As the enrollment period for health insurance approaches, it's essential to stay informed and prepared for the upcoming changes. Many people overlook the significance of reviewing their options, but taking the time now can save you both money and stress in the long run. From understanding different plans to assessing your healthcare needs, the right choice can make all the difference for you and your family. Don't miss out on vital informationâread on to discover everything you need to know about the enrollment process!

Clear and Concise Language

Health insurance enrollment is crucial for accessing medical care and financial protection. Open enrollment periods, such as those that occur annually between November 1 and December 15 in the United States, allow individuals to apply for or change their health insurance plans. Documentation like proof of income, Social Security numbers, and coverage details for dependents may be necessary. Choosing from various plans, such as those offered through the Health Insurance Marketplace, requires careful consideration of premiums, deductibles, and network providers. Missing the enrollment deadline can lead to gaps in coverage and potential medical expenses, emphasizing the importance of timely action.

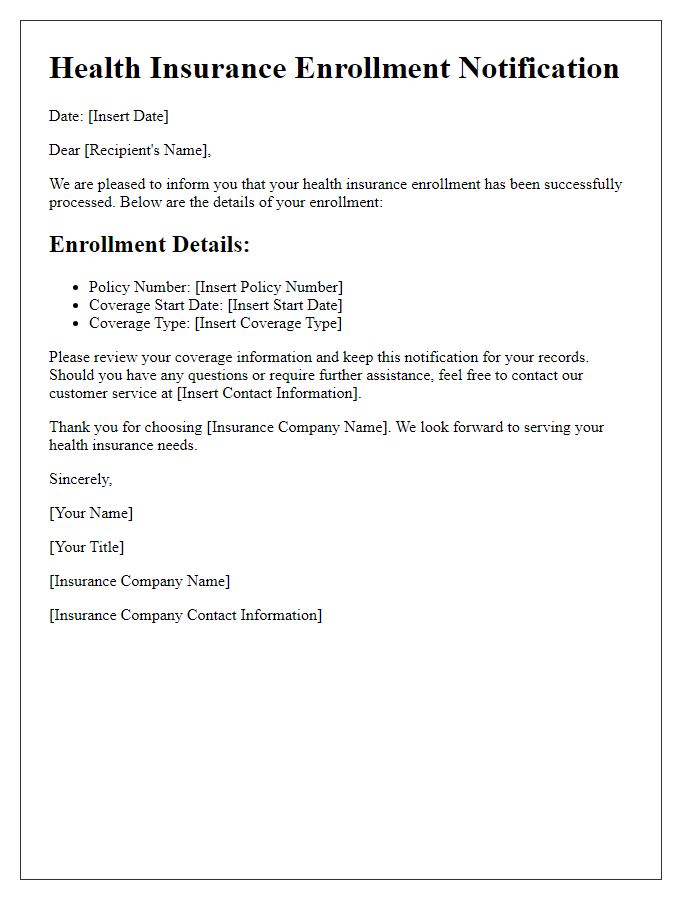

Required Enrollment Information

In order to facilitate a smooth health insurance enrollment process, applicants must ensure that all required enrollment information is accurately provided. Essential data includes personal identification, such as Social Security numbers and dates of birth, for each family member being enrolled. Applicants should also prepare income documentation, which may encompass recent pay stubs, tax returns, and proof of any government assistance programs. It is crucial to identify the specific health insurance plan desired, whether through the Health Insurance Marketplace or employer-sponsored benefits. Additionally, a list of preferred healthcare providers and any pre-existing medical conditions must be documented to ensure optimal coverage. Timely submission of this information is vital to meet open enrollment deadlines and secure health insurance coverage for the upcoming year.

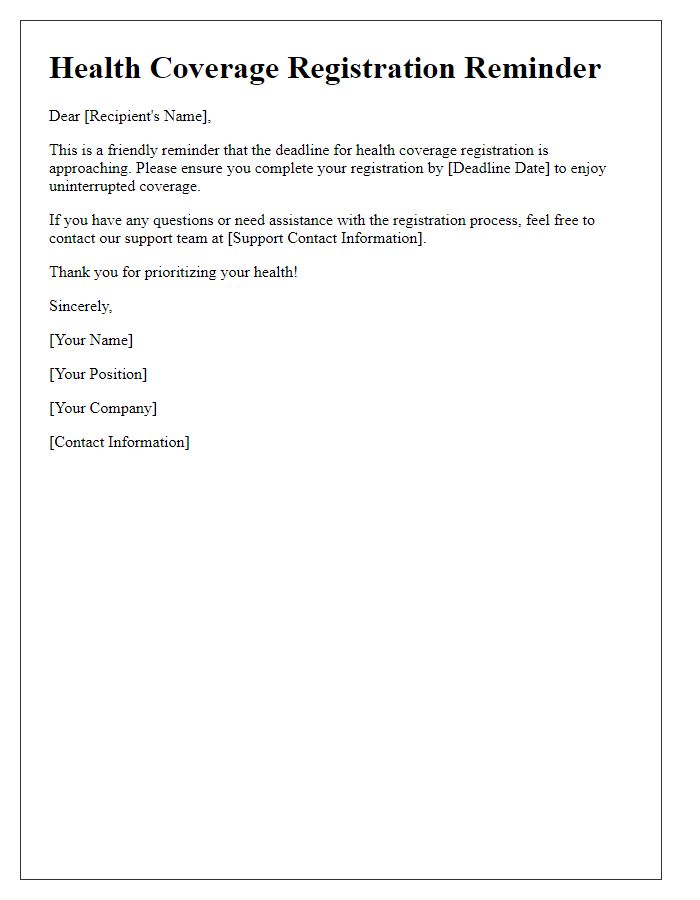

Deadline and Important Dates

Health insurance enrollment is a crucial process for ensuring access to essential medical services. The Open Enrollment Period, typically occurring from November 1 to December 15 each year, allows individuals to select or change their health plans through platforms like the Health Insurance Marketplace. Key dates include the start date on November 1, when eligibility verification begins, and the last day on December 15, when all applications must be completed. Additionally, if enrollment occurs during this period, coverage starts on January 1 of the following year, providing a fresh start for beneficiaries. Individuals must be aware of special enrollment periods triggered by qualifying events, such as marriage or the birth of a child, which can offer additional opportunities to secure insurance outside the standard enrollment timeframe.

Contact Information for Assistance

An insurance enrollment reminder is crucial for maintaining optimal health coverage. Health insurance policies, like those offered under the Affordable Care Act (ACA), require timely enrollment during designated open enrollment periods each year, typically running from November to December. Individuals should verify coverage start dates and eligibility criteria specific to their state, such as New York or California. During this process, providing accurate contact information can facilitate access to assistance. Health insurance navigators are available through organizations like the National Association of Insurance Commissioners (NAIC), which can offer guidance tailored to individual circumstances. Quick access to customer service hotlines and local enrollment centers is essential for addressing questions regarding plan options, premium costs, and benefits.

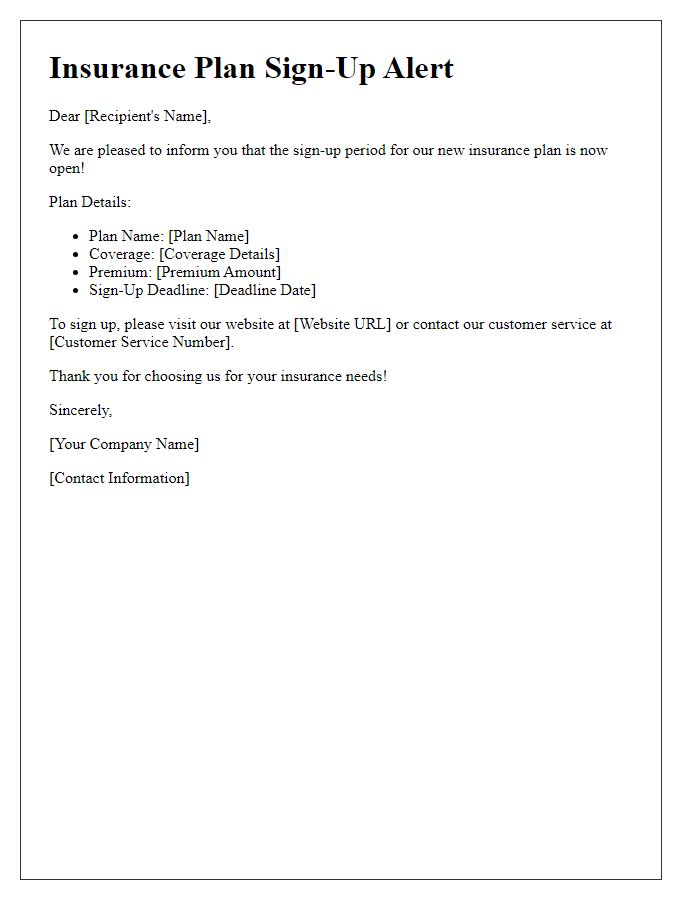

Highlight Benefits and Plan Options

Health insurance enrollment presents a vital opportunity for individuals and families to secure coverage for medical expenses. Numerous plan options exist, encompassing comprehensive services, preventive care, and specialist access. Benefits such as financial protection from high healthcare costs, access to a broad network of providers, and wellness programs can significantly enhance overall well-being. Additionally, flexibility in choosing between HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans allows members to tailor their coverage to fit unique medical needs and lifestyle preferences. It's crucial to explore diverse choices, ensuring the selected plan offers essential features such as deductibles, co-pays, and coverage for prescription medications. Timely enrollment ensures immediate access to these significant health benefits.

Comments