Are you looking to request a tax identification number but unsure how to get started? It's essential to provide the right information in your letter to ensure a smooth process. In this article, we'll guide you through a simple, effective letter template that you can customize to fit your needs. Read on to discover the steps you can take to secure your tax identification number effortlessly!

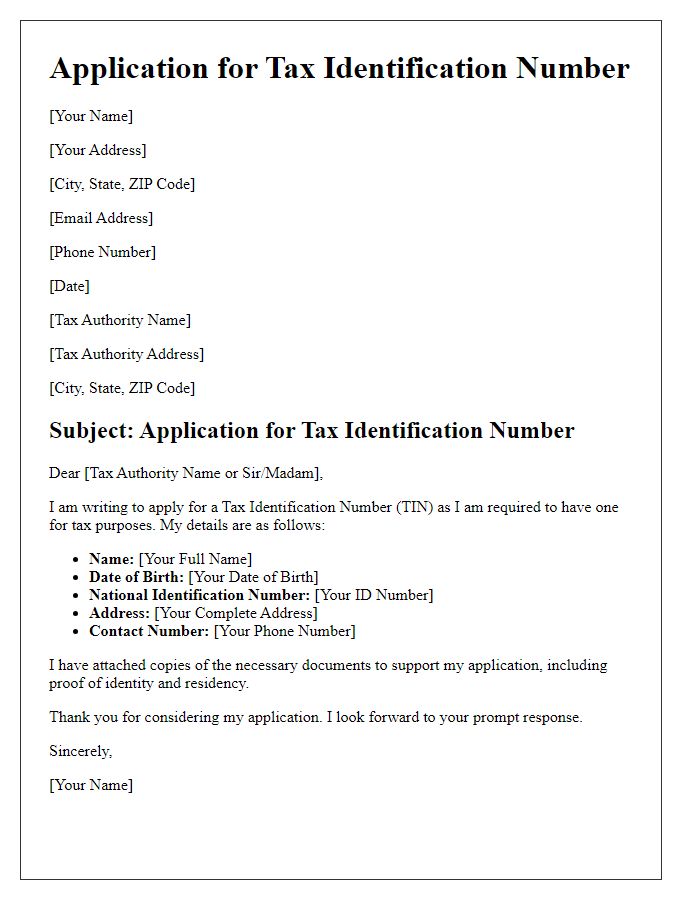

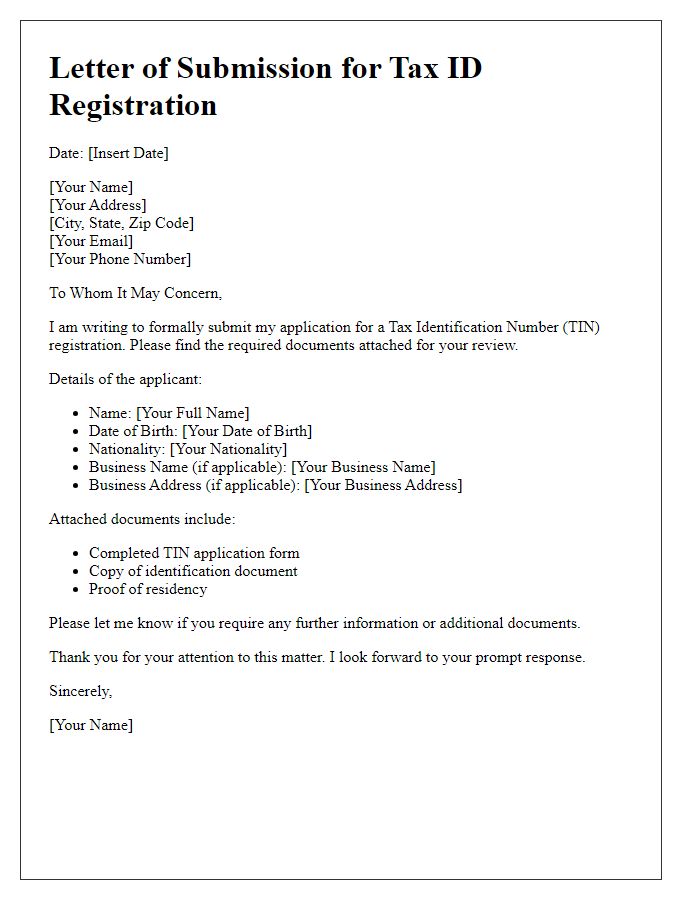

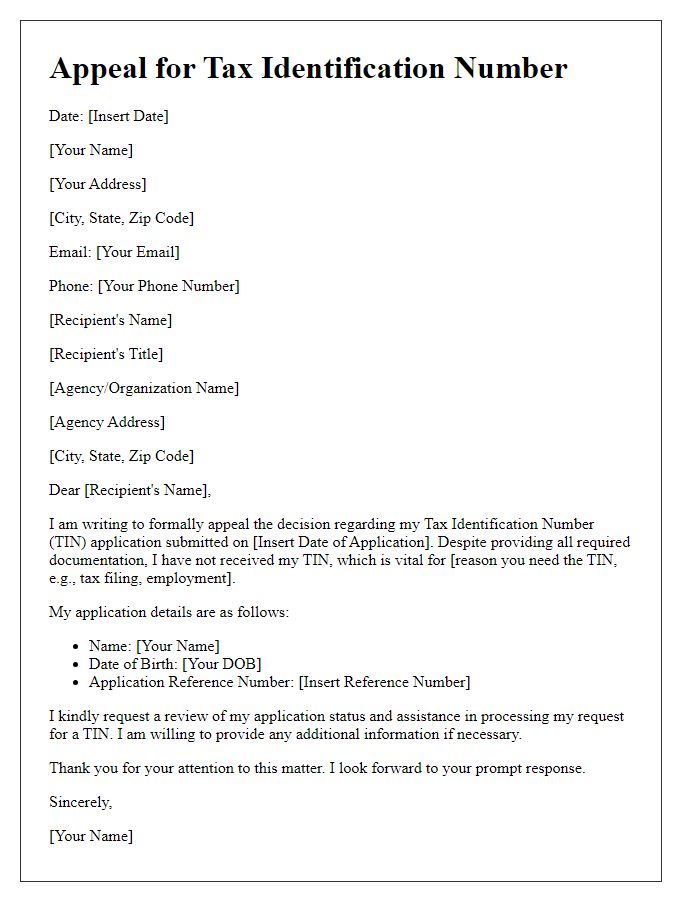

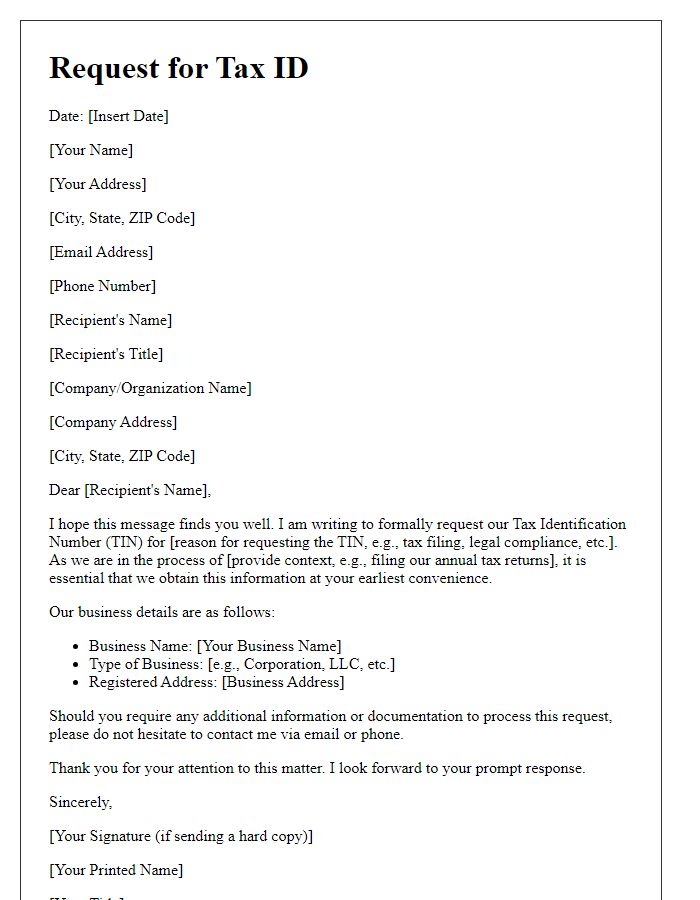

Requestor's full legal name and contact information.

A tax identification number (TIN) is essential for individuals and businesses to file taxes and conduct financial transactions in the United States. The requestor's full legal name, such as Johnathan Michael Smith, is critical to ensure accurate processing. Additionally, providing complete contact information, including a valid address (e.g., 123 Elm Street, Springfield, IL 62701), phone number (e.g., (555) 123-4567), and email address (e.g., jsmith@email.com), helps the relevant tax authority, such as the Internal Revenue Service (IRS), to facilitate any necessary communication regarding the TIN request. Ensuring that this information is current and accurate is vital for the efficiency of processing and future correspondence.

Recipient's name and address (tax authority).

A tax identification number (TIN) is essential for individuals and businesses in managing their tax obligations and compliance with the Internal Revenue Service (IRS) in the United States. The process of requesting a TIN typically involves submitting Form W-7 for individual applicants or Form SS-4 for businesses, which requires personal details such as full name, address, and purpose of application. The IRS processes these requests through its main office located in Washington, D.C., where they verify the information provided. Additionally, expedited services may be available for urgent cases, reducing wait times from several weeks to just a few days depending on the circumstances. Proper documentation, including proof of identity, is necessary to expedite the issuance of this crucial identification number, which impacts tax withholding, reporting obligations, and eligibility for various tax credits.

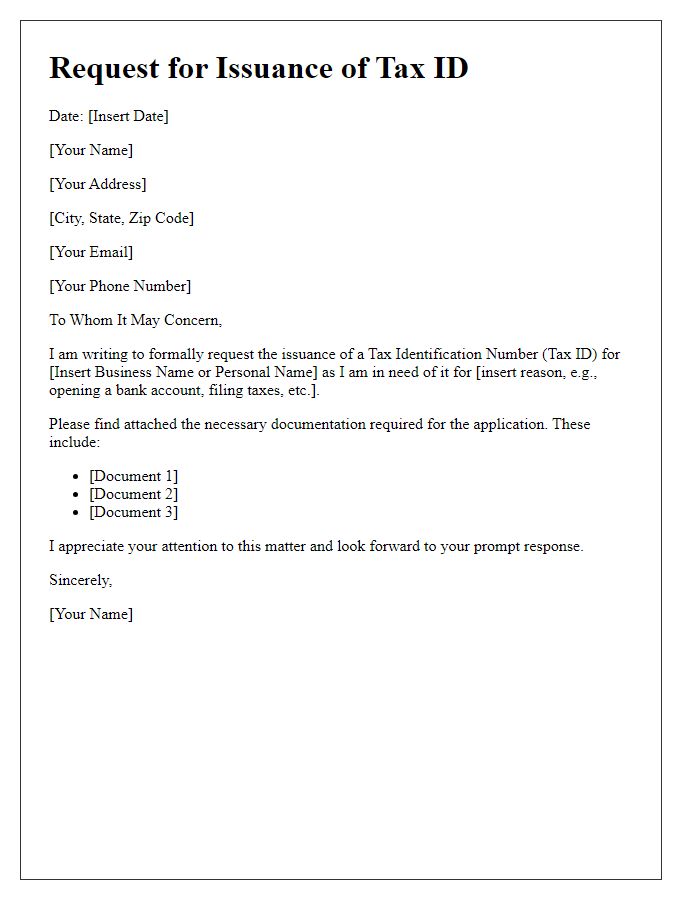

Purpose of the request (clarifying need for tax identification number).

A tax identification number (TIN) serves as a unique identifier for individuals or businesses in financial transactions, particularly for taxation purposes established by the Internal Revenue Service (IRS) in the United States. Obtaining a TIN is essential for complying with federal tax regulations and accurately reporting income. Organizations may require a TIN for several reasons, including opening business bank accounts, filing tax returns, and ensuring proper tax withholding. It is crucial for freelancers, sole proprietors, and corporations to secure this identification in order to facilitate smooth financial operations and maintain transparency with tax authorities.

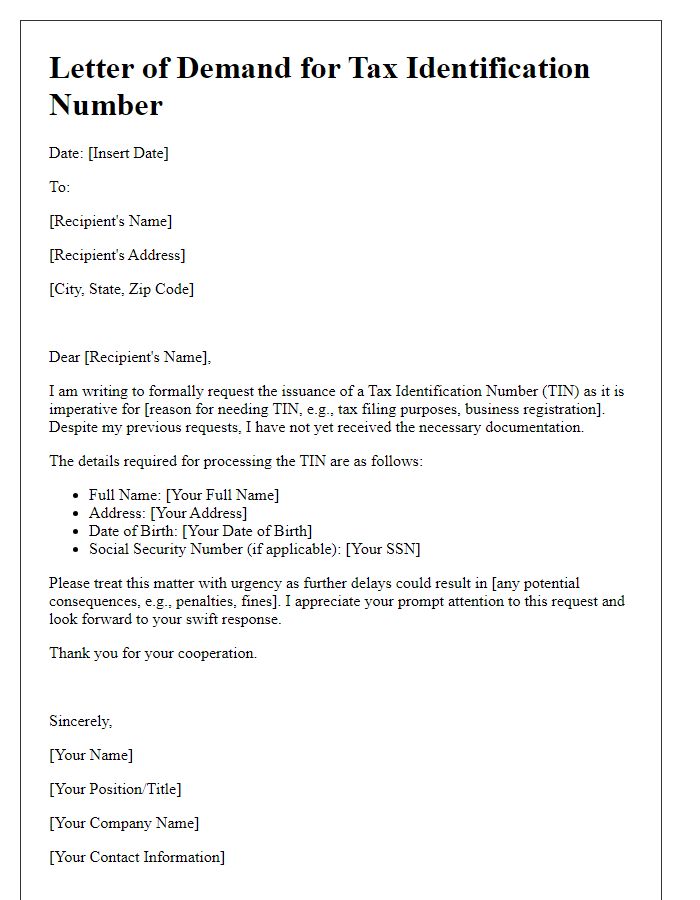

Relevant personal or business identification details (e.g., Social Security Number, Employer Identification Number).

A tax identification number (TIN) is crucial for individuals and businesses to comply with federal tax regulations in the United States. TINs may include Social Security Numbers (SSNs), assigned to individuals, or Employer Identification Numbers (EINs), designated for businesses. The Internal Revenue Service (IRS) requires accurate submissions of these numbers for various financial activities, including employment, taxation, and banking. For individuals, the SSN consists of nine digits, formatted as XXX-XX-XXXX. The EIN, used primarily by businesses, also comprises nine digits but is formatted as XX-XXXXXXX. Proper documentation and timely requests for these identification numbers ensure compliance with tax obligations and facilitate smooth financial transactions within legal frameworks.

Reference to relevant tax law or regulations requiring the TIN.

Tax Identification Numbers (TINs) serve as essential components in the administration of taxation systems, particularly in jurisdictions like the United States, where Internal Revenue Service (IRS) regulations mandate their use for income reporting, identification of taxpayers, and the facilitation of tax administration. Under Section 6109 of the Internal Revenue Code, taxpayers must provide a TIN when filing federal tax returns, ensuring their transactions are duly recorded and compliant with federal standards. Additionally, the requirement aligns with the Anti-Money Laundering regulations enforced by the Financial Crimes Enforcement Network (FinCEN) to deter tax evasion and maintain financial integrity. Acquiring a TIN is crucial for individuals and businesses, enabling them to engage seamlessly in financial and legal transactions across various platforms.

Comments