Purchasing a home can be an exhilarating yet overwhelming process, especially when it comes to gathering all the necessary documents. To ensure a smooth transaction, it's essential to have a comprehensive checklist at your fingertips. From financial statements to property disclosures, each document plays a critical role in making your home-buying experience seamless. Ready to dive into the details and get your checklist organized? Let's explore what you need to streamline your purchase process!

Identification Documents

Identification documents play a crucial role in the home purchase process, ensuring that all parties involved can verify their identities. Commonly required identification includes a government-issued photo ID, such as a driver's license or passport, which should include details like name, address, and date of birth. Additional identification may also be requested, such as Social Security cards or birth certificates, especially for first-time homebuyers. Lenders may require multiple forms to cross-verify identity and assess financial stability, ensuring compliance with regulations. Accurate and complete identification documents help facilitate a seamless transaction, protecting both buyers and sellers in the real estate market.

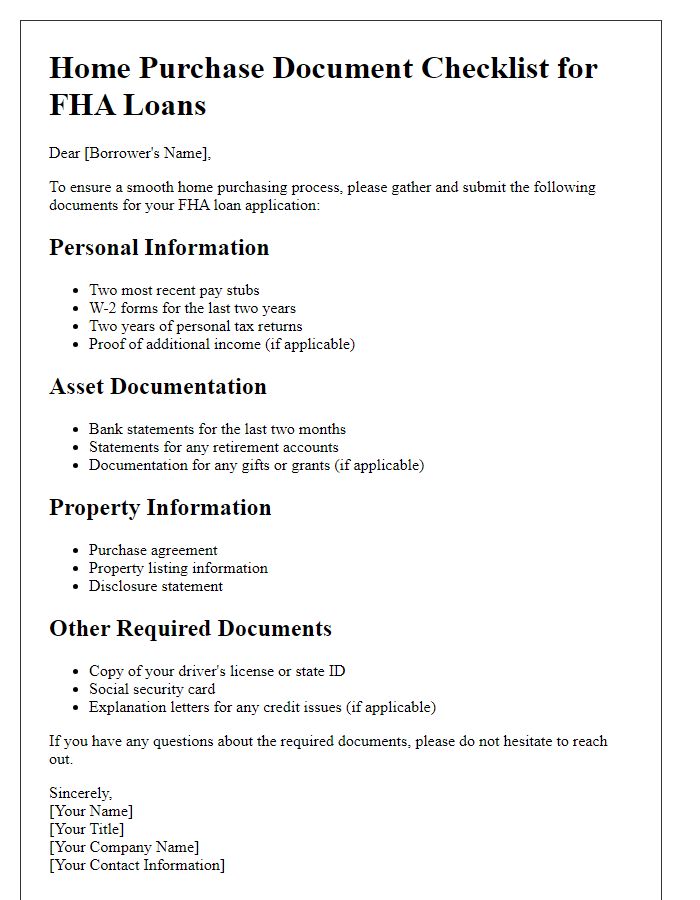

Financial Pre-Approval

When seeking a home purchase, obtaining financial pre-approval is crucial in today's competitive real estate market. Lenders typically require documents such as recent pay stubs (usually covering the last 30 days), W-2 forms (from the past two tax years), and bank statements (reflecting the last two months). Potential homeowners must also provide documentation of assets, a valid government-issued ID, and details regarding any additional debts, such as student loans or credit card debts, to assess their financial standing. An accurate credit report, which highlights credit utilization ratios and payment history, will also play a vital role in determining the pre-approval amount. By compiling this information, buyers enhance their chances of receiving favorable loan terms and can present themselves as serious contenders when making an offer on their ideal home.

Property Inspection Reports

Property inspection reports are detailed assessments conducted by certified home inspectors regarding the condition of residential real estate properties. These reports typically include information on structural integrity, electrical systems, plumbing, roofing, and pest infestations. Homebuyers should ensure that inspection reports contain clear documentation of any issues discovered during the evaluation, along with photographs for clarity. It is crucial to review the findings to make informed decisions regarding repairs or negotiations with sellers. Additionally, understanding local regulations or codes could impact the overall assessment and subsequent actions needed. Ensuring access to these reports can aid in securing a safe investment in a property, particularly in competitive real estate markets, such as those in urban centers like New York City or San Francisco.

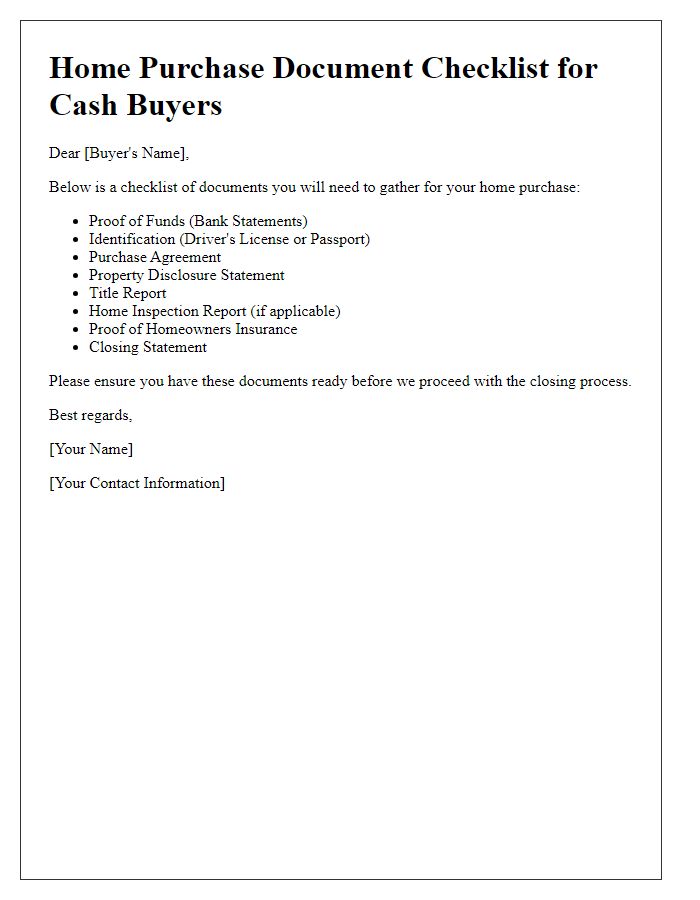

Purchase and Sale Agreement

The Purchase and Sale Agreement serves as a vital document in real estate transactions, outlining key terms between buyer and seller. Essential details include the purchase price, typically expressed in U.S. dollars, and the earnest money deposit, often ranging from 1% to 3% of the purchase price, ensuring the buyer's intent. Property descriptions must include specific details such as street address, lot number, and legal descriptions derived from local land surveys. Contingencies may be listed, such as financing approval or property inspections, defining conditions under which the transaction may be dissolved. Additionally, dates for closing, usually set within 30 to 60 days post-acceptance, must be explicitly stated. Signatures from both parties finalize this critically important contract, serving as a legally binding agreement. The document should also reference any relevant local laws or regulations that govern real estate transactions in the jurisdiction, adding layers of protection and clarity for both buyers and sellers.

Closing Disclosure

Closing Disclosure serves as a vital document in the home buying process, detailing the finalized terms of the mortgage, including loan amount, interest rate, and monthly payments. Typically, this document is provided to buyers three days prior to closing and must include all closing costs (ranging from 2% to 5% of the loan amount) and any adjustments based on the property taxes of the residential real estate. It highlights the settlement agent's information, provides a breakdown of the loan's terms, and outlines the total amount the buyer must pay at closing. Moreover, the Closing Disclosure offers a comparison with the Loan Estimate, ensuring transparency in any changes made during the loan approval process. Reviewing this document carefully is crucial, as it can prevent potential surprises on the closing day.

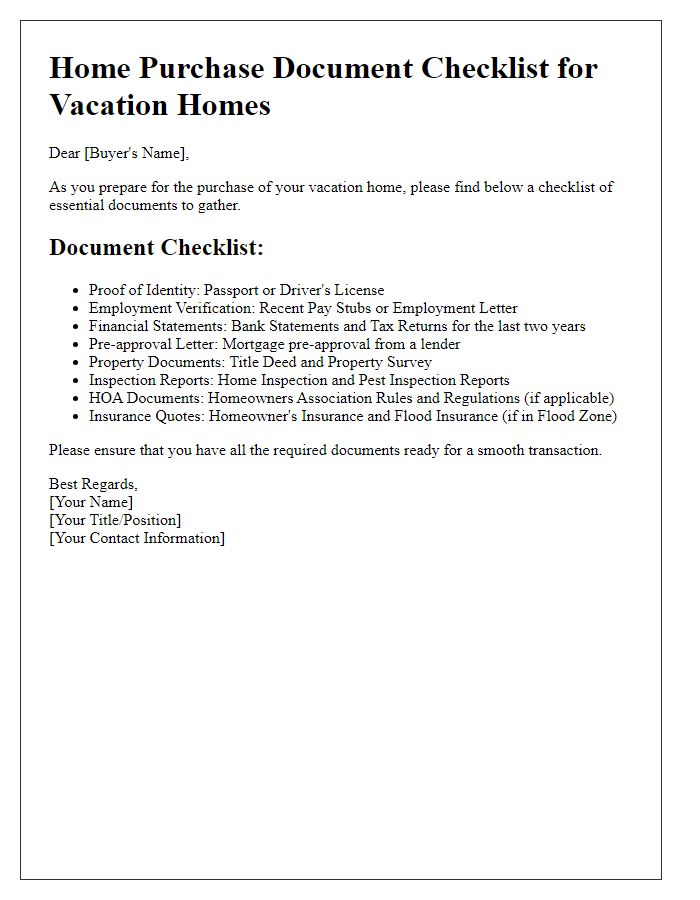

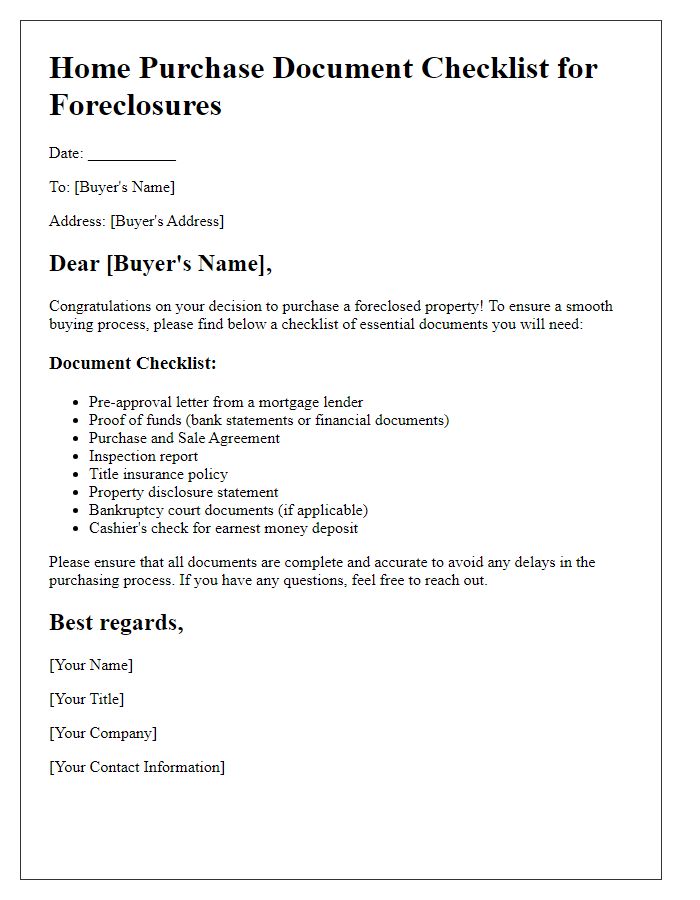

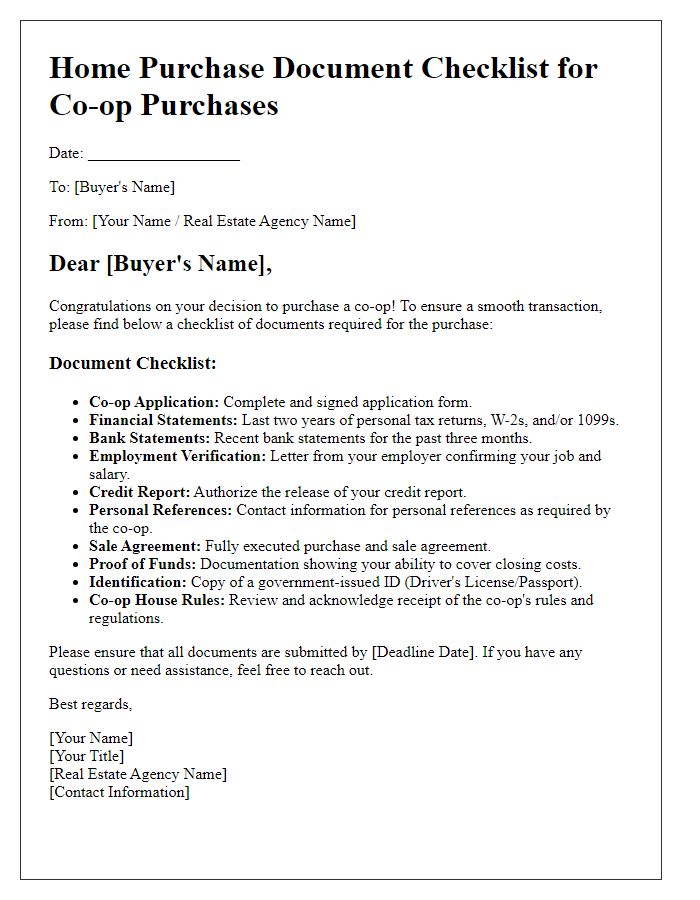

Letter Template For Home Purchase Document Checklist Samples

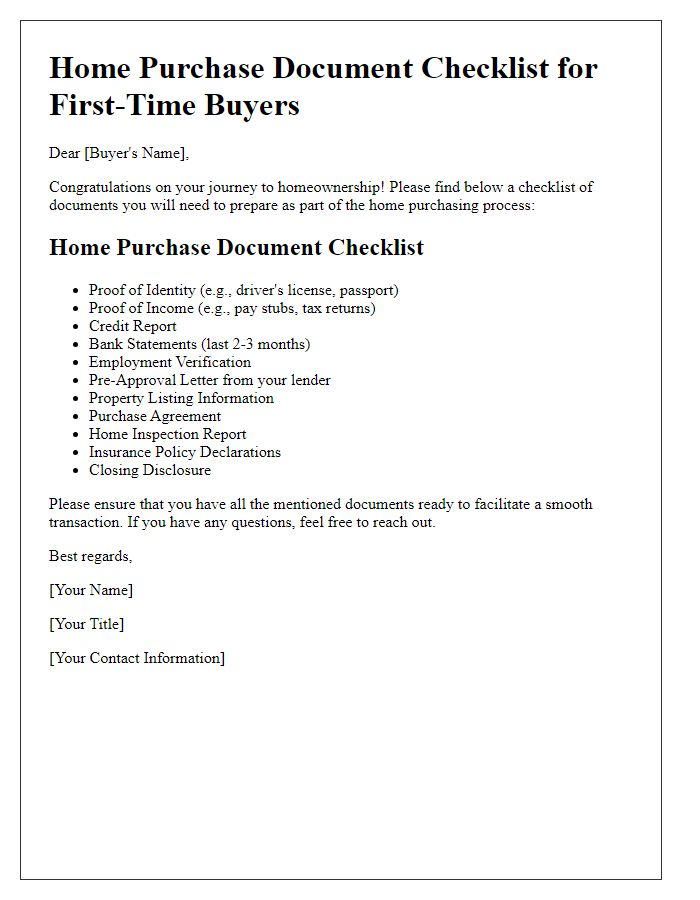

Letter template of home purchase document checklist for first-time buyers

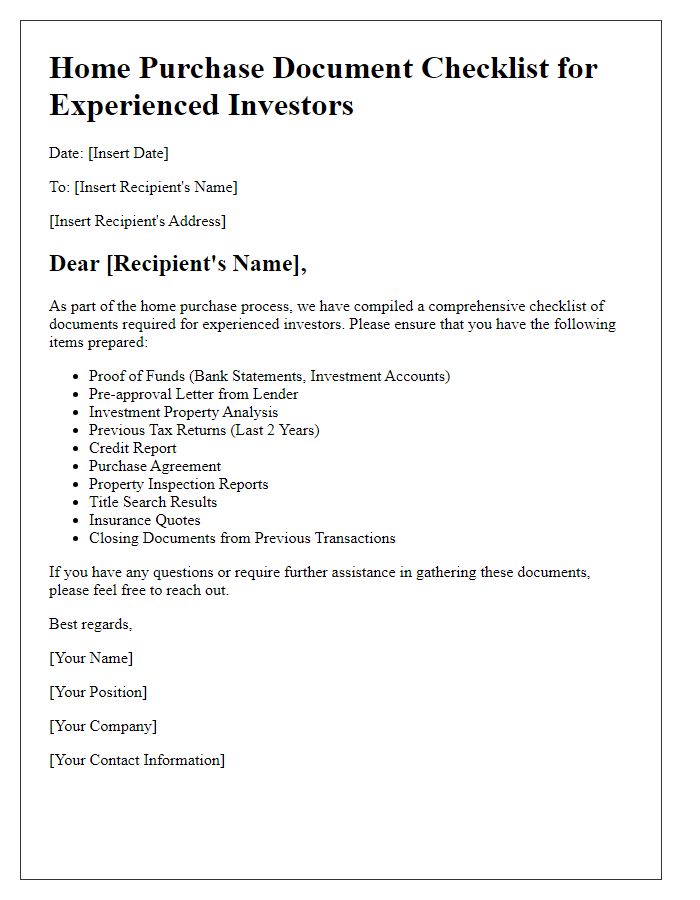

Letter template of home purchase document checklist for experienced investors

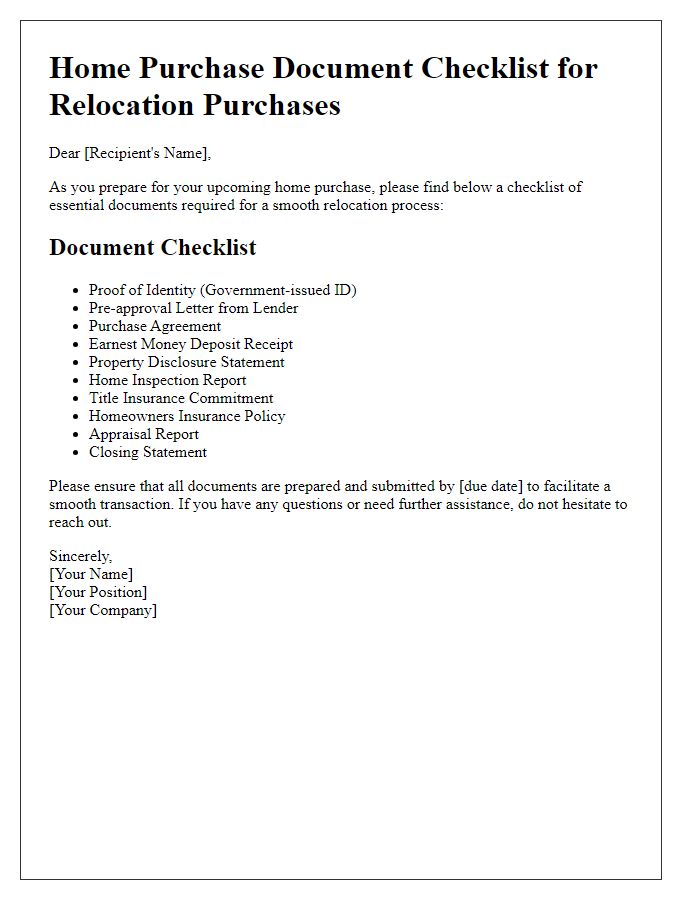

Letter template of home purchase document checklist for relocation purchases

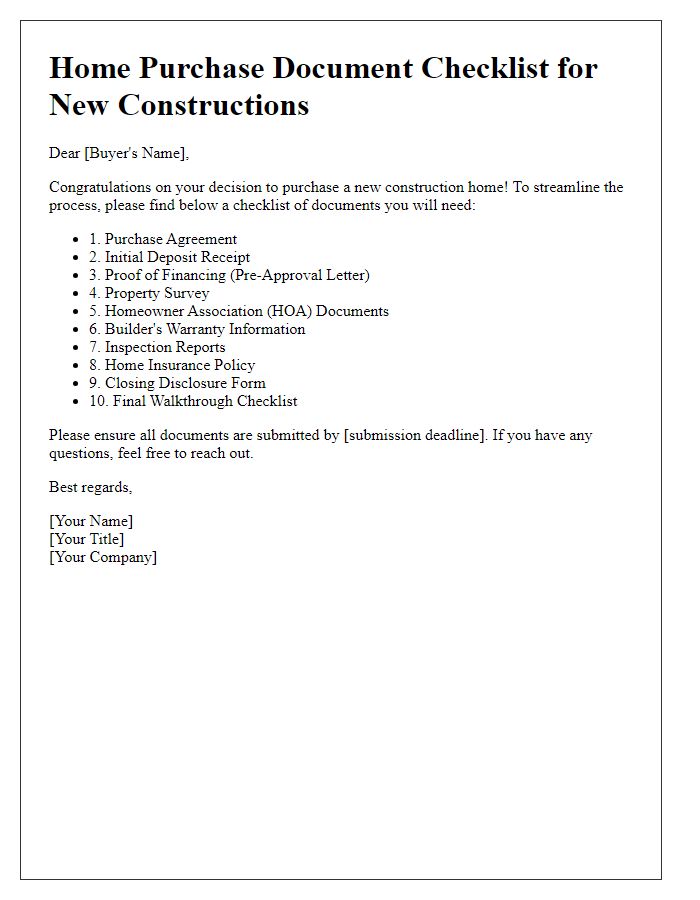

Letter template of home purchase document checklist for new constructions

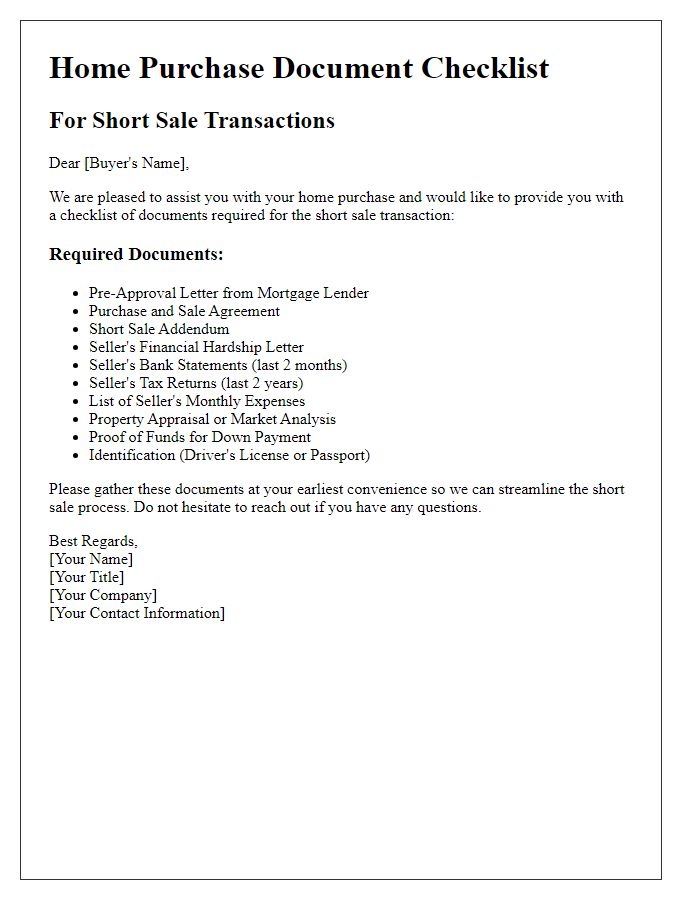

Letter template of home purchase document checklist for short sale transactions

Comments