Are you considering expanding your real estate portfolio? Crafting the perfect acquisition proposal can make all the difference in securing that next prime property. In this article, we'll break down the essential components of a compelling letter, ensuring you make a lasting impression on potential sellers. So, let's dive in and explore how to create a proposal that stands out and resonates with your audience!

Recipient and Sender Information

A well-structured acquisition proposal for real estate captures essential details, clearly presenting the sender's intention. The sender, often a prospective buyer or real estate firm, should include their name, title, address, and contact details prominently at the top of the document. This section indicates their professional status and establishes credibility. Following the sender's information, the recipient's details must be accurately listed, encompassing the name (typically of the property owner or decision-maker), position, company name, address, and contact information. This information is crucial for ensuring the proposal reaches the appropriate individual, facilitating effective communication regarding the acquisition negotiations.

Property Description and Details

The proposed acquisition involves a prime real estate asset located at 123 Main Street, Springfield, a bustling urban area characterized by its vibrant community and proximity to key amenities. This 10,000-square-foot building features modern architecture and was constructed in 2015, providing contemporary office space ideal for businesses. The property is currently zoned for mixed-use, allowing for both commercial and residential development, catering to diverse market needs. Its strategic location offers easy access to major transportation routes (Interstate 55, Route 30) and is within walking distance of local attractions such as City Park and Springfield Public Library. The surrounding area boasts an average annual growth rate of 5% in property values, indicating strong investment potential. Key utilities, including high-speed internet and upgraded electrical systems, are already established, enhancing operational efficiency for future tenants.

Offer Terms and Price

Acquisition proposals for real estate often detail specific offer terms and prices. The proposed price for the property located at Main Street, Springfield, is $1.5 million, reflecting recent market analysis data and comparable sales in the southern district. A 10% earnest money deposit will be submitted upon acceptance of this proposal, ensuring commitment and intent. Closing is proposed within 30 days of acceptance, facilitating a smooth transaction process. Additionally, the offer includes a thorough due diligence period of 14 days, allowing for inspections and necessary evaluations. Financing is expected through a conventional mortgage, with a pre-approval letter available from Local Bank, which strengthens the credence of this acquisition proposal.

Funding and Financial Qualifications

The funding and financial qualifications for a proposed real estate acquisition, specifically the multi-family residential complex known as Maple Grove Apartments located at 123 Main Street, are crucial for assessing project viability. The acquisition budget stands at $5 million, with potential financing options including 70% leverage through commercial loans at competitive interest rates, currently averaging 4.5%. Projected cash flow analysis indicates an annual rental income of $600,000, with operating expenses estimated at 30%, yielding a net operating income of approximately $420,000. Investor equity contributions will be sought to cover 30% of the total purchase price, equating to $1.5 million, fostering a solid financial foundation for this opportunity. This strategic financial structuring aims to ensure long-term profitability and sustainable growth within the increasingly competitive real estate market.

Due Diligence and Closing Conditions

The due diligence process for a real estate acquisition involves comprehensive evaluation, including property inspections, financial assessments, and legal verification. It typically spans 30 to 60 days, allowing for examination of title reports, zoning approvals, and environmental assessments, particularly under the National Environmental Policy Act (NEPA). Closing conditions must outline specific requirements, such as financing approval, satisfactory completion of inspections, and the absence of material adverse changes in the property condition. Successful completion of these conditions is crucial for the final transaction, often processed through escrow agents in accordance with local real estate regulations.

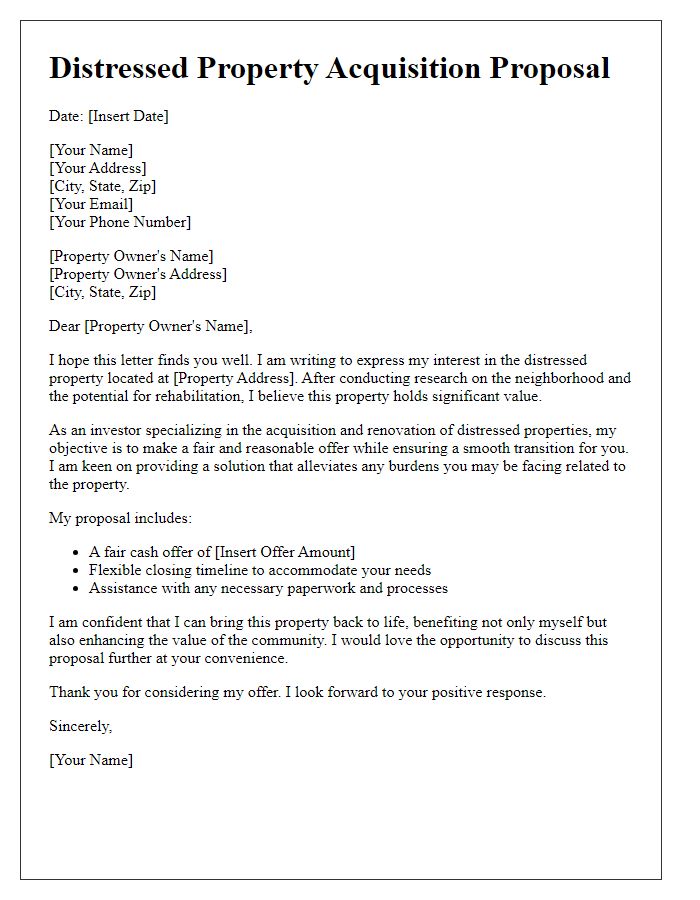

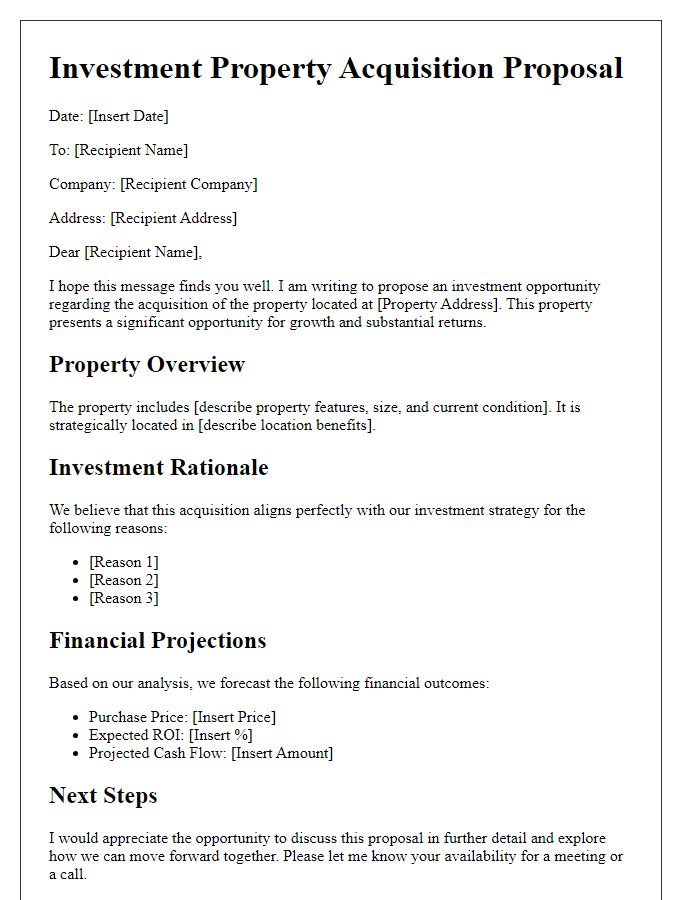

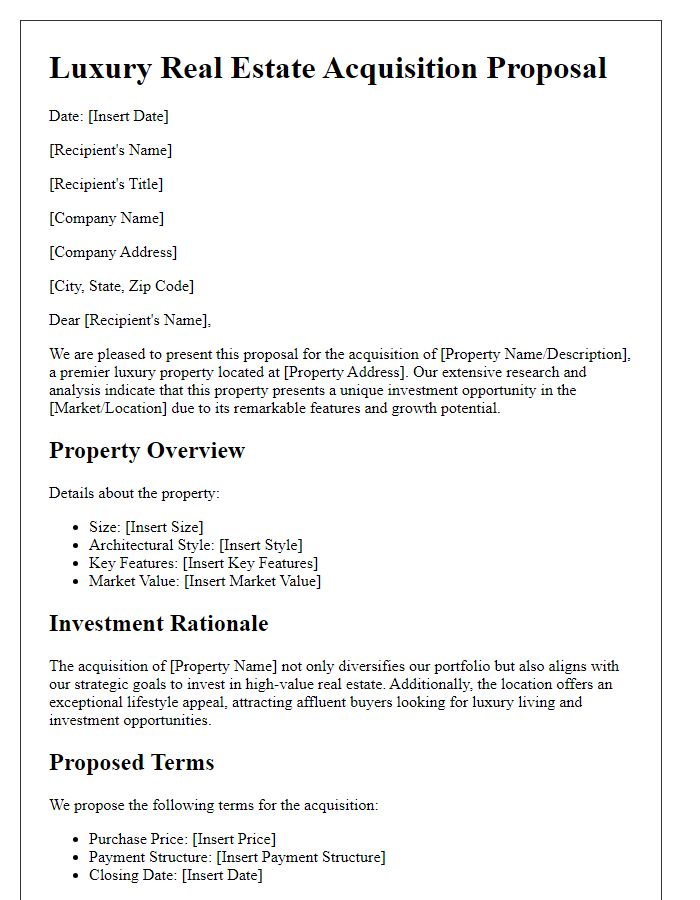

Letter Template For Acquisition Proposal Real Estate Samples

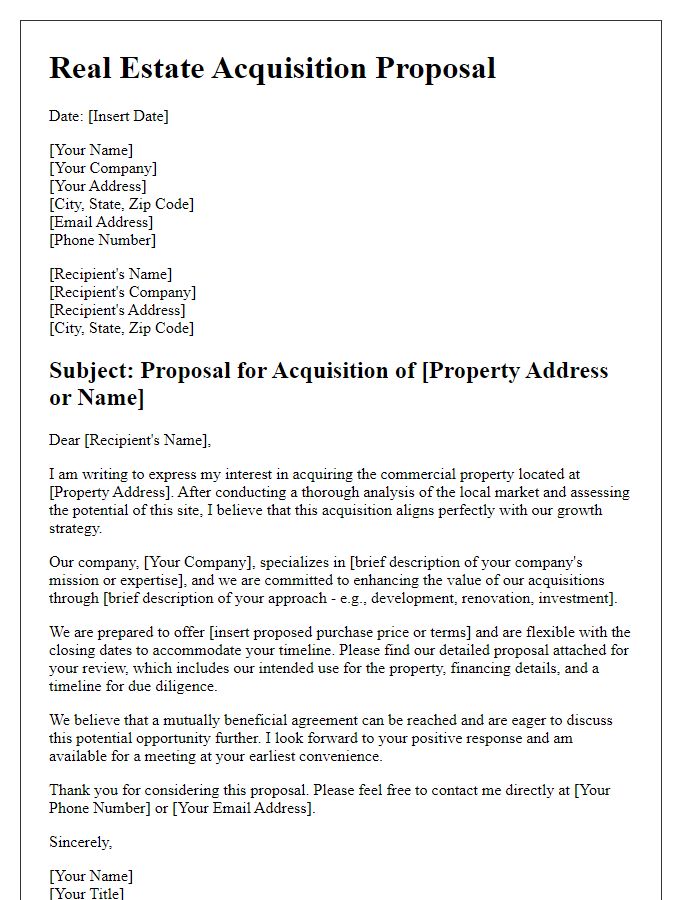

Letter template of real estate acquisition proposal for commercial property.

Comments