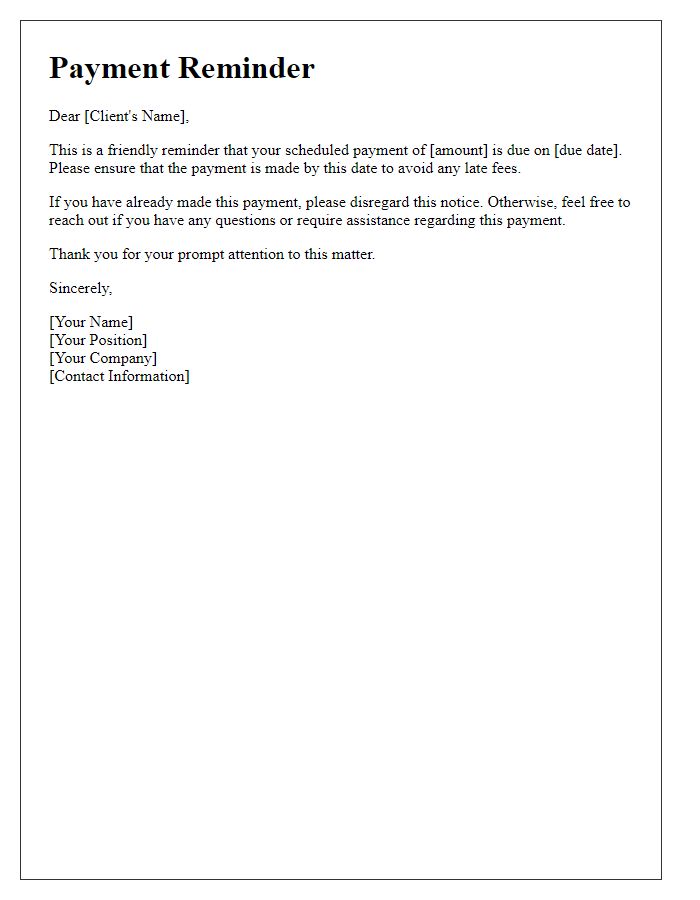

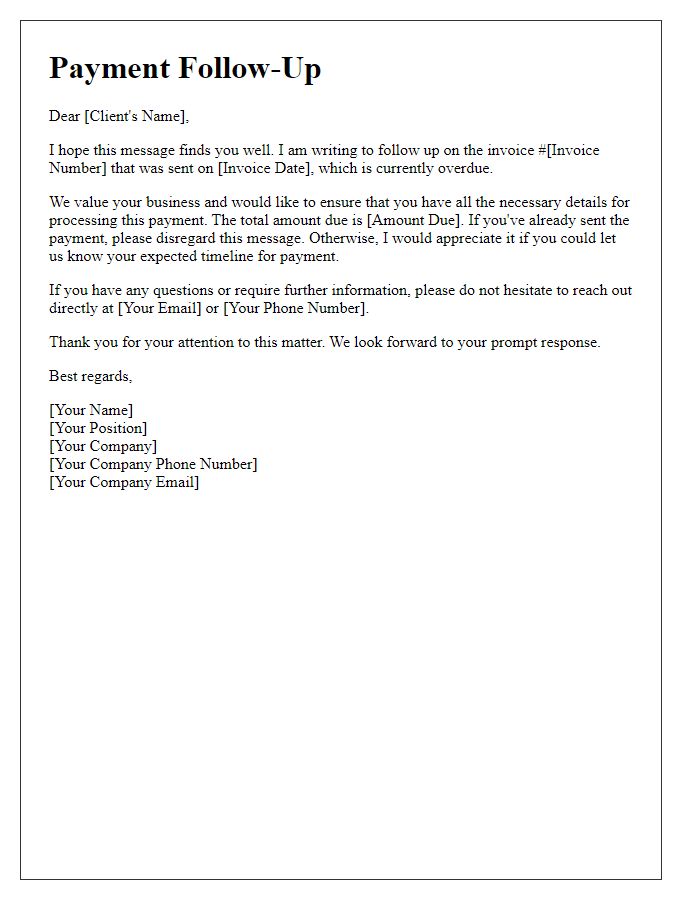

Hey there! We all know that managing payments can sometimes get a bit overwhelming, especially when life gets busy. That's why we've crafted a simple and effective letter template just for you - to gently remind your clients about outstanding payments while keeping the tone friendly and professional. If you're ready to streamline your payment reminders and enhance your client communication, keep reading to discover our easy-to-use template!

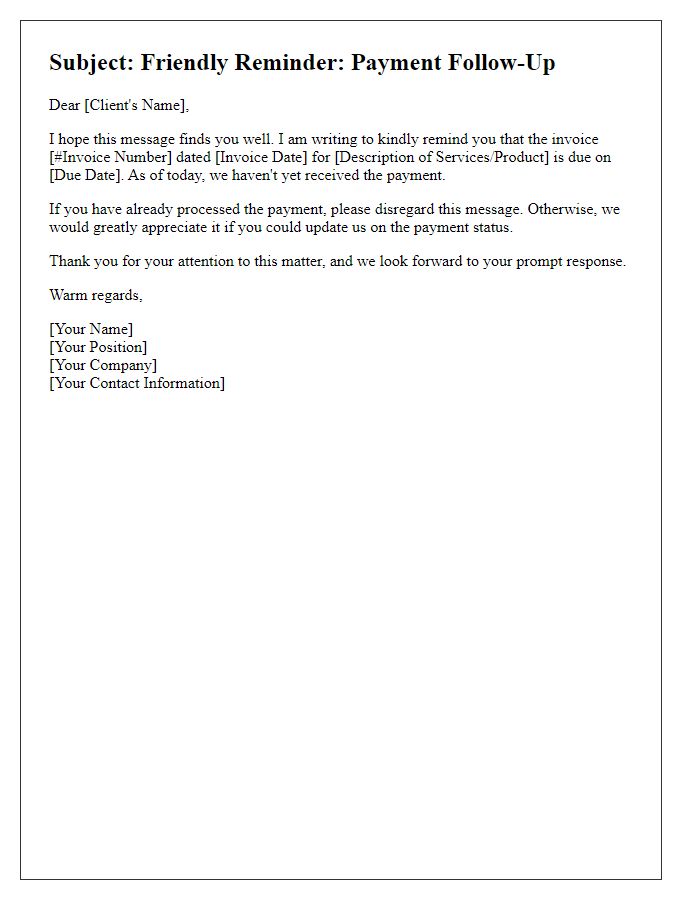

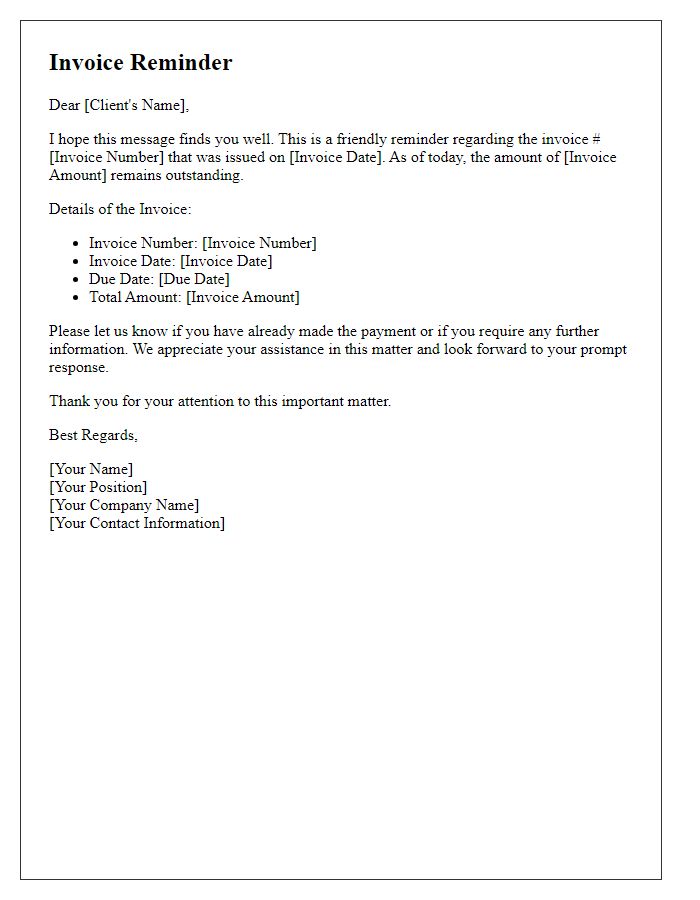

Subject Line Optimization

A well-crafted subject line is crucial for ensuring that a client payment reminder notice captures attention effectively. Using a concise and clear approach can enhance engagement and prompt a swift response. Consider using phrases such as "Friendly Reminder: Payment Due on [Date]" or "Action Required: Invoice #[Invoice Number] Payment Reminder." Including a specific date creates urgency, while mentioning the invoice number streamlines recognition of the payment in question. This strategy not only showcases professionalism but also reinforces importance, increasing the likelihood of timely payment.

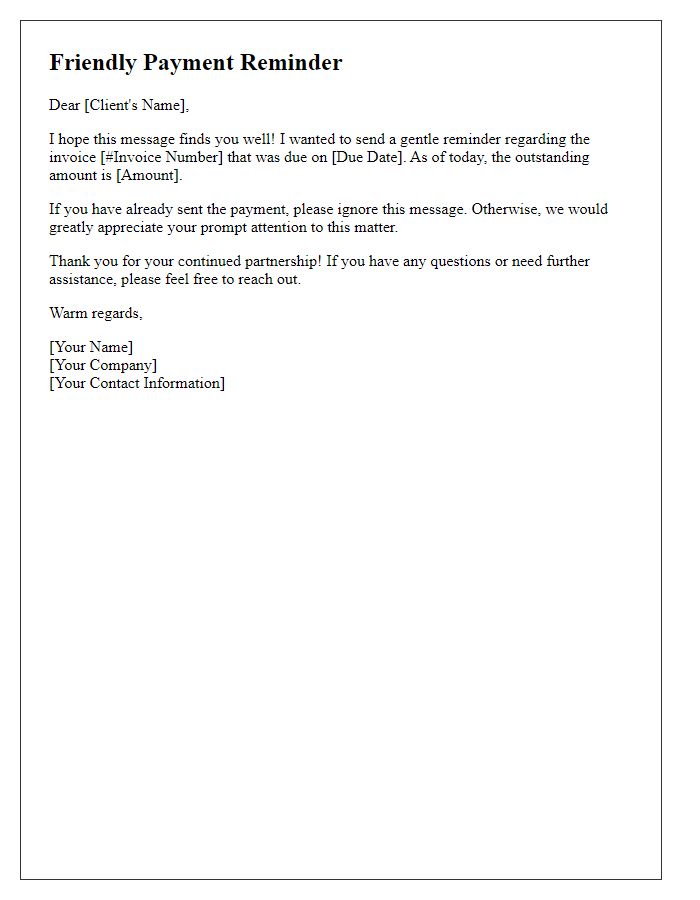

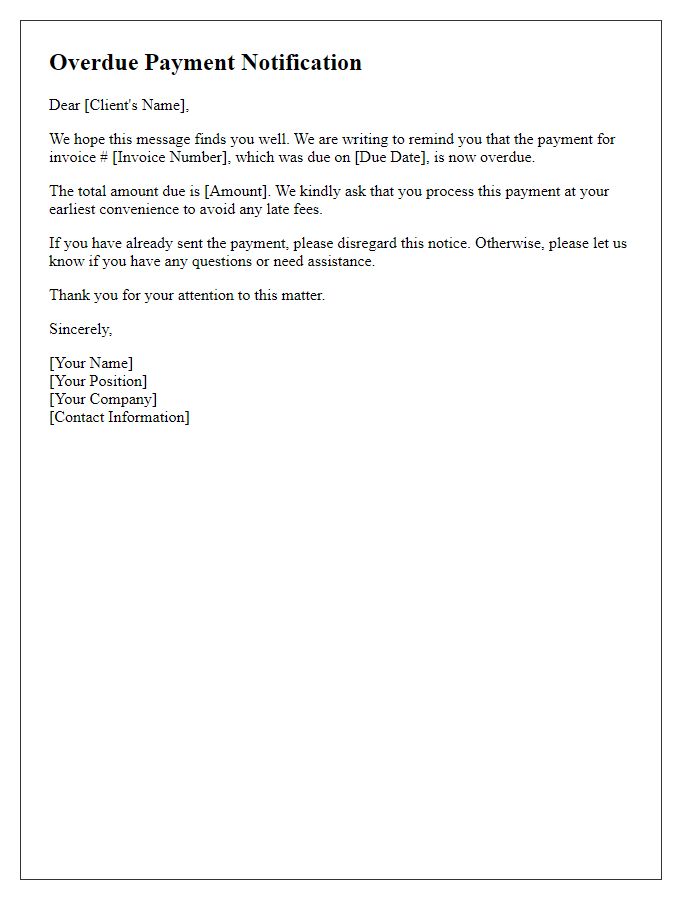

Clear and Polite Language

A payment reminder notice serves as an essential communication tool for businesses, ensuring timely collection of outstanding invoices. Sending a notification can result in improved cash flow, crucial for maintaining operational efficiency. A well-crafted reminder includes key details, such as the invoice number, the original due date, and the outstanding amount, providing clients with clarity. Additionally, a courteous tone fosters positive client relationships, encouraging prompt payment while minimizing potential disputes. Including contact information enhances accessibility for clients seeking clarification or discussing payment options, further strengthening business relations.

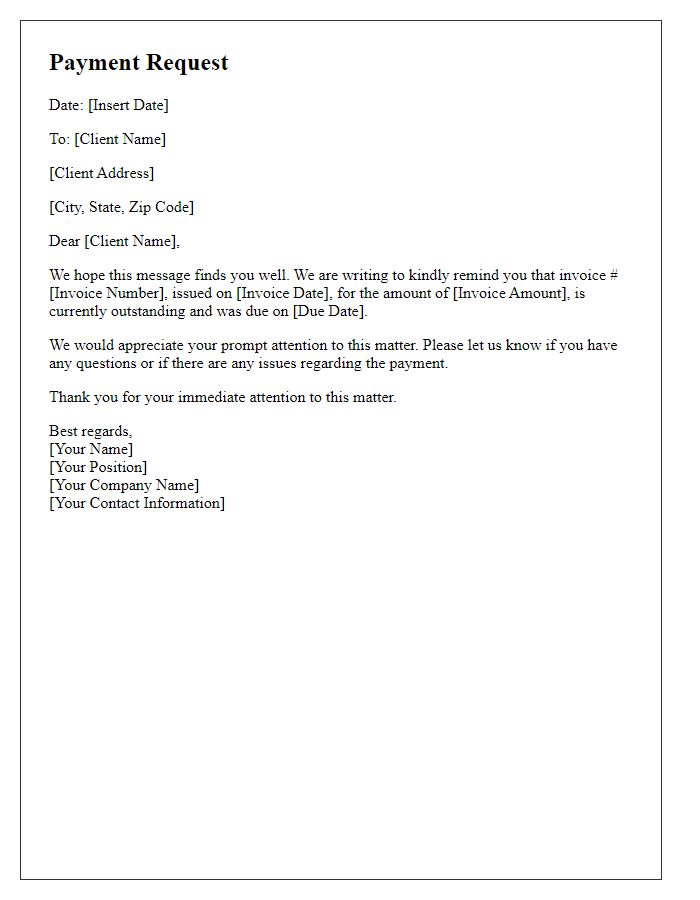

Specific Payment Details

Timely client payment reminders are crucial for maintaining a healthy cash flow in business operations. When a client invoice remains unpaid past the due date, it may lead to cash flow challenges. Specific payment details such as invoice number (#12345), due amount ($500), and due date (August 30, 2023) should be included in reminders. Additionally, referencing the services rendered (consulting services for project X) provides context for the payment request. Offering accepted payment methods (bank transfer, credit card, PayPal) facilitates easier transactions. Clear communication enhances client relationships while ensuring obligations are met efficiently.

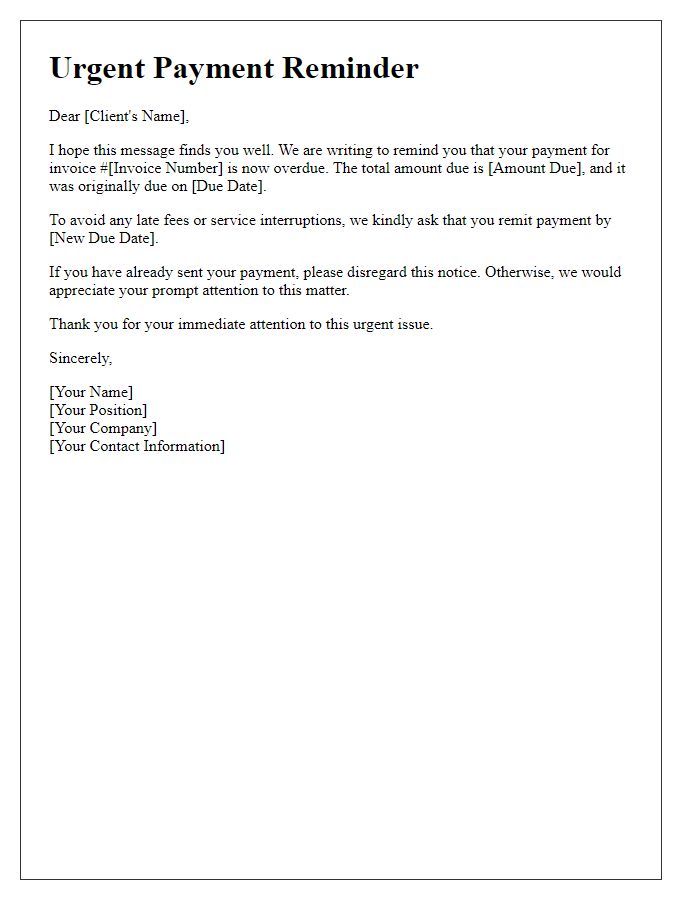

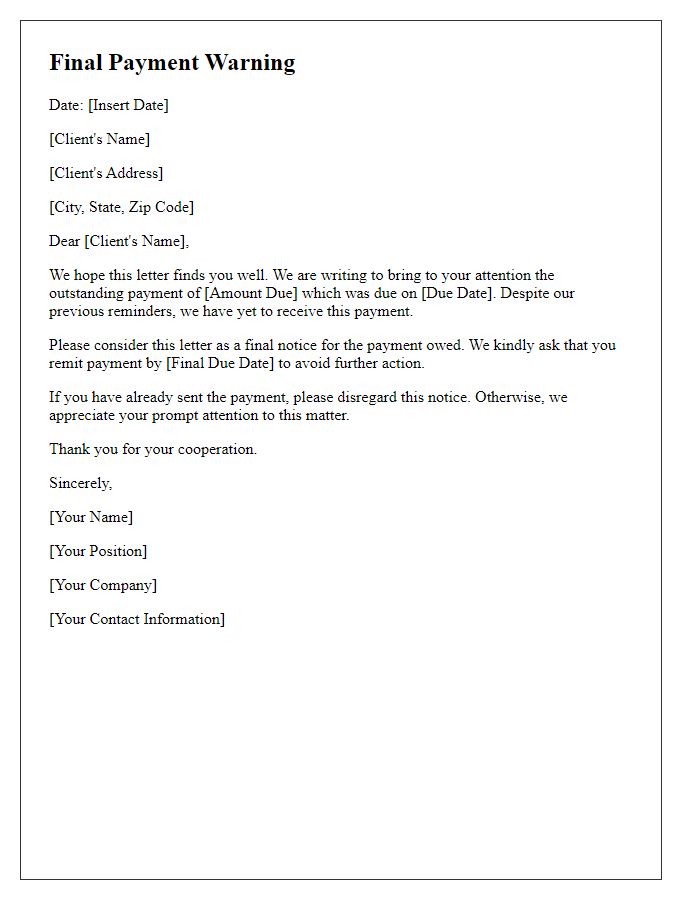

Call-to-Action

A client payment reminder notice encourages prompt action for outstanding invoices from businesses, fostering positive cash flow. Many companies issue reminders after 30 days of the invoice date, referencing specific amounts owed. Clear policies typically state late fees can apply if payments exceed 60 days. Effective reminders include payment methods, such as bank transfers or credit cards, detailing due dates to create urgency. Using a friendly yet professional tone can enhance client relationships, ensuring timely responses. Essential information like invoice numbers and contact details should be prominently featured, making it easier for clients to locate their obligations.

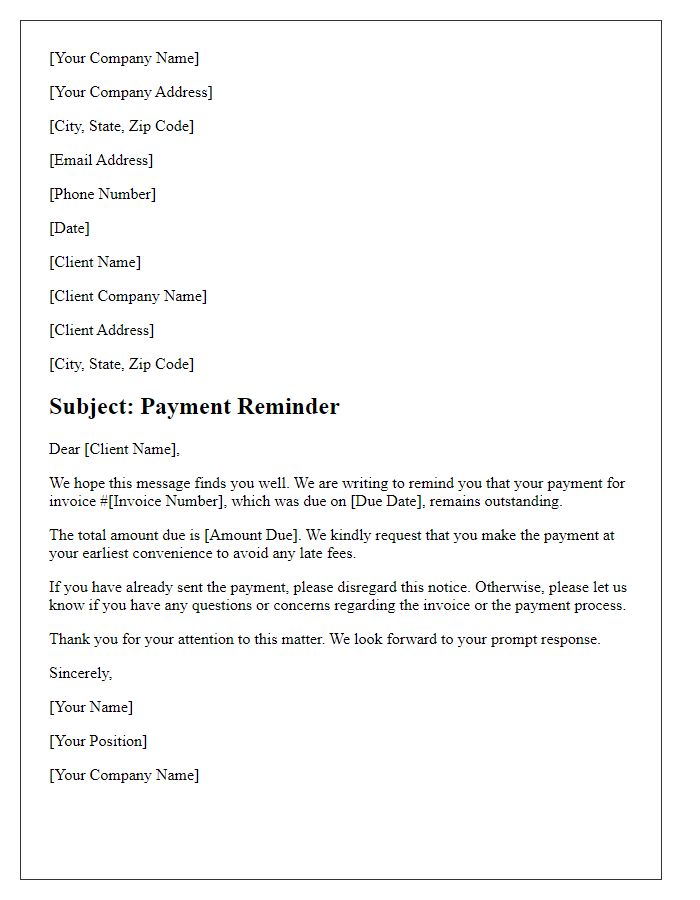

Contact Information

In the realm of client payment reminders, ensuring clarity in contact information plays a crucial role. Accurate details include the company name, office address, and telephone numbers such as (555) 123-4567, ideally located in the city of Springfield, USA. The email address, for instance, accountsreceivable@yourcompany.com, should also be highlighted to facilitate quick communication. Furthermore, specifying a particular contact person, such as John Smith, Accounts Manager, enhances the personalization of the message, thus encouraging timely responses regarding overdue invoices. Other significant components include the due date for payment, which may be positioned prominently, ensuring that clients are aware of their timelines and obligations without confusion.

Comments