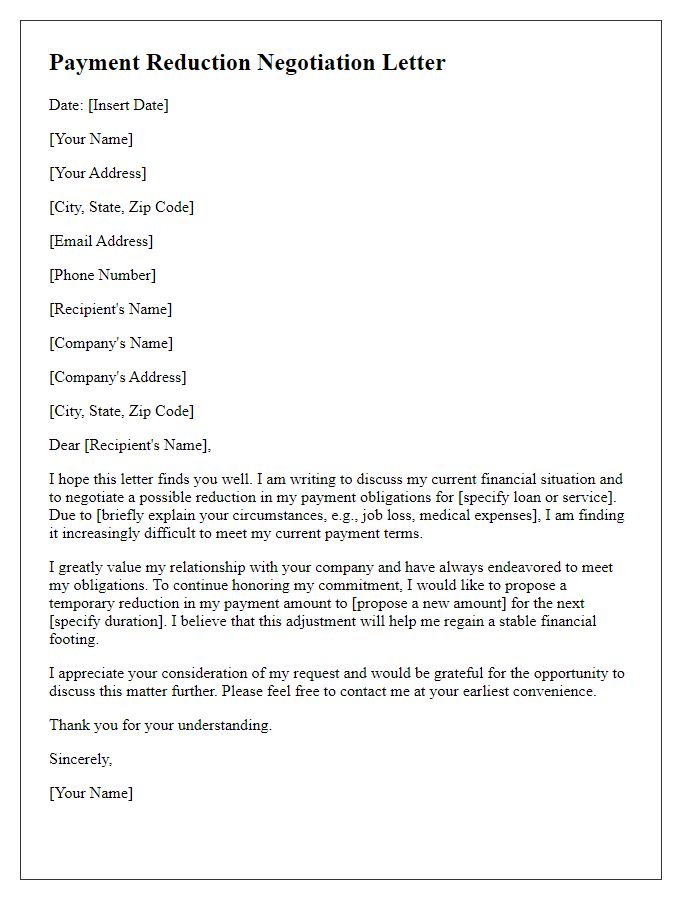

Personal Information and Contact Details

Individuals seeking mortgage repayment negotiation often need to compile essential personal information and contact details. This includes full name, date of birth, and Social Security number for identity verification. Important documents like property address, loan account number, and lender information must also be included. Current contact details covering phone number, email address, and mailing address facilitate direct communication with the mortgage company. It is crucial to also reference the specific circumstances leading to the repayment negotiation request, such as job loss, medical emergencies, or other financial hardships.

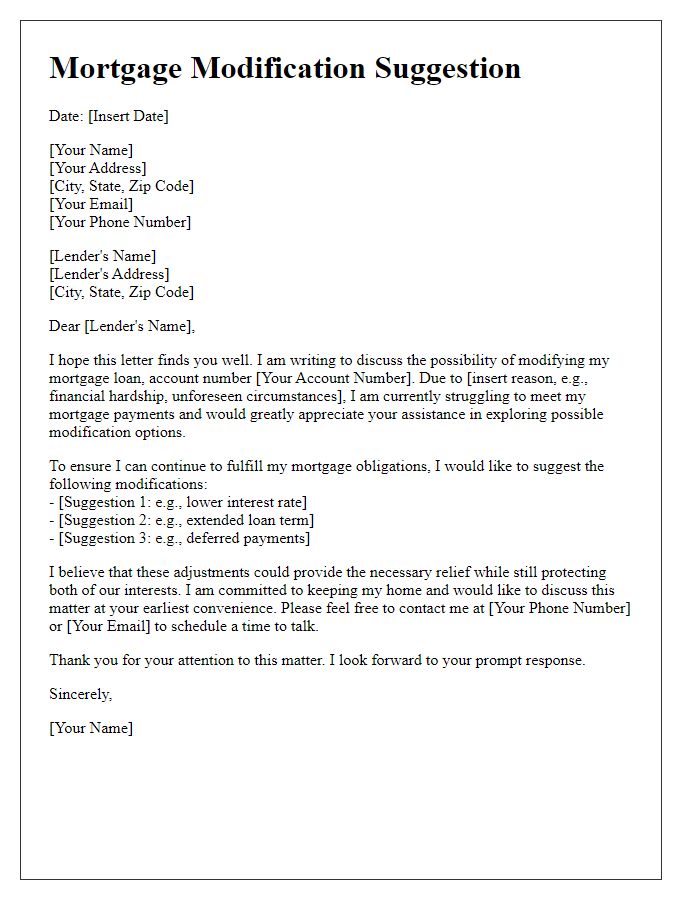

Current Loan and Repayment Terms

Current mortgage loan terms usually include principal amount, interest rate, and repayment schedule. For example, a standard 30-year fixed-rate mortgage might have a principal of $250,000 at an interest rate of 4.5%. Monthly repayments based on this term would total approximately $1,266, including principal and interest. Homeowners may seek to negotiate these terms due to financial hardship or changes in economic conditions, such as increased living costs or changes in employment status. Consulting with mortgage servicers, financial advisors, or housing counselors can provide options for restructuring the loan, potentially resulting in a lower monthly payment or extending the loan term for better manageability.

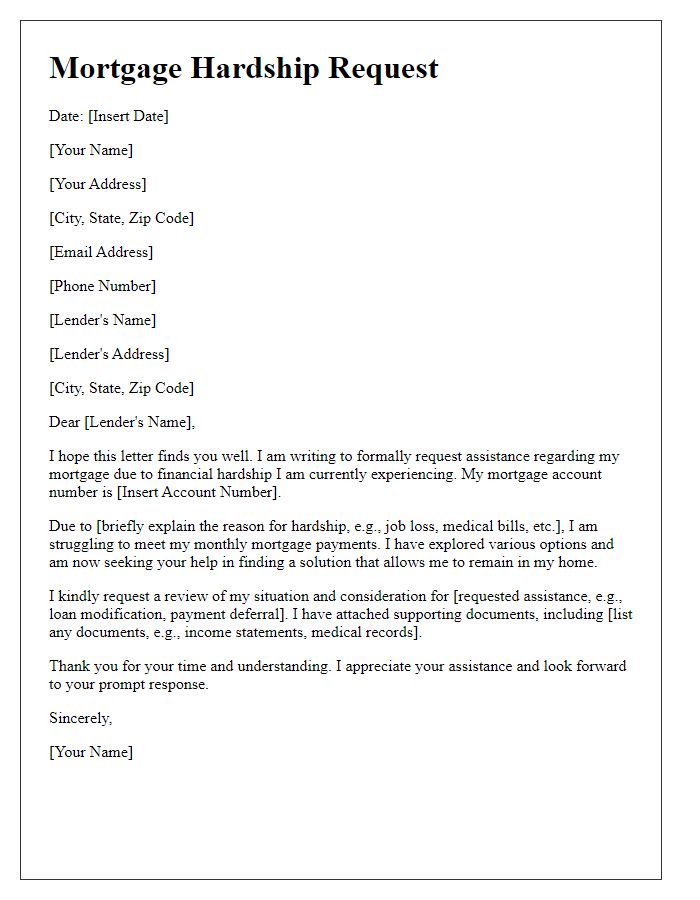

Justification for Request (Financial Hardship or Changes)

Homeowners facing mortgage repayment challenges often encounter financial hardships due to unexpected life changes, such as job loss or medical emergencies. These events can lead to significant decreases in income or increases in expenses, making it difficult to keep up with monthly mortgage payments. For instance, a homeowner previously earning $75,000 per year might experience a job loss, resulting in a drastic reduction in income. Additionally, rising living costs, especially in high-rent areas like San Francisco, can further strain finances. Mortgage companies often have programs to assist borrowers in distress, including repayment plans or loan modifications. Documentation of financial hardship, such as unemployment letters or medical bills, is typically required to support requests for assistance. Understanding these factors is essential for lenders to evaluate and negotiate reasonable repayment options for affected homeowners.

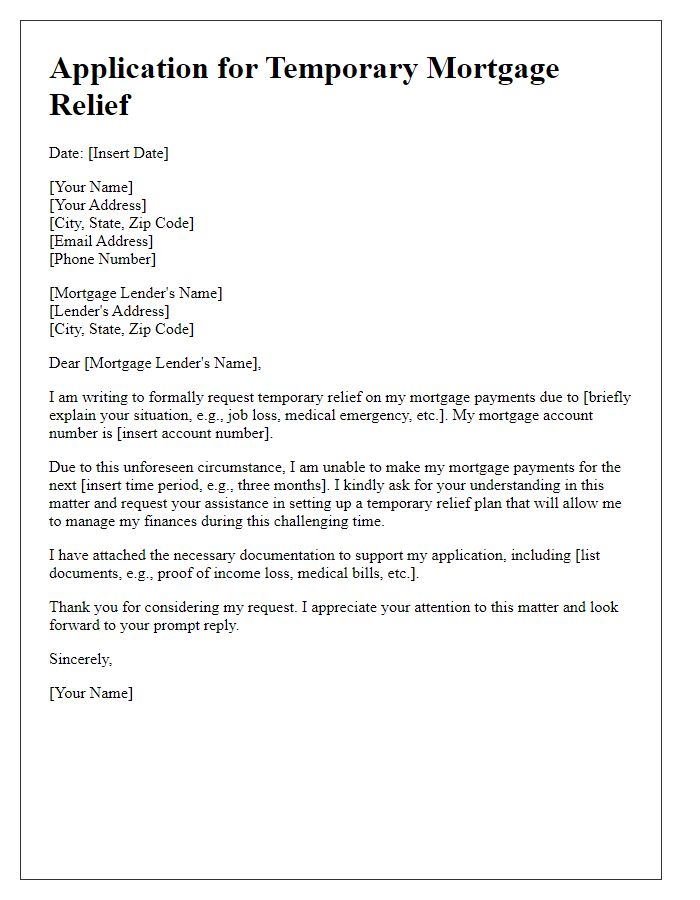

Proposed New Repayment Plan

Negotiating a new mortgage repayment plan can help homeowners manage their finances more effectively during challenging times. A proposed new repayment plan may include adjusting the monthly payment amount, extending the loan term, or temporarily reducing payments. For example, a homeowner facing financial difficulties may request a reduction from $1,500 to $1,200 for a six-month period. Additionally, incorporating a grace period or deferment may provide immediate relief. Interested parties, such as banks or mortgage lenders like Bank of America or Wells Fargo, often consider such proposals, especially when presented with a clear rationale indicating financial hardship. Open communication with the mortgage servicer can facilitate a mutually beneficial agreement, helping homeowners avoid default or foreclosure.

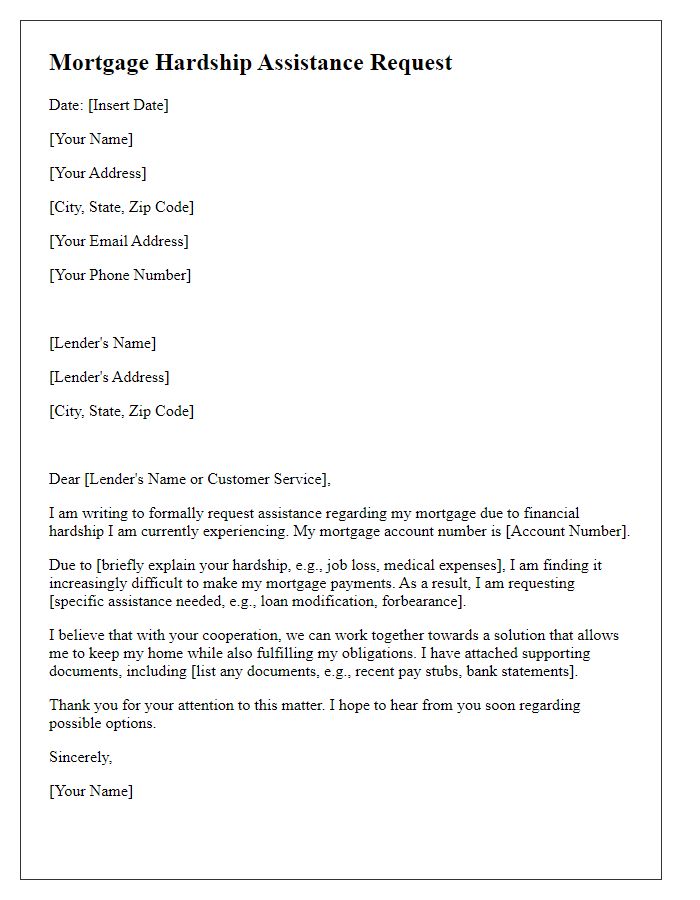

Supporting Documentation and Evidence

In mortgage repayment negotiations, supporting documentation and evidence play a crucial role in presenting a compelling case to lenders. Essential documents include a detailed financial statement showcasing monthly income and expenditures, which helps illustrate the borrower's current financial situation. Tax returns from the past two years provide insight into overall earnings and consistency. Bank statements, particularly from the last three months, demonstrate cash flow and savings patterns. Furthermore, a hardship letter outlining the specific circumstances leading to the need for negotiation, such as job loss or medical expenses, adds a personal touch. Additional evidence may comprise any correspondence with creditors or proof of unemployment benefits, reinforcing the message of financial strain. These elements collectively create a robust foundation for the negotiation process.

Comments