Are you considering joining a corporate board? Navigating the nuances of board membership can be quite a journey, filled with opportunities for growth and influence. Whether you're an experienced executive or new to the scene, understanding the dynamics and responsibilities is crucial. Join us as we explore the essential elements of securing a position on a corporate board and what it takes to excelâlet's dive in!

Professional tone and format

Joining a distinguished board of directors involves understanding the requirements and responsibilities of corporate governance within a specific organization. Corporate board membership entails strategic oversight, fiduciary duties, and adherence to regulatory compliance. Members are expected to contribute their expertise in areas such as finance, marketing, or technology. Understanding key metrics like ROI (Return on Investment) and shareholder equity become crucial in decision-making processes. Participation in regular meetings (usually quarterly) necessitates preparation on financial reports, market trends, and organizational challenges. Board diversity, encompassing various backgrounds and experiences, is essential for comprehensive perspectives and innovation. Networking opportunities within industry circles foster collaboration that can drive the company's mission forward while aligning with long-term objectives.

Clear role and responsibilities

Corporate board membership entails specific roles and responsibilities that ensure governance and strategic oversight of the organization. Board members are tasked with providing fiduciary duties, inclusive of care, loyalty, and compliance, vital for maintaining ethical standards and legal adherence within the company. They participate in regular meetings, typically held quarterly, to discuss financial performance metrics, such as revenue growth percentages and profit margins, assessing the overall health of the organization. Board members also oversee major decisions involving mergers and acquisitions, which can significantly alter the company's trajectory, and they must ensure that executive leadership aligns with long-term goals through effective performance evaluations and strategic planning sessions. Furthermore, they are responsible for risk management strategies, ensuring that adequate measures are in place to mitigate financial, operational, and reputational risks associated with the business environment. Active engagement in committees, such as audit and compensation, is essential for effective governance and accountability, shaping the company's future while addressing stakeholder interests.

Term and duration of service

A corporate board membership typically includes a specific term duration, often set at three years, based on bylaws. For instance, members may have the opportunity to be re-elected for successive terms, allowing them continued involvement in strategic decisions. The beginning of the term usually coincides with the annual shareholders' meeting, where new members can be elected. Additionally, board members are expected to fulfill responsibilities during their term, such as attending regular meetings, which can occur quarterly at the corporate headquarters. This structure ensures effective governance and aligns with corporate objectives and shareholder interests.

Confidentiality obligations

Confidentiality obligations play a critical role in corporate governance and board member responsibilities. Board members of organizations, such as Fortune 500 companies, are often privy to sensitive information, including proprietary data, financial reports, and strategic plans. Maintaining confidentiality is essential to protect the company's interests and uphold fiduciary duties. Breaches of confidentiality can result in legal repercussions, such as litigation under federal laws including the Sarbanes-Oxley Act, or reputational damage that could impact stock prices. Additionally, board members must navigate confidentiality agreements that detail stipulations on information sharing during meetings held at headquarters, often located in major business districts like Manhattan or Silicon Valley. Adherence to these obligations is vital to foster trust among stakeholders, including investors and employees, and ensure compliance with regulatory bodies like the Securities and Exchange Commission (SEC).

Acceptance and acknowledgment process

Corporate board membership signifies a crucial role in a company's governance structure, representing significant responsibilities and strategic oversight. Upon acceptance of the board position, a formal acknowledgment process typically commences. This process includes reviewing the company's bylaws and governance policies to understand duties. Moreover, newly appointed board members may need to attend onboarding sessions that cover financial statements, regulatory obligations, and corporate culture. Key documentation such as nondisclosure agreements and conflict-of-interest statements should also be signed before the first board meeting. Active participation in committees may further enhance their understanding of specific areas such as audit or compensation. Regular communication with the board chair and fellow members facilitates integration into the team, fostering a collaborative environment for effective governance.

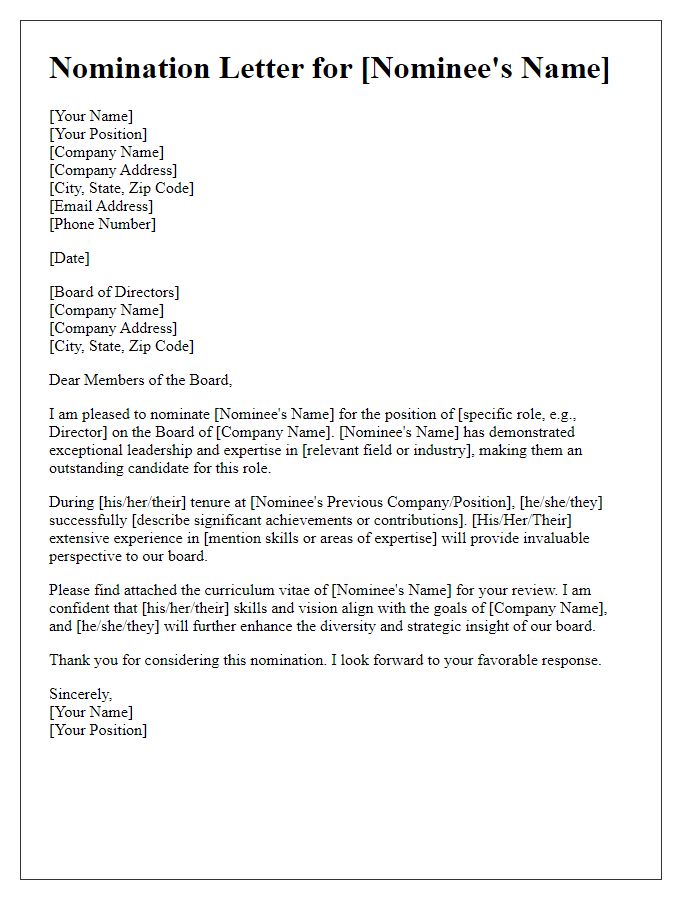

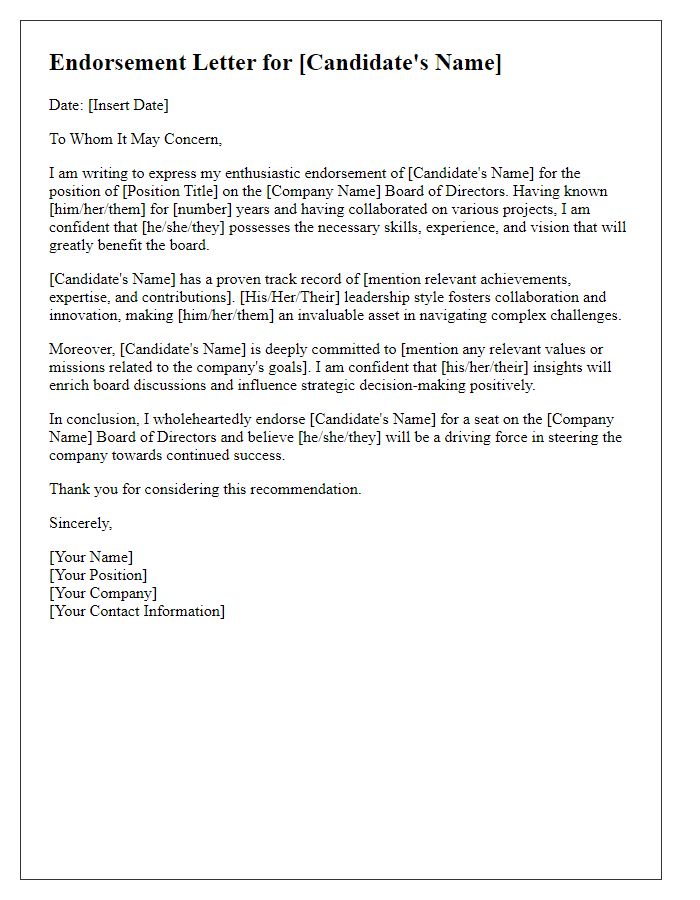

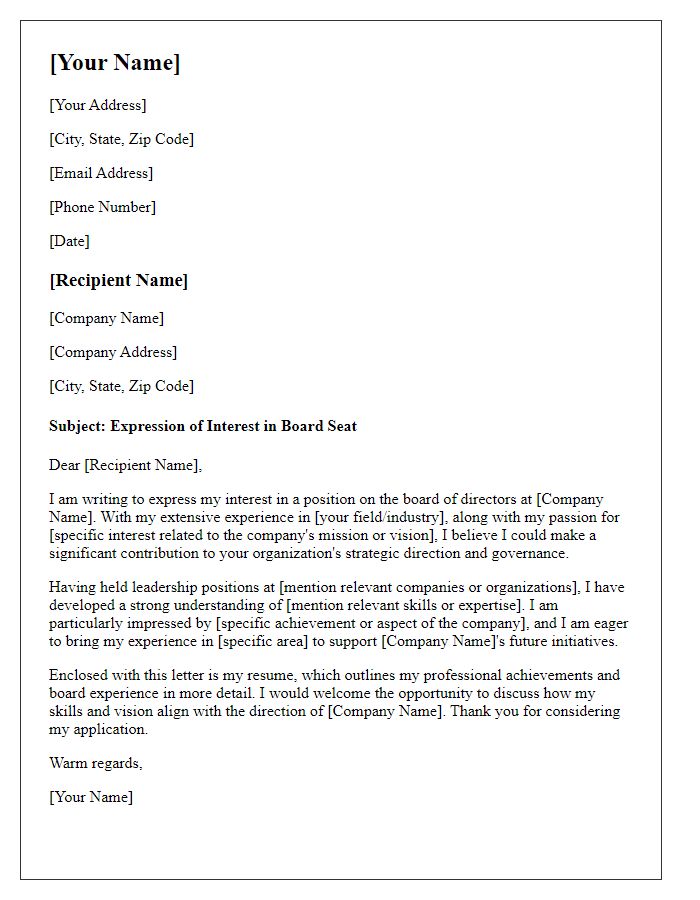

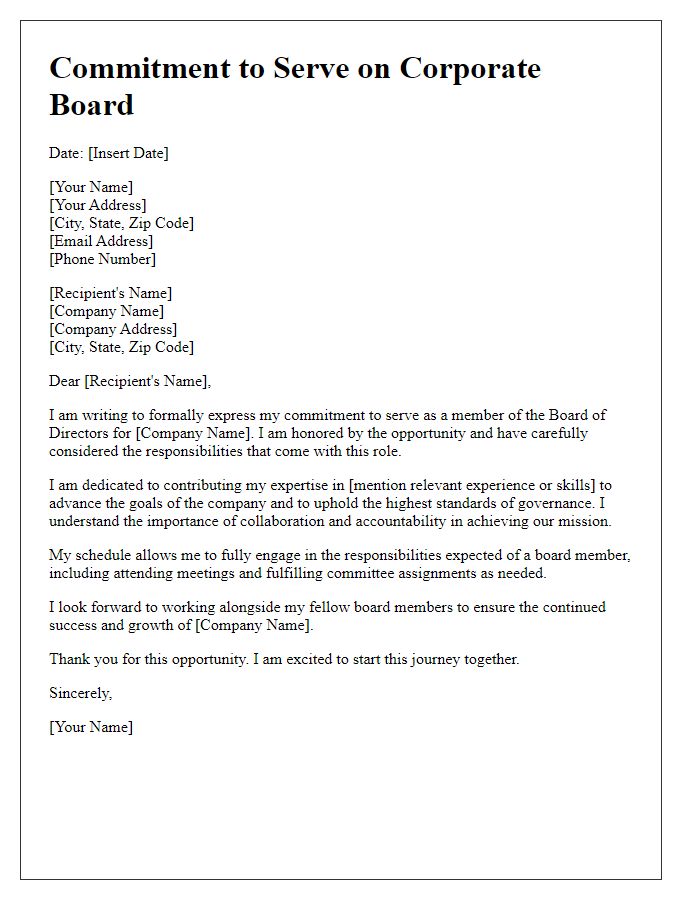

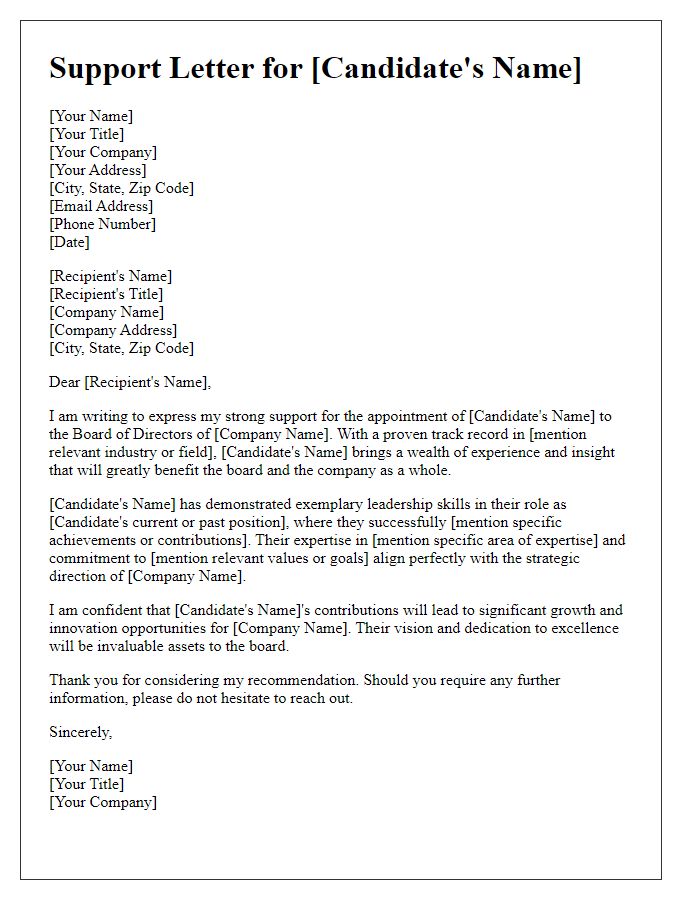

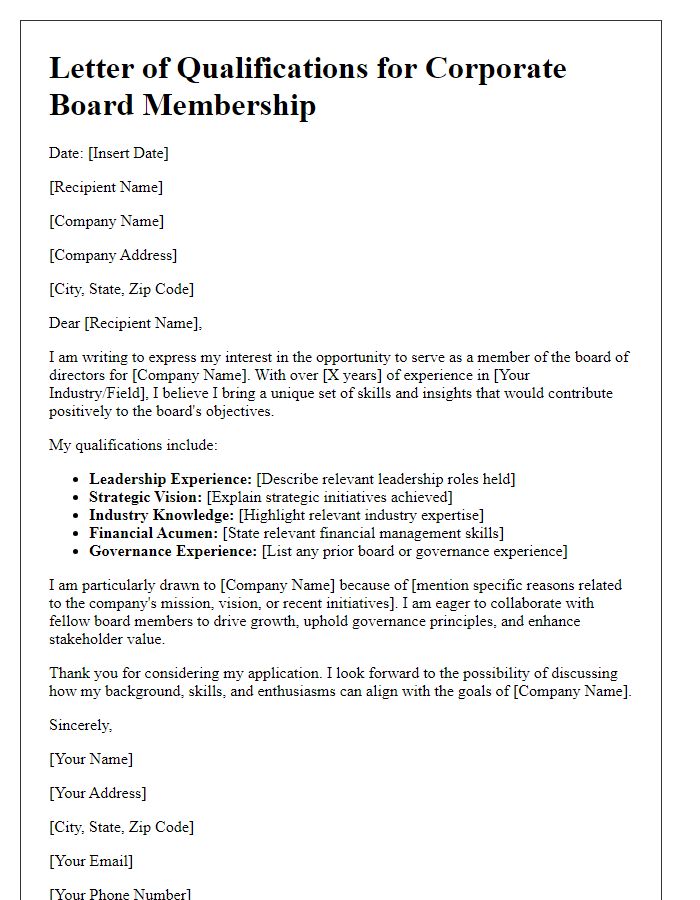

Letter Template For Corporate Board Membership Samples

Letter template of request for corporate board membership consideration.

Comments