Are you looking to make a lasting impression with your commercial property proposal? Crafting the perfect letter is essential in showcasing your professionalism and the unique value your offer presents. With the right template, you can easily communicate your ideas and capture the attention of potential partners. Join us as we explore effective strategies to elevate your proposal writing and ensure your message resonatesâread more to discover our comprehensive guide!

Property Description and Location

The commercial property located at 1234 Business Lane, Springfield, features a 5,000 square foot warehouse space with a loading dock and ample parking for tenants and customers. This strategically situated property lies in a rapidly expanding industrial area, just minutes from Interstate 95, ensuring excellent accessibility for logistics and transportation. Nearby businesses include established retailers and service providers, enhancing foot traffic and potential customer outreach. The vicinity boasts amenities such as restaurants, banks, and supply stores, further appealing to prospective tenants who value convenience and a robust local economy. The property is zoned for commercial use, allowing for various opportunities, from retail showrooms to distribution centers. Recent developments in the area, including a new business park slated to open in late 2024, indicate strong growth potential for this prime location.

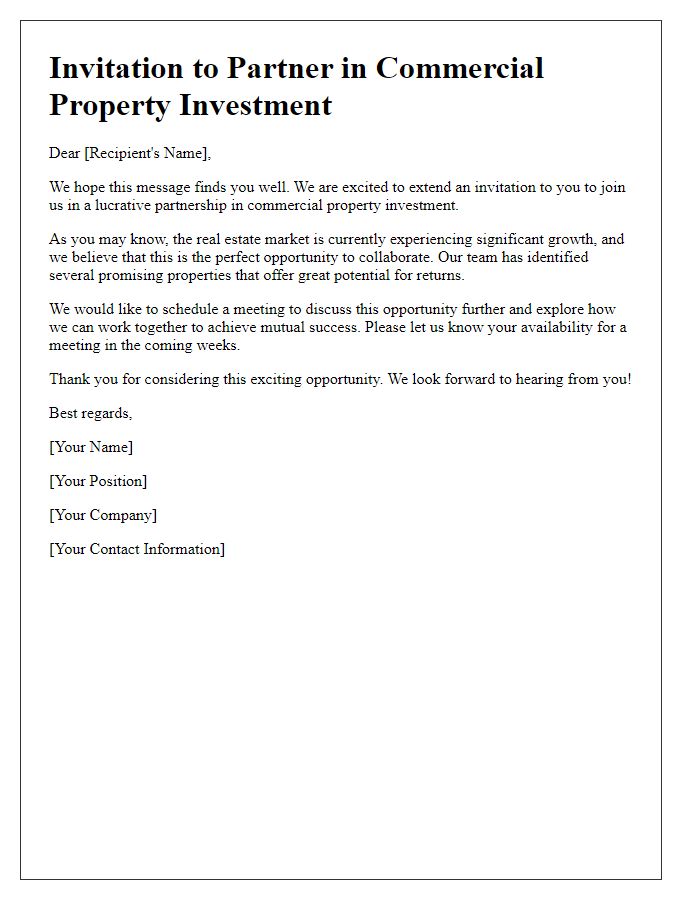

Investment Highlights and Benefits

Investment in commercial property presents significant opportunities for wealth accumulation and portfolio diversification. High traffic locations, such as downtown business districts or near major transportation hubs, provide excellent visibility and accessibility, attracting a diverse tenant base. Properties with triple-net leases offer steady income streams, minimizing landlord responsibilities while ensuring long-term financial stability. Additionally, the comparative analysis of market trends indicates increasing rental rates in urban areas, enhancing potential returns on investment. Strategic improvements, such as eco-friendly upgrades or amenity enhancements, can further increase property value, appealing to modern tenants and aligning with sustainable investment practices. Engaging in this sector not only fosters economic development but also positions investors to take advantage of tax benefits associated with commercial real estate ownership.

Financial Projections and ROI

Investing in commercial property often requires comprehensive financial projections, which include detailed cash flow analysis illustrating anticipated revenue streams from tenant leases, maintenance costs, insurance, and property management fees. For instance, a 10,000 square foot retail space in downtown Manhattan may generate an annual rental income of approximately $2 million, with projected maintenance expenses around $150,000 and property management fees typically ranging from 4-10% of gross income. A thorough ROI (Return on Investment) assessment calculates the expected returns over a specific period, factoring in initial capital outlays, potential appreciation in property value, and exit strategy options. Investors often seek a minimum ROI of 8-12% in major metropolitan areas, like New York or Los Angeles, to justify the risks associated with commercial real estate investments.

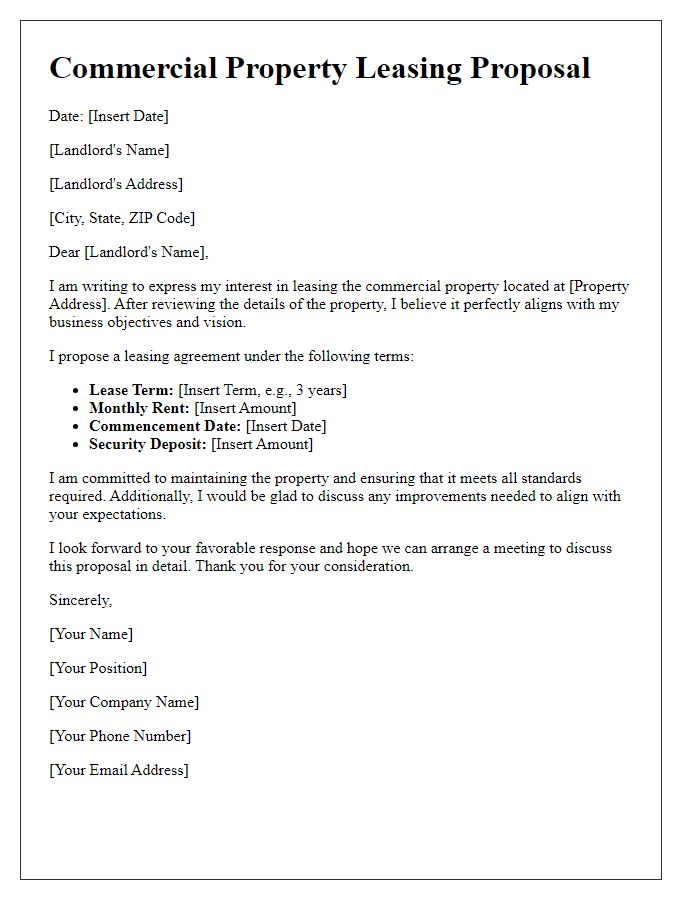

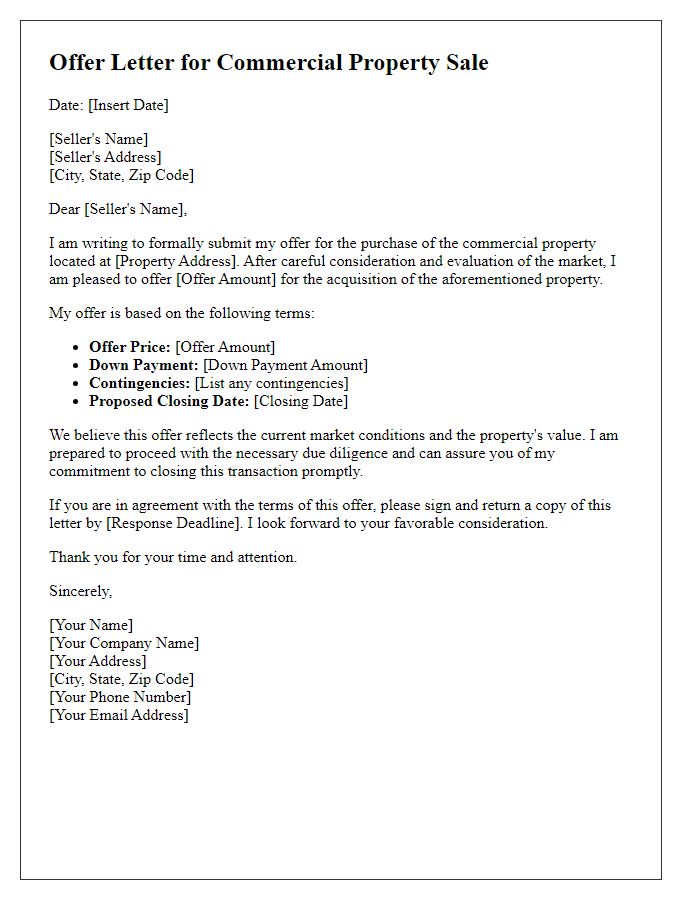

Terms and Conditions

A commercial property proposal outlines essential terms and conditions that govern the agreement between parties, ensuring clarity and protection for both landlords and tenants. Key elements include rental pricing, typically expressed as a monthly rate per square foot (e.g., $25/sq ft annually), lease duration, often ranging from one to five years, and payment due dates, which should specify the exact day of the month (e.g., 1st of every month). Additional clauses include security deposit requirements, generally equivalent to one month's rent, maintenance responsibilities, particularly regarding shared facilities, and guidelines for property modifications. Important details also encompass termination clauses, which outline notice periods (generally 30-90 days), and dispute resolution methods, such as mediation or arbitration, to address any potential conflicts arising during the lease term.

Contact Information and Next Steps

A commercial property proposal typically includes crucial details for potential stakeholders. Contact information should feature relevant individuals or departments, such as leasing agents, property managers, or real estate brokers. This may include phone numbers, email addresses, and physical addresses of the parties involved. Next steps should outline the process for moving forward, such as scheduling property viewings, submitting offers, or conducting due diligence. Additionally, it may specify timelines for decision-making, inspections, and closing dates, emphasizing the importance of clear communication to facilitate negotiations and ensure all parties are well-informed of their responsibilities.

Comments