Dealing with a deceased estate can be challenging and emotionally taxing, but having the right approach can make things easier. Whether you're managing a property left behind or navigating the complexities of inheritance, understanding the process is key to honoring your loved one's legacy. In this article, we'll guide you through essential steps and considerations when handling property from a deceased estate, providing clarity in moments that can feel overwhelming. So, grab a cup of tea, and let's dive into this important topic together!

Beneficiary Identification Information

Beneficiary identification information is crucial in the process of managing deceased estate properties, ensuring rightful heirs receive their inheritance. Key details include full names, birth dates, and contact information of beneficiaries, which may often be outlined in the Last Will and Testament. Additionally, Social Security numbers or equivalent identification numbers are vital for legal verification and tax implications. Informing local probate court offices about beneficiaries, especially in jurisdictions like California or New York, is necessary for smooth transition and distribution. Properly identifying and documenting each beneficiary's relationship to the deceased, such as child, spouse, or sibling, helps in settling estate disputes effectively and expediting the administration process.

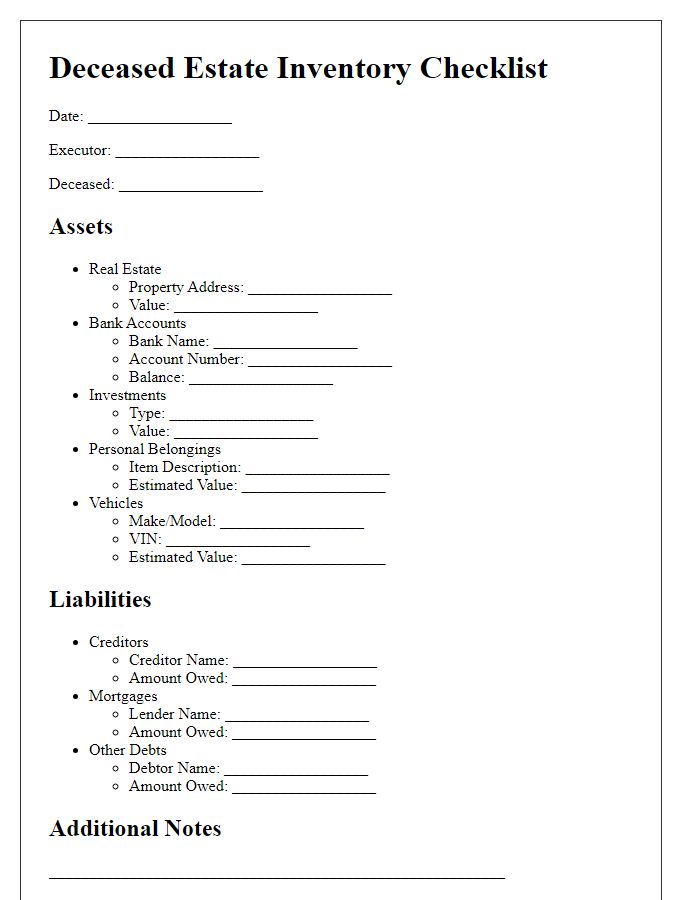

Estate Inventory and Asset Description

Estate inventory refers to the comprehensive list of assets belonging to a deceased individual, important for estate administration. It includes real estate, such as residential properties located at 123 Main Street, Springfield, valued at $250,000, and personal property, including a vintage car registered in 1965 and worth $30,000. Financial assets, like bank accounts with XYZ Bank holding $50,000, and stocks in ABC Corporation valued at $20,000, must also be documented. Additionally, liabilities such as outstanding mortgage debts of $150,000 and credit card balances of $5,000 need inclusion. Proper documentation of these assets ensures compliance with legal requirements and assists in equitable distribution among heirs.

Executor or Administrator's Contact Details

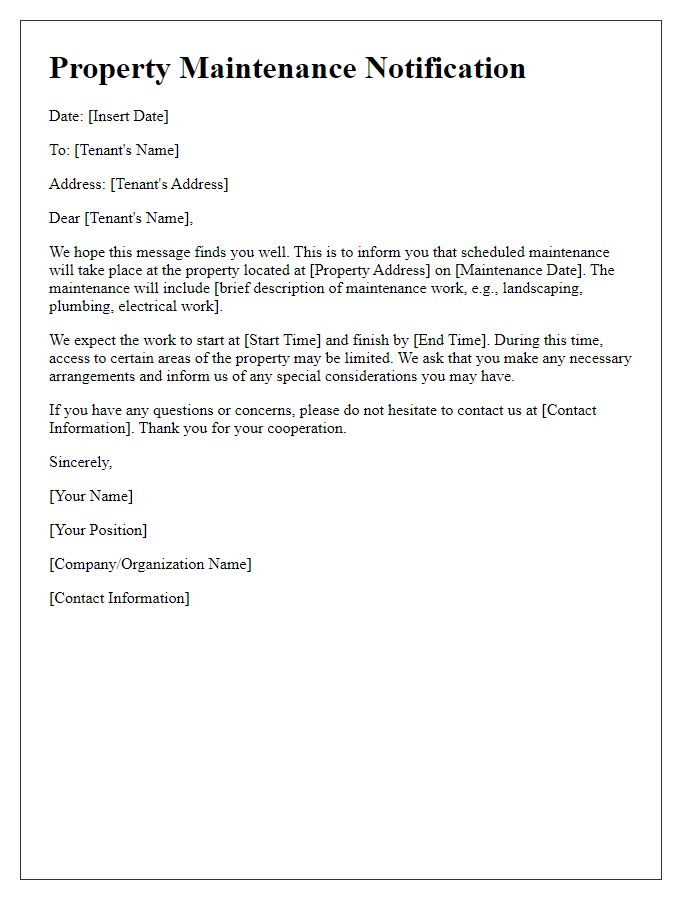

The Executor or Administrator of a deceased estate is responsible for managing the property and assets left behind, ensuring that everything is handled according to the legal requirements set forth in the Will or under intestacy laws. Key details such as the Executor's full name and contact information, including phone number and email address, are crucial for communication with beneficiaries, lawyers, and financial institutions. The estate may encompass diverse properties, including residential homes, commercial real estate, and personal belongings, all of which must be managed effectively. Timely communication is essential to address outstanding debts, property maintenance, and final distributions to beneficiaries, ensuring a smooth transition in compliance with state probate laws. Proper documentation and record-keeping are vital throughout this process to maintain transparency and uphold the intentions of the deceased.

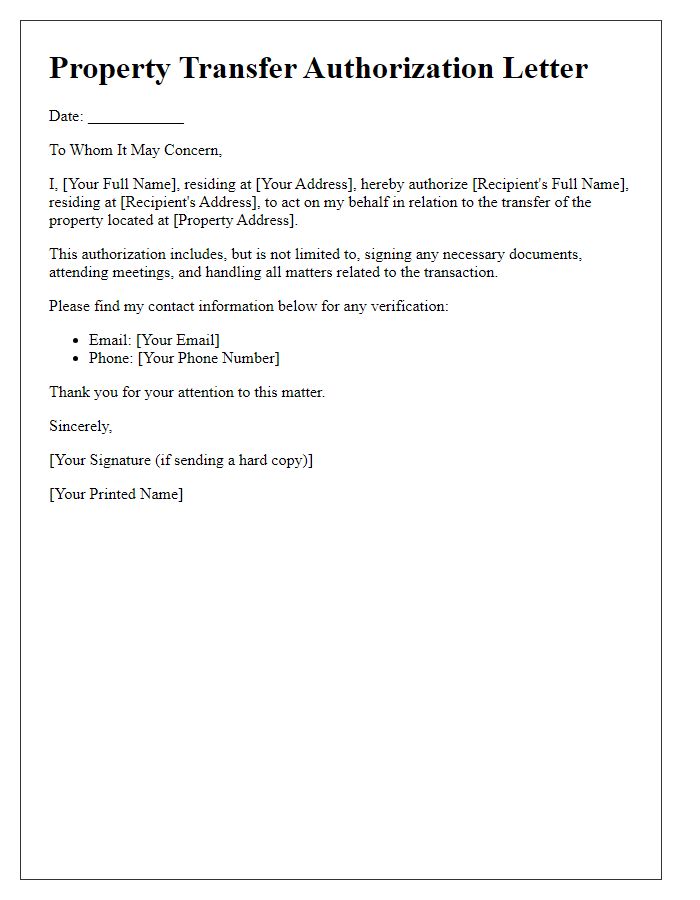

Legal and Financial Obligation Instructions

Deceased estate property handling involves a multitude of legal and financial obligations requiring clear and methodical management. Executors or administrators must obtain a Grant of Probate or Letters of Administration from local courts, which formally authorizes them to manage the deceased's assets. Beneficiaries, typically outlined in the will, must be informed about their entitlements under the Estate Laws applicable in the jurisdiction, such as intestate succession rules. Accurate inventory of assets, including real estate, bank accounts, and personal belongings, is essential for proper estate valuation. Debts, such as mortgages or credit card liabilities, must be settled from the estate before distribution takes place. Tax obligations, including estate taxes potentially due within nine months after death, require timely attention to avoid penalties. Furthermore, compliance with local property laws, such as property transfer documentation, is critical for transferring ownership to beneficiaries, ensuring that all transactions reflect legal ownership accurately and maintain beneficiaries' rights.

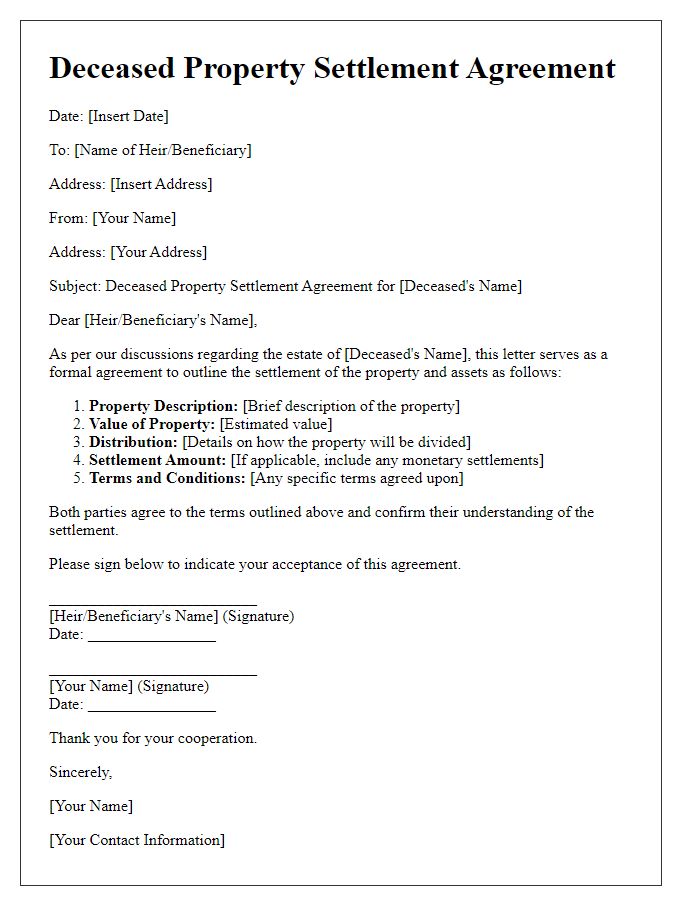

Formal Authorization and Consent

Formal authorization for deceased estate property handling is crucial in ensuring legal compliance and proper management. Executors or administrators (individuals appointed by the probate court) must gain consent from beneficiaries (those entitled to inherit) regarding asset distribution. This authorization outlines specific property (real estate, financial accounts) management procedures after a death, with attention to relevant laws such as intestacy rules (guidelines for asset distribution when no will exists). Documenting this process typically involves collecting signatures (confirmation of agreement) from all parties involved, thus reducing potential disputes. Estates often involve the probate process (court proceedings to validate a will), which can take several months or years depending on jurisdiction. Proper handling of deceased estates ensures a smooth transition of assets while honoring the wishes of the deceased.

Comments