Are you feeling a bit overwhelmed by your upcoming property tax payment? You're not alone; many homeowners find this time of year can be stressful. In this article, we'll break down what you need to know about property tax notices, from understanding your bill to tips for timely payment. So, if you're ready to simplify your tax experience, read on for more insights!

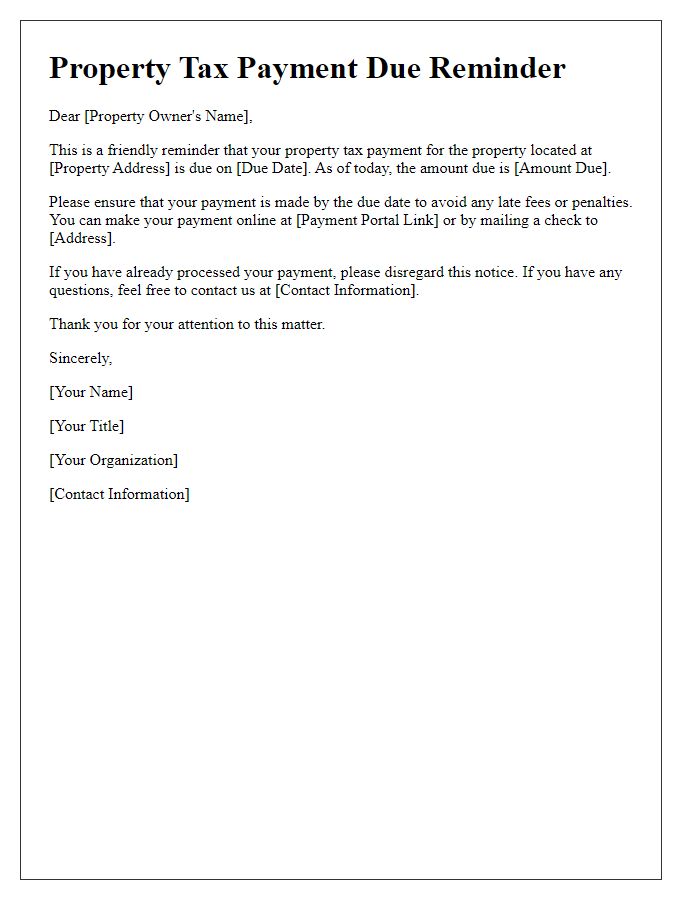

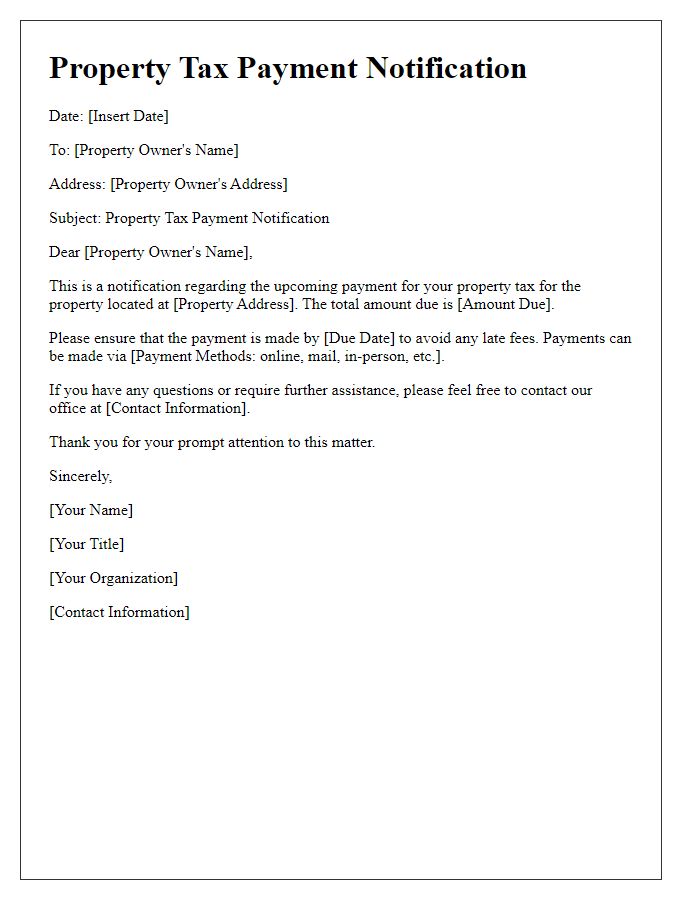

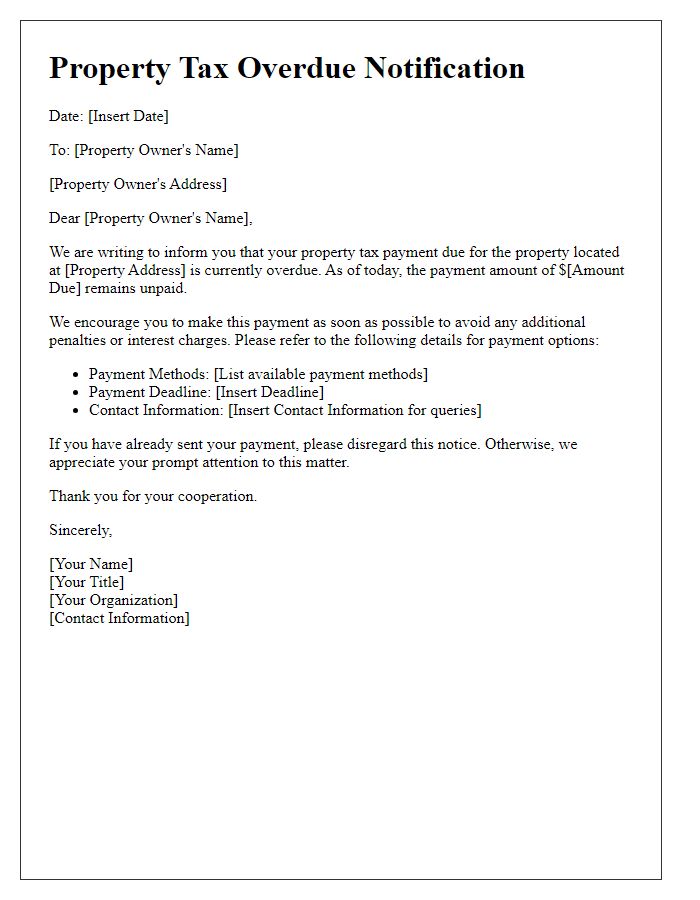

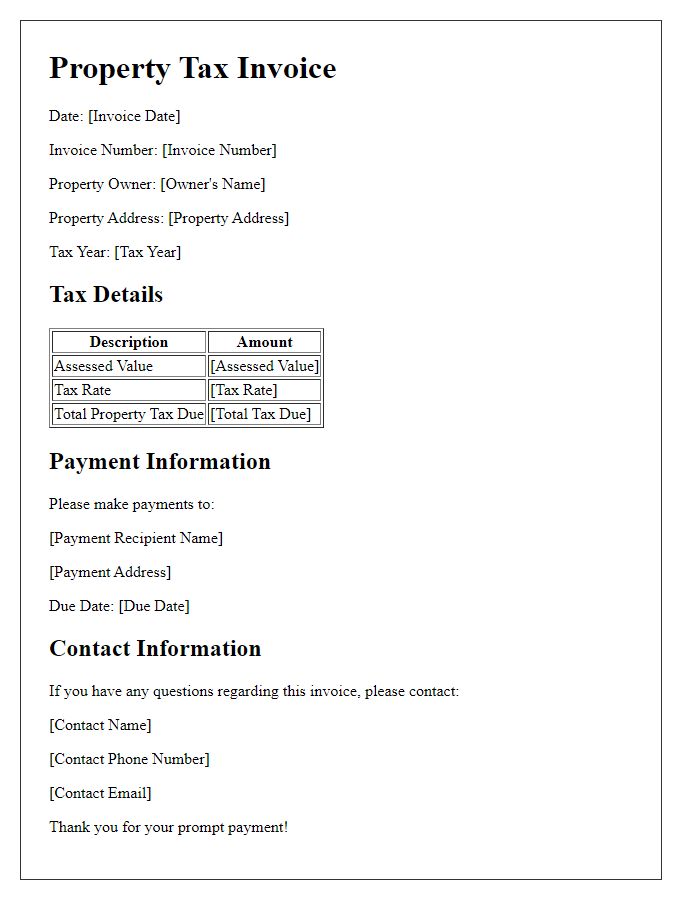

Sender and recipient information.

A property tax payment notice includes critical information for both the sender and the recipient. The sender typically consists of the local government tax authority, such as the County Tax Assessor's Office, located in a specific jurisdiction (for example, Los Angeles County, California). The sender's address, including the ZIP code for accurate mail delivery, is essential. The recipient refers to the property owner, which could be an individual or a business entity, requiring their full name and mailing address, including ZIP code. The tax notice contains important details such as the property identification number, assessed value, and the payment due date along with any penalties for late payment. This structured information ensures clarity, timely communication, and compliance with local tax regulations.

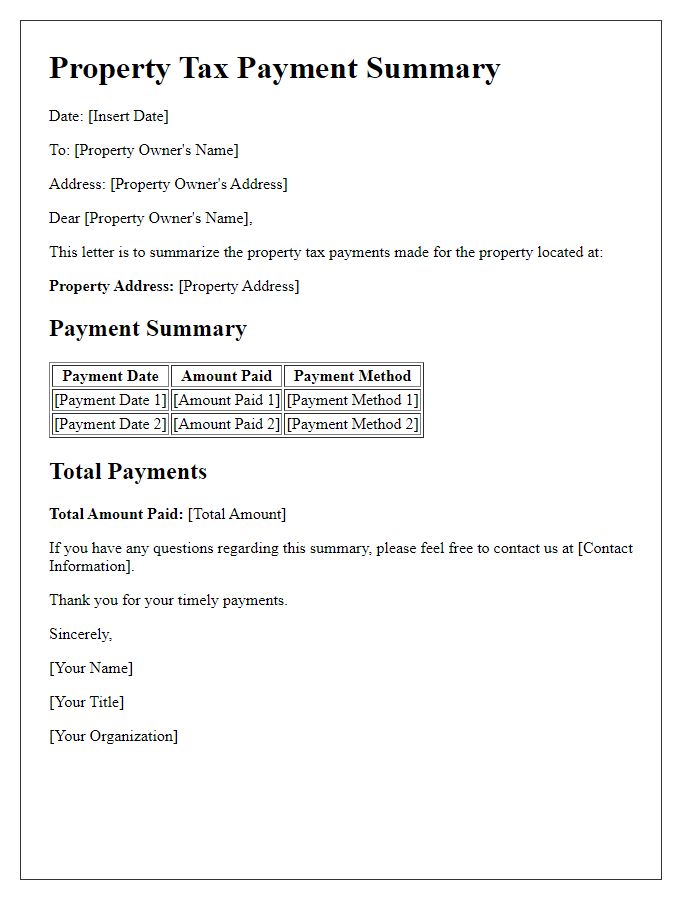

Payment due date and amount.

Property tax payment notices are vital documents for homeowners, detailing the financial obligations associated with real estate ownership. These notices typically specify the due date, often set for December 31st or other designated date by local municipalities, and outline the payment amount, which can vary significantly based on property value assessments conducted by city or county officials. Local tax authorities frequently provide this information through mail or electronic communication, ensuring transparency in government revenue collection practices. Failure to meet the specified payment deadline may result in penalties, interest, or liens being placed on properties, underscoring the importance of adhering to these timelines for financial stability.

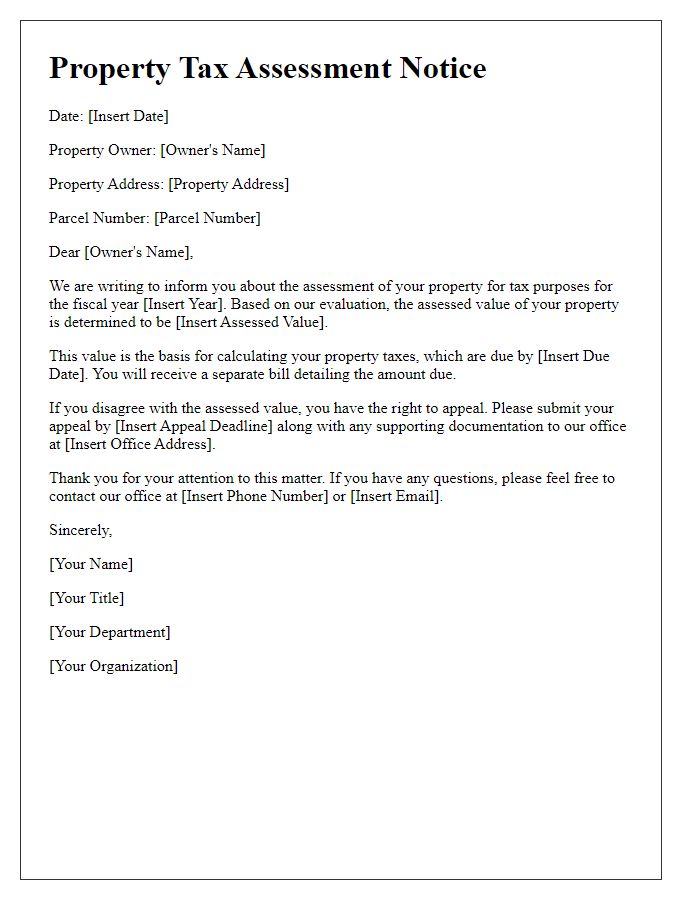

Property identification or parcel number.

Property tax payment notices typically include essential details such as the unique property identification number (PIN) or parcel number, which serves as a vital reference for tracking specific properties within municipal records. For example, in New York City, the property identification number consists of a unique 10-digit code that identifies each property within the city's tax database. Additionally, municipalities often require tax payments to be completed by specific due dates, such as January 31st and July 31st in many counties, to avoid penalties. Clear communication regarding the amount due, payment methods accepted (e.g., online payment, mail), and potential late fees is crucial for maintaining compliance with local tax regulations.

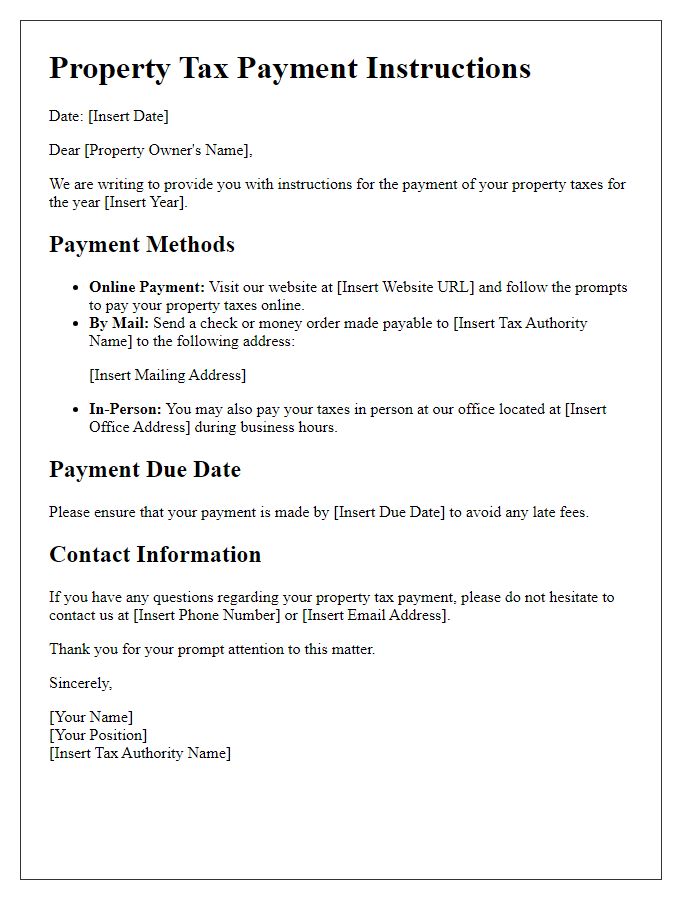

Payment methods and instructions.

Payment of property taxes can be made using various methods, each designed to facilitate timely compliance with local regulations. Online payment through official city websites offers convenience with immediate transaction confirmation, often supported by secure payment gateways such as PayPal or credit card processing systems. Mail-in payments can be sent to designated tax offices, typically requiring checks or money orders made payable to the local treasury department, ensuring to include relevant property identification numbers for correct allocation. In-person payments may be accepted at municipal offices (often located in county seat cities), providing direct assistance from tax office personnel. Many jurisdictions may also offer automatic bank drafts, allowing for periodic deductions from bank accounts on specified dates, minimizing late fees associated with overdue payments. Deadlines for property tax payments often align with fiscal years, commonly due in the spring or fall, depending on local legislation.

Contact information for inquiries.

Property tax payment notices are essential documents for homeowners, reminding them of their financial obligations to local municipalities. These notifications typically include vital details such as the property address (including street name and number), owner name, tax assessment amount (which can range significantly depending on the property's value and location), payment due date, and the repercussions of late payments (like fines or penalties). Additionally, contact information for inquiries commonly provides specific departments within the local tax authority, often including phone numbers (usually direct lines for efficient service), email addresses for convenient digital communication, and office hours, ensuring that property owners can seek clarification regarding their tax obligations or dispute any inaccuracies.

Comments