Are you navigating the complexities of a partnership exit plan? It's crucial to have a clear and comprehensive agreement in place to ensure a smooth transition for all parties involved. From outlining the terms of the exit to addressing financial arrangements, every detail matters in safeguarding your interests. Ready to dive deeper into crafting the perfect partnership exit plan?

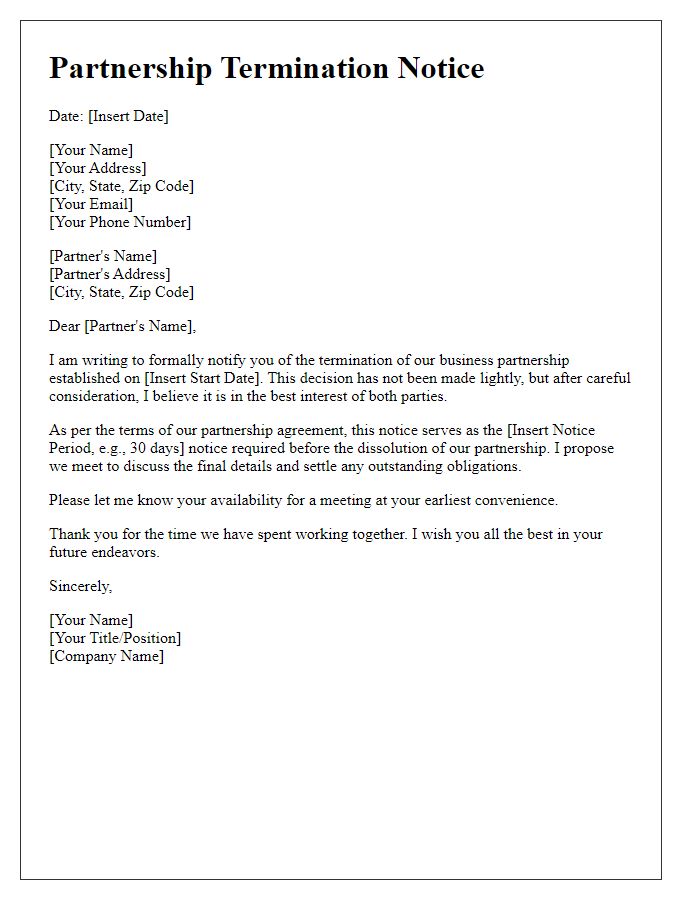

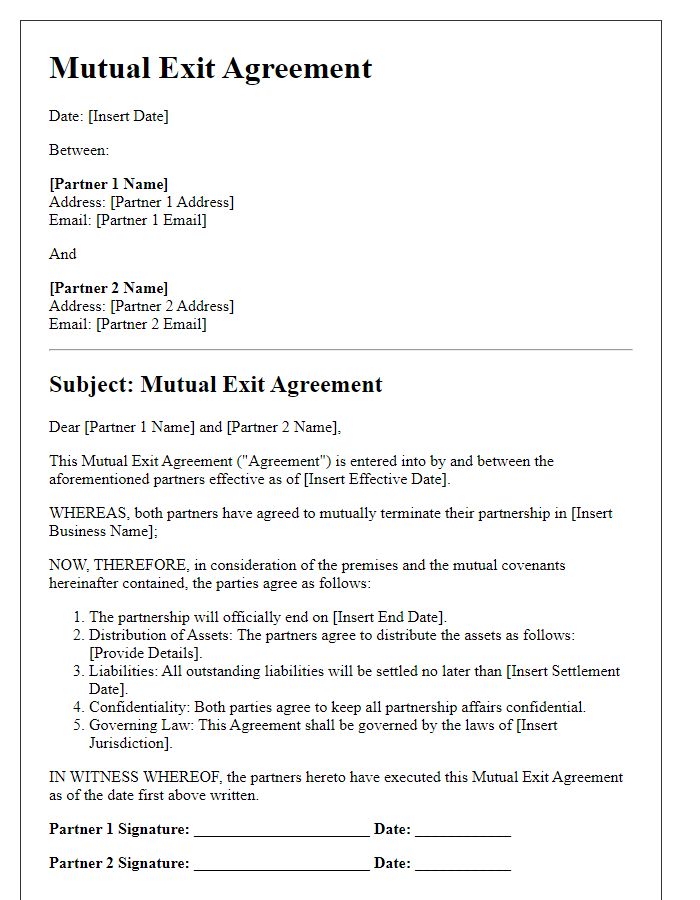

Roles and Responsibilities

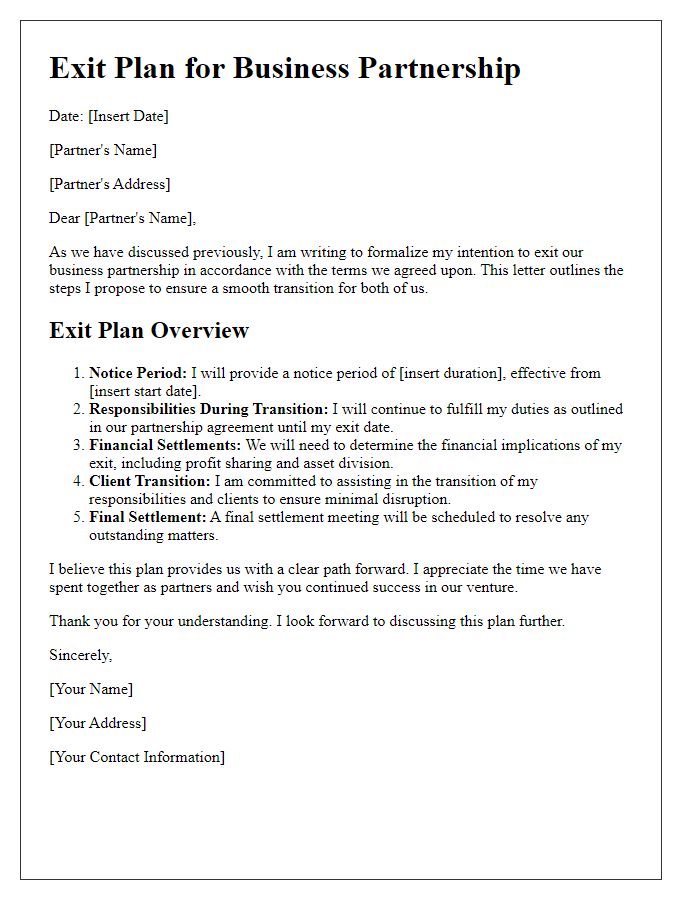

A partnership exit plan agreement outlines the roles and responsibilities of each partner during the transition period in business disassociation. Essential elements include the termination process, which addresses the timeline of exit procedures, such as providing a minimum of 60 days written notice. Financial responsibilities must be clearly defined, covering the distribution of assets, resolution of outstanding debts, and the allocation of profits accrued up to the exit date. Additionally, intellectual property rights should be addressed, ensuring a fair division of proprietary technology or branding elements developed during the partnership. Finally, communication strategies should be established to inform stakeholders, including employees, suppliers, and customers, regarding the changes in management and operational structure. It's vital for each partner's obligations and rights to be detailed, providing clarity and reducing potential conflicts during the exit process.

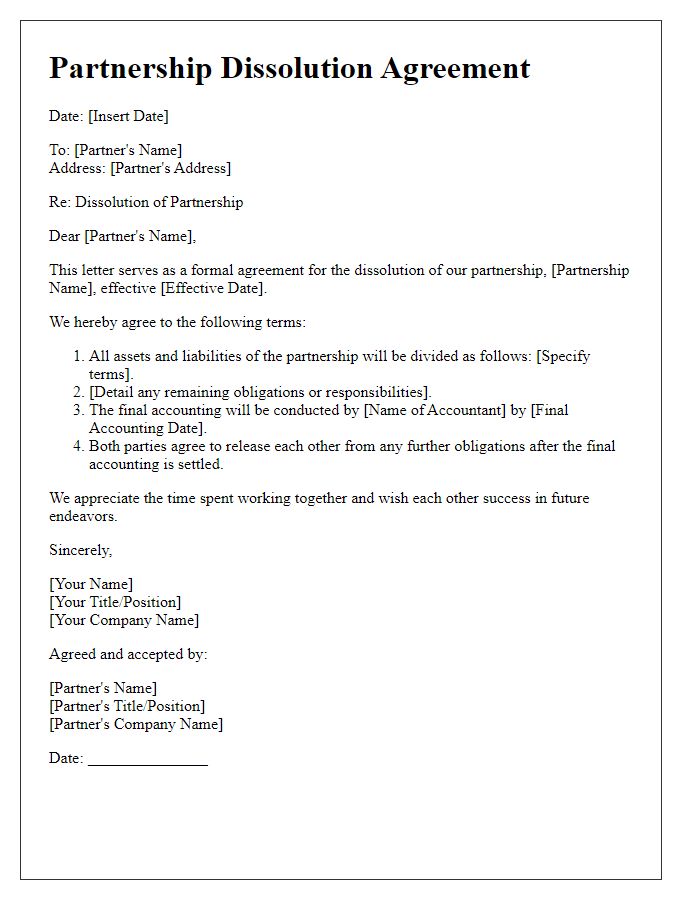

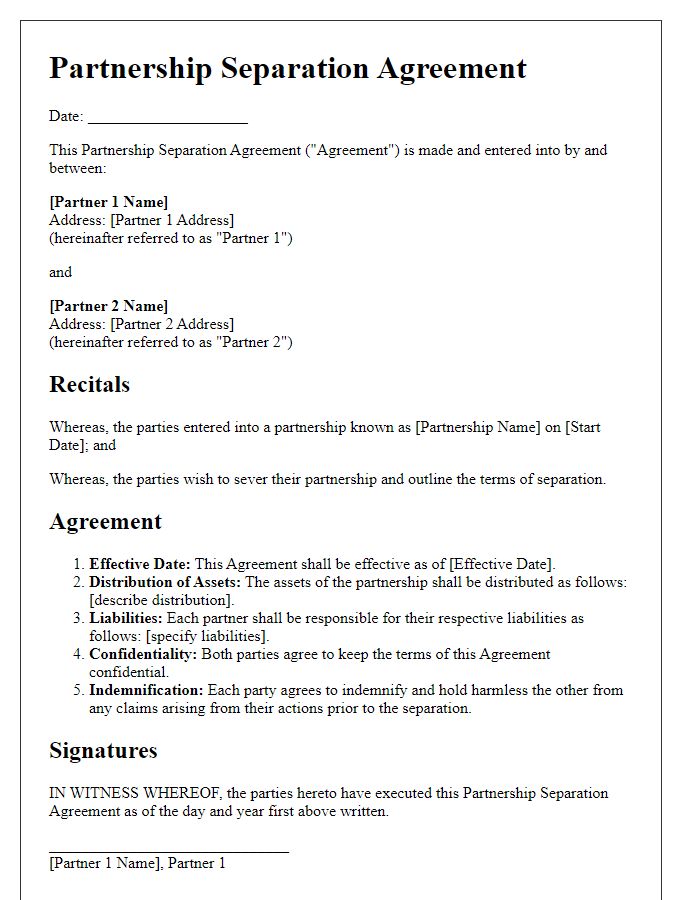

Termination Clauses

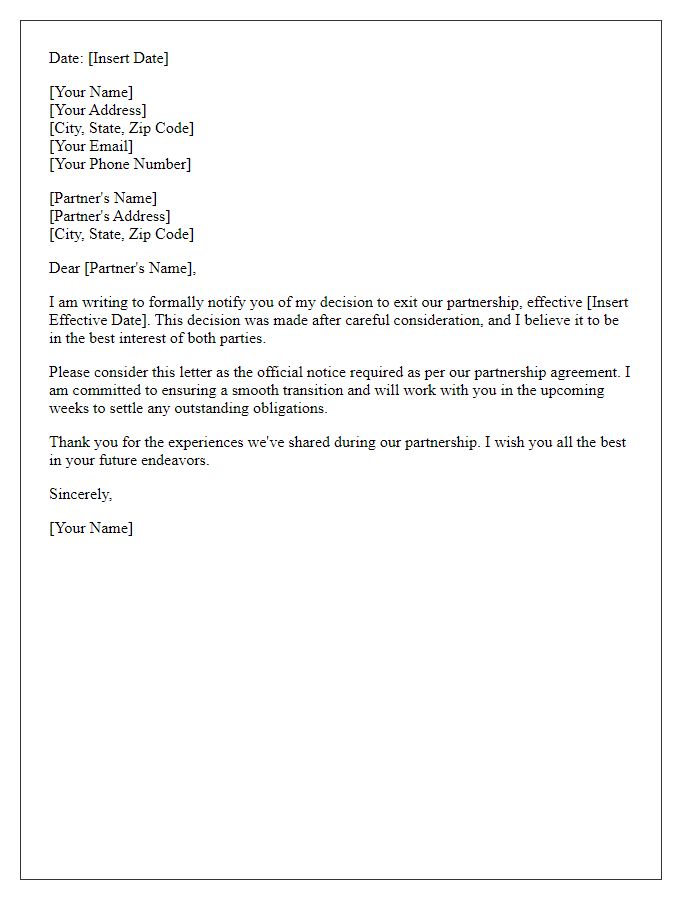

A well-structured partnership exit plan agreement contains clear termination clauses, outlining conditions for dissolution and duties of each partner. In the case of a partnership formed in California, the agreement may specify a minimum notice period, typically 30 days, required before termination. Key terms should define events such as mutual consent or violation of partnership duties, covering critical aspects like financial settlements, asset distribution, and protection of intellectual property developed during the partnership. Additionally, partners must understand the impact on ongoing projects, potential liabilities, and responsibilities for any existing contracts with third parties, ensuring a smooth transition and minimizing disruptions to business operations.

Financial Settlement

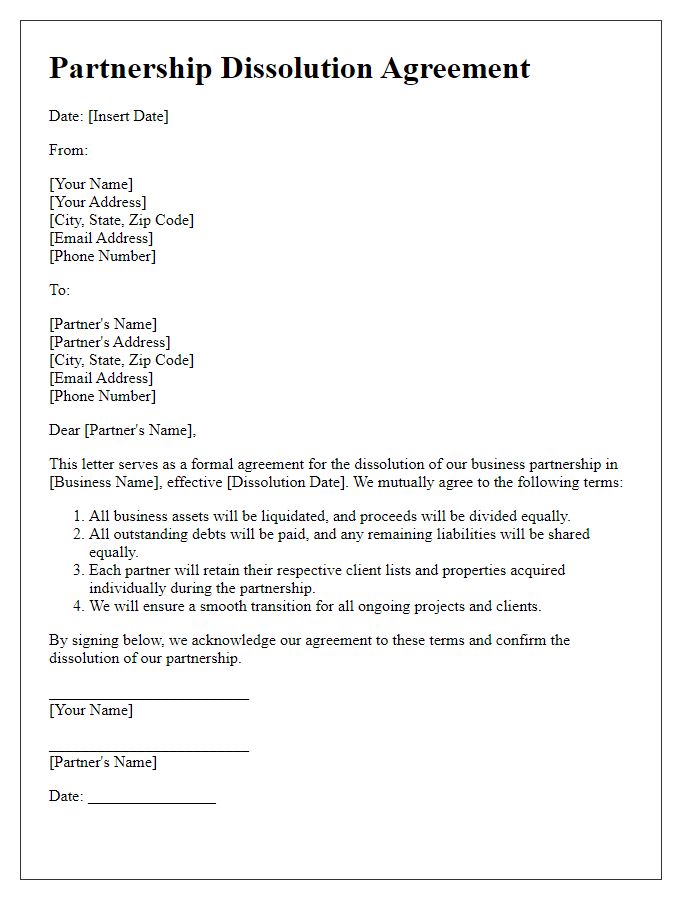

A partnership exit plan agreement involves critical financial settlements addressing the division of assets and liabilities. Key elements include the fair market valuation of business assets such as equipment, inventory, and real estate at the time of dissolution. An accurate assessment typically utilizes a certified appraiser who adheres to industry standards, ensuring compliance with local regulations. Additionally, the agreement must delineate how debts, including loans and outstanding invoices, will be managed, specifying obligations for each partner, usually identified by percentage ownership. Tax implications play a significant role in shaping the financial settlement, necessitating consultation with certified public accountants (CPAs) to optimize the tax structure post-exit. Defined timelines for settlement payment, often set within 30, 60, or 90 days, are crucial to maintain transparency and minimize disputes. Clear documentation and mutual consent are vital to safeguarding the interests of both exiting partners and the remaining business entity.

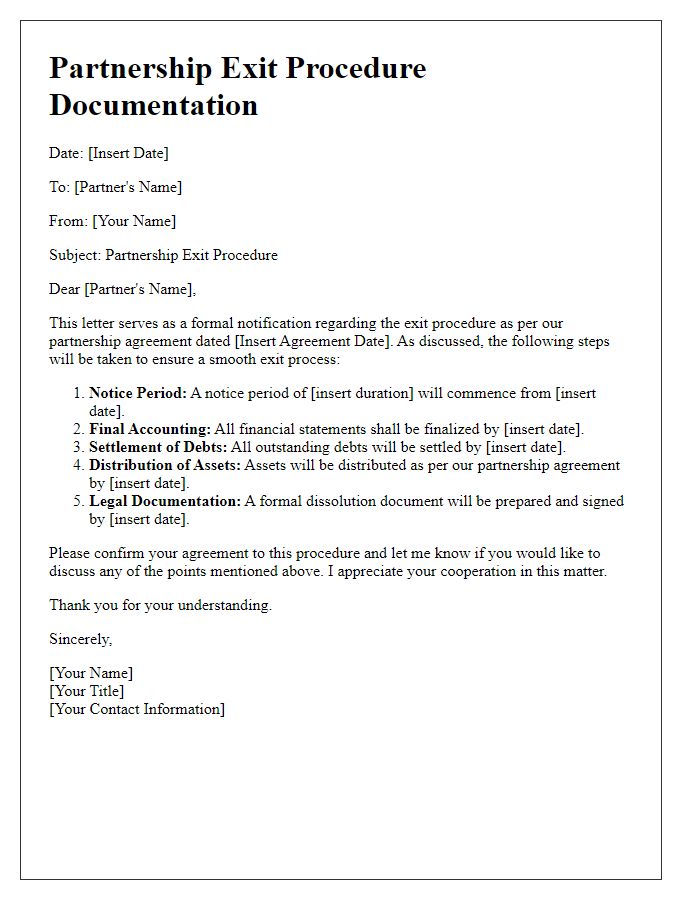

Confidentiality Agreements

Confidentiality agreements play a crucial role in partnership exit plans, ensuring the protection of sensitive information during the transition phase. These legal contracts, often binding, prevent the sharing of proprietary data, trade secrets, or any sensitive material that could jeopardize either party's business operations post-exit. Key elements include definitions of confidential information, obligations of the departing and remaining partners, the duration of confidentiality (often spanning several years), and the jurisdiction under which the agreement is enforceable. Failure to adhere to confidentiality can result in significant financial penalties and reputational damage. Properly structured, these agreements foster trust and allow for a smoother transition while safeguarding each partner's interests.

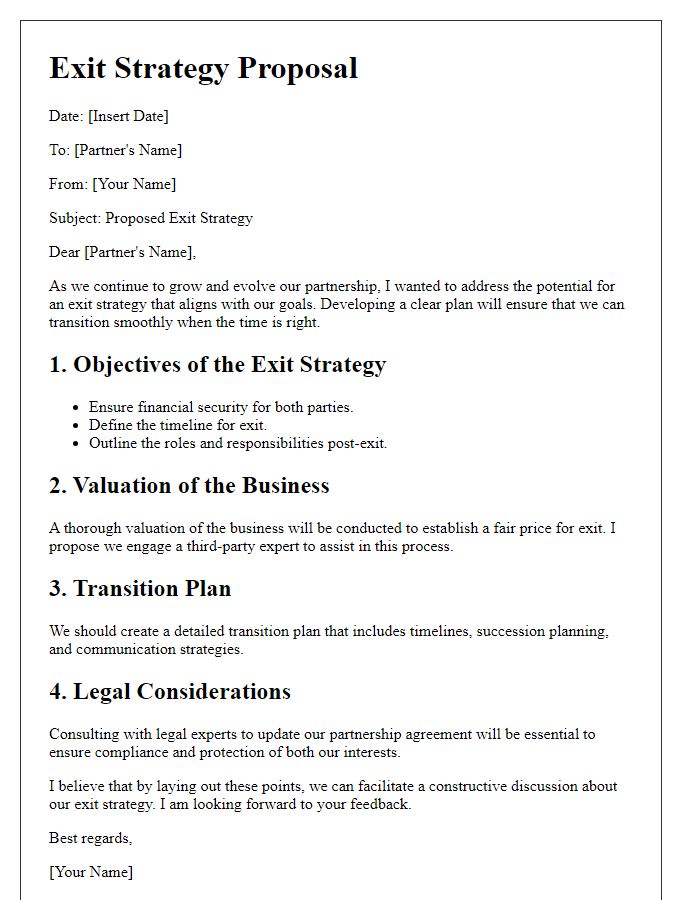

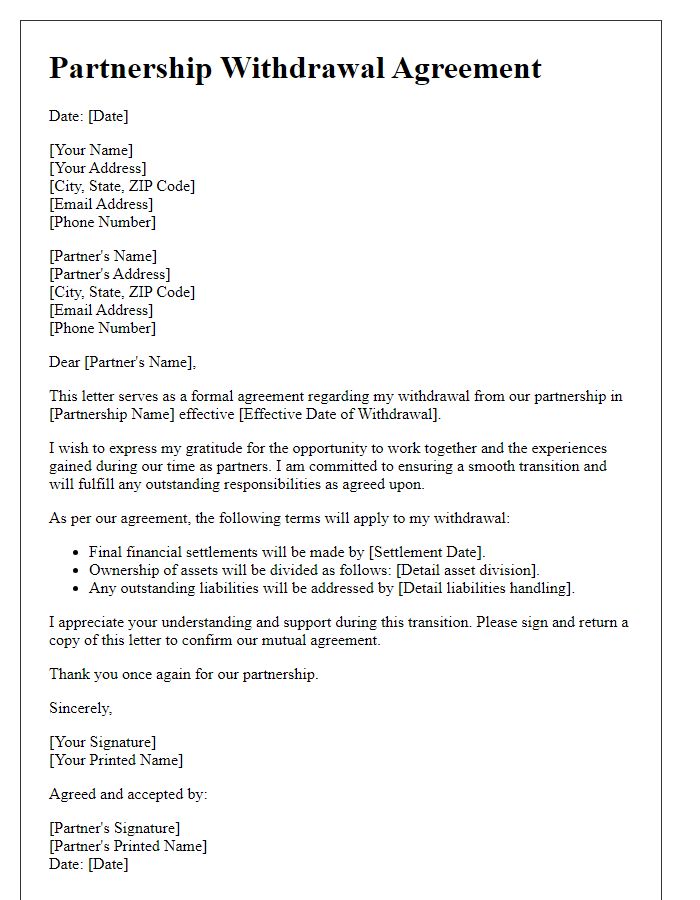

Transition Plan

A partnership exit plan is a critical document that outlines the structured process for a partner to leave a business. This agreement typically includes key elements such as a clear definition of roles, responsibilities, and timelines for each step of the transition. For instance, financial aspects would cover valuation methods for the departing partner's stake, often referencing market conditions as of the date of the exit, such as an economic downturn affecting business value at the time. The document should also specify the timeline, for instance, a six-month period for the transition, allowing adequate time to prepare for the departure. Communication strategies for informing stakeholders, including investors and employees, often detail the specific individuals responsible for these communications, ensuring consistency. Additionally, it should outline any ongoing obligations, such as non-compete clauses or confidentiality agreements, aiming to protect the remaining partnership's interests amidst changes. Consideration for operational handover plans to ensure business continuity can further enhance the effectiveness of the exit strategy.

Comments