Are you scratching your head over local property tax rebates? Understanding how these rebates work can be a game changer for homeowners looking to save money. In this article, we'll break down the key elements of the rebate process, from eligibility requirements to application steps. So, if you're ready to uncover the potential savings waiting for you, keep reading!

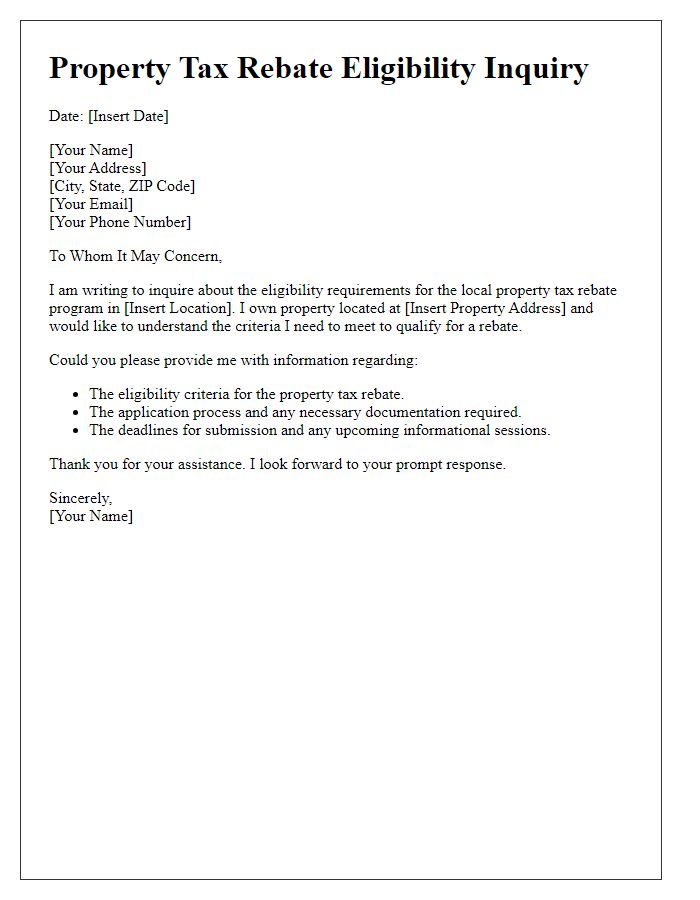

Clear and concise subject line

Local property tax rebate programs provide financial relief to homeowners, especially in densely populated areas. These programs aim to reduce the overall property tax burden by offering reductions based on specific criteria, such as income level, senior status, or disability. For instance, in cities like Chicago, eligible homeowners can receive a rebate of up to $300, while states like California offer varying amounts depending on the Proposition 13 provisions. Applying for these rebates typically requires submitting forms and documentation, with deadlines varying by location. Understanding the eligibility requirements and application process is vital for maximizing potential savings on annual property taxes.

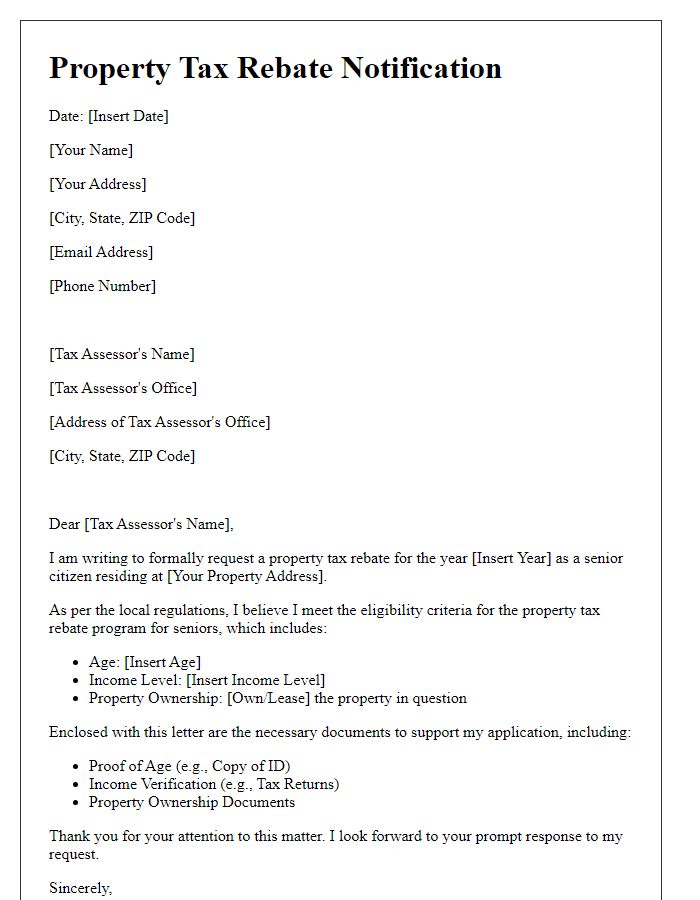

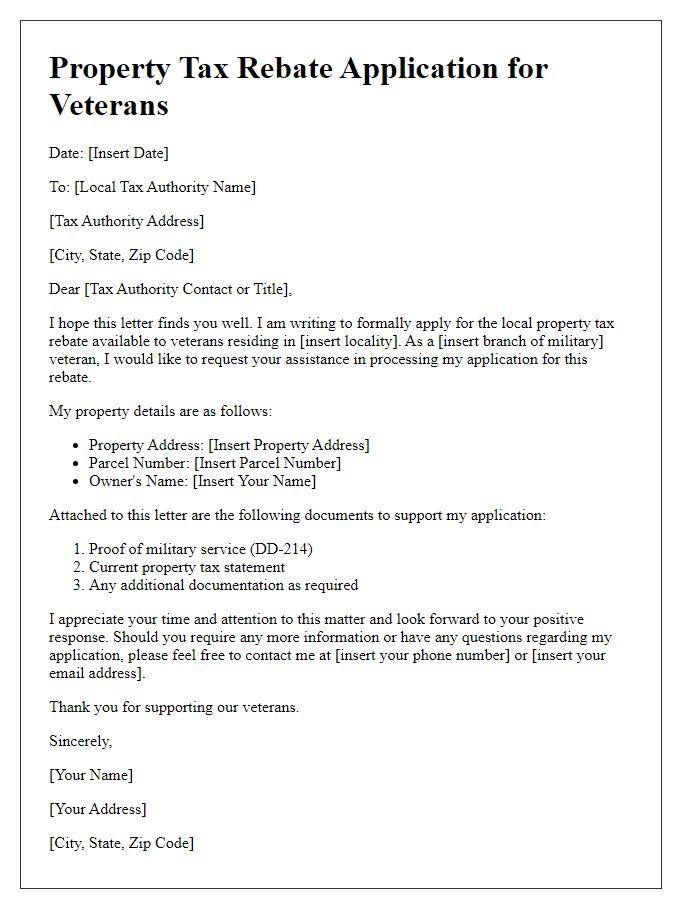

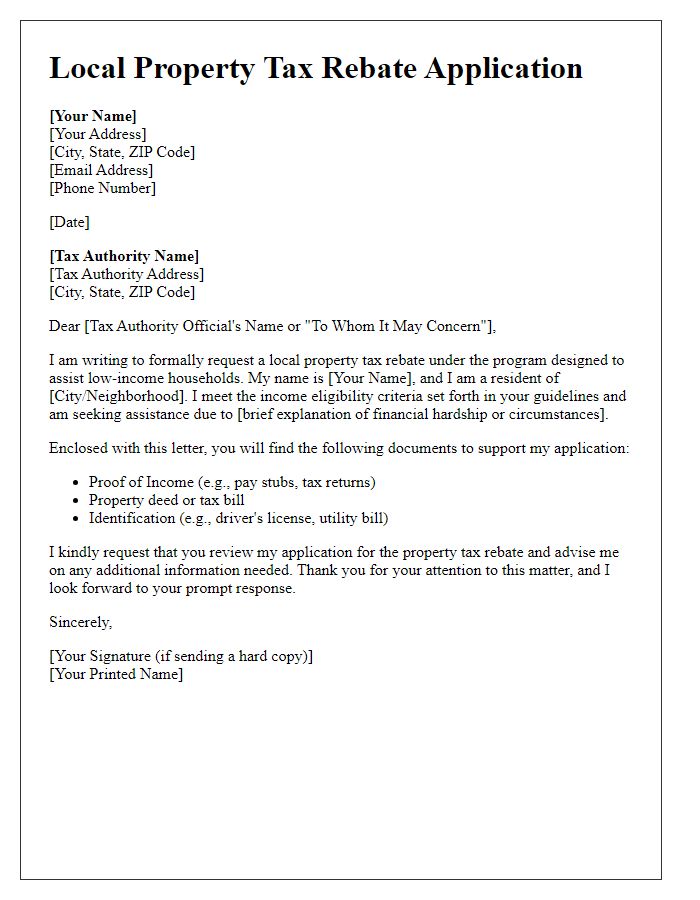

Personalization details (e.g., recipient's name and address)

Local property tax rebate programs provide financial relief to eligible homeowners. In the United States, programs can vary by state, with some offering benefits for low-income residents, senior citizens, or veterans. Specific eligibility criteria, such as income limits (which can be set at different thresholds depending on the state), play a crucial role in determining participation. For instance, a homeowner residing in California might qualify for rebates if their annual income does not exceed $50,000. The application process typically requires documentation, including proof of income and property ownership, submitted to local tax offices, such as the Los Angeles County Assessor's Office. Failure to meet deadlines, which can range from March to May in various jurisdictions, may result in loss of potential benefits. Understanding local laws and requirements is essential for maximizing rebate opportunities.

Explanation of eligibility criteria for the rebate

Local property tax rebate programs aim to provide financial relief to eligible homeowners. Key eligibility criteria often include age, income level, and residency status. For instance, many programs target seniors aged 65 and older, granting them potential reductions in property taxes based on their annual income, which may not exceed specific thresholds, often around $50,000. Property must be a primary residence within the designated municipality, with taxes paid in full to qualify. Additional requirements might involve application deadlines and proof of income, ensuring that the rebate reaches those most in need within the community. Local governments typically outline these criteria to facilitate accessibility and support for eligible property owners.

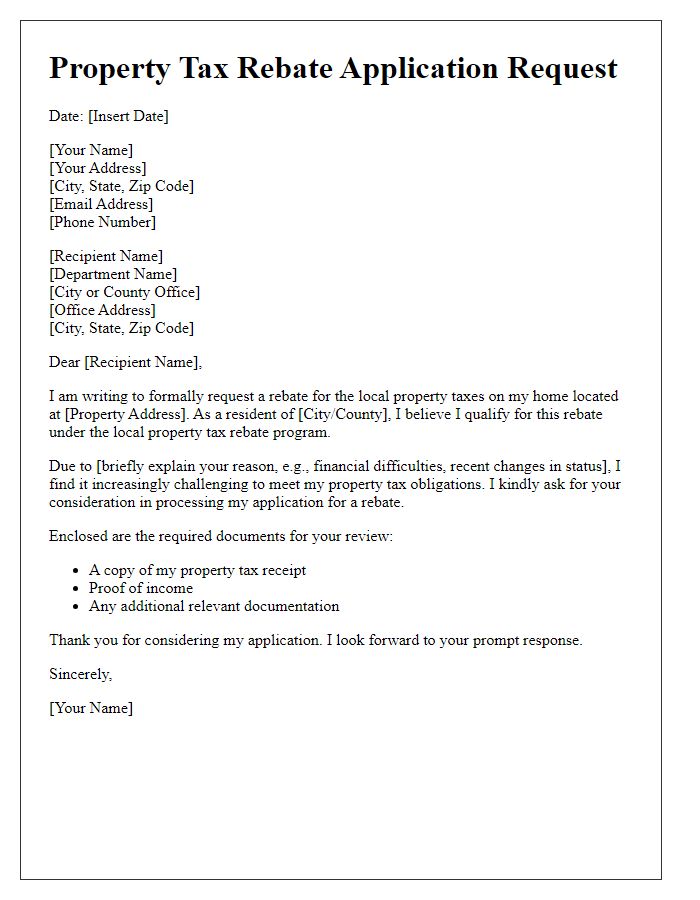

Step-by-step instructions for application or next steps

The local property tax rebate program provides homeowners with financial relief by reducing their annual tax burden based on specific eligibility criteria. Applicants must first determine eligibility by reviewing requirements such as property ownership, income levels, and residency status. The next step involves gathering necessary documentation, including proof of income, property deed, and identification. Homeowners must then complete the designated application form, available on the official municipal website or local government office, ensuring all sections are filled out accurately. After submission, applicants should track their application status through the local government's portal. Follow-up may be required if additional information is requested. The rebate amount is typically calculated based on a percentage of property taxes paid, so homeowners should keep a record of their previous tax bills for future reference.

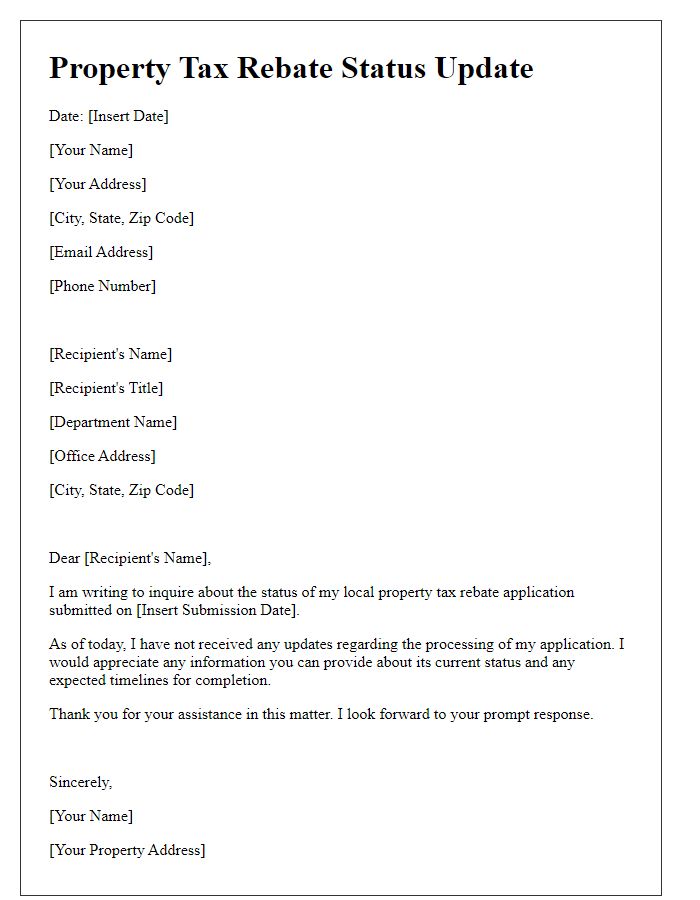

Contact information for further inquiries or assistance

Local property tax rebates provide significant financial relief for homeowners, particularly in areas experiencing rising property values. Eligibility criteria often include factors such as income level, age, and disability status, which vary by municipality; for example, the City of Los Angeles offers rebates to low-income senior citizens. The application process typically requires documentation such as proof of residency and income statements, ensuring that only qualifying residents benefit. Property owners should also be aware of deadlines, as many local governments set specific dates for applications, such as the March 15 deadline in Baltimore. For further inquiries related to property tax rebates, residents can contact their local tax assessor's office or visit their official websites to access detailed information and support resources.

Comments