Are you looking to streamline your financial communications? Understanding the importance of an escrow account statement can help ensure clarity and transparency in your transactions. This crucial document not only details the funds held in escrow but also outlines the terms and conditions agreed upon by all parties involved. So, if you're eager to learn more about creating an effective and professional escrow account statement, read on!

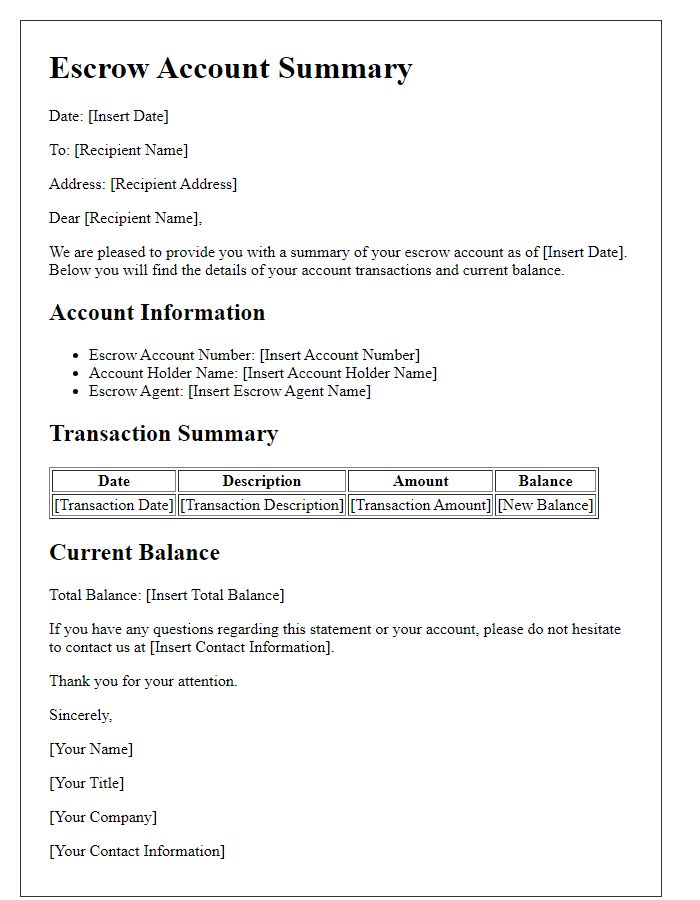

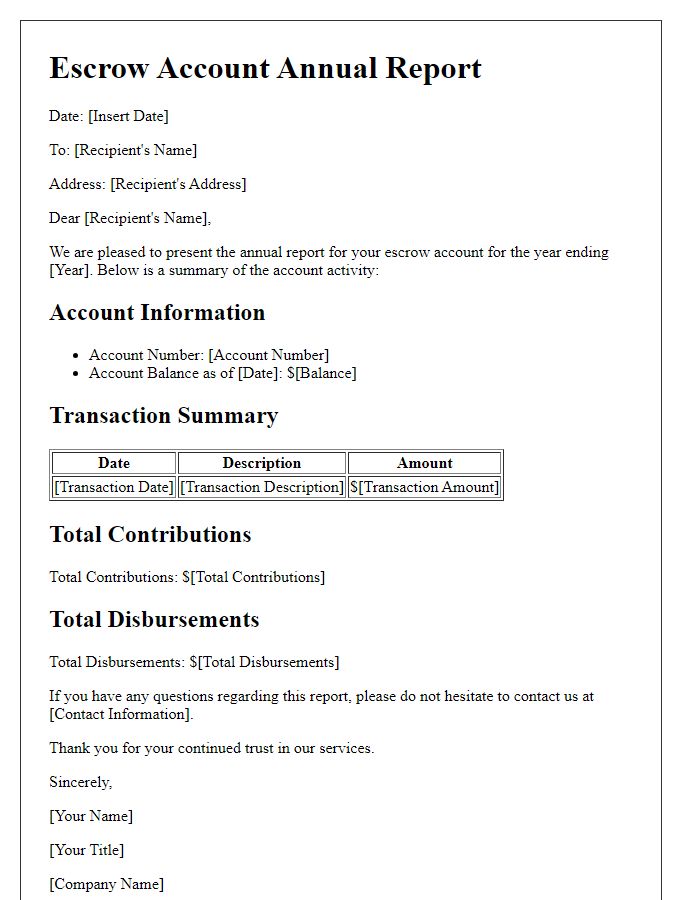

Account Information

An escrow account statement provides essential financial details, facilitating transparency in transactions. Account information typically includes account number, a unique identifier for monitoring funds held in trust. Transaction dates highlight when deposits and withdrawals occur, while the current balance indicates the amount available at a specific point in time. Fees associated with the escrow management, such as administrative charges, might be included in the statement, contributing to the overall financial understanding. Additionally, parties involved in the escrow agreement, such as real estate buyers and sellers, are typically named, ensuring clarity about who benefits from the account. Details about the escrow agent, often a financial institution or a licensed professional, also play a critical role in establishing trust throughout the transaction process.

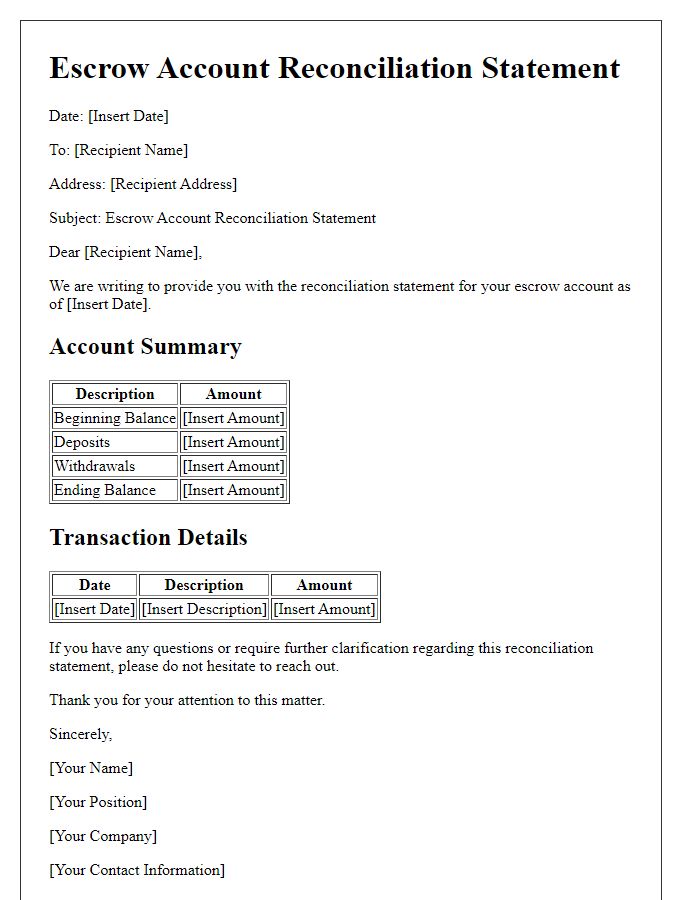

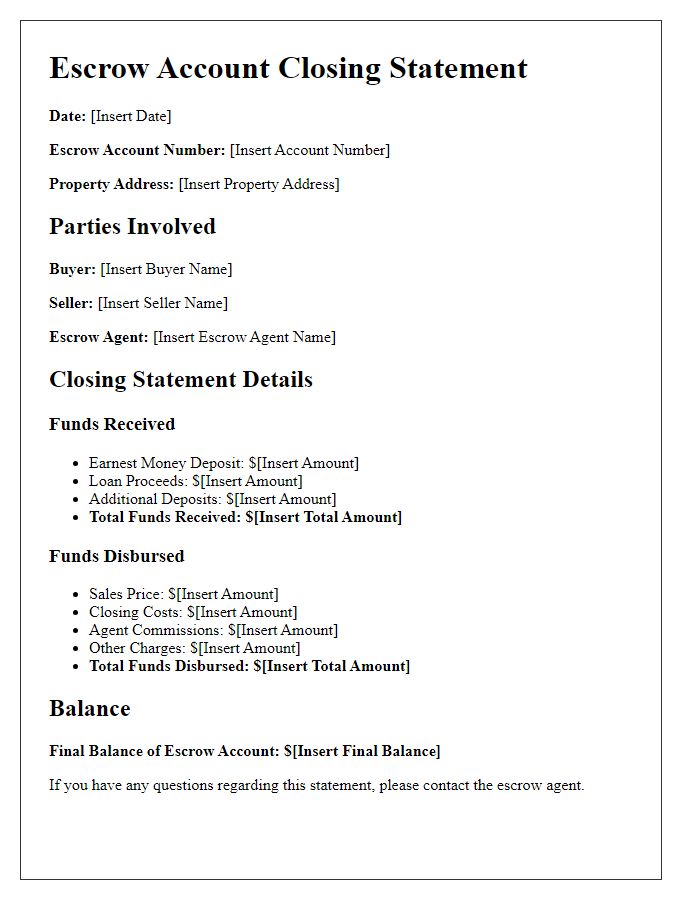

Transaction Summary

An escrow account statement provides a detailed report of transactions related to a specific real estate closing, including all deposits, disbursements, and remaining balances. Typically covering a period (such as monthly or quarterly), the statement includes transaction dates, amounts involved, and the purpose of each transaction. For instance, an initial deposit (often called earnest money) submitted by the buyer could be detailed alongside disbursements for property taxes (as mandated in many states) or homeowners insurance. Additionally, a balance summary at the end highlights the current funds held in escrow, ensuring compliance with regulations governing real estate transactions. Accurate record-keeping of these transactions is crucial for ensuring trust among all parties involved, including buyers, sellers, and lenders.

Beginning and Ending Balances

An escrow account statement provides crucial financial information regarding an escrow arrangement, typically used during real estate transactions, legal settlements, or construction projects. The beginning balance reflects the total amount deposited into the escrow account at the start of the reporting period, often influenced by the terms outlined in the escrow agreement. This amount may include buyer deposits, earnest money, or funds set aside for property taxes and insurance premiums. The ending balance represents the total funds remaining in the account at the close of the reporting period, accounting for any disbursements made during that time for services rendered, payments to third parties, or other expenses. Transparency in these transactions helps maintain trust among the parties involved, ensuring that funds are managed according to the specified terms and conditions. Regular statements are essential for tracking these financial movements, allowing for effective planning and accountability.

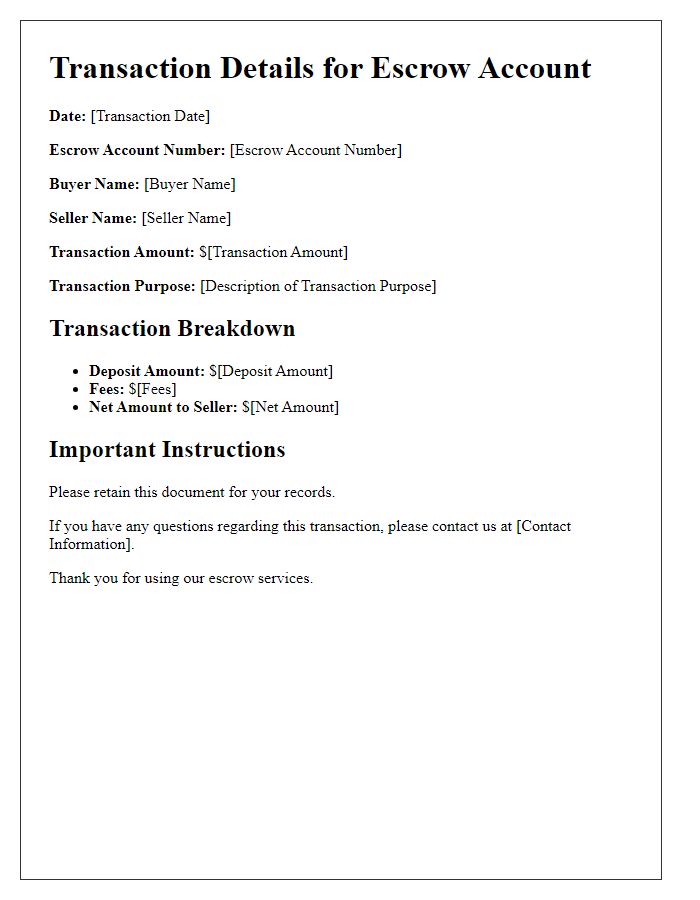

Deposits and Withdrawals

An escrow account statement provides a detailed overview of all deposit and withdrawal transactions related to a specific escrow arrangement. The statement includes the initial deposit amount, often significant (typically ranging from thousands to millions of dollars depending on the transaction type, such as real estate). Each withdrawal transaction must be clearly itemized, indicating the date, amount, and purpose, such as payment for property taxes or repair costs associated with a property located in a specific ZIP code. The statement should summarize the starting balance, total deposits, total withdrawals, and the ending balance as of the report date, ensuring transparency and accountability for all parties involved in the escrow agreement. Regular statements help maintain clear financial records, crucial in high-stakes transactions, ensuring compliance with legal and financial obligations.

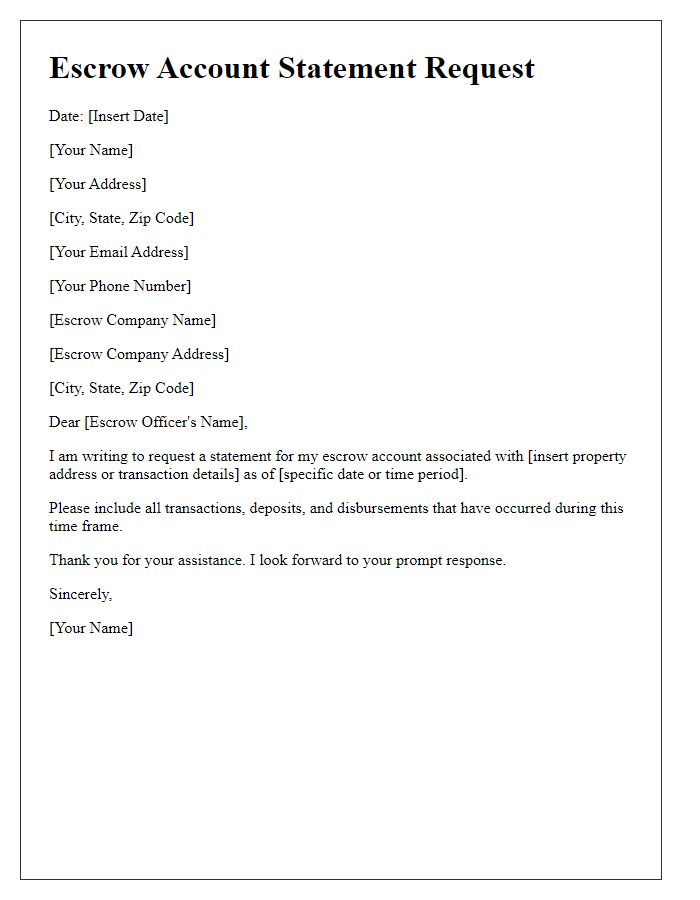

Contact Information for Inquiries

For inquiries regarding the escrow account statement, please reach out to the dedicated customer service team at XYZ Escrow Services Inc., located at 123 Financial Way, Suite 200, Capital City, State, ZIP Code. Our contact number is (123) 456-7890, available Monday through Friday, from 9 AM to 5 PM local time. For your convenience, please have your account number handy when calling. Alternatively, you can email us at support@xyzescrow.com for assistance. We ensure prompt responses to all inquiries, typically within 24 hours on business days.

Comments